Breaking Down Solv V3: Modular Architecture and Innovations in DeFi Structured Products

The decentralized finance (DeFi) ecosystem has witnessed a wave of innovation over the past few years, with protocols continuously evolving to meet the growing demands of users and institutions alike. One standout development in this domain is the launch of Solv V3, a sophisticated upgrade that redefines the boundaries of what is possible in structured financial products on-chain.

Solv Protocol, known for pioneering the concept of Financial NFTs (F-NFTs), has made remarkable strides in bringing real-world finance to decentralized platforms. With the release of Solv V3, the protocol is positioning itself as a foundational pillar for programmable asset management in DeFi. This article delves deep into Solv V3’s modular architecture, cross-chain capabilities, and the new era of customizable financial instruments it introduces.

1. A Brief Recap: What is Solv Protocol?

Solv Protocol is a DeFi platform designed to create, manage, and trade structured financial products using tokenized assets. It allows developers and institutions to package yield-generating strategies, lock-up mechanisms, vesting schedules, and other custom features into Financial NFTs.

Since its inception, Solv has raised capital from notable investors like Binance Labs and Blockchain Capital and has collaborated with major ecosystems such as Ethereum, BNB Chain, and Arbitrum.

2. Solv V3 Overview: A Leap Forward

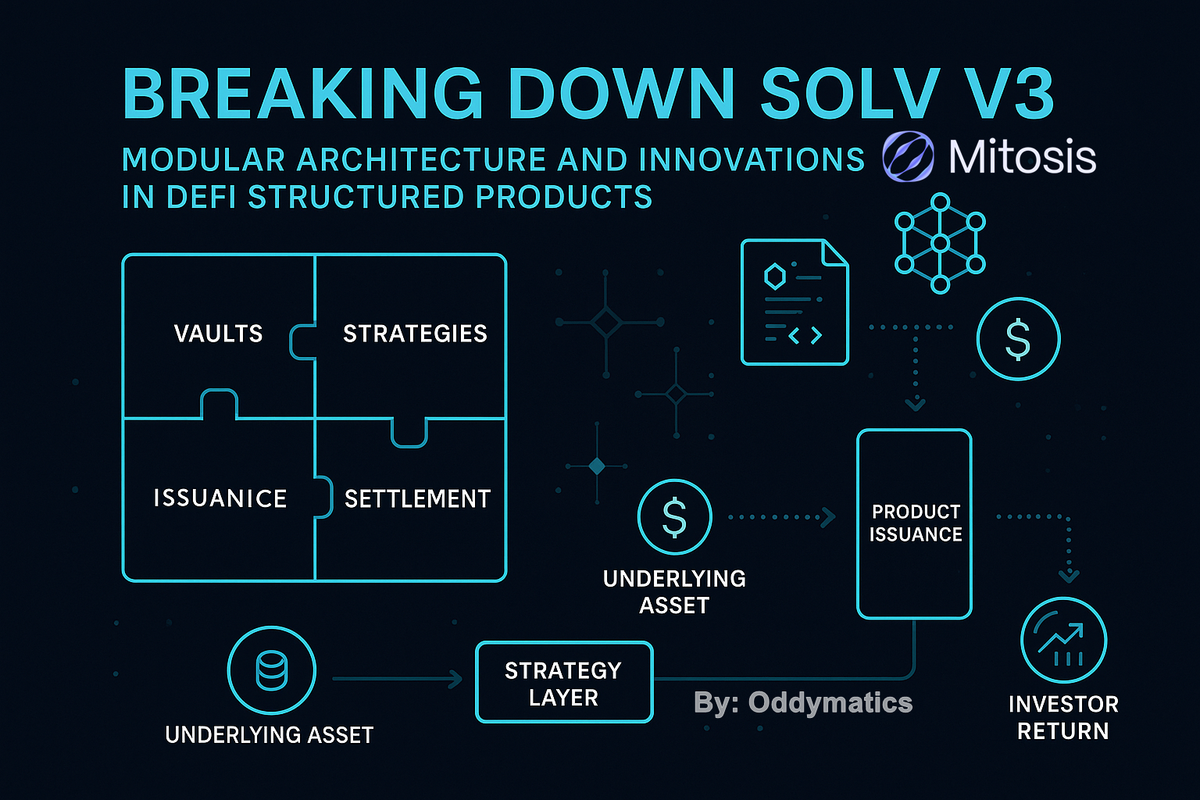

Solv V3 is not just a protocol upgrade, it’s a paradigm shift. It introduces a modular and extensible framework that enables unprecedented flexibility in creating structured financial instruments.

