A Strict Regulation from Turkey to the Crypto World: Historic Moves by the CMB and MASAK

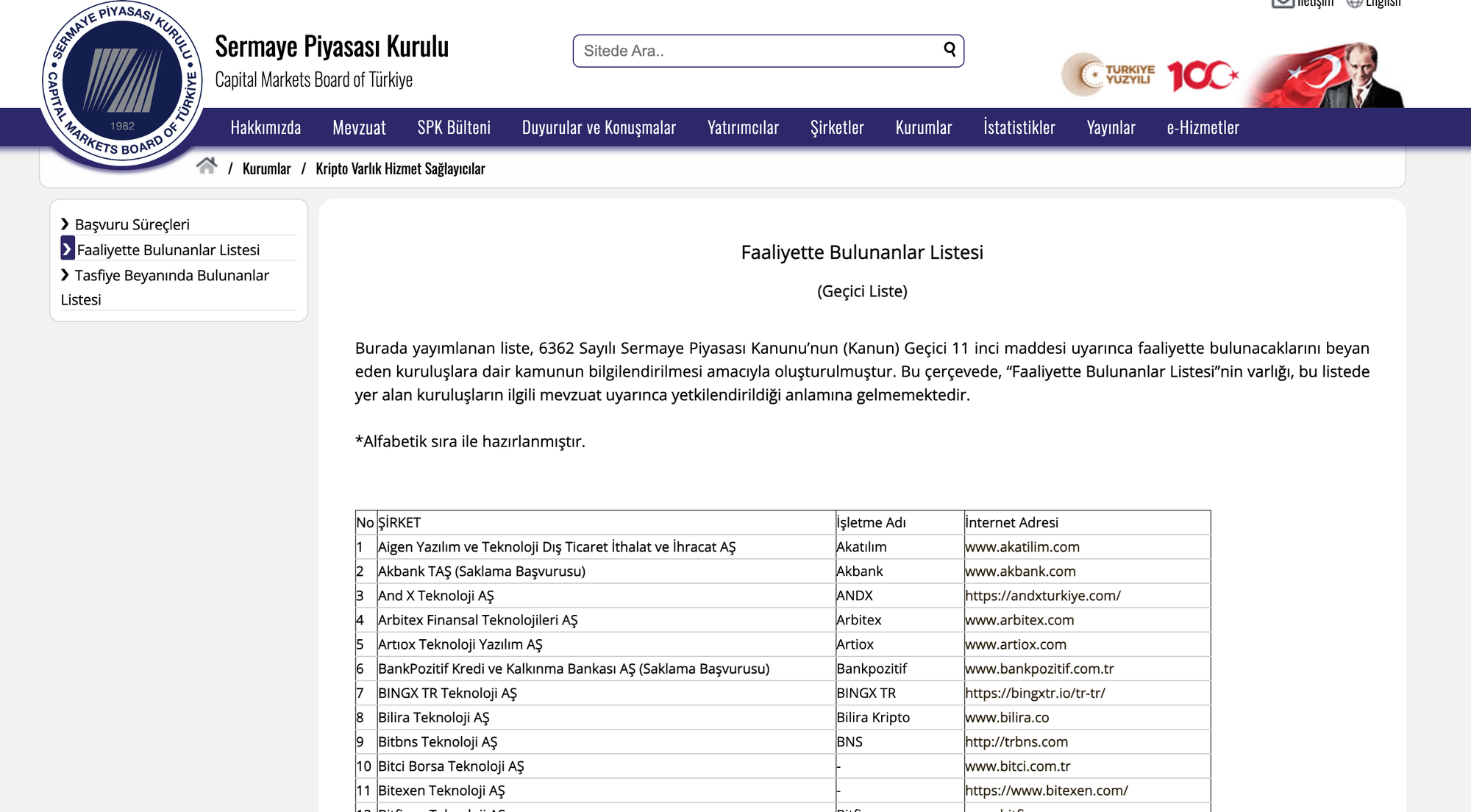

Access Ban on PancakeSwap: A First by the CMB

The Capital Markets Board of Turkey (CMB) has taken an unprecedented step. The decentralized cryptocurrency exchange PancakeSwap has been blocked from access in Turkey due to its lack of a regulatory license. This decision marks a significant turning point in the crypto ecosystem, being the first of its kind in the decentralized exchanges (DEX) category. It was also announced that the CryptoRadar platform would face a similar access restriction.

What Does the New Crypto Law Bring?

According to Webtekno, the cryptocurrency law that came into effect last year mandates that foreign-based platforms must obtain a license from the CMB to operate in Turkey. The decision to block platforms like PancakeSwap, which operate without a license, demonstrates Turkey's commitment to regulating the crypto market more tightly.

