American Express and the Crypto Industry: A New Benchmark for Traditional Banks

American Express (Amex), one of the largest global players in the financial industry, is taking confident steps towards integrating cryptocurrency technologies. This transition marks a significant stage in the evolution of traditional banks' attitudes towards digital assets. If previously large financial institutions treated cryptocurrencies with caution or distrust, today Amex is demonstrating an example of actively including crypto instruments in its services.

In this article, we will consider what solutions Amex is implementing, what technical challenges it faces, and what impact this may have on the entire banking sector.

Key areas of Amex crypto initiatives

American Express is primarily focused on integrating cryptocurrency payments into the familiar ecosystem of payment cards. Among the main projects:

Creating conditions for paying with cryptocurrency via a card - the client can manage digital assets, and settlements are made in fiat currencies;

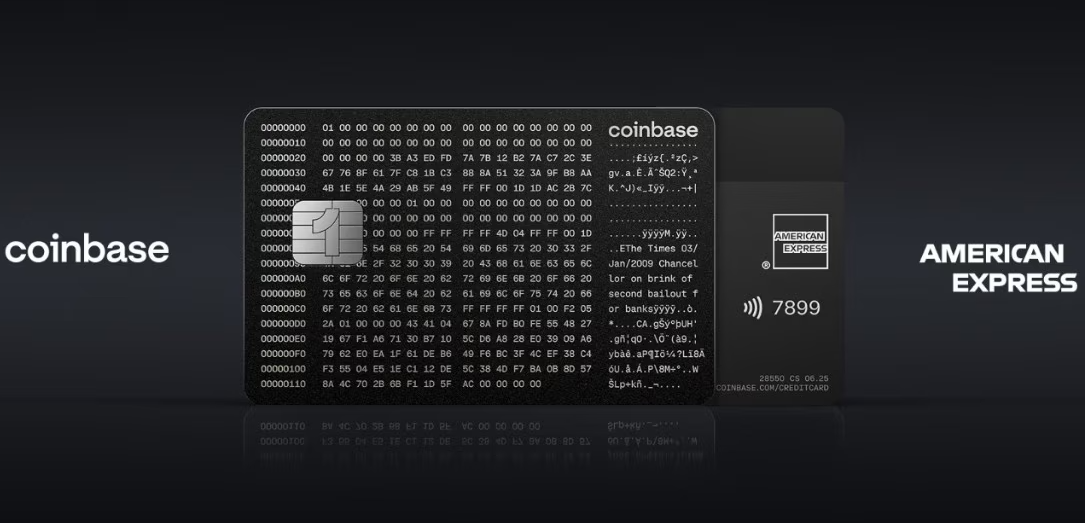

· Partnership with crypto exchanges and wallets to issue joint cards and simplify crypto-fiat exchange;

· Implementation of loyalty programs with the ability to receive rewards in cryptocurrency or purchase NFTs.

· From the technical side, this requires reliable exchange gateways, integration with blockchains via API and ensuring instant conversion with minimal delays.

American Express Crypto Integration – Technical Features and Challenges

|

Aspect |

Description |

Benefits |

Challenges |

|

Crypto

Payment Support |

Enables

users to pay with cryptocurrencies via card through crypto-to-fiat conversion |

Seamless

user experience; bridges crypto and fiat |

Requires

robust real-time conversion infrastructure |

|

Partnerships |

Collaborations

with crypto exchanges and wallets for co-branded card issuance |

Expands

market reach; leverages existing crypto platforms |

Dependency

on third-party security and compliance |

|

Transaction

Speed |

Use of

off-chain scaling solutions (rollups, payment channels) to reduce latency |

Faster

transaction confirmation close to traditional payments |

Complexity

in integrating blockchain with legacy systems |

|

Compliance

and Security |

Integration

of KYC/AML procedures with blockchain transactions via advanced analytics |

Ensures

regulatory adherence; reduces fraud risk |

Balancing

privacy with regulatory demands |

|

Custody

Solutions |

Employs

third-party custodians with multi-signature wallets and cold storage |

Enhanced

security for digital assets |

Reliance

on custodial providers; potential centralization |

|

APIs

and Infrastructure |

Development

of hybrid systems linking traditional banking and blockchain networks |

Facilitates

interoperability and scalability |

Requires

continuous updates to keep pace with blockchain tech |

Technical difficulties and their solutions

Implementation of cryptocurrency products in the infrastructure of a traditional bank is not an easy task:

Transaction speed: classic payment systems work with delays of milliseconds, while blockchains confirm transactions in seconds or minutes. Amex uses off-chain solutions and scaling technologies (rollups, payment channels) to minimize delays.