Key Innovations:

- Modular Contract System: Plug-and-play architecture for creating unique financial products.

- Cross-Chain Interoperability: Native support for multichain deployment using LayerZero and other bridging tech.

- Custom Asset Design: Fully customizable parameters, from yield logic to vesting curves.

3. The Modular Architecture: Plug-and-Play for DeFi

At the heart of Solv V3 lies a modular smart contract architecture that separates logic layers for product design, asset issuance, and yield management. This abstraction allows builders to:

- Develop custom fund strategies with minimal overhead.

- Add or replace modules without affecting the entire protocol.

- Integrate external oracles, vaults, or staking mechanisms.

Architecture Layers:

| Component | Function |

|---|---|

| Product Factory | Blueprint creation for new F-NFTs |

| Issuance Module | Handles minting, burning, and distribution |

| Strategy Module | Connects to vaults or protocols for yield generation |

| Oracle Module | Fetches off-chain or on-chain data for pricing |

This architecture fosters programmability and composability, two vital attributes for DeFi scalability.

. Financial NFTs Reimagined

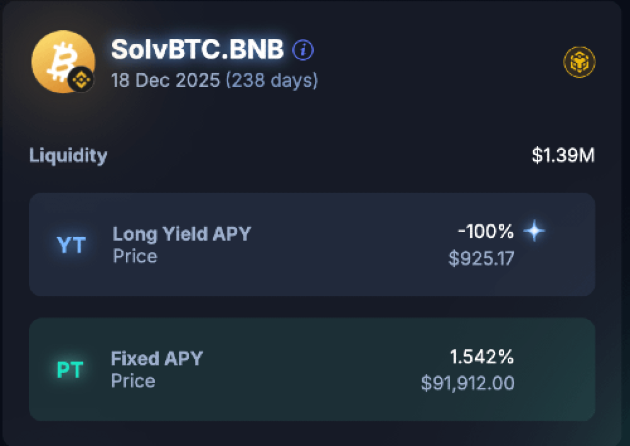

Solv’s flagship innovation, F-NFTs, has evolved significantly in V3. These tokens represent ownership of a structured financial position, such as:

- Yield-bearing locked tokens

- Vesting schedules for IDOs

- Tokenized bonds and treasuries

New Features in V3:

- Dynamic Metadata: Real-time yield, balance, and status display.

- Secondary Market Support: Enhanced liquidity on decentralized exchanges.

- Custom Vesting Logic: Tailored to DAO treasuries, employee incentives, and more.

