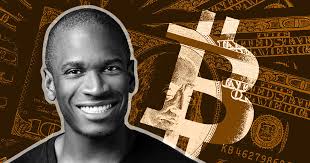

"Assume The Position": Arthur Hayes on Stablecoin IPOs and Investor Risk

Arthur Hayes, co-founder and former CEO of BitMEX, has published a new essay titled "Assume The Position." In it, he dissects the stablecoin market and issues a cautionary forecast: the coming wave of stablecoin-related IPOs might be less of an opportunity and more of a trap.

Hayes outlines how early winners like Tether and Circle succeeded due to a unique combination of timing, access, and infrastructure. But the door, he argues, has largely closed. Without distribution power via exchanges, banks, or social networks, new issuers will struggle. Investors might chase the next unicorn, but most new public stablecoin companies could end up overvalued and underperforming.

Circle IPO and the New Stablecoin Gold Rush

Circle's IPO inspired the essay. Hayes suggests that while Circle may already be overvalued, its stock could still rise as part of a new "stablecoin mania." More projects will go public, dazzling with sleek presentations and sky-high projections yet many won’t understand the actual mechanics of the market they’re entering.

He urges readers especially those trading public stocks tied to stablecoins to scrutinize the fundamentals and avoid marketing hype.

Why Distribution Matters More Than Issuance

For most, the history of stablecoin distribution remains a blind spot. But Hayes insists this is the very lens through which we must judge any issuer. Without access to a trading platform, banking rails, or a massive user base (like a social network), a stablecoin is dead on arrival.

In the early days, buying crypto with fiat was a logistical nightmare. In 2013, Hayes recalls personally delivering cash or wiring funds to obtain Bitcoin. Exchanges existed, but fiat onramps were unreliable and risky, often relying on intermediaries or shadow banking arrangements.

That chaos gave rise to innovation—particularly in the "Greater China" region, where Hayes was active. It’s also where stablecoins truly found product-market fit.

The Rise of Tether: A Distribution Masterclass

By the mid-2010s, Bitfinex was the largest global exchange outside China. It had bank accounts in Hong Kong, enabling efficient fiat transfers. Meanwhile, Chinese exchanges like OKCoin and Huobi also enjoyed strong banking ties.

But pressure from regulators eventually shut down those channels. That’s when Tether stepped in. In 2015, Bitfinex added support for USDT via the Omni protocol on Bitcoin. It allowed users to wire fiat and receive tokenized dollars, bypassing traditional banking obstacles.

Tether thrived because it solved a real pain point—fiat transfer risk—and because Bitfinex gave it instant distribution. The Chinese crypto diaspora, especially in Southeast Asia, embraced USDT as a "dollar account." This regional trust quickly expanded across the Global South.

ICO Boom and the Ethereum Catalyst

The August 2015 devaluation of the Chinese yuan and Ethereum’s launch sparked the next phase of crypto growth. Poloniex became the epicenter for ICOs, trading new altcoins and enabling crypto-to-crypto markets with USDT pairs.

Platforms like Poloniex and Yunbi (a major Chinese ICO venue) used USDT to sidestep fiat entirely. Later, Binance leveraged the same model. With no bank account but full access to USDT, Binance became the go-to platform for altcoin trading.

Tether wasn’t a payment tool—it was a liquidity layer. And from 2015 to 2017, it built a network effect that still defines the stablecoin sector today.

Why New Issuers Can’t Replicate That Playbook

Western startups tried launching alternatives to USDT, but only Circle’s USDC survived long-term. Despite marketing narratives painting Tether as risky and USDC as “safe,” emerging market users preferred USDT.

The lesson? Distribution beats branding. And today, most distribution channels—exchanges, wallets, liquidity partners—are already locked up by Tether, Circle, or new players like Ethena.

Social Networks and the Coming Wave

Tech giants have always eyed stablecoins. Facebook’s failed Libra project (later Diem) had the right ingredients: user base, behavioral data, and global apps like WhatsApp and Instagram. But US political opposition shut it down.

In 2025, with Donald Trump back in office and traditional banks less politically protected, social platforms are reviving stablecoin ambitions. Companies like Meta, X (formerly Twitter), and Google may reenter the game.

That’s bullish for shareholders of these companies—but bad news for startups. These platforms don’t need partners. They’ll build everything in-house, cutting off distribution for smaller players.

Why Banks Are Out of the Game

Banks see stablecoins as a threat. Hayes shares that a senior banker once told him a third of Nigeria’s GDP moves through USDT, despite local bans.

Stablecoins are driven bottom-up—by users, not governments. Traditional banks, burdened by regulatory requirements and legacy systems, can’t compete. Tether, with under 100 employees, outperforms banks with hundreds of thousands.

Even if banks adopt stablecoins, it’ll be limited. Every country has different rules, and global banks like JPMorgan can’t scale a single solution across jurisdictions. Like social networks, they’ll also build internal-only systems—shutting out external stablecoin issuers.

The Profit Model: Net Interest Margin

Stablecoin profitability hinges on net interest margin (NIM)—the difference between yields on reserves and what’s paid to holders. Tether’s model is the most profitable: it pays holders nothing and earns yield on Treasuries.

In 2023, Tether was the most profitable "bank" in the world on a per-employee basis. Circle, by contrast, shares 50% of its NIM with Coinbase for distribution.

New issuers face a brutal math problem. Without existing user bases, they’ll have to spend heavily on marketing or give up most of their yield to attract users. Many will try—but few will win.

The Narrative That Sells

Beyond speculation and mining, Hayes identifies three ways to get rich in crypto:

- Mining

- Running an exchange

- Issuing a stablecoin

BitMEX made Hayes rich. His best investment? Ethena—currently the #3 stablecoin issuer. The target market is massive, and the business model is clear.

Governments are beginning to support stablecoins too. The U.S. Treasury now sees dollar-pegged tokens as a tool to strengthen USD dominance and ensure global demand for Treasuries.

With regulatory momentum shifting and political winds turning favorable (even Trump’s sons are involved in crypto), the narrative has never been more compelling.

The Fall Before the Peak?

Circle was first to go public. Hayes believes it's overvalued—half its income goes to Coinbase, yet its market cap is 39% of the exchange’s. Should you short it? Probably not. Buying Coinbase might be the better trade if you believe in the ecosystem. But copycats will soon follow, launching splashy IPOs with little real edge. They’ll pitch institutional partnerships and regulatory clarity. But unless the U.S. loosens rules enough to allow Terra-style schemes, their upside will be capped—and their risks outsized. Most new issuers won’t have access to meaningful distribution. The best spots are already taken. Still, markets don’t care until they do. Hayes ends with a quote from former Citibank CEO Chuck Prince: “As long as the music is playing, you’ve got to get up and dance.”

Hayes concludes: "I don’t yet know how Maelstrom [his fund] will dance. But if there’s money to be made, we’ll find a rhythm."

Comments ()