Beyond Chats and Likes: Mitosis as the Financial Engine for the SocialFi Revolution

1. Introduction: The SocialFi Explosion and the Birth of a New Economy

In recent months, the Web3 space has been swept by a new wave of innovation called SocialFi (Social Finance). Projects like Friend.tech, and subsequently its numerous followers, have demonstrated the incredible potential of merging social networks and financial markets.

The concept is simple yet brilliant: transforming social capital, influence, and attention into liquid, tradable assets. The "keys" or "shares" of popular personalities, content creators, or even regular users have become a new class of speculative and utility assets. This has spawned an entire new economy where users can:

- Invest in the potential growth of other people's popularity.

- Gain access to exclusive content or private chats by owning a "key."

- Monetize their own influence and community.

This explosion of activity has brought hundreds of thousands of new users into Web3, many of whom had never interacted with DeFi before. However, this growth has also exposed a serious problem.

The "Islands" of SocialFi: The Problem of Isolated Value

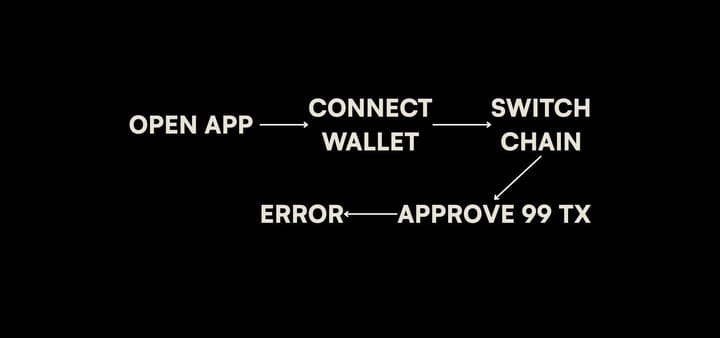

To provide the high speed and low fees necessary for social interactions, most SocialFi platforms are launching on modern Layer 2 networks, such as Base or Blast. This is an ideal environment for them to operate, but it also creates economic isolation:

- Capital is Locked In: The ETH and other assets that users deposit onto these platforms to buy "keys" become locked within the ecosystem of that specific L2 and SocialFi application.

- Profits are Hard to Withdraw and Use: A user who has profited from trading "keys" faces a problem: how can they efficiently withdraw this profit and use it in other DeFi protocols on Arbitrum, Solana, or Ethereum Mainnet?

- Barriers to Entry: A user whose main capital is on Ethereum must go through a complex and not always intuitive bridging process to participate in a new "hot" SocialFi platform on Base.

- "Keys" as Illiquid Assets Outside the Platform: Your valuable "key" from a popular influencer is completely useless outside of one specific SocialFi platform. It cannot be used as collateral, nor can it be easily swapped for other assets in the global DeFi landscape.

This fragmentation holds back the growth of SocialFi, turning each platform into an isolated "island of value" and limiting the potential of this new class of "social assets."

Mitosis: Connecting the Social and Financial Economies

This is precisely the problem that infrastructure like Mitosis is needed to solve. As a protocol specializing in the secure and efficient movement of liquidity between any networks, Mitosis can become the key financial layer that connects these booming SocialFi "islands" with the global DeFi economy.

What role can Mitosis play?

- "Onboarding" Capital: Providing a simple and secure way for users from any network (Ethereum, Solana, etc.) to deposit funds onto SocialFi platforms to participate in trading.

- "Offboarding" Profits: Giving users the ability to easily withdraw their earned funds to any DeFi ecosystem for further investment.

- Creating Bridges for "Social Assets": In the future, enabling the movement of the "keys" themselves (if they are standardized as NFTs or tokens) between networks, opening up new markets and use cases for them.

What Will You Learn From This Article?

In this article, we will explore in detail how Mitosis can be a catalyst for the next phase of SocialFi growth:

- We will analyze specific scenarios of how Mitosis solves the "on-ramp" and "off-ramp" problems for users of SocialFi platforms.

- We will discuss how Mitosis can increase the liquidity and utility of "social tokens."

- We will examine why the synergy between SocialFi and cross-chain liquidity protocols is important for creating a more mature and integrated Web3 ecosystem.

We will show that Mitosis is not just infrastructure for "serious" DeFi, but a flexible and powerful tool capable of providing the financial foundation for the hottest and fastest-growing sectors of Web3, including the economy of attention and social capital.