Security and compliance: KYC/AML procedures must be harmoniously combined with the anonymity of the blockchain. For this, blockchain transaction analytics systems and machine learning are used to monitor suspicious activity.

Custody services: digital asset custody is often outsourced to specialized providers with multi-layered security systems, including cold wallets and multi-signatures.

These technical solutions require the development of a hybrid architecture that combines banking and blockchain systems.

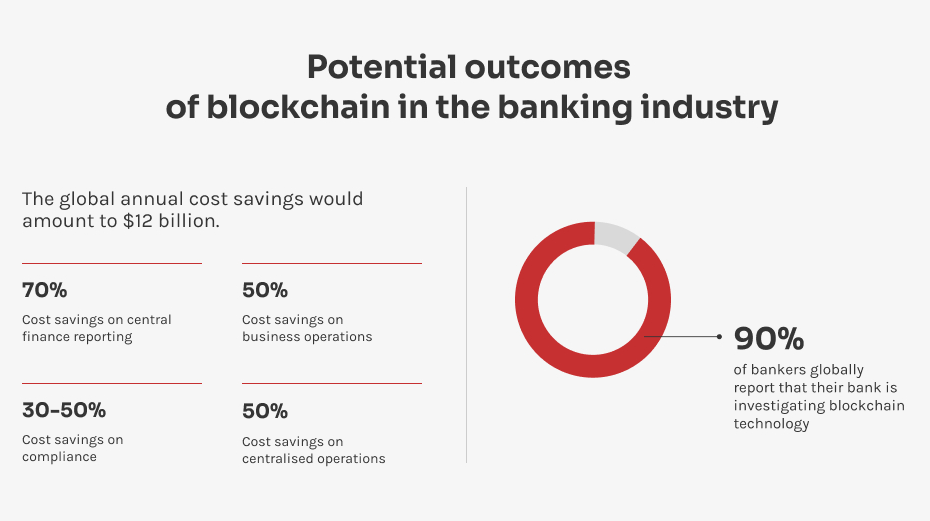

Impact on cryptocurrency adoption in the banking sector

Amex’s presence in the crypto space reflects important trends:

1) Removing barriers for users: using cryptocurrency within familiar payment instruments facilitates widespread adoption.

2) Connecting fiat and crypto: instant conversions make the user experience smooth and straightforward, without the need for in-depth blockchain knowledge.

3) Focus on regulatory compliance: Amex’s strong regulatory framework shows the way for large banks to handle digital assets legally and securely.

This creates a roadmap for other banks, accelerating institutional adoption of cryptocurrencies.

Implications of Amex’s Crypto Adoption for Banking Industry

|

Area |

Impact |

Opportunities |

Potential Risks |

|

User

Adoption |

Simplifies

crypto payments via familiar card products |

Increased

mainstream crypto usage |

User

confusion over crypto/fiat conversion process |

|

Fiat-Crypto

Bridge |

Instant

conversion enables smooth user experience |

Drives

seamless integration of traditional and digital finance |

Volatility

risk during conversion delays |

|

Regulatory

Model |

Demonstrates

compliance frameworks for crypto banking |

Sets

industry standard for safe crypto operations |

Possible

regulatory changes impacting operations |

|

Competitive

Landscape |

Pressures

banks to innovate and offer crypto services |

Accelerates

digital transformation in financial sector |

Increased

competition could impact smaller banks |

|

Technology

Innovation |

Encourages

development of hybrid blockchain-finance infrastructure |

Promotes

adoption of new blockchain tech and smart contracts |

High

cost and complexity of integration |

|

Market

Infrastructure |

Spurs

growth of custody, settlement, and payment solutions supporting crypto |

Enhances

ecosystem maturity and reliability |

Dependence

on third-party providers and interoperability |

Broader implications for the industry

Amex’s moves are pushing competitors to innovate, as banks are beginning to:

Create their own digital asset platforms or partner with crypto companies;

Explore opportunities to tokenize traditional assets;

Implement blockchain technologies to streamline internal processes.

Increased involvement of large financial players can stimulate the development of a regulatory framework and infrastructure that will benefit the entire crypto market.

Conclusion

American Express, by integrating cryptocurrency solutions, is setting a new benchmark for traditional banks. This process is not just a product launch, but a paradigm shift in the perception of digital assets in the financial sector. By overcoming technical and regulatory challenges, Amex is showing that crypto integration is becoming a strategic necessity for large players.

As more banks follow suit, the boundaries between classic and decentralized finance will blur, ushering in an era of hybrid financial ecosystems.

Comments ()