Amex's Role in Cryptocurrency: A New Precedent for Mainstream Banks

For a long time, cryptocurrencies were perceived by traditional banks as something marginal: a speculative asset that cannot be controlled, with a high level of risk and an uncertain legal status. However, as the crypto market matures and integrates into the global economy, the rhetoric is beginning to change. And one of the main signals of this transformation is the participation of American Express (Amex).

Amex, one of the symbols of the classical banking world, is known for its conservative policies and attentive attitude to innovation. However, in 2022-2025, the company began to consistently enter the crypto market. This is not just a tactical move, but a strategic restructuring that can become a benchmark for other large financial institutions.

Comparison of Crypto Engagement Strategies Among Major Card Networks

|

Category |

Visa |

Mastercard |

American Express (Amex) |

|

Market

Focus |

Mass-market

users |

Mass-market

and SMBs |

Premium

and business clients |

|

Crypto

Card Launches |

Multiple

partnerships (Crypto.com, Binance) |

Several

crypto card projects (e.g., Gemini) |

Limited

pilot with Abra |

|

NFT/Web3

Initiatives |

NFT

platform sponsorship, partnerships |

NFT-based

loyalty pilots |

Experimental,

premium-focused NFT access |

|

Blockchain

Infrastructure |

Visa

B2B Connect, stablecoin pilots |

Multi-chain

payments, identity on-chain |

Early-stage

blockchain exploration |

|

Risk

Tolerance |

High

(aggressive market testing) |

Moderate |

Low

(cautious, compliance-first) |

|

Strategic

Messaging |

"Crypto

is the future of payments" |

"Exploring

crypto for financial inclusion" |

"Testing

crypto for client value" |

A history of caution: why Amex hesitated

Unlike Visa and Mastercard, which actively experimented with crypto cards, blockchain and partnerships with crypto exchanges, American Express took a wait-and-see attitude for a long time. The reasons for this approach were quite rational:

1. Legal uncertainty: especially in the US, where cryptocurrency regulation remains ambiguous and contradictory;

2. Compliance risks: Amex traditionally relies on reliability, compliance with international AML standards and protection of user data;

3. Reputational risks: mass thefts of cryptocurrencies, bankruptcies of exchanges and projects with signs of pyramids created a toxic atmosphere around the crypto industry.

However, in parallel with this, technologies were developing (especially in the stablecoins and blockchain infrastructure segment), as well as the demand from premium clients for digital assets. This became the entry point.

