Bitcoin Ordinals

Bitcoin Ordinals represent a significant evolution in the cryptocurrency landscape, merging the foundational principles of Bitcoin with the dynamic world of digital collectibles. Introduced in January 2023 by developer Casey Rodarmor, Ordinals enable the inscription of unique digital content—such as images, videos, and text—directly onto individual satoshis, the smallest unit of Bitcoin. This innovation transforms Bitcoin from a mere store of value into a platform for digital art and collectibles, all while maintaining its core attributes of security and decentralization.

Understanding Bitcoin Ordinals

At its essence, the Ordinals protocol assigns a unique serial number to each satoshi, based on the order in which it was mined and transferred. This numbering system allows for the tracking and inscription of data onto individual satoshis. Utilizing Bitcoin's SegWit and Taproot upgrades, Ordinals store this data within the witness portion of a transaction, ensuring that the inscriptions are fully on-chain and immutable .

Unlike traditional NFTs, which often rely on off-chain storage solutions, Ordinals ensure that the associated data resides entirely on the Bitcoin blockchain. This approach enhances the permanence and security of the inscriptions, aligning with Bitcoin's reputation as a robust and reliable network .

The Rarity of Ordinals

The Ordinals protocol introduces a layered rarity system, categorizing satoshis based on their position in the blockchain:

- Common: All satoshis except the first sat of each block.

- Uncommon: The first sat of each block.

- Rare: The first sat of each difficulty adjustment period.

- Epic: The first sat after each halving.

- Legendary: The first sat of each cycle (a cycle is defined as the period between two halvings).

- Mythic: The first sat of the genesis block.

This structured approach to rarity has added a layer of collectibility to Bitcoin, attracting enthusiasts and collectors seeking unique and historically significant satoshis .

Notable Ordinals Projects

Several projects have emerged within the Ordinals ecosystem, showcasing the versatility and creativity enabled by this protocol:

- TwelveFold by Yuga Labs: A limited edition collection of 300 generative art pieces, blending 3D graphics with hand-drawn elements, exploring the relationship between blockchain, time, and mathematics.

- Taproot Wizards: A collection of 2,108 digital wizard images, inspired by the "magic internet money" meme, celebrating Bitcoin's culture and community.

- Ordinal Punks: A nod to the CryptoPunks collection, featuring 100 unique pixel art characters, highlighting the intersection of traditional art and blockchain technology.

- Ordinal Loops: A series showcasing dynamic generative art, emphasizing the potential of Ordinals in representing motion and interactivity within the digital space.

These projects illustrate the diverse applications of Ordinals, from static art to dynamic and interactive pieces, reflecting the evolving nature of digital collectibles on the Bitcoin network .

Advantages of Ordinals

- On-Chain Permanence: Inscriptions are stored directly on the Bitcoin blockchain, ensuring longevity and resistance to censorship.

- Enhanced Security: Leveraging Bitcoin's robust security features, Ordinals benefit from the network's proven resilience.

- Cultural Significance: Ordinals have introduced a new dimension to Bitcoin, fostering a vibrant community of artists, collectors, and enthusiasts.

- Innovation within Bitcoin: Demonstrates Bitcoin's adaptability, allowing for creative applications without compromising its foundational principles.

Challenges and Criticisms

- Network Congestion: The surge in Ordinals inscriptions has led to increased transaction fees and potential delays, raising concerns among Bitcoin users about the primary use of block space .

- Environmental Impact: The energy consumption associated with Bitcoin's proof-of-work consensus mechanism extends to Ordinals, contributing to the overall environmental footprint of the network .

- Community Division: The introduction of Ordinals has sparked debates within the Bitcoin community, with some purists viewing them as a deviation from Bitcoin's original purpose, while others embrace the innovation .

