ARK Invest Bolsters Crypto Portfolio with $47 Million in Coinbase and BitMine Shares Amid Market Dip

ARK Invest, the prominent investment management firm led by Cathie Wood, has reaffirmed its commitment to the cryptocurrency sector with a bold move amid recent market volatility. On Friday, August 1, 2025, ARK disclosed the purchase of approximately $47 million in shares of Coinbase Global Inc. (COIN) and BitMine Immersion Technologies (BMNR) across three of its actively managed exchange-traded funds (ETFs). The purchases were timed with a notable market dip in both stocks, underscoring ARK’s strategy of capitalizing on short-term weakness to build long-term positions in disruptive innovation.

Strategic Allocation: $30 Million to Coinbase, $17 Million to BitMine

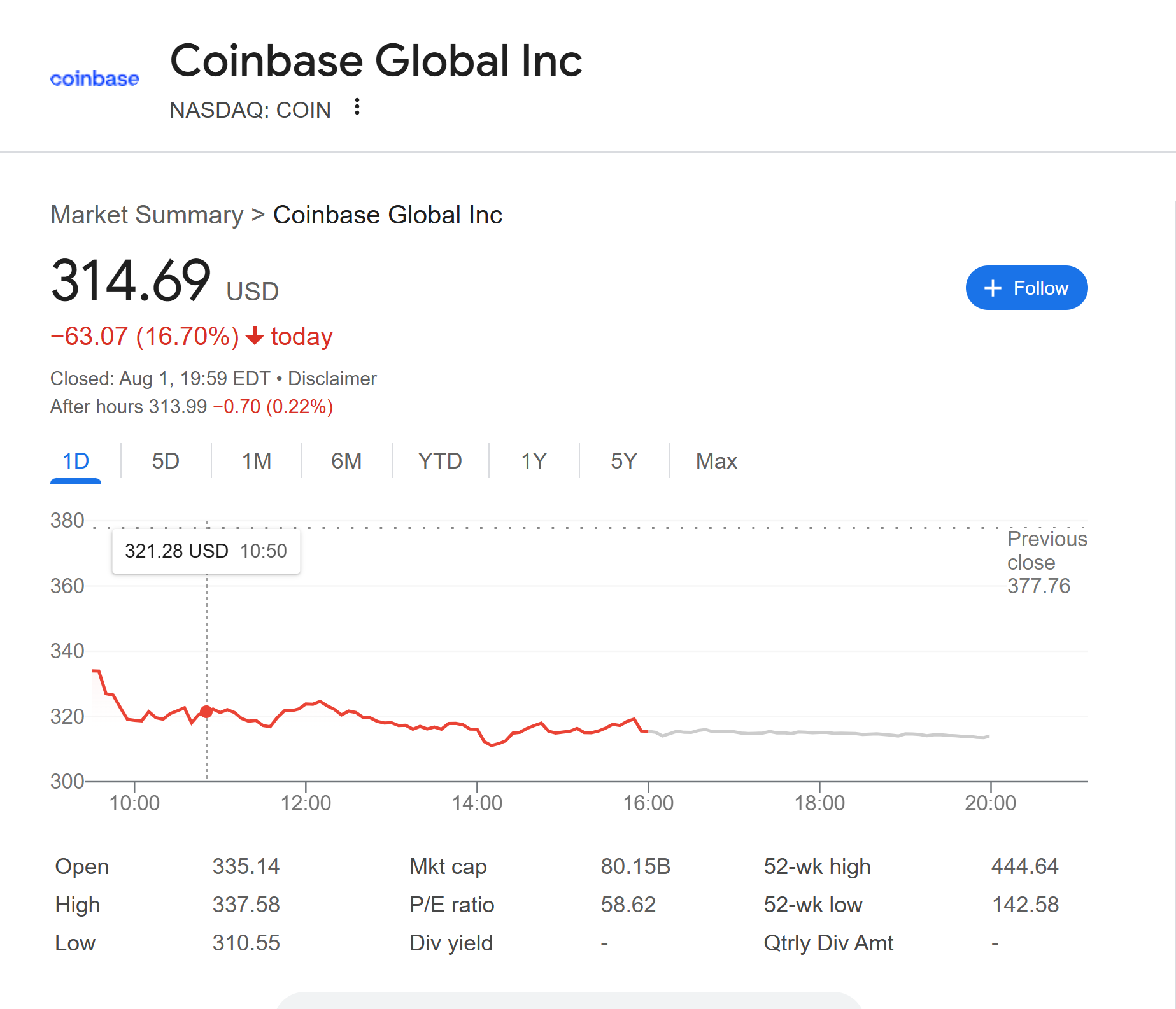

According to ARK’s daily trading disclosures, the firm purchased 94,678 shares of Coinbase, allocating around $30 million across three funds: ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF). The majority of the acquisition went to ARKK, which received $22.6 million worth of shares. This move came as Coinbase shares fell 16.7%, closing Friday at $314.69, down from a recent high of $377 earlier in the week and significantly below its 52-week high of $444.64. The stock briefly reached an intraday low of $310.55 following weaker-than-expected second-quarter earnings.

