BlackRock + DeFi: How the World’s Largest Investment Fund Is Betting on Blockchain

Introduction

Imagine earning returns from U.S. Treasuries while simultaneously using them as collateral to take out loans or participate in decentralized finance (DeFi) protocols. Sounds like the future? It’s already happening. In May 2025, BlackRock, the world’s largest investment fund, officially entered the DeFi space by integrating its U.S. Treasury fund with the blockchain. This move could be a turning point for the entire financial system.

In this article, we’ll explain in simple terms:

- What BlackRock did

- Why it matters for both retail and institutional investors

- What this could lead to in the near future

What Happened: Tradition Meets Innovation

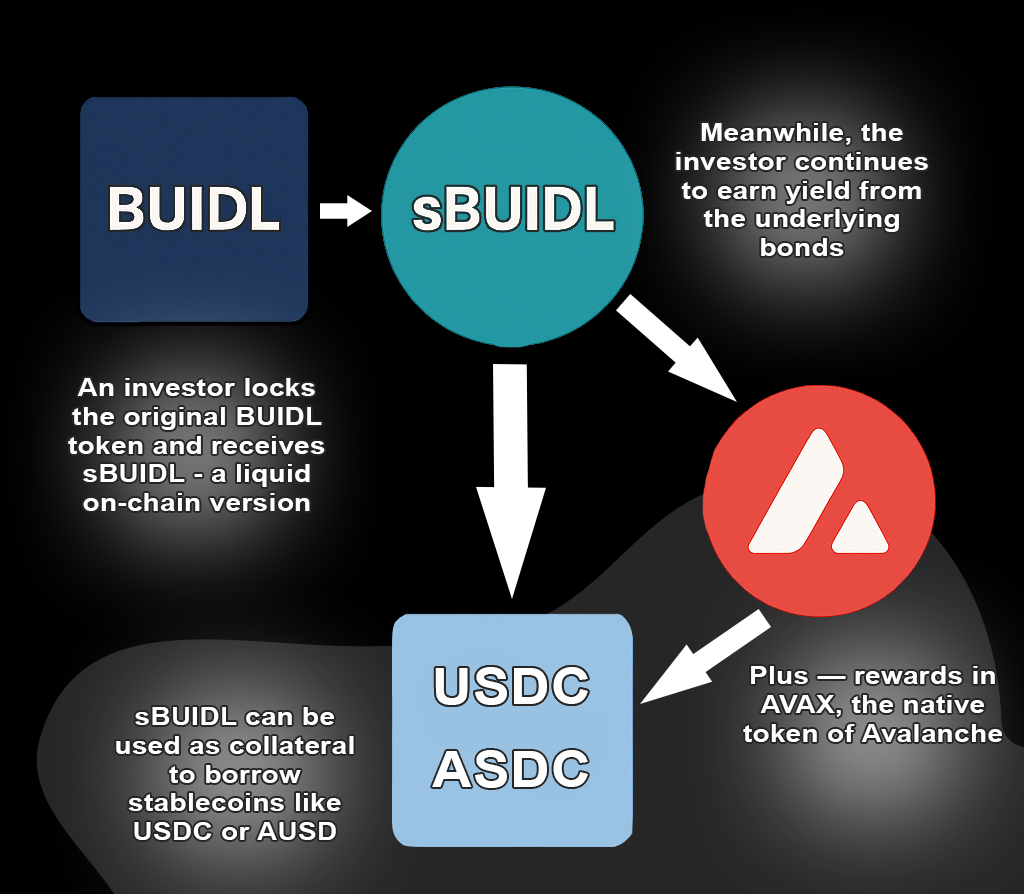

BlackRock announced the first-ever direct integration of its tokenized U.S. Treasury fund BUIDL (valued at around $3 billion) with the DeFi protocol Euler, built on the Avalanche blockchain. This integration was made possible via a special token called sBUIDL, created with the help of Securitize.

How it works:

- An investor locks the original BUIDL token and receives sBUIDL - a liquid on-chain version

- sBUIDL can be used as collateral to borrow stablecoins like USDC or AUSD

- Meanwhile, the investor continues to earn yield from the underlying bonds

- Plus - rewards in AVAX, the native token of Avalanche

“BlackRock presents the product as a bridge between traditional assets and permissionless protocols, without sacrificing liquidity or stability.”

This system allows real-world assets, like U.S. Treasury bills, to be used in DeFi without losing their yield - for the first time.

Why It Matters for Finance

1. Boosting Trust in DeFi

When a player with over $500 billion in assets connects to decentralized protocols, it sends a powerful message. DeFi has long been viewed as a niche for crypto enthusiasts - now it’s part of the strategy for top institutional players.

“BlackRock’s entry increases trust in DeFi among traditional financial institutions.”

This move could inspire others, like Fidelity or Vanguard, to explore similar innovations.

2. New Opportunities for Institutional Investors

Institutional investors now have the chance to:

- Use familiar assets (U.S. Treasuries)

- Participate in DeFi protocols

- Retain stability and yield, while adding flexibility

This transforms traditional asset management. Instead of idle capital, assets can now be active on-chain.

3. A Boom in Real Asset Tokenization

The success of sBUIDL proves that tokenization isn’t just a buzzword - it’s a practical tool. We're seeing bridges form between the “paper-based” and “blockchain-based” economies.

“Using real assets as collateral opens up new financial possibilities.”

Companies like Securitize are strengthening their positions as tech leaders in this space. This may kick off a wave of tokenization by other major players.

Conclusion

BlackRock’s DeFi integration is not just a tech upgrade - it’s the first true step toward merging the worlds of traditional and decentralized finance. This move:

- Shows that DeFi can be secure and compliant

- Offers new options for institutions and high-net-worth clients

- Matures the market for tokenized assets

⚠️ Access to BUIDL and sBUIDL is still limited to qualified investors (minimum investment: $5 million), but this is only the beginning.

What’s next?

- Which assets will be tokenized next?

- Will we see DeFi protocols using bonds from other countries?

- Could this mark the start of a new era in capital management?

There are more questions than answers right now, but one thing is clear: the future of finance has already begun.

About Mitosis:

Mitosis APP

Blog

Docs

X

Discord

Comments ()