Navigating the Ordinals Minting Process

Minting Ordinals, or creating new inscriptions, is one of the most intriguing aspects of the protocol, but it can be a bit tricky if you're new to it. Here’s how you can get started:

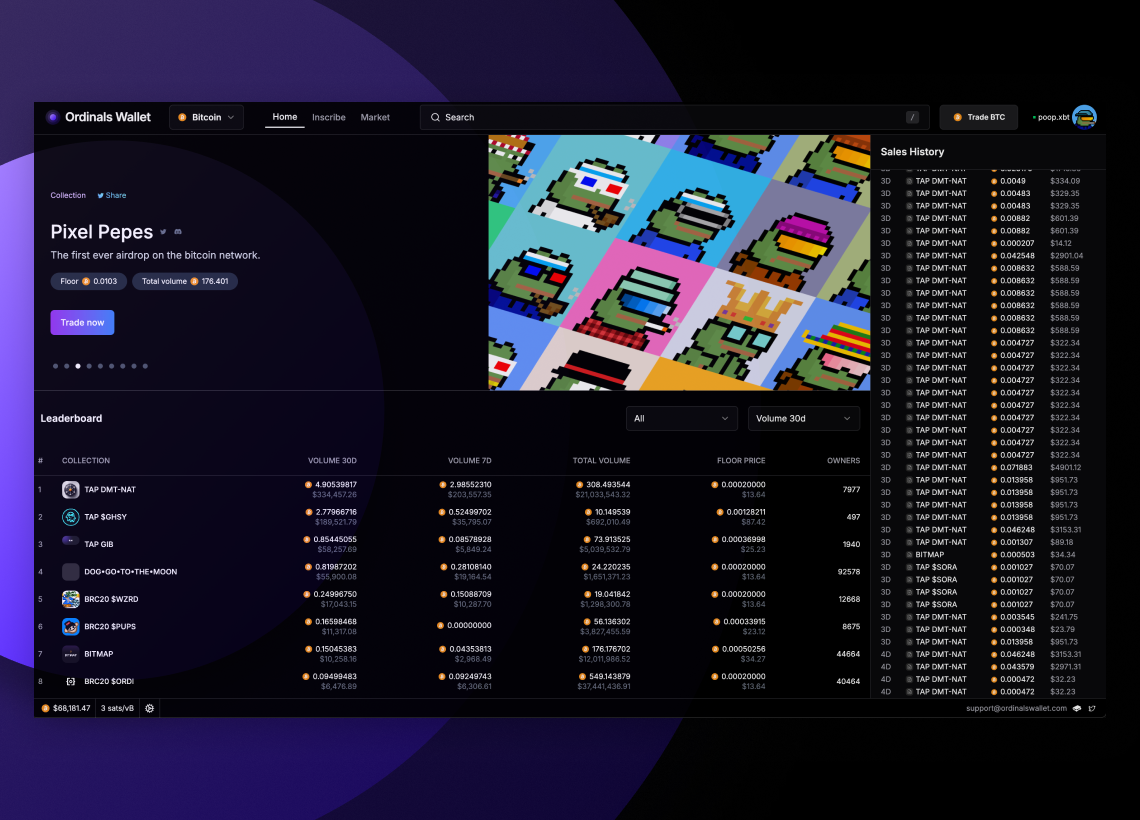

1. Choose a Wallet That Supports Ordinals

To mint Ordinals, you need a Bitcoin wallet that supports the Ordinals protocol. Some popular wallets include:

- Xverse (mobile)

- Unisat (browser-based)

These wallets let you store and view your inscribed satoshis and also offer minting functionalities. Be sure to download the latest versions of these wallets to ensure full compatibility with Ordinals.

2. Acquire Bitcoin

You'll need a small amount of Bitcoin to cover transaction fees. You can acquire Bitcoin from exchanges like Coinbase, Binance, or Kraken. Once you've purchased Bitcoin, transfer it to your Ordinals-compatible wallet. Remember, the minting fee itself might vary depending on the size of the inscription and the network congestion, so it's good to have a little extra.

3. Inscribing Your Ordinal

Once your wallet is set up with Bitcoin, you can mint your own Ordinal by uploading the digital file (image, video, or text) that you want to inscribe. Websites like OrdinalsBot or Gamma offer services that simplify this process:

- Go to the service, upload your file, and the platform will automatically inscribe it onto a satoshi.

- You’ll then pay the transaction fee, and your Ordinal will be stored on the Bitcoin blockchain forever.

4. Confirm the Transaction

After you mint your Ordinal, it will appear in your wallet. You can trade it, hold it, or transfer it to other users. If you're trading, you’ll need to navigate to marketplaces like Magic Eden, Gamma, or Ordinal Market to buy or sell.

