Agentic AI and the Data Revolution: Building Smarter Systems for a Connected World

The evolution from Big Data to Big AI marks a paradigm shift: data is no longer just collected and stored, but acted upon autonomously by intelligent agents. See Medium. Open‑source, agentic AI frameworks—such as LangGraph, SmolAgents, and CrewAI—are lowering the barrier to entry for building autonomous systems, handling everything from prompt orchestration to multi‑step workflows. See Medium. Underpinning these frameworks is an open‑source stack—Agent‑S, LaVague, Playwright—that equips AI agents with real‑world interfaces and execution capabilities. See Medium. In the crypto world, AI‑driven analytics and autonomous trading bots are emerging as critical tools for market makers and DeFi protocols; platforms like Mitosis leverage AI for vault monitoring, cross‑chain messaging safeguards, and community‑governed liquidity strategies, demonstrating how AI and blockchain can coalesce to create resilient, transparent ecosystems. See Mitosis UniversityMitosis University.

From Big Data to Big AI

For decades, enterprises have amassed massive data warehouses—Big Data—to inform decisions retroactively. Yet this model falters in fast‑moving environments, where historical insights can’t anticipate real‑time market shifts, supply chain disruptions, or emergent security threats. See Medium. Big AI transcends mere pattern recognition by embedding intelligence directly into systems: algorithms not only analyze but also decide and execute actions autonomously. This shift demands a new architecture—one where data pipelines feed large language models (LLMs) and reinforcement‑learning agents that interact with external systems.

Defining Agentic AI Frameworks

Agentic AI frameworks encapsulate the building blocks for autonomous LLM‑driven agents—enabling them to access live data, plan multi‑step workflows, and interface with real‑world APIs. Unlike monolithic LLM libraries, these frameworks break tasks into modules: knowledge grounding, tool invocation, state management, and action execution. This modularity accelerates development while ensuring agents remain adaptable and auditable. See Medium.

Comparing Open‑Source Frameworks

A variety of open‑source frameworks vie for prominence in the agentic AI space. Below is a comparison of three leading contenders:

| Framework | Key Strengths | Use Cases | License |

|---|---|---|---|

| LangGraph | Graph‑based workflow orchestration | Complex decision trees, data routing | Apache 2.0 |

| SmolAgents | Lightweight, Hugging Face integration | Rapid prototyping, embedding retrieval | MIT |

| CrewAI | Multi‑agent collaboration, hierarchical planning | Team‑based automation, research | GPLv3 |

Source: Agentic AI Revolution analysis Top AI Tools List - OpenTools.

Building AI Agents: The Open‑Source Stack

Underpinning frameworks are supportive libraries that give agents real‑world capabilities:

- Agent‑S for app and UI interaction

- LaVague for web navigation and form filling

- Playwright and Puppeteer for cross‑browser automation Medium.

These tools let agents move beyond text: they can scrape websites, execute transactions, and react to dynamic interfaces—crucial for use cases like DeFi arbitrage or on‑chain governance monitoring.

Data as the New Fuel

Big AI consumes data at an unprecedented scale, demanding robust pipelines. Data lakes and warehouses now feed real‑time streams into agents via vector stores and retrieval‑augmented generation (RAG). The result is systems that aren’t limited by static datasets but can query, ingest, and act on live blockchain data—opening doors to AI‑driven risk assessment and predictive modeling.

AI‑Driven Analytics in Crypto

In crypto markets, AI models analyze on‑chain metrics (volume, liquidity depth, gas fees) alongside off‑chain signals (social sentiment, macroeconomic trends). These analyses power trading bots that execute orders within milliseconds, optimize liquidity provision, and detect anomalous activity, helping exchanges and DeFi protocols mitigate risks and capture alpha. See https://medium.com/data-science-collective/the-open-source-stack-for-ai-agents-8ab900e33676?

Agentic AI for Automated Trading

Agentic frameworks enable the creation of autonomous trading agents that:

- Monitor on‑chain order books and liquidity pools

- Plan optimal trade sequences (e.g., sandwich or MEV strategies)

- Execute transactions across rollups or DEXs

- Learn from outcomes via reinforcement learning loops

These agents can outperform static algorithms by adapting to shifting market regimes in real time. See https://medium.com/data-science-collective/the-open-source-stack-for-ai-agents-8ab900e33676?

