A Strategic Guide to Maximizing Returns in the Programmable Liquidity Era

Unlocking DeFi’s Full Potential with Mitosis’ Unique Features

The Power of Programmable Liquidity

Did you know? Over $50B in DeFi liquidity sits idle or underutilized due to fragmented markets and opaque pricing. Mitosis transforms this wasted potential into programmable yield engines.

Imagine turning static ETH into a yield-generating, cross-chain asset while hedging risks—all with a few clicks. This guide will show you how to maximize returns, mitigate risks, and leverage Mitosis’ groundbreaking features like the upcoming "Matrix Theo campaign".

Table of Contents

1. Understanding Mitosis’ Value Proposition

2. Strategies for Retail Users

- Yield Stacking with EOL and Matrix

- Liquidity Arbitrage Across Chains

- Hedging Against Impermanent Loss

3. Advanced Tactics for Seasoned Investors

4. Risk Management Best Practices

5. The Future of Mitosis – What’s Next?

6. Mastering the Programmable Liquidity Revolution

Key Terms to Know

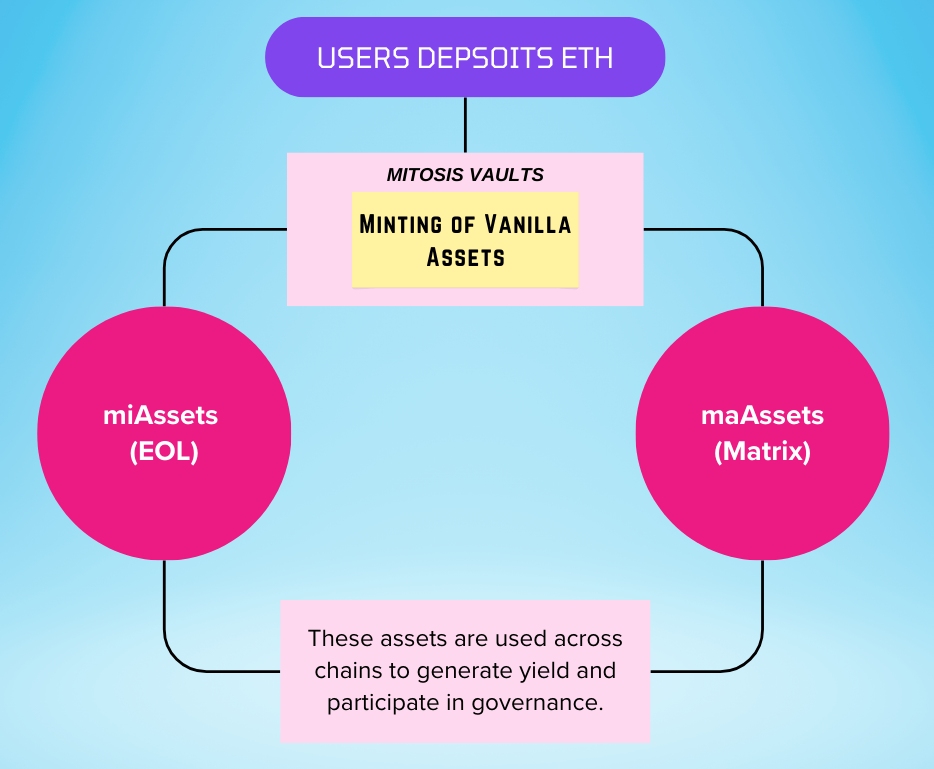

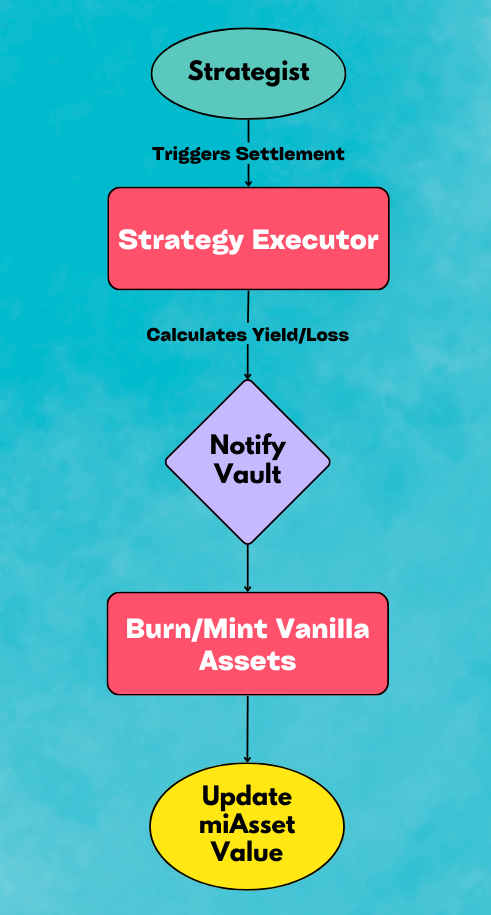

- Vanilla Assets (vETH, vBTC): Tokenized, yield-ready versions of your deposits.

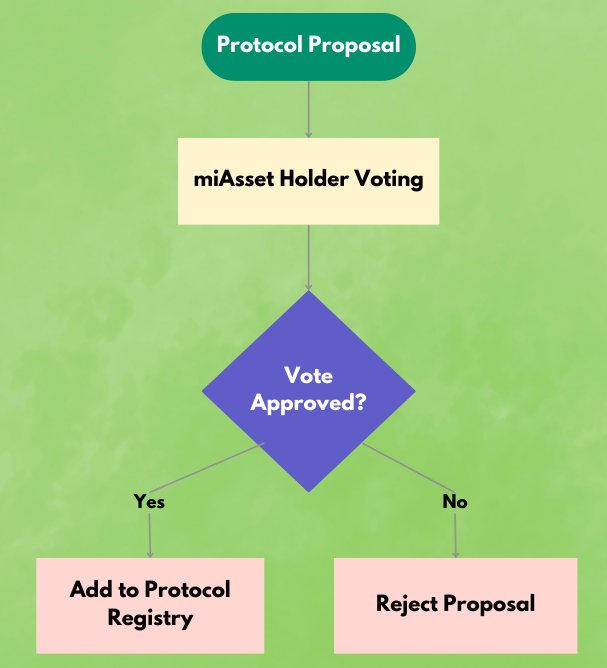

- miAssets: Governance-powered tokens (think “voting shares” for liquidity allocation).

