A New Wave of Interest in Bitcoin and Gold Amid Global Instability

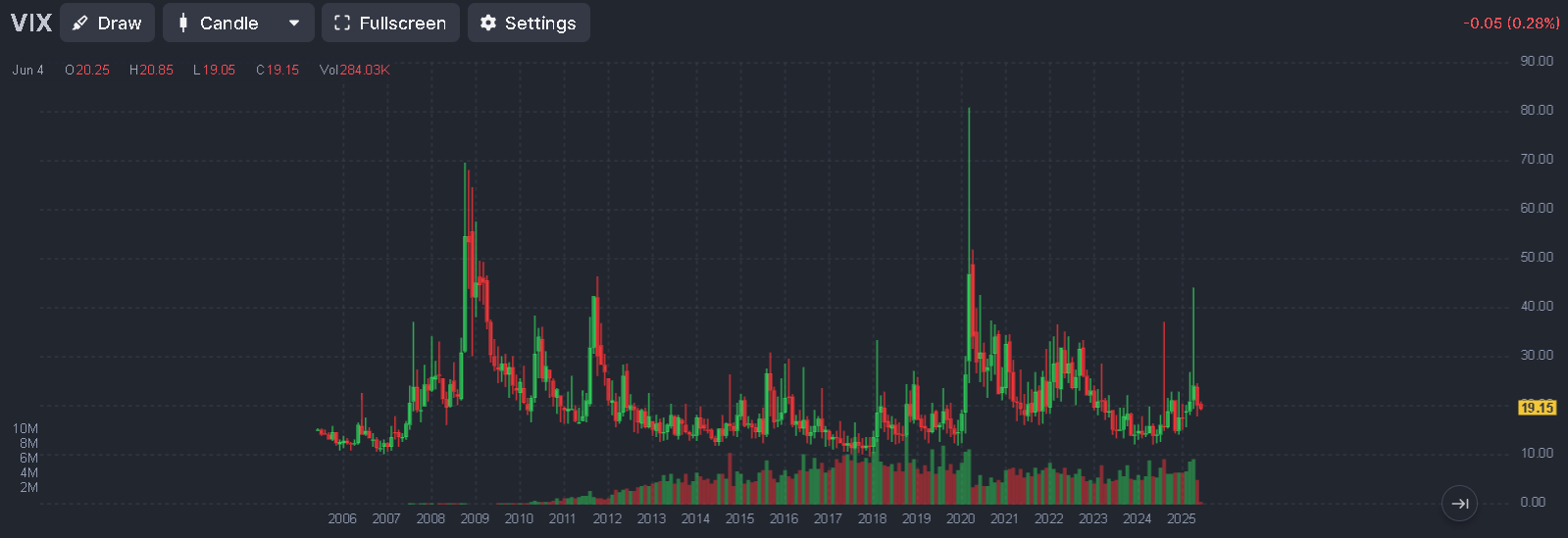

Global financial markets are experiencing increasing volatility and geopolitical risks. Over the past decade, the VIX fear index has entered the "panic zone" eight times, and the U.S. Dollar Index has shown a consistent downward trend since late 2022, reminiscent of its prolonged decline in the early 2000s. The weakening of traditional safe-haven assets, declining dollar strength, and falling bond yields are prompting investors to seek alternatives. Against this backdrop, interest in non-traditional safe-haven assets like gold and bitcoin is rising.

Geopolitical and Macroeconomic Risks

Heightened volatility and market uncertainty are driving demand for safe-haven assets. The VIX reached a peak of 80 during the COVID-19 pandemic, surpassing the 2008 crisis level. Assets with high correlation to the equity market may experience sharp declines under such stress. At the same time, the U.S. Dollar Index is showing a persistent downtrend, mirroring the pre-2008 crash pattern.

Traditional shelters such as U.S. government bonds, long seen as reliable, have underperformed in recent years. Since 2021, their yield curve has remained bearish, and investor confidence has deteriorated. Experts now highlight a potential shift in the global financial role of the U.S. dollar.

As Bridgewater founder Ray Dalio aptly stated: "If you don’t own gold, you know neither history nor economics."

