Beyond Incentives: The Mitosis Architecture and Its Revolution in Liquidity

In the ever-expanding universe of DeFi, it’s easy to get distracted by shiny things like APYs, airdrops, or governance rewards. But the real breakthroughs are rarely loud. They’re often buried under technical documentation, overlooked by those chasing the next yield opportunity. They reside in the architecture, the unseen scaffolding that powers scalable, efficient systems.

Mitosis is one such quiet revolution, a protocol that transcends fleeting incentives to redefine liquidity itself. While miAssets and maAssets draw users in, the true brilliance of Mitosis lies in its engineering: a modular, interoperable, and programmable liquidity operating system designed to solve DeFi’s deepest inefficiencies.

This article delves into the core components Vaults, Vanilla Assets, miAssets, and maAssets while exploring the technical and conceptual depth of Mitosis’s architecture.

The Liquidity Problem: Fragmentation and Rigidity

DeFi’s meteoric rise has exposed a structural flaw: liquidity fragmentation. Capital is scattered across chains, protocols, and pools, locked in rigid structures that hinder efficiency. Once deployed, liquidity often becomes static, unable to adapt to new yield opportunities or move seamlessly between ecosystems. Cross-chain barriers exacerbate this, with assets on Ethereum, Solana, or Cosmos unable to interact without costly, friction-laden bridges. Composability, DeFi’s promised superpower, is curtailed by siloed protocols that limit liquidity’s versatility. Mitosis addresses these issues by reimagining liquidity as programmable, tokenized primitives (assets that are fluid, composable, and chain-agnostic). Its architecture transforms capital from a static resource into a dynamic, interoperable system, unlocking unprecedented flexibility for users and developers.

Mitosis Architecture: A Liquidity Operating System

Mitosis is not a single DeFi product but a liquidity operating system, a purpose-built infrastructure for capital to flow intelligently across ecosystems. Built on the Cosmos SDK with EVM compatibility, the Mitosis Chain is a settlement layer optimized for scalability, interoperability, and developer accessibility. Its core flow:

Deposit → Supply → Utilization

It is elegantly modular:

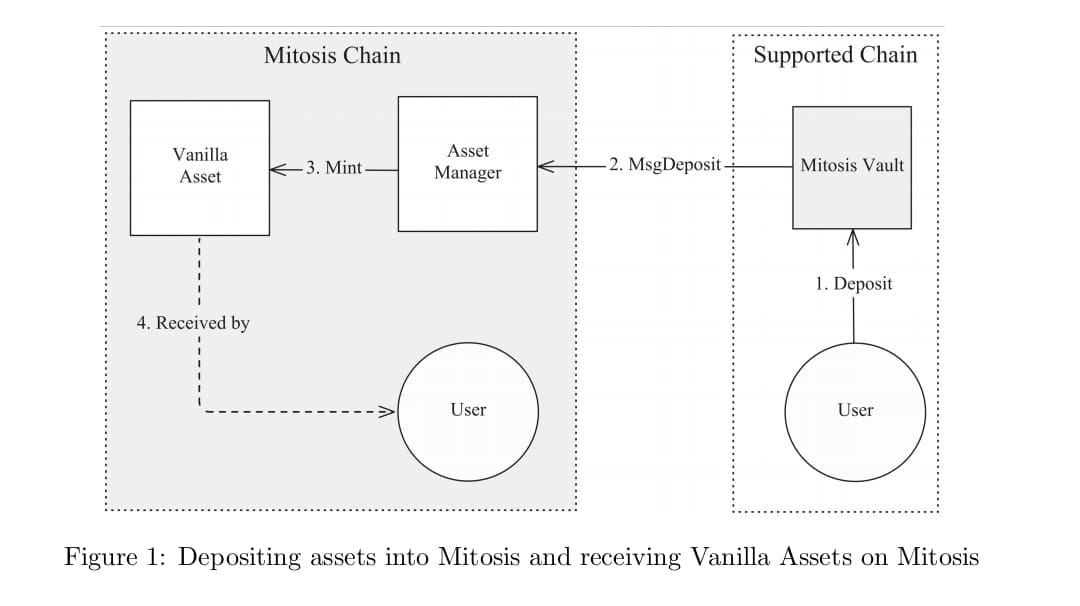

- Deposit: Users deposit assets into chain-specific Vaults, which aggregate liquidity.

- Supply: Deposited assets are tokenized into Vanilla Assets, 1:1 mirrored representations that enable cross-chain and cross-protocol composability.

- Utilization: Vanilla Assets are deployed into yield-generating strategies, Ecosystem-Owned Liquidity (EOL) or curated Matrix campaigns, producing miAssets (EOL yield) or maAssets (Matrix yield), both retaining ecosystem utility.

This flow is powered by a technical foundation that balances scalability, interoperability, and accessibility, making Mitosis a cornerstone for DeFi’s evolution. To understand its transformative potential, we must dissect its core components.

