Beyond a Single Chain: How Mitosis Unlocks the Era of True DeFi Composability

1. Introduction: "Money Legos" and Their Multichain Challenge

One of the most revolutionary and appealing concepts in decentralized finance (DeFi) is composability – often described as "money Legos." It's the ability of different DeFi protocols and applications to seamlessly interact with each other, combining to form more complex and powerful financial instruments. For example:

- You can take out a loan in one protocol (e.g., Aave).

- Swap the borrowed funds for another asset on a decentralized exchange (DEX) like Uniswap.

- Provide this new asset as liquidity in a third protocol to earn yield (yield farming).

All of this occurs within a single ecosystem where protocols "understand" each other and can easily interact. It is precisely composability that has driven innovation and the explosive growth of DeFi on platforms like Ethereum.

The Problem: Composability is Lost Between Chains

However, the magic of composability begins to falter as soon as we move beyond a single blockchain network. In today's multichain world, with dozens of L1s, L2s, and appchains, each with its own DeFi protocols, a significant problem arises:

- Isolated Ecosystems: A protocol on Polygon cannot directly "talk" to a protocol on Arbitrum or Solana. Assets and data are locked within their respective networks.

- User Complexity: To implement a complex DeFi strategy involving multiple networks, users have to manually use numerous bridges, pay fees for each step, and manage assets in different environments. This is inconvenient, expensive, and risky.

- Developer Limitations: dApp creators are forced either to choose a single ecosystem, limiting their reach, or to independently solve the extremely complex tasks of interoperability, which distracts from the core logic of their application.

The fragmentation of liquidity and data between networks effectively destroys composability at a global level, turning Web3 from a unified "money Lego" set into a collection of incompatible construction kits.

Mitosis: Restoring Composability in Multichain

This is precisely the problem Mitosis aims to solve. By providing secure and efficient infrastructure for moving liquidity (and potentially data) between different blockchains, Mitosis lays the foundation for restoring and expanding composability at the multichain level.

How does Mitosis achieve this?

- Seamless Asset Movement: Allows for the easy transfer of assets (including LP tokens, collateral positions, etc., if technically feasible) from one network to another.

- Liquidity Management (EOL): Ensures the availability of liquidity for executing cross-chain operations, making interactions more predictable.

- Potential for Data Transfer (via underlying protocols): By utilizing messaging protocols, Mitosis can facilitate the transfer of not only value but also information between networks, which is critical for complex interactions.

This opens the door for creating a new generation of cross-chain dApps that can leverage the best features and liquidity from different ecosystems, providing users with a unique and more efficient experience.

What Will You Learn From This Article?

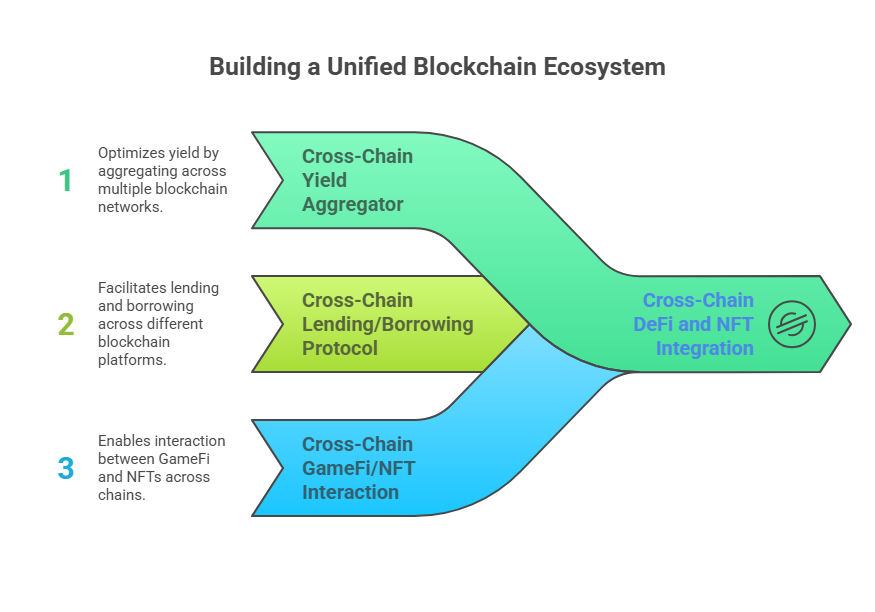

In this article, we won't limit ourselves to theory. We will examine concrete, albeit potentially hypothetical (if real integrations are few), examples of how developers can use Mitosis to create innovative cross-chain dApps that would be impossible or extremely difficult to implement without such infrastructure. We will explore:

- An example of a cross-chain yield aggregator.

- An example of a cross-chain lending/borrowing protocol.

- An example of cross-chain interaction in the GameFi or NFT space.

We will try to show how Mitosis can become that "missing link" enabling DeFi and Web3 developers to fully realize the potential of composability across the entire multichain universe.

2. Assembling the Cross-Chain "Legos": Examples of dApps Built on Mitosis

Now let's move from general concepts to more concrete examples of what innovative decentralized applications (dApps) can be built using Mitosis as a foundation for cross-chain composability. These examples, even if hypothetical for now, illustrate the enormous potential.

