Asymmetric Opportunities in Crypto: A Strategy with Limited Risk and High Potential

In the world of cryptocurrencies, there are many approaches to investing and trading.

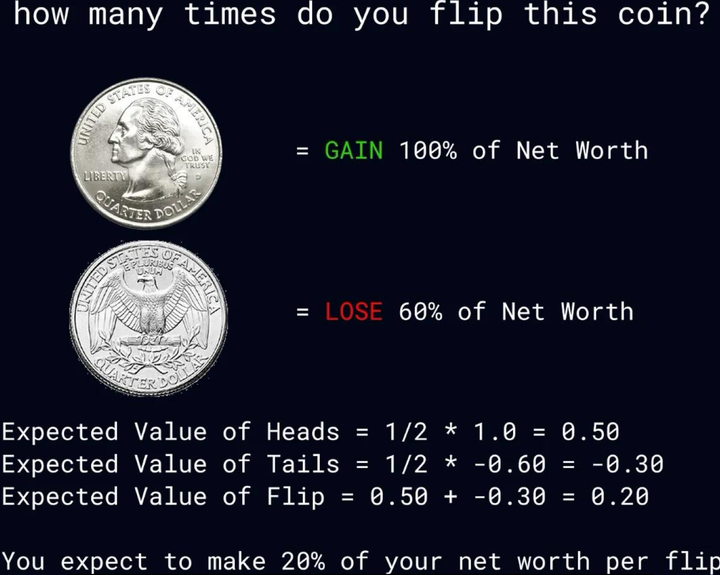

However, one of the most attractive is asymmetric bets—strategies that limit potential losses while offering high upside potential.

In this article, we will explore such a strategy using a specific case — the HYPE/uETH LP pool — and explain why it represents a unique opportunity.

Pix On Chain Х - https://x.com/PixOnChain

HyperUnit X - https://x.com/@hyperunit

ProjectX - https://www.prjx.com/

1. Why Choose ETH Instead of BTC

Many investors traditionally focus on Bitcoin, considering it "digital gold." However, in this cycle, Ethereum offers more compelling growth prospects. Why?

- Recency Bias: The market tends to overvalue assets that recently surged. As a result, Bitcoin has already made a significant move—from $16K to $120K—and most positive news is already priced in.

- Ethereum’s Growth Potential: ETH has not yet reached its peak. It’s gearing up for its "ETF-party" (institutional inflows), which could serve as a catalyst for the next rally.

- Technological Advantages: ETH is more than just a token; it provides staking yields, burns issuance, and underpins the entire DeFi ecosystem. In a scenario where prices increase 2–3 times (e.g., to $6–10K), such growth seems quite justified.

2. Why Choose uETH Instead of Plain ETH

Holding ETH is a classic strategy, but uETH offers additional benefits:

- Combination with Options: uETH includes ETH plus an option on future drops or tokens.

- HyperEVM Protocol by UNIT: This protocol issues on-chain stocks and is testing innovative features that could surpass platforms like Robinhood or Solana.

- Potential for Future Drops: uETH acts as a gateway to possible future token drops from the UNIT project, adding extra value.

This makes uETH a more dynamic asset with additional upside potential compared to simply holding ETH.

3. Why HYPE Is Key to Asymmetry

The HYPE token recently broke through the $40 level with strong support both on-chain and across social media. Historical patterns suggest:

- After breaking $40, expect 2–3x growth over several months.

- Target ranges are $80–120.

- A conservative scenario estimates $65–80.

Additional factors:

- Low TVL (Total Value Locked) and market cap indicate undervaluation relative to actual usage.

- Open interest in perpetual contracts exceeds $2 billion, signaling high conviction and large positions in the market.

This creates favorable conditions for price growth with limited downside risk.

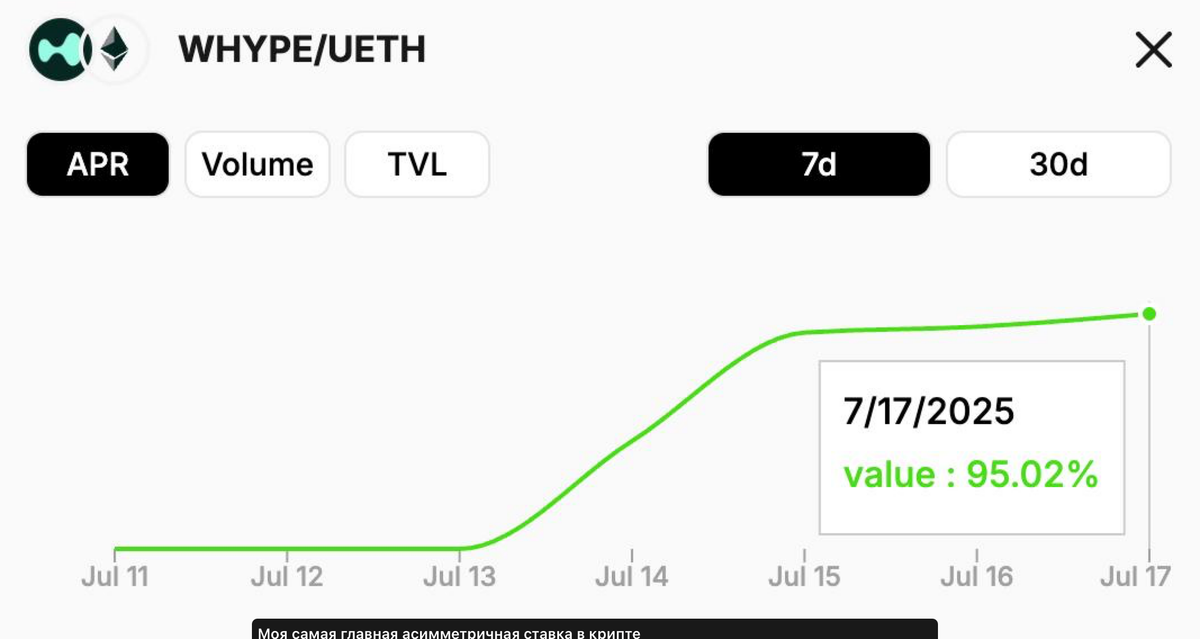

4. The Power of the HYPE/uETH LP Pool: Automatic Rebalancing and Yield

Why consider an LP pool instead of simply holding assets?

- Automatic Rebalancing: The pool dynamically adjusts between uETH and HYPE based on their growth curves.

- Yield Farming: Participating in projects like Project X can generate yields up to 80% APR.

- Enhanced Asymmetry: Multi-asset strategies can yield 1.5–2 times higher upside compared to just holding individual tokens.

This approach offers not only potential price appreciation but also steady income during the waiting period.

5. Conclusion: Why This Strategy Is Among the Most Attractive

True asymmetry isn’t about obvious trades or popular assets; it’s about structures that appear “not like a trade.” They seem less obvious to most market participants but provide the clearest risk-to-reward skew.

In the case of the HYPE/uETH LP:

- Limited risk due to structured design

- Undervalued assets with high growth potential

- Opportunity to participate in promising projects at low entry points

This makes such strategies some of the most interesting for those seeking unconventional solutions and willing for long-term positions.

P.S.: As always, remember to do your own research (DYOR). But the idea that ETH could reach new heights remains quite realistic with a proper approach.

6. Useful Links

🌐 Website: https://mitosis.org

📖 Docs: https://docs.mitosis.org

🐦 Twitter / X: https://twitter.com/MitosisOrg

💬 Discord: https://discord.gg/mitosis

Comments ()