Arthur Hayes’ $250K Bitcoin Prediction – What It Could Mean for Mitosis

Introduction hook:

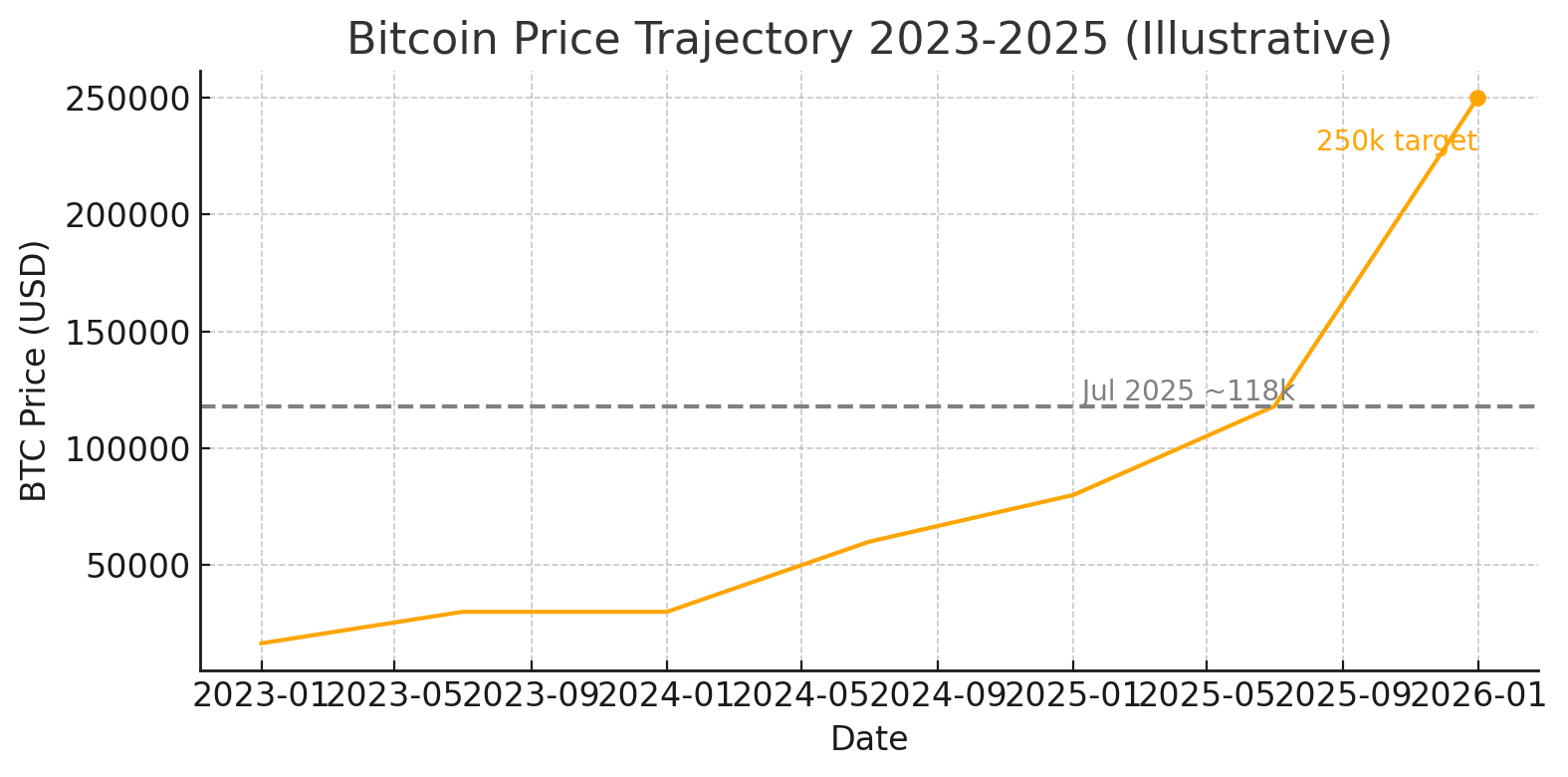

Quarter-million dollar Bitcoin? Five-figure Ether? These bold targets aren’t just clickbait – they’re the year-end 2025 predictions from Arthur Hayes, the outspoken BitMEX co-founder and crypto essayist. Hayes argues that a “war-time” credit-fueled economy and stablecoins funneling billions into U.S. treasuries will propel Bitcoin to $250,000 and Ethereum to $10,000. He posits that relentless monetary expansion (central banks printing money) is the drumbeat behind crypto’s rally – and with Bitcoin’s fixed supply, more fiat liquidity means an upward price crescendo. Meanwhile, big institutions are piling in: Ethereum ETFs recently saw over $533 million in one-day inflows (part of a $4B+ streak), led by BlackRock’s trust. If Hayes is right about this credit-driven bull market, what might such a scenario spell for Mitosis and its cross-chain DeFi ecosystem?