Example 1: Universal Yield Aggregator "MultiYield"

- The Problem: A user wants to get the maximum yield on their stablecoins (e.g., USDC), but the best offers constantly shift between different lending protocols and liquidity pools on Ethereum, Polygon, Arbitrum, and Solana. Manual monitoring and moving funds is laborious and expensive.

- How MultiYield with Mitosis Can Solve It:

- User Deposit: The user deposits their USDC into the MultiYield smart contract on their "home" network (e.g., Ethereum).

- Analysis and Decision: The MultiYield smart contract (or an associated off-chain "solver") constantly scans USDC yields across dozens of protocols on all supported networks. It finds that the best current yield is offered by protocol X on Arbitrum.

- Cross-Chain Transfer via Mitosis: MultiYield automatically initiates the transfer of the user's USDC from Ethereum to Arbitrum via Mitosis. Thanks to EOL and Mitosis's efficiency, the transfer is fast and with predictable costs.

- Deployment in Protocol X: The funds are automatically deployed into protocol X on Arbitrum.

- Rebalancing: MultiYield continues monitoring. If a more profitable offer appears on Solana, the protocol automatically withdraws funds from Arbitrum, transfers them via Mitosis to Solana, and deploys them in the new protocol. The user simply sees their MultiYield balance grow.

- Role of Mitosis: Provides fast, cheap, and secure "transport" for moving assets between networks, making automatic cross-chain yield rebalancing a reality. Without Mitosis, such an aggregator would be extremely complex to implement and inefficient.

Example 2: Cross-Chain Lending Protocol "OmniLend"

- The Problem: A user has a valuable but low-liquidity asset (e.g., a rare NFT or a tokenized RWA) on network A but wants to take out a stablecoin loan on network B, where lending terms are better or specific needs exist. Traditional bridges are not always suitable for such complex collateral operations.

- How OmniLend with Mitosis Can Solve It:

- Collateral on Network A: The user locks their NFT or RWA token in the OmniLend smart contract on network A.

- Cross-Chain Message via Mitosis/Hyperlane: The OmniLend smart contract on network A sends a secure message via the infrastructure used by Mitosis (e.g., Hyperlane, secured by AVS) to the OmniLend smart contract on network B. This message confirms that the collateral has been successfully locked.

- Loan Issuance on Network B: Upon receiving confirmation, the OmniLend smart contract on network B allows the user to take out a stablecoin loan against their asset held on network A.

- Position Management and Liquidation: The OmniLend protocol can use cross-chain messages to monitor the collateral's status and, if necessary, initiate cross-chain liquidation processes.

- Role of Mitosis: Ensures the secure transfer of critically important information (about collateral locking, need for liquidation) between networks. Mitosis's EOL model could also be used to provide initial stablecoin liquidity for lending across different networks.

Example 3: Gaming Metaverse "NexusVerse" with Cross-Chain Assets

- The Problem: Game projects are often built on their own appchains or L2s for performance. But players want their in-game items (NFTs, currency) to have value and be usable or tradable outside of a single game or appchain.

- How NexusVerse with Mitosis Can Solve It:

- Unique Assets on Appchains: Each game in NexusVerse can run on its own optimized appchain, where unique NFT items are created.

- Mitosis "Portal": Within NexusVerse, a "portal" (integration with Mitosis) exists that allows players to securely move their NFT items or in-game currency between different gaming appchains or to a main L1 (e.g., Ethereum) for trading on major NFT marketplaces.

- Cross-Game Interactions: An item from a game on appchain A, transferred via Mitosis, could provide unique bonuses or abilities in a game on appchain B.

- Role of Mitosis: Provides interoperability for game assets, increasing their value and utility for players. EOL could be used to provide liquidity for exchanging in-game currencies of different appchains.

Conclusion: Mitosis – A Catalyst for Cross-Chain Innovation

The examples provided are just the tip of the iceberg. The potential for creating cross-chain dApps using Mitosis is vast and limited only by developers' imaginations. By solving the fundamental problems of secure and efficient liquidity (and data) movement between networks, Mitosis provides developers with a powerful toolkit to:

- Expand the reach of their applications to the entire multichain universe.

- Attract users and liquidity from different ecosystems.

- Create unique user scenarios that were previously impossible.

- Restore and enhance the "magic" of DeFi composability on a global scale.

In a world that is becoming increasingly multipolar and multi-networked, protocols like Mitosis cease to be just a "convenient feature" and transform into critically important infrastructure upon which the next generation of decentralized applications will be built. Mitosis doesn't just connect networks – it connects ideas, users, and capital, catalyzing a wave of cross-chain innovation.

Learn more about Mitosis:

- Explore details on the official website: https://www.mitosis.org/

- Follow announcements on Twitter: https://twitter.com/MitosisOrg

- Participate in discussions on Discord: https://discord.com/invite/mitosis

- Read articles and updates on Medium: https://medium.com/mitosisorg

- Blog: https://blog.mitosis.org/

Comments ()