Vaults: The Foundation of Liquidity Aggregation

Vaults are the entry points to Mitosis’s ecosystem, serving as chain-specific repositories where users deposit assets to participate in the liquidity system. Each Vault is tailored to a particular blockchain (Ethereum, Cosmos, Linea, Scroll, Mantle, etc) acting as a standardized interface for onboarding liquidity across several networks. Technically, Vaults are smart contracts that securely custody deposited assets while issuing tokenized claims (Vanilla Assets). They leverage the Cosmos SDK’s modular architecture for chain-specific optimizations, such as gas efficiency on Ethereum or low-latency transactions on Cosmos. Interoperability is ensured through the Inter-Blockchain Communication (IBC) protocol for Cosmos chains, while non-Cosmos chains use secure bridges. Vaults aggregate liquidity across networks, reducing fragmentation and enhancing capital efficiency. Conceptually, Vaults are the first step in Mitosis’s vision of unified liquidity. They abstract away the complexities of individual chains, creating a standardized, secure point for liquidity to enter the Mitosis ecosystem.

Vanilla Assets: Programmable Liquidity Primitives

After depositing into a Vault, users receive Vanilla Assets, tokenized 1:1 representations of their deposits (e.g., 1 ETH yields 1 vETH). Far more than simple wrappers, these assets transform static capital into programmable primitives that transcend ecosystems. Technically, Vanilla Assets follow ERC-20 standards on EVM chains and equivalent standards on others, ensuring broad DeFi compatibility. They move seamlessly across Cosmos chains via IBC and use bridges for other networks. Vanilla Assets can be used in AMMs, lending protocols, or Mitosis’s internal strategies. Developers can even build complex instruments like structured products or cross-chain derivatives using these building blocks. Conceptually, Vanilla Assets exemplify Mitosis’s goal: fluid, adaptable liquidity. They allow capital to simultaneously participate in multiple DeFi functions, shifting liquidity from isolated pools into a unified programmable ecosystem.

miAssets: Stable Yield from Ecosystem-Owned Liquidity (EOL)

Vanilla Assets can be deployed into EOL, Mitosis’s curated liquidity pool that optimizes allocation across DeFi protocols. Users receive miAssets in return, representing their share of EOL’s performance while retaining composability. EOL aggregates Vanilla Assets into diversified strategies (AMMs, lending markets, aggregators) based on algorithmic optimization. miAssets accrue value through trading fees, lending interest, and more, with real-time yield distribution. Like Vanilla Assets, miAssets are composable, usable in further DeFi strategies or protocols. Risk is mitigated via diversification and rigorous monitoring. Conceptually, miAssets provide low-friction, stable yield. EOL abstracts the complexity of yield optimization, enabling users to earn reliable returns while keeping assets dynamic and composable.

maAssets: High-Yield Opportunities from Matrix Campaigns

For higher-risk, higher-reward strategies, Mitosis offers Matrix campaigns—curated, time-bound opportunities. Vanilla Assets deployed into these campaigns mint maAssets, which reflect performance while maintaining utility. Campaigns are selected based on return potential and protocol integrity. Assets are deployed via smart contracts, and maAssets are issued to track returns, governance tokens, fees, etc. maAssets fluctuate in value and remain composable, usable across the Mitosis ecosystem or beyond. Conceptually, maAssets showcase Mitosis’s frontier approach. Users gain exposure to high-yield opportunities without complexity. maAssets ensure users retain flexibility and can continuously adapt or stack strategies across campaigns.

The Technical Foundation: Cosmos SDK and EVM Compatibility

Mitosis’s power lies in its technical infrastructure. The Cosmos SDK provides modularity and IBC for cross-chain communication with low friction. EVM compatibility bridges Cosmos and Ethereum ecosystems, allowing developers and users to operate seamlessly across both. The Mitosis Chain itself is optimized for throughput, cost efficiency, and decentralized governance. This infrastructure supports advanced cross-chain strategies and future expansion, making Mitosis resilient and adaptable as DeFi evolves.

Why Mitosis Matters: Redefining Liquidity

Mitosis builds a liquidity operating system that goes beyond temporary incentives. Vaults and Vanilla Assets dismantle silos; miAssets and maAssets keep liquidity composable and active. The technical stack ensures scalability, and the open architecture empowers developers to innovate. While yield products entice users, the architectural vision ensures longevity.

Conclusion: The Future of Liquidity

Mitosis starts in DeFi but aims higher. Its architecture could power tokenized real-world assets, cross-border settlements, and dynamic financial instruments, bridging traditional and decentralized finance. It transforms liquidity into an active, programmable force that can fuel a new era of global finance. The brilliance of Mitosis lies not in its incentives but in its vision. Vaults aggregate liquidity, Vanilla Assets make it programmable, and miAssets and maAssets keep it dynamic. Together, they form a system that quietly redefines how capital moves in decentralized ecosystems. For those willing to look beyond the surface, Mitosis is writing the future of liquidity, one block at a time.

Comments ()