Hayes’ Bull Thesis: Credit, Stablecoins, and Institutions

Hayes’ macro thesis centers on credit creation as the catalyst for crypto growth. He points out that governments in quasi-war postures will expand fiscal deficits and bank lending to fund industry – effectively printing money that has to flow somewhere. In this scenario, Bitcoin is “the best horse to ride” if you expect a wave of new fiat, thanks to its scarcity and hard cap. Accordingly, Hayes has publicly gone all-in on this cycle, predicting Bitcoin at $250,000 and Ether at $10,000 by end of 2025.

A striking element of Hayes’ view is the role of stablecoins. He argues that stablecoin issuers like Tether and USDC have become de facto financiers of the U.S. government, recycling crypto capital into short-term Treasury bills. As crypto markets swell, a portion of that value parks in stablecoins – and those reserves (over $120 billion in Tether’s case) get plowed into T-bills. In essence, crypto liquidity is now intertwined with government debt markets. This stablecoin-Treasury nexus means that booming crypto prices could ironically help fund government spending, creating a feedback loop of liquidity.

Finally, Hayes notes growing institutional involvement as a green light for his bullish targets. Traditional finance is entering the crypto fray via regulated channels – for example, multiple spot Bitcoin and Ether ETF filings, large fund launches, and corporate treasury allocations. The recent torrent of Ethereum ETF inflows (with BlackRock’s iShares fund spearheading the surge) underscores that big-money investors are seeking crypto exposure. Such influx of institutional capital not only validates the market but also adds depth and stability to liquidity across chains.

Implications for Mitosis: Cross-Chain Supercharged

If Bitcoin at $250K and Ethereum at $10K become reality, the ripples will be felt across the multi-chain DeFi landscape – and Mitosis is poised to benefit. Mitosis, known as “the network for programmable liquidity,” is built to optimize and connect liquidity across chains. A crypto bull of that magnitude could supercharge cross-chain activity in several ways:

- Explosive Cross-Chain Volume: A flood of new capital would chase yields and opportunities on many networks, driving demand to move assets seamlessly. Higher prices and user growth mean more transactions bridging between Layer-1s, Layer-2s, and appchains. Mitosis’ infrastructure for cross-chain liquidity would see significantly more usage as traders and yield farmers shuttle funds to wherever returns are highest. More volume flowing through Mitosis bridges and vaults would reinforce its role as a highway for liquidity, not just within Ethereum but across the entire Web3 ecosystem.

- Deeper Stablecoin Liquidity Pools: In a boom, stablecoin circulation tends to expand alongside crypto market cap – providing the grease for trading and DeFi. If stablecoin issuers are pumping liquidity into treasuries as Hayes suggests, they’re also issuing more tokens into crypto markets. This means larger pools of USDT, USDC, etc. on every chain. Mitosis, which enables unified liquidity and even ecosystem-owned liquidity provisioning, could tap into these growing stablecoin reserves. More stablecoins on Mitosis-powered networks equates to tighter spreads, lower slippage, and more efficient arbitrage across chains. In short, abundant stablecoin liquidity would make Mitosis’s cross-chain swaps and yield strategies even more effective.

- Surging Demand for Seamless Bridging: With institutional and retail entrants spreading into various blockchain ecosystems (Ethereum, modular rollups, Solana, Cosmos, etc.), the need for trustworthy, fast bridges will be critical. Users will expect to move value from a Layer-2 to an alt-L1 or between any chains without a second thought. As a cross-chain bridge protocol focused on security and usability, Mitosis stands to attract these users. Its emphasis on interoperability and programmable liquidity means new users can easily bridge assets and even deploy them in yield opportunities in one go. A bull run would amplify the urgency for robust bridging solutions – and any mishaps on less secure bridges could drive even more users toward Mitosis for peace of mind.

Conclusion & Key Takeaways

Hayes’ optimistic forecast paints a picture of a liquidity-driven crypto boom. For the Mitosis ecosystem, such macro tailwinds could translate into a period of rapid growth and adoption. A few key takeaways emerge:

- Cross-Chain Renaissance: A credit-fueled crypto boom would bring unprecedented cross-chain activity. Mitosis could see record bridging volumes as users seek yield and arbitrage across networks.

- Stablecoins as Kingmakers: With stablecoins expanding in a bull market, Mitosis would benefit from deeper stablecoin liquidity pools, enhancing its efficiency for swaps and lending.

- Institutional Grade Bridging: As institutional capital flows in, the demand for secure, seamless bridging will soar. Mitosis is positioned to become a go-to backbone for moving assets in a multi-chain world, leveraging the very trends Hayes highlights.

In summary, Arthur Hayes’ $250K Bitcoin thesis isn’t just about eye-popping prices – it’s about a macro environment that could supercharge the pipes and plumbing of DeFi. Mitosis, by connecting those pipes through innovative cross-chain technology, may find itself at the center of the action if the next crypto crescendo comes to pass. If Hayes is right, Mitosis’ role in enabling a unified, liquid, and accessible crypto ecosystem could become more crucial than ever.

Useful links:

Comments ()