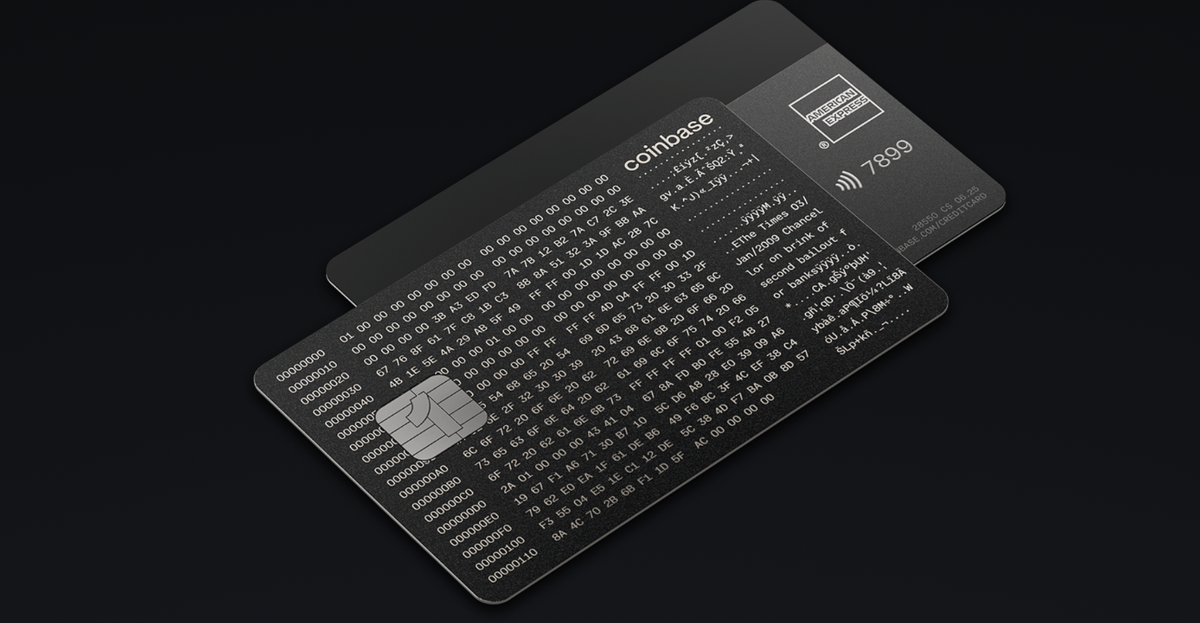

A crypto card from Amex and partnership with Abra: the first swallow

In 2022, Amex entered into a partnership with the Abra crypto platform, announcing the launch of the first joint American Express crypto card, operating on the Amex network and linked to the user's crypto wallet. Key features:

· The user can spend cryptocurrency at a familiar point of sale;

· Cryptocurrency cashback is provided;

· Works under the Amex license in compliance with all regulatory requirements.

This was Amex's first attempt to adapt its premium service to the new digital environment without destroying the company's basic architecture.

Potential Crypto Applications Within Amex Ecosystem

|

Application Area |

Description |

Strategic Benefits for Amex |

|

Loyalty

& Rewards (Web3) |

Tokenized

membership rewards, NFT-based experiences, smart contract redemptions |

Increased

engagement, programmable incentives, exclusivity |

|

Stablecoin

Payments |

Enabling

USDC or other stablecoin-based settlements |

Faster

cross-border transactions, reduced fees, currency risk hedging |

|

Crypto

Cashback Cards |

Spending

crypto with cashback in digital assets |

Client

retention, entry point for new user demographics |

|

Metaverse

Integration |

Offering

VIP access, premium perks in digital environments |

Brand

visibility in emerging markets, unique client experience |

|

On-Chain

Identity & KYC |

Blockchain-based

verification for high-trust operations |

Lower

fraud risk, regulatory innovation |

|

Business

Crypto Accounts |

Custodial

or managed access for SME/business crypto treasury |

High-value

B2B services, early market positioning |

Potential scenarios: where Amex might go

Unlike other banks' "tests", Amex's actions look like structural investments in the future. Three strategic directions can be distinguished:

Blockchain as the basis for loyalty

Amex is a leader in rewards programs, bonuses and exclusive offers. Transferring these systems to smart contracts can simplify the management of points, their conversion, increasing transparency and reducing operating costs.

Example: instead of internal currency (points), a client can receive NFT access to events, premium services or collections.

Support for stablecoins for international payments

Payments using stablecoins (such as USDC or even CBDC) allow you to bypass slow and expensive SWIFT transfers. For Amex customers, this is a chance to receive a faster and more transparent cross-border service. This is especially relevant for customers with global businesses.

Integration with Web3 and metaverses

Amex can offer digital identification, tokenized premium cards, and personalized offers in metaverses, including discounts, events, or virtual clubs.

Why Amex's move is a precedent

Amex is not just a private company. It is a kind of financial beacon, which is monitored by competitors, regulators, and venture investors. Its approach is different from Visa and Mastercard.

Amex does not follow the trend, but forms its own standard for the implementation of cryptocurrencies in the classic banking rails.

Risks and Challenges

Despite the positive signal, Amex faces a number of challenges:

1. Regulatory turbulence: especially in the US, where the SEC and CFTC are competing for jurisdiction;

2. Conflict with central banks: the introduction of stablecoins could cause tension amid the preparation of digital currencies (CBDCs);

3. The need for customer education: cryptocurrencies remain a complex topic for most Amex users.

However, the company seems ready to tackle these challenges step by step, without fanfare.

Conclusion: the beginning of a new era?

American Express’ involvement in the crypto economy is not just news. It is a precedent with a big idea behind it: large, time-tested banks are beginning to recognize that digital assets are not a threat, but part of a new financial architecture.

If Amex is not just “flirting” but actually building a long-term crypto strategy, then other banks — from HSBC to Deutsche Bank — may follow suit. And then what crypto enthusiasts have been waiting for since 2009 will happen: the merger of traditional and digital capital into a single financial ecosystem.

Comments ()