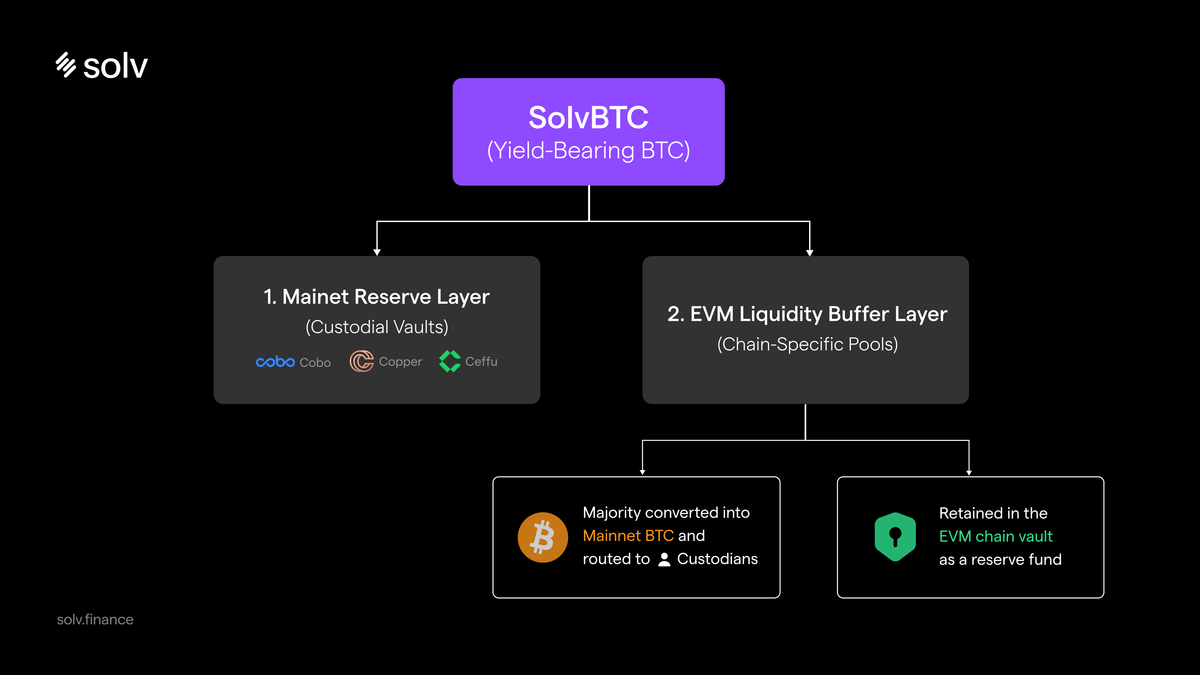

5. Cross-Chain Deployment: Bridging DeFi Silos

With V3, Solv embraces a cross-chain first strategy, ensuring that structured products are not confined to one ecosystem. Using technologies like LayerZero, Solv V3 allows:

- Issuance of F-NFTs on one chain (e.g., Ethereum) while generating yield on another (e.g., Arbitrum).

- Gas abstraction and seamless bridging of financial instruments.

- Cross-chain fund management for DAOs and treasuries.

This interoperability helps unify fragmented liquidity pools and extends the reach of DeFi into multiple Layer 1s and Layer 2s.

6. Use Cases: Powering Next-Gen DeFi Products

Solv V3 is built to cater to a variety of structured financial products. Here are some real-world use cases already being explored:

| Use Case | Description |

|---|---|

| Token Vesting NFTs | Custom lockups for project teams or investors |

| Yield-Bearing Bonds | Time-locked instruments providing fixed or dynamic returns |

| DAO Incentive Programs | Non-transferable NFTs distributed as part of liquidity mining or governance |

| Treasury Management NFTs | Protocol treasuries deploying assets for yield while maintaining transparency |

| NFT Subscriptions | Tokenized subscription models with built-in expiration and renewal logic |