AI and DeFi: Risk Management

DeFi protocols face smart‑contract vulnerabilities, oracle manipulation, and rug‑pull scams. AI‑powered auditing tools (like CertiK and SmartLLM) automate contract reviews, while anomaly‑detection models flag suspicious fund flows. Integrating these defenses into vault dashboards enhances transparency and trust.

Mitosis: AI‑Enhanced Vault Monitoring

Mitosis leverages AI within its Matrix Vaults framework to monitor vault inflows, outflows, and reward distributions. Real‑time anomaly detection helps trigger automated circuit breakers when irregular patterns (e.g., flash withdrawals or spoofed deposits) are detected, safeguarding both principal and yield strategies Mitosis University.

Cross‑Chain Messaging Safeguards

Hyperlane powers Mitosis’s permissionless, atomic cross‑chain transfers. By incorporating AI‑based validators that analyze message patterns—identifying delayed relays, duplicate proofs, or suspicious on‑chain events—Mitosis ensures deterministic settlement and minimizes reliance on manual bridge oversight Mitosis University.

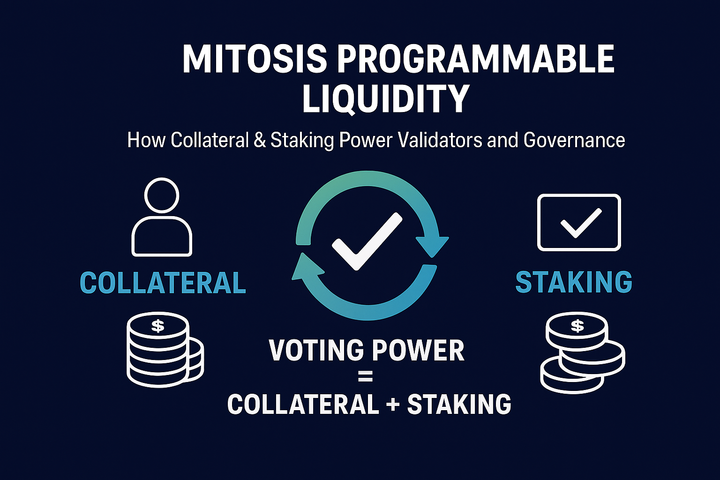

Community‑Driven Liquidity with EOL

Under Ecosystem‑Owned Liquidity (EOL), miAsset holders vote on capital allocation strategies. AI analytics surface voting anomalies, such as rapid, coordinated vote swings—alerting the community to potential governance attacks. This blend of AI insight and on‑chain democracy fortifies Mitosis’s DeFi backbone, Mitosis University.

Charting AI‑Crypto Growth

Token launches with built‑in AI utility have surged:

- 2021: 20 AI tokens

- 2022: 45

- 2023: 80

- 2024: 130

- 2025: 200

This trend underscores investor appetite for AI‑enhanced crypto projects. See https://opentools.ai/news/agentic-ai-revolution-comparing-emerging-open-source-frameworks?

The Road Ahead: Ethical and Technical Considerations

While AI amplifies capabilities, it also raises concerns: data privacy, model bias, and adversarial attacks. Ethical guidelines and open‑source scrutiny—alongside on‑chain audit trails—are essential to ensuring AI serves the many, not the few.

Integrating AI and Mitosis: A Blueprint

By uniting agentic AI frameworks with Mitosis’s programmable liquidity primitives—Matrix Vaults Mitosis University, EOL governance Mitosis University, and Hyperlane messaging Mitosis University—developers can build DeFi apps that are not only scalable and composable but also self‑optimizing and resilient.

Conclusion

The convergence of Big AI and blockchain heralds a new era of autonomous, data‑driven finance. As agentic frameworks mature and DeFi protocols like Mitosis embed AI for security, liquidity, and governance, we move closer to a world where intelligent systems manage complex financial ecosystems with minimal human intervention—and maximal transparency.

🔗Links:

Comments ()