Navigating Bitcoin's Mempool During Congestion

Bitcoin’s mempool (short for memory pool) is where transactions are temporarily stored before being added to the blockchain. During periods of high congestion, especially when there's a surge in Ordinals minting or trading, transactions can get delayed, and fees can skyrocket. Here's how you can navigate these challenges:

Understanding Mempool Congestion

The mempool is essentially a waiting area for transactions. Each transaction has a fee attached to it, and miners prioritize transactions with higher fees to include in the next block. During times of high demand (such as when a new Ordinals collection is being minted), more transactions pile up in the mempool, leading to delays.

How Mempool Congestion Affects Ordinals

When you inscribe an Ordinal, you’re essentially adding a new transaction to the Bitcoin blockchain. If Bitcoin’s network is congested, it may take longer for your transaction to be confirmed. You might see transaction fees increase as well, as everyone rushes to get their data onto the blockchain.

How to Minimize Delays

- Monitor Fees: Use fee estimators like Mempool.space to gauge the optimal fee for your transaction. This tool gives you an overview of the current state of the Bitcoin mempool and lets you choose an appropriate fee.

- Consider Timing: If possible, try to mint or make transactions during off-peak hours when congestion is lower. This reduces the likelihood of delays and high fees.

- Increase Your Fee: If you're in a rush to mint a popular Ordinal or ensure your transaction goes through quickly, you can manually increase the transaction fee. While this might cost a little more, it increases your chances of getting your Ordinal inscription included in the next block.

- Layer 2 Solutions: As the Ordinals ecosystem matures, some projects are exploring Layer 2 solutions (like Bitcoin’s Lightning Network) to offload some of the congestion from the main Bitcoin chain. This would allow for faster and cheaper transactions, although this remains a work in progress.

Handling Mempool Delays

If your transaction doesn’t go through as quickly as you’d like, you may encounter an option called Replace By Fee (RBF). This feature allows you to increase the fee on a pending transaction to incentivize miners to prioritize it.

Dealing with Speculative Hype & The Risks of Ordinals

While Ordinals have generated significant interest and speculation, it's important to understand the risks associated with investing in or collecting them.

Speculative Nature of Ordinals

As with traditional NFTs, many Ordinals have seen extreme price fluctuations. While some early Ordinals inscriptions have fetched high prices at auction, others may lose value over time. This speculative nature makes the market unpredictable, and it’s crucial to exercise caution, particularly if you're new to crypto.

Rarity & Scarcity

The allure of owning a piece of Bitcoin’s history—whether it’s an early inscription or a rare satoshi—has led many collectors to enter the Ordinals market. However, this also fuels a speculative bubble. Similar to trading collectible items like trading cards, the rarity of some satoshis can create a competitive market, driving up prices based on perceived value rather than intrinsic worth.

Diversifying Your Approach

If you’re interested in the Ordinals ecosystem, it’s a good idea to start small. Don’t get caught up in the hype of the latest "rare" Ordinal or highly speculative project. Consider starting with lower-cost inscriptions and avoid spending large sums of money based on short-term price trends.

The Future of Ordinals

Looking forward, the Ordinals ecosystem is still in its infancy, and new developments are likely to emerge. Key areas to watch include:

- Improved User Interfaces: As more wallets and marketplaces integrate with Ordinals, the user experience will continue to improve, making it easier for normies to mint, buy, and sell inscriptions.

- Broader Adoption in Art and Culture: Ordinals could see further adoption in the art world, with galleries and artists increasingly using Bitcoin’s blockchain to prove provenance and authenticity for digital and physical art pieces.

- Layer 2 Solutions: Developers are already exploring ways to scale Ordinals using Layer 2 networks, which could alleviate congestion and reduce fees without compromising Bitcoin’s security.

Conclusion

Ordinals are transforming Bitcoin from a purely financial tool into a platform for digital expression, cultural significance, and collectibles. Whether you're an artist, collector, or curious observer, understanding how to navigate the minting process, handle mempool congestion, and assess the risks of speculative hype will help you make the most of this new chapter in Bitcoin's history.

References

Comments ()