In tandem, ARK increased its exposure to BitMine Immersion Technologies by purchasing 540,712 shares valued at approximately $17 million. These shares were also distributed among ARKK, ARKW, and ARKF, with ARKK again receiving the largest allocation at $11.6 million. BitMine’s stock closed at $31.68 on Friday, down 8.55%, with an intraday low of $30.30.

These purchases follow a pattern of strategic accumulation. Earlier in the same week, ARK had invested an additional $20 million in BitMine on Monday and $15.3 million on Tuesday, bringing its total five-day investment in the company to $52.4 million. This sustained activity suggests a high-conviction bet on BitMine’s long-term potential and its growing role in the Ethereum ecosystem.

Market Context and Tactical Approach

ARK’s latest moves come during a period of heightened volatility for crypto-linked equities. Broader macroeconomic uncertainty, including a slowing U.S. economy, softening consumer demand, and reduced loan activity at major financial institutions, has contributed to sell-offs across technology and digital asset sectors. Financial stocks such as JPMorgan Chase and Wells Fargo also posted declines on Friday, highlighting the cross-sector impact of recent economic data.

Despite these challenges, ARK’s willingness to increase its stake in Coinbase and BitMine reflects its long-term confidence in blockchain infrastructure and digital asset adoption. The firm has built a reputation for adopting a contrarian investment strategy, often entering or expanding positions in high-growth companies during periods of market pessimism.

Interestingly, the Coinbase purchases followed ARK’s sale of 18,204 COIN shares earlier in the week, totaling approximately $7 million. This suggests a flexible approach that allows for short-term portfolio adjustments while remaining committed to core holdings. The post-earnings decline in Coinbase stock appears to have provided what ARK viewed as an attractive re-entry point for building a deeper position.

BitMine’s Ethereum-Centric Evolution

While Coinbase has long been a key component of ARK’s crypto exposure, BitMine Immersion Technologies is emerging as a new pillar in the firm’s investment thesis. BitMine has recently pivoted from its original focus on immersion cooling systems to become an Ethereum-focused treasury and infrastructure company.

At the time of ARK’s most recent investment, BitMine held 625,000 ETH in its corporate treasury, making it the largest publicly known Ethereum holder among U.S.-listed companies. This positions it ahead of competitors such as SharpLink Gaming, which holds approximately 438,200 ETH. BitMine’s ETH holdings give it strategic relevance as Ethereum becomes increasingly central to enterprise applications, DeFi protocols, and tokenized asset infrastructure.

The company has also drawn attention with the appointment of Tom Lee, founder of Fundstrat Global Advisors, as CEO. Lee’s reputation in institutional finance and his long-standing bullish view on cryptocurrencies have enhanced market interest in BitMine’s direction. Under his leadership, the company has expanded into Ethereum staking, custody solutions, and low-energy mining operations, aligning with Ethereum’s shift to proof-of-stake and scalable Layer 2 ecosystems.

ARK’s Broader Strategy

The Coinbase and BitMine acquisitions are consistent with ARK’s focus on identifying and investing in disruptive innovation. Blockchain technology is viewed by the firm as a foundational pillar for future economic systems. Its research highlights blockchain’s potential to transform industries ranging from finance and supply chains to artificial intelligence and data verification.

Coinbase remains the largest U.S.-listed cryptocurrency exchange and a gateway to digital assets for both retail and institutional investors. Despite recent earnings pressure, the company continues to expand its business model through institutional custody, blockchain analytics, and regulatory partnerships. BitMine, on the other hand, represents a more speculative yet potentially high-reward play on Ethereum infrastructure, a segment expected to see growth as decentralized applications and smart contracts become mainstream.

ARK’s research team has often emphasized the potential for exponential growth in digital assets. Long-term forecasts from the firm include bullish projections for Bitcoin, Ethereum, and tokenized asset networks. These outlooks are based on anticipated adoption cycles, network effects, and regulatory evolution. ARK's portfolios often reflect these themes through substantial allocations to companies building or supporting blockchain ecosystems.

Market Implications

For market participants, ARK’s activity may indicate a belief that crypto-related equities have reached a local bottom. While the volatility in this sector remains elevated, many analysts and institutional investors are beginning to reassess long-term value as crypto companies mature and expand into new service offerings.

Several developments could influence sentiment moving forward. These include Federal Reserve policy decisions, the potential for new U.S. legislation around digital assets, the implementation of Ethereum’s next scalability upgrades, and global regulatory changes such as Europe’s Markets in Crypto-Assets (MiCA) framework. Coinbase’s performance in the coming quarters will also be a focal point, particularly in terms of user engagement and non-trading revenue growth.

BitMine’s success may depend on how well it navigates Ethereum’s evolving network and how effectively it leverages its large ETH holdings to generate yield, drive product development, or form institutional partnerships.

Conclusion

ARK Invest’s $47 million investment in Coinbase and BitMine shares during a week of market declines reflects its conviction in the long-term trajectory of blockchain technologies and digital finance. By increasing its positions in both a market-leading exchange and an emerging Ethereum infrastructure firm, ARK is reinforcing its commitment to innovation-driven investing.

While the near-term outlook for crypto markets remains uncertain, ARK’s consistent accumulation of shares in companies central to blockchain development suggests that it views these assets as foundational components of the next wave of technological disruption. As the crypto sector continues to evolve, these moves could provide the firm with early positioning in a rapidly transforming digital economy.

References

Comments ()