Apollo’s $785B Tokenized Credit Fund: The Boldest Bet Yet on DeFi’s Institutional Future

Introduction: A Financial Earthquake on the Blockchain

In January 2025, Apollo Global Management a titan overseeing $785 billion in assets, made a seismic move by launching its tokenized private credit fund, ACRED, on the Solana blockchain. This isn't just another fund; it's a bold stride into the future of finance, where traditional assets meet decentralized technology. By partnering with Securitize, Kamino Finance, and Drift Protocol, Apollo is not merely participating in the DeFi revolution; it's leading it.

The ACRED Initiative: Bridging Traditional Finance and DeFi

ACRED, or the Apollo Diversified Credit Securitize Fund, represents a diversified portfolio of private credit assets, including direct corporate loans and asset-backed securities. Historically, such investments were accessible only to institutional investors. Now, through tokenization, ACRED democratizes access, allowing a broader range of investors to participate in private credit markets.

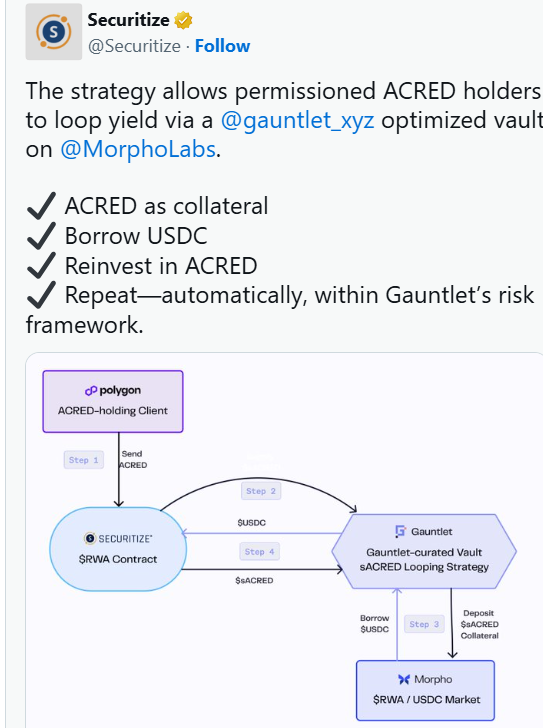

Issued under Securitize’s regulated sToken framework, ACRED ensures compliance while offering the flexibility of blockchain-based assets. This dual approach provides investors with the confidence of regulatory oversight and the benefits of decentralized finance.

Solana: The Chosen Blockchain for ACRED

Solana's high-speed, low-cost infrastructure makes it an ideal platform for ACRED. With transaction speeds surpassing those of Ethereum and minimal fees, Solana facilitates seamless trading and integration of tokenized assets. This choice underscores the growing trend of leveraging efficient blockchain networks for complex financial instruments. Mitosis University

Strategic Partnerships Enhancing ACRED's Utility

- Kamino Finance: Through its Multiply product, Kamino enables investors to leverage ACRED tokens, amplifying exposure while managing risk via smart contracts. Kamino Governance

- Drift Protocol: Drift Institutional offers a white-glove service, assisting large institutions in integrating real-world assets like ACRED into the DeFi ecosystem. drift.trade

- Steakhouse Financial: As a DeFi risk advisor, Steakhouse ensures that the integration of ACRED into decentralized platforms maintains financial stability and adheres to best practices.

The Broader Implications: A $30 Trillion Opportunity

Tokenized real-world assets (RWAs) represent a burgeoning market, with estimates suggesting a $30 trillion opportunity globally. The U.S. private credit market alone has expanded from $1 trillion in 2020 to approximately $1.5 trillion in 2025, with projections reaching $2.8 trillion by 2028.

By tokenizing assets like ACRED, Apollo not only enhances liquidity and accessibility but also sets a precedent for other financial institutions to follow. This move could catalyze a shift in how traditional assets are managed and traded, blending the security of traditional finance with the innovation of blockchain technology.

Educational Insights: Understanding Tokenized Private Credit

What is Tokenized Private Credit?

Tokenized private credit involves converting private debt instruments into digital tokens on a blockchain. This process enhances transparency, reduces transaction costs, and allows for fractional ownership, making private credit more accessible to a broader range of investors.Reuters

Benefits:

- Liquidity: Traditionally illiquid assets become tradable on secondary markets.

- Accessibility: Investors can participate in markets previously reserved for institutions.

- Transparency: Blockchain's immutable ledger ensures clear records of transactions and ownership.

Challenges:

- Regulatory Compliance: Navigating the complex landscape of financial regulations across jurisdictions.CoinDesk

- Technology Integration: Ensuring seamless integration between traditional financial systems and blockchain platforms.Messari

Conclusion: A Paradigm Shift in Asset Management

Apollo's launch of the ACRED token on Solana is more than a novel financial product; it's a harbinger of a new era in asset management. By marrying the robustness of traditional finance with the agility of decentralized platforms, Apollo sets a benchmark for innovation in the financial sector.

As tokenization continues to gain traction, we can anticipate a future where financial assets are more accessible, transparent, and efficient. Apollo's bold move into the DeFi space is not just a strategic business decision; it's a visionary step towards redefining the financial landscape.

For further reading on the evolution of tokenized assets and their impact on global finance, consider exploring the following resources:

INTERNAL LINKS:

Why Solana?

Tokenizing Real-World Assets

Unlocking Financial Composability

Apollo’s Credit Fund

Comments ()