2. Mitosis in Action: Practical Scenarios for the SocialFi Ecosystem

Having examined the isolation problems in SocialFi, let's delve into specific scenarios made possible by Mitosis and assess how they change the game for users and content creators.

Scenario 1: Seamless "Onboarding" to SocialFi

Imagine Alice, a DeFi user whose main capital (ETH and USDC) is on the Arbitrum network. She sees the hype on Twitter about a new SocialFi platform, "ConnectSphere," launched on the Base network, and wants to buy the "keys" of a popular analyst.

- The Problem: Without Mitosis, Alice would have to go through a complicated process using the official Base bridge, which takes time and multiple transactions.

- The Solution with Mitosis:

- The "ConnectSphere" platform integrates the Mitosis widget or API.

- Alice connects her wallet. The platform shows her a zero balance on Base but offers a button: "Deposit from another network."

- Alice clicks the button, selects "Arbitrum" as the source network, and specifies that she wants to transfer 0.5 ETH.

- Mitosis works "under the hood" to perform a secure and fast transfer. Thanks to EOL, ETH liquidity is already available on Base.

- A few minutes later, Alice's balance on "ConnectSphere" is funded, and she is ready to buy "keys."

The Result: Mitosis eliminates the main barrier to entry, allowing SocialFi platforms to attract users and capital from the entire Web3 ecosystem, not just their "home" network. New user conversion rates increase dramatically.

Scenario 2: Efficient "Offboarding" and Profit Composability

Imagine Bob, a content creator on "ConnectSphere." He has successfully grown his community, and the value of his "keys" has increased. He sold some of them and made a profit of 5 ETH on the Base network.

- The Problem: Bob wants to use this profit in DeFi. For example, he wants to stake his ETH via Lido on Ethereum Mainnet to get stETH and additional yield.

- The Solution with Mitosis:

- Instead of searching for a bridge and manually transferring ETH, Bob can use a dApp aggregator that is integrated with Mitosis.

- He creates an "intent": "Swap 5 ETH from Base for stETH on Ethereum Mainnet."

- Mitosis executes the transfer of 5 ETH from Base to Ethereum.

- On Ethereum, the aggregator's smart contract automatically swaps the ETH for stETH via Lido.

- Bob receives the stETH in his wallet.

The Result: Profits earned in SocialFi are not "locked in." They can be seamlessly reinvested into any DeFi protocol on any network. This makes SocialFi platforms much more attractive to content creators and speculators, as their capital remains mobile and composable.

Scenario 3 (The Future): Cross-Chain Utility of "Social Tokens"

Imagine that the "keys" on Friend.tech or "ConnectSphere" are standardized as NFTs (ERC-721).

- The Problem: The value and utility of these NFTs are limited to a single platform.

- The Solution with Mitosis:

- Cross-Chain Collateral: The owner of a very valuable "key" on Base could use Mitosis to "move" it (or prove ownership) to the Arbitrum network to use it as collateral in a lending protocol.

- Cross-Platform Privileges: A DAO or another project on Ethereum could grant exclusive voting rights or access to owners of the top 100 influencer "keys" from "ConnectSphere" by verifying their ownership via Mitosis.

The Result: "Social tokens" are transformed from niche assets into full-fledged, composable Web3 assets, whose value and utility can extend across the entire ecosystem.

Conclusion: Mitosis as the Financial Artery for the Attention Economy

SocialFi is more than just hype. It's the dawn of a new economy built on attention, reputation, and social capital. But like any economy, it needs reliable financial infrastructure to thrive. It needs "arteries" through which capital can flow freely, connecting it to the rest of the world.

Mitosis is perfectly suited for the role of this financial artery. It solves the key problems of liquidity and fragmentation that are holding back SocialFi's growth and provides tools that:

- Simplify life for users, making entering and exiting SocialFi platforms a trivial task.

- Expand opportunities for content creators and investors, making their capital truly mobile.

- Create a foundation for future innovations, where "social assets" will become an integral part of the global DeFi landscape.

By connecting the worlds of SocialFi and DeFi, Mitosis is not just building another bridge. It is helping to catalyze the growth of one of the most dynamic and user-oriented areas of Web3, proving its value as a universal infrastructure for the entire Internet of Value.

Learn more about Mitosis:

- Explore details on the official website: https://www.mitosis.org/

- Follow announcements on Twitter: https://twitter.com/MitosisOrg

- Participate in discussions on Discord: https://discord.com/invite/mitosis

- Read articles and updates on Medium: https://medium.com/mitosisorg

- Blog: https://blog.mitosis.org/

Comments ()