A Simple Guy with $40M Profit in a Month or an Up-and-Coming Crypto Twitter Star?

In the world of cryptocurrencies, there are countless approaches to trading, and everyone is searching for their own formula for success. One notable example is Top-2 in the Hyperliquid leaderboard, a trader known as TheWhiteWhale, who shares his unique trading methodology. Below is his breakdown, which can help you understand how he achieves such results and what he pays attention to when making decisions.

X - https://x.com/TheWhiteWhaleHL

Wallet for tracking: hyperdash.info/trader/0xb8b9e3097c8b1dddf9c5ea9d48a7ebeaf09d67d2

Part 1: Behavior of Apex Predators ⚔️

The core idea is that price movements are not random but driven by manipulations from large players or "predators." They use liquidation traps, fake-outs, sharp sentiment reversals, and other tactics to achieve their goals.

TheWhiteWhale evaluates their intentions: Are they instilling fear or hunting for liquidations? It’s not just about the movement itself but its logic and long-term purpose for maintaining trust and extracting capital.

This approach helps understand the true motives behind market moves and avoid falling into traps.

Part 2: Technical Structure 📈

Technical analysis is an important tool but not the only one. It includes breakouts, patterns, and candle closes. However, these signals can be easily countered by "predator" tactics that create false movements.

Trading solely based on TA without considering the behavior of higher-level players is a guaranteed path to mistakes. Therefore, it’s crucial to see that setups often precede "dirty" market moves. Technical analysis is useful only when it aligns with the motives of bigger players.

Part 3: Macro + Narrative 🌎

Global factors—such as Federal Reserve policies, ETF flows, regulatory news, and liquidity—have a strong influence on the market. Narratives attract capital but can also be traps if they don’t match the current situation.

TheWhiteWhale asks himself: Is this movement logical in the context of the bigger picture? This analysis helps avoid traps and make decisions based on global trends rather than just local signals.

Part 4: On-Chain Data + Whale Activity 🐋

Data on liquidations, whale positions, and order book levels provide valuable insights into potential traps and "magnetic" prices. These signals help understand the intentions of major participants: are levels zones of defense or bait?

It’s important to use on-chain data as signals of market sentiment rather than static maps. For example, a heatmap cluster can be either a lure or a defensive zone—context matters.

Part 5: Sentiment + Crowd Psychology

Retail trader emotions—funding rates, long/short ratios, fear & greed index—are key factors. Analyzing crowd behavior helps understand their beliefs and potential reversal points.

TheWhiteWhale often reverse-engineers "predator" plans: who benefits from current emotions? This allows him to anticipate big players’ actions and avoid traps.

Part 6: Final Philosophy: Balancing Signals ⚖️

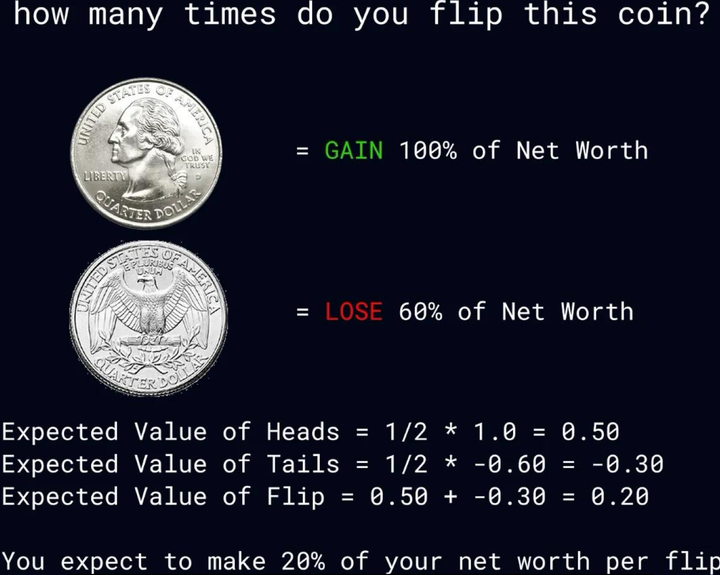

The main principle in his approach is dynamically weighing all five factors depending on current market conditions. There’s no single "king" signal—success comes from intersecting multiple factors.

If there’s a strong convergence—he acts. If there’s conflict—he waits for clearer conditions.

The essence: most traders seek certainty in one signal; he seeks confidence through their combination. If a setup looks clean but timing isn’t right—he skips; if it looks messy but offers real ROI—he enters.

This approach demonstrates that success in crypto trading isn’t about guessing or blindly following signals but about comprehensive analysis considering market behavior and global trends.

Part 7: Useful Links

🌐 Website: https://mitosis.org

📖 Docs: https://docs.mitosis.org

🐦 Twitter / X: https://twitter.com/MitosisOrg

💬 Discord: https://discord.gg/mitosis

Comments ()