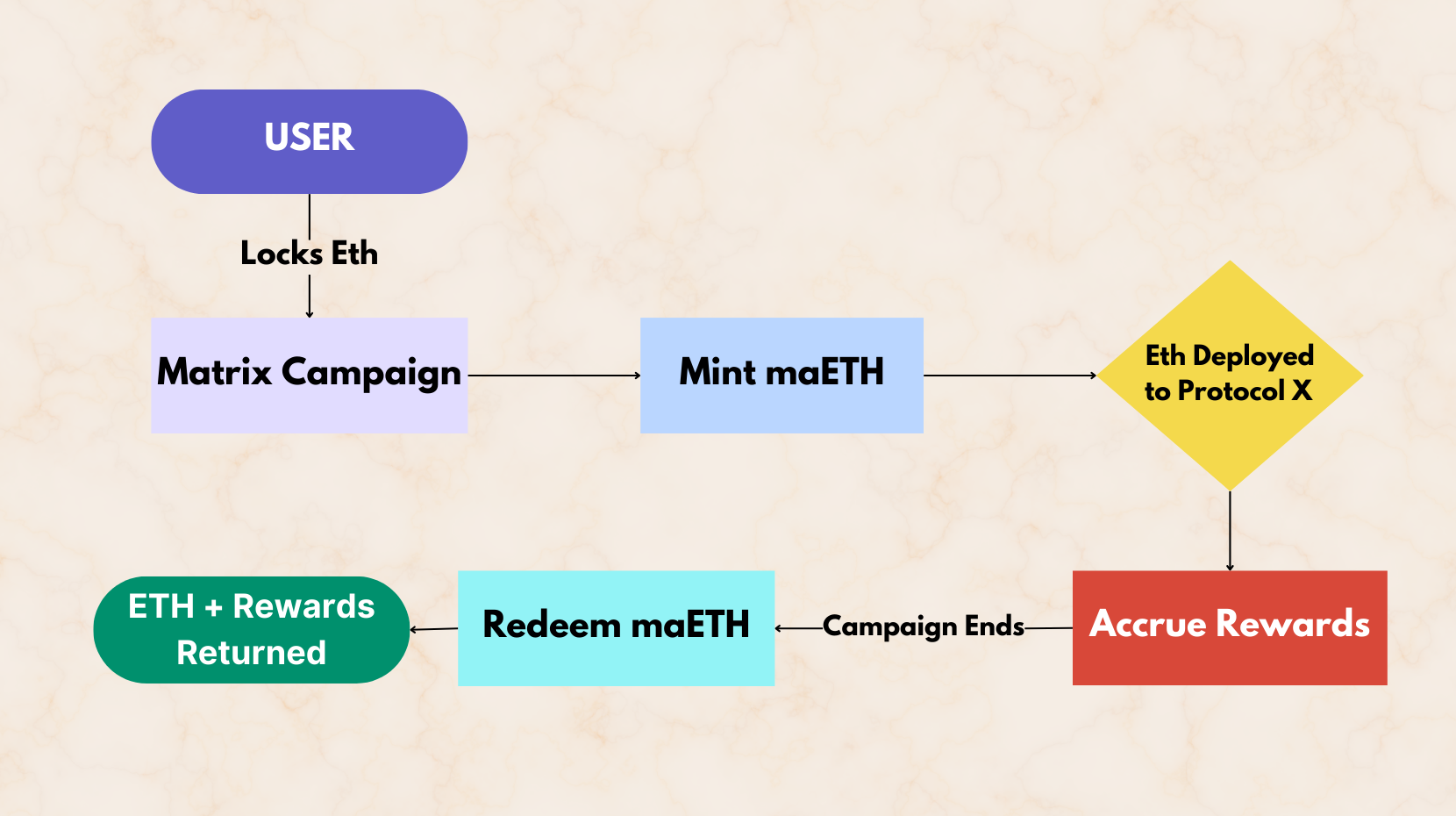

- maAssets: Fixed-term campaign tokens (e.g., lock ETH for 60 days → earn 10% APY + rewards).

- EOL: "Ecosystem-Owned Liquidity" democratically managed by miAsset holders.

- Matrix: Curated campaigns for direct protocol-to-LP partnerships.

Understanding Mitosis’ Value Proposition

1.1 What Makes Mitosis Unique?

Mitosis isn’t just another bridge or vault—it’s a liquidity supercharger. By tokenizing positions (miAssets/maAssets) and enabling cross-chain governance, it solves DeFi’s biggest pain points:

- Fragmented Liquidity: Move assets seamlessly across chains without manual bridging.

- Opaque Yields: Access institutional-grade deals through collective bargaining.

- Idle Capital: Use tokenized LP positions as collateral for loans or leveraged strategies.

Strategies for Retail Users

2.1 Strategy 1: Yield Stacking with EOL and Matrix

Step 1: Deposit ETH into Mitosis Vaults → Receive miETH (EOL) or maETH (Matrix).

Step 2: Use miETH as collateral in Mitosis’ lending markets to borrow stablecoins.

Step 3: Deploy borrowed stablecoins into high-yield protocols (e.g., Aave, Compound).

Example:

- Deposit 10 ETH → Receive 10 miETH.

- Use miETH as collateral to borrow $20,000 in stablecoins.

- Deploy stablecoins into Aave at 5% APY.

- Earn:

- ETH staking yield (e.g., 4% APY on miETH).

- Aave yield (5% APY on $20,000).

- Total ROI: ~9% APY.

Result:

Earn yield on ETH (via miETH) + yield on stablecoins + governance rewards. Pro tip: Keep an eye on upcoming campaigns for bonus rewards!

2.2 Strategy 2: Liquidity Arbitrage Across Chains

- Opportunity: Capitalize on yield disparities between chains.