Institutional Interest in Bitcoin and Gold

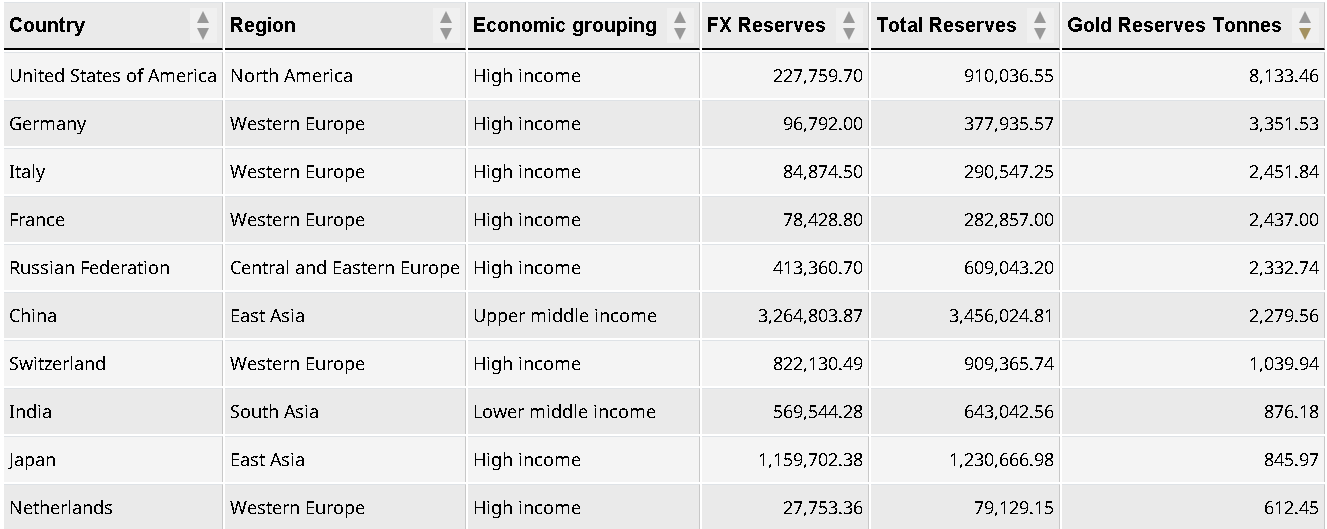

Rising macroeconomic risks coincide with increasing accumulation of gold and bitcoin by major institutional players. Central banks have purchased record volumes of gold for three consecutive years: 1082 tonnes in 2022, 1037 tonnes in 2023, and 1045 tonnes in 2024. Leading buyers include Uzbekistan, China, Kazakhstan, as well as Poland and India-each of which added 3 tonnes to their reserves in January 2025. This trend reflects an "accelerated preparation of states for a transitional phase in the global economy."

Crypto companies are also stockpiling bitcoin. The top holders include MicroStrategy (580,250 BTC), Marathon Digital (~49,230 BTC), and Metaplanet (8,888 BTC). Moreover, traditional investors are increasingly adding bitcoin to their portfolios. According to a survey by The Nakamoto Project, around 80% of respondents are willing to convert part of the national gold reserves into bitcoin, underscoring rising institutional confidence in cryptocurrencies alongside gold.

4 in 5 Americans want some US gold reserves converted to bitcoin. pic.twitter.com/ibxXfe04g5

— The Nakamoto Project (@NakamotoProjct) May 19, 2025

Storage Risks and Gold Repatriation

Storing gold abroad introduces significant risks.

As Jim Rickards notes, gold not stored directly under your control is effectively "paper gold," which can be frozen or confiscated during crises.

History offers compelling examples. In the 1960s, French President Charles de Gaulle demanded the return of France’s gold reserves from the U.S. and U.K. As part of the secret “Vide-Gousset” operation, France repatriated 3,313 tonnes of gold. This move strained U.S. reserves and contributed to President Nixon's 1971 decision to end the gold standard.

Even today, many nations still hold substantial portions of their gold reserves overseas:

- India: During the 1991 crisis, around 8 tonnes of gold were sent to London for credit; in 2024, the Reserve Bank of India repatriated about 100 tonnes from the Bank of England-the first such move since 1991.

- Netherlands: Holds 31% of its gold at the Federal Reserve Bank of New York.

- Italy: Keeps 43.3% of its reserves in New York, 6.1% in Bern, and 5.8% in London.

- Germany: As of late 2023, 36.6% of its gold was stored in New York, and 12.8% in London.

These examples underscore the vulnerabilities of "paper gold" and are driving interest in digital assets and sovereign custody solutions.

Gold Acquisition Conditions: Global Comparison

The cost and ease of purchasing gold vary significantly across regions:

- Western countries: High taxes and bureaucratic hurdles limit private investor access to bullion.

- India: VAT is just 3%, and import duties were reduced to 6% in 2024.

- China: Standard investment gold sold through the Shanghai Gold Exchange is VAT-exempt.

- Middle East: The UAE imposes no import duty, while Saudi Arabia exempts 99% pure investment gold from tax; Qatar has zero tax on all precious metal transactions.

- Japan: VAT on gold is relatively high at 10%.

Conclusion

Growing global instability is encouraging large investors to diversify foreign reserves. Peaks in fear indices like the VIX coincide with record levels of central bank gold buying (over 1,000 tonnes annually) and strategic bitcoin accumulation on market dips. Long-term players are unfazed by short-term price swings: they accumulate during corrections. These trends suggest an impending shift in the global monetary order, where gold and cryptocurrencies may play foundational roles.

Questions for Consideration:

- Will central banks begin to include bitcoin in official reserve strategies alongside gold?

- How might geopolitical conflicts reshape access to physical versus digital stores of value?

- Could a future global liquidity crisis accelerate the move away from the U.S. dollar toward decentralized assets?

Comments ()