Beyond Blockchain: Could Directed Acyclic Graph (DAG) Technology Be the Future of Cryptocurrency?

Introduction: Why Blockchain Isn’t the Ultimate Solution

Since the emergence of Bitcoin, blockchain has become a revolutionary tool for recording digital assets and ensuring decentralized trust. However, over time, some fundamental limitations of blockchain have become apparent. High transaction fees, low throughput, and excessive energy consumption make blockchain-based networks insufficient in certain use cases.

In a world where more users and devices are joining the digital economy, flexible, fast, and scalable solutions are increasingly essential. This is precisely where Directed Acyclic Graph (DAG) technology offers an alternative roadmap for cryptocurrencies.

What Does DAG Technology Mean?

A Directed Acyclic Graph (DAG) is a type of data structure where data points are connected, but no cycles are formed. In simpler terms, a DAG flows in one direction only and never loops back to its starting point.

This feature is particularly useful in validating data and creating a chain of trust. Each new transaction references previous ones, thereby confirming them and contributing to the growth of the network’s security.

DAG vs. Blockchain: Philosophical and Technical Differences

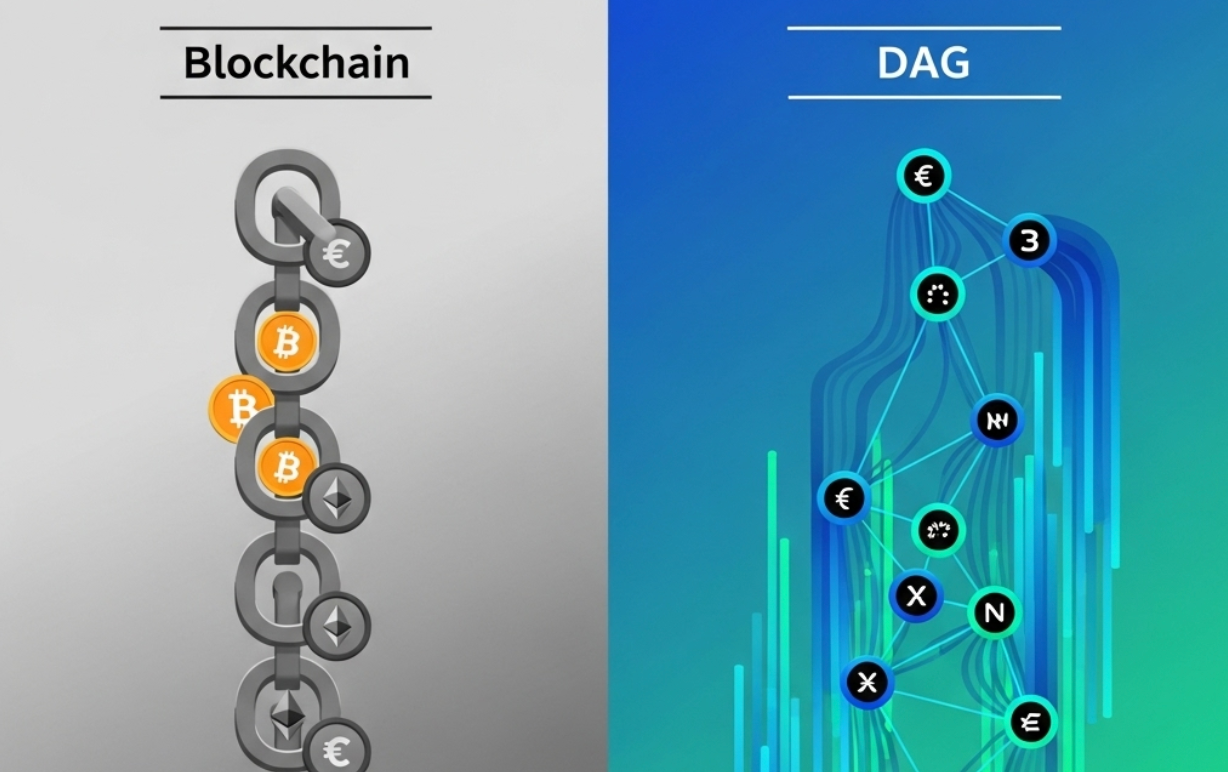

In blockchain, transactions are bundled into blocks, each verified by miners and added to the chain. While this provides robust security, it introduces latency and high energy usage due to mining competition.