- Workflow:

- Deposit ETH on Ethereum → Convert to vETH (Automatic process- Mints to miAssets) → Deploy to a low-yield chain (e.g., Polygon).

- Monitor Mitosis’ governance proposals for high-yield opportunities on chains like Avalanche.

- Reallocate liquidity via EOL votes to capture rising yields.

2.3 Strategy 3: Hedging Against Impermanent Loss

- Problem: AMM liquidity providers (LPs) face impermanent loss (IL) from volatile prices.

- Mitosis Solution:

- Use maETH (Matrix tokens) for fixed-term, IL-free yields.

- Pair maETH with stablecoin collateral to balance risk.

Example: Lock ETH in a 60-day Matrix campaign for 10% APY while using borrowed stablecoins to hedge ETH price volatility.

Case Study:

- User locks 5 ETH in “Matrix Theo” → earns 10% APY + THEO tokens.

- Simultaneously shorts ETH on derivatives to hedge price risk.

- Result: Predictable returns, zero impermanent loss.

Advanced Tactics for Seasoned Investors

3.1 Leveraging Governance for Strategic Advantage

- Power of miAssets: miETH holders vote on liquidity allocation.

- Tactic: Accumulate miETH in protocols poised for growth (e.g., emerging L2 chains).

- Outcome: Influence liquidity deployment to favor high-growth ecosystems, boosting your rewards.

Case Study:

Accumulate miETH to vote on EOL liquidity allocation. Example:

- A DAO pools 1,000 miETH to direct liquidity to Avalanche protocols.

- Earns 12% APY from Avalanche rewards + governance token airdrops.

Power Move: Use flash loans to temporarily boost miETH holdings during governance votes.

3.2 Cross-Chain Flash Loans

- How It Works:

- Borrow ETH on Ethereum via Mitosis’ lending markets.

- Deploy ETH to a high-yield protocol on Solana via Mitosis’ cross-chain vaults.

- Repay the loan within one transaction block, pocketing the yield difference.

Risk Note: Requires precise timing and understanding of gas fees.

Risk Management Best Practices

4.1 Mitosis’ Safety Net

- Audits: Vaults and MLFs are audited by [Audit Firm].

- Insurance: Allocate 5% of yields to Nexus Mutual coverage.

- Exit Plans: Sell maAssets on secondary markets (e.g., Mitosis AMM) if liquidity is urgent.

4.2 Avoiding Liquidity Lock-Up Pitfalls

- Matrix Campaigns: Only lock funds you won’t need short-term.

- Exit Strategy: Use secondary markets to sell maETH if urgent liquidity is needed.

4.3 Monitoring Cross-Chain Fees

- Cost Traps: Cross-chain transactions can incur high gas fees on certain networks.

- Solution: Use Mitosis’ fee calculator (when available) to estimate costs before deploying liquidity.

The Future of Mitosis — What’s Next?

5.1 Upcoming Features to Watch

- Single-Sided Liquidity Pools: Deposit ETH without pairing it with stablecoins.

- Institutional Vaults: KYC-enabled pools for compliant capital deployment.

- AI-Driven Yield Optimization: Automatically rebalance liquidity based on market trends.

Collaboration Spotlight: While partnerships like the Matrix Theo campaign remain under wraps, they signal Mitosis’ commitment to blending innovation with community-driven opportunities.

Mastering the Programmable Liquidity Revolution

Mitosis isn’t just about moving assets across chains — it’s about redefining how we interact with money in a decentralized world. By combining strategic yield farming, governance participation, and risk mitigation, users can unlock unprecedented opportunities in DeFi.

Get Started with Mitosis

- Main Website: Explore Mitosis’ features → mitosis.org

- Expedition App: Start earning yields → app.mitosis.org

- Join the Community: Discuss strategies and updates → Mitosis Discord

- Explore Matrix Vaults: Mitosis Website

- Read about Mitosis Litepaper here: mitosis-litepaper-6e8de95ce2bb14f8c2d2ffc8c272b9f3.pdf

Comments ()