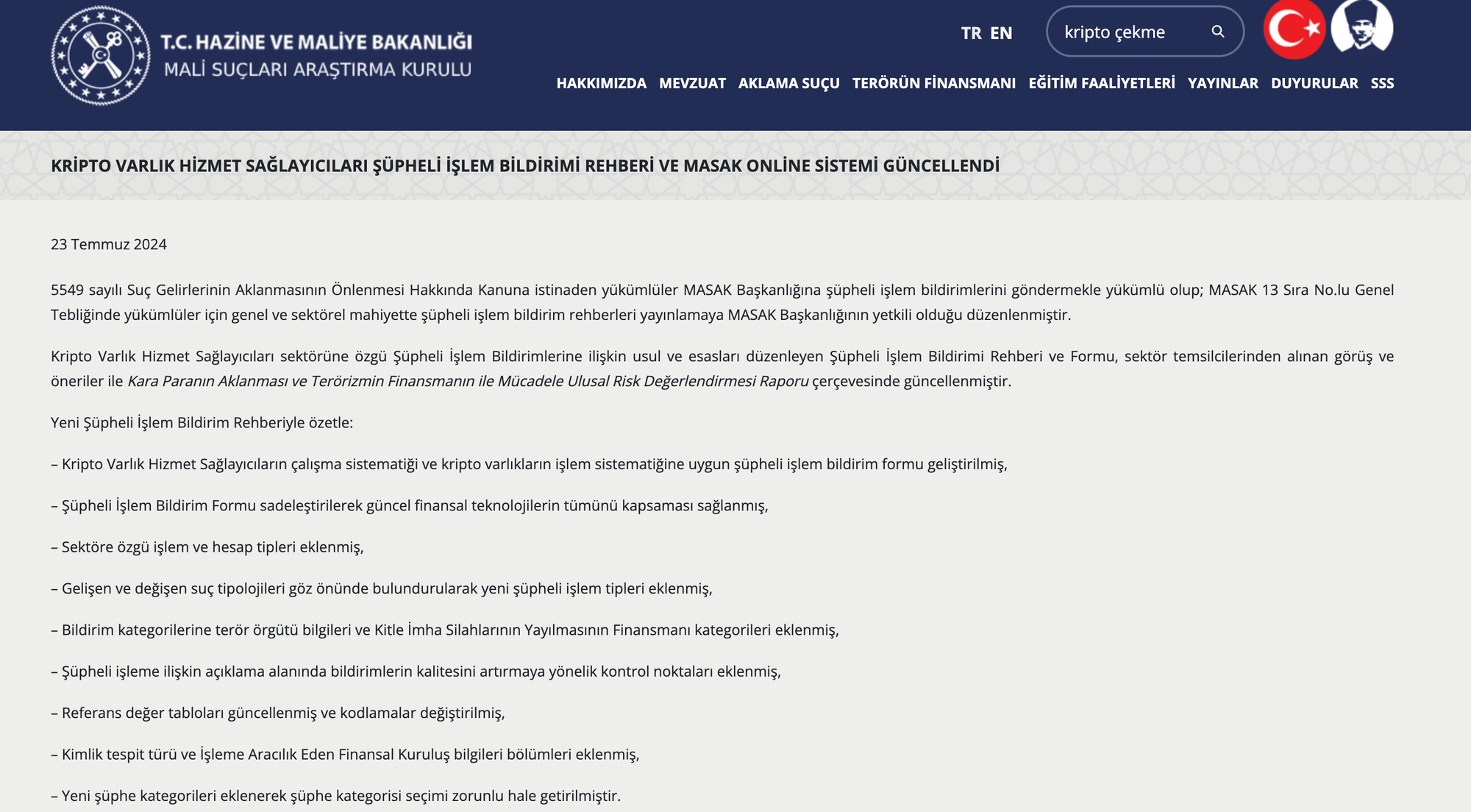

MASAK Communiqué No. 29: A New Era Has Begun

Published in the Official Gazette on June 28, 2025, the 29th Communiqué issued by MASAK introduces numerous new obligations and restrictions for both crypto asset service providers and investors. The goal is to prevent money laundering and increase transparency in the financial system.

What Does This New Communiqué Mean?

With this new regulation:

- Know Your Customer (KYC) requirements have been tightened.

- Transaction description obligations have been introduced.

- A withdrawal delay period has been implemented for crypto assets.

- Transfer limits and source documentation are now mandatory.

Strengthened Security Measures

Transaction Delay and Transfer Limits

Crypto withdrawals will now be subject to a minimum 48-hour waiting period, with a 72-hour observation period for first-time withdrawals. Additionally, stablecoin transactions will be limited to USD 3,000 per day and USD 50,000 per month. These measures aim to prevent sudden fund outflows and curb money laundering activities.

Mandatory Transaction Descriptions

For every transfer, users are now required to provide a description of at least 20 characters. These descriptions will serve as evidence in the event of a MASAK investigation.

Measures Against Arbitrage and Market Manipulation

Liquidity provision, arbitrage, and market-making activities have been categorized as high-risk. Users executing simultaneous trades on multiple platforms may be blocked automatically.

Obligation to Document Asset Sources

Platforms must now collect documentation showing the source of users’ assets, such as bank statements and external account activity records. Transactions will not be approved without this documentation.

Evaluation from the Perspective of Crypto Platforms

Although these new legal obligations introduce additional operational costs for platforms, they can also enhance international credibility. Establishing compliance departments, implementing advanced KYC systems, and integrating with MASAK systems are no longer optional they are mandatory.

Impact on Investors

The new regulations require investors to plan their actions more carefully. Withdrawal delays, description obligations, and source documentation can help prevent illegal funds from entering the system, but they may also indirectly restrict individual property rights. For high-volume investors, transfer limits could mean splitting their holdings and withdrawing over an extended period, increasing price risk.

Criticisms and Recommendations

While the new rules seem to contradict the core philosophy of crypto “freedom, decentralization, and instant transfer” they could ultimately boost the system’s reliability. However, transparency and user-friendly implementation are essential.

Platforms should update their internal control policies, prepare risk reports certified by financial auditors, and investors should carefully plan their transactions. Regulators must provide technical support and expedite secondary regulations to ensure smooth adaptation.

Conclusion

Turkey is taking decisive steps toward building a safer, more transparent, and traceable crypto asset market. The CMB’s access ban decisions and MASAK’s stricter regulations should be seen as part of the maturing process of the sector. All stakeholders must be prepared for this shift, which will help Turkey solidify its position in the global crypto ecosystem

Comments ()