In a DAG system, each transaction is added as a separate “node.” There are no miners, no blocks, and nearly zero waiting times. As the number of transactions increases, network performance also improves making DAG highly scalable.

For instance, in IOTA’s Tangle structure, every new transaction must validate two previous ones. This process creates a web of trust without relying on centralized miners.

How Does a DAG Work?

Let’s look at a simple scenario:

- Alice wants to send 10 DAGTokens to Bob.

- Before initiating her transaction, she selects two unconfirmed transactions on the network and references them.

- Her references validate those previous transactions.

- A new user then validates Alice’s transaction by referencing it in their own transaction.

The network grows as users validate past transactions with their own. Since there are no miners, transaction fees are nearly nonexistent, making this system ideal for microtransactions.

Real-Life Projects and Use Cases

IOTA – The Tangle Network

IOTA is one of the most well-known DAG-based projects, designed for the Internet of Things (IoT). It enables free transactions between machines and devices, facilitating automation in digital economies.

Nano

Nano utilizes a Block Lattice DAG structure that allows users to make instant and feeless transactions. Each account maintains its own blockchain, reducing network congestion.

Obyte (Byteball)

Obyte explores the flexibility of DAGs in financial contracts and payment systems, offering practical real-world applications.

In-Depth Advantages of DAG Technology

1. High Scalability

Unlike traditional blockchains, DAGs become faster as the number of transactions increases. Unlike Ethereum or Bitcoin, the system does not slow down with network congestion.

2. Zero or Low Transaction Fees

With no need for miners, users aren’t burdened with high fees. This is especially useful for sending micropayments or frequent, low-value transactions.

3. Energy Efficiency

Compared to traditional Proof of Work (PoW) models, DAGs consume far less energy, making them more eco-friendly.

4. Instant Transactions

Since there are no block times, transactions are processed almost instantly. This significantly improves user experience.

Challenges and Criticisms

Despite its strengths, DAG comes with its own set of challenges:

- Centralization Risk: Some projects require centralized coordinators during their early stages, raising concerns about true decentralization.

- Limited Adoption: DAG-based networks are still maturing and have yet to see wide adoption.

- Double-Spending Risk: Without a strong user base, DAG networks can become vulnerable to malicious activity or conflicting transaction paths.

For instance, IOTA initially used a centralized “Coordinator” node to secure its network. While this was meant as a temporary solution, critics argued that it contradicted the principles of decentralization.

Where DAG Technology Excels

DAG systems shine in use cases where speed, scalability, and cost-efficiency are critical:

- Internet of Things (IoT): DAG enables seamless microtransactions between devices and sensors.

- Micropayments: Suitable for sub-cent value transfers without being affected by high fees.

- Supply Chain Management: Handles high transaction volumes with better performance than traditional blockchains.

- Gaming Ecosystems: Enables instant asset transfers within games or metaverse economies.

Conclusion: New Horizons Beyond Blockchain

Directed Acyclic Graph (DAG) technology presents an exciting alternative to traditional blockchain systems. Its potential to address scalability, speed, and energy concerns makes it an attractive foundation for future crypto ecosystems.

Still, whether DAG will truly reshape the future of decentralized finance depends on several factors including user trust, practical adoption, and how well these networks handle real-world challenges.

As a participant or investor, it’s always wise to ask three key questions before supporting any crypto project:

- Why does this project exist?

- Whose problem is it solving?

- How exactly does it solve it?

DAG could very well define the next evolution in crypto. But only time and user adoption will reveal its ultimate role

Comments ()