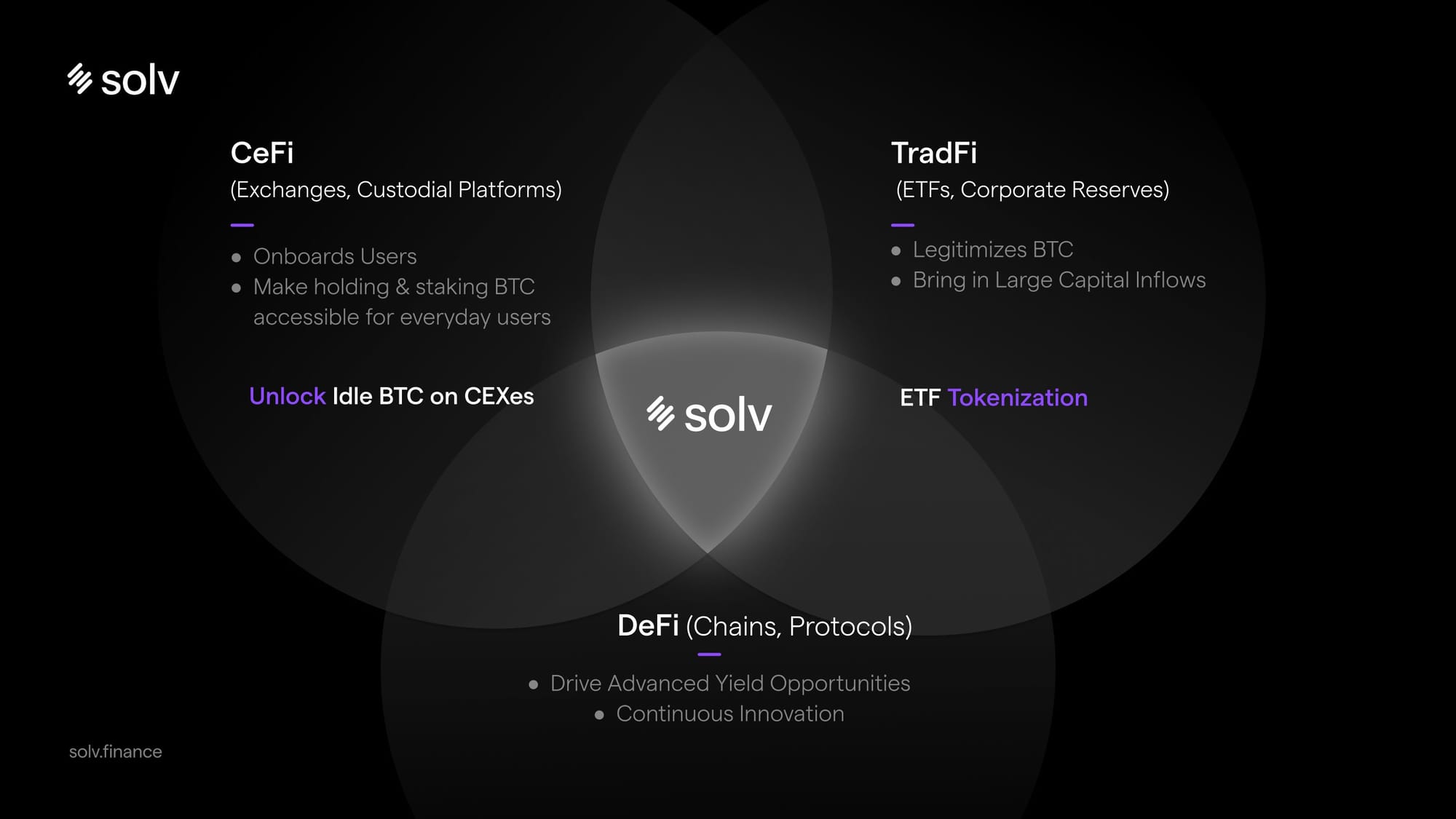

7. Institutional Appeal: DeFi Meets TradFi

By enabling programmable financial contracts, Solv V3 makes DeFi much more accessible for institutions. Features such as compliance-friendly design, auditable smart contracts, and customizable risk profiles are instrumental in bridging the gap between TradFi and DeFi.

The protocol’s design allows asset managers, hedge funds, and DAOs to create on-chain portfolios that mirror traditional structures but with blockchain-native advantages, transparency, immutability, and 24/7 global access.

8. Solv V3 vs Other DeFi Structured Protocols

| Feature | Solv V3 | Ribbon Finance | Element Finance |

|---|---|---|---|

| Modular Architecture | ✅ Yes | ❌ No | ❌ No |

| Financial NFT Support | ✅ Advanced | ❌ Limited | ✅ Basic |

| Cross-Chain Support | ✅ Multi-Chain | ❌ Single-Chain | ❌ Single-Chain |

| Custom Product Builder | ✅ Available | ❌ No | ❌ No |

| Institutional Design | ✅ Yes | ❌ No | ✅ Moderate |

9. Ecosystem Growth and Adoption

Solv Protocol has already integrated with major DeFi players and Layer 1 ecosystems, including:

- Ethereum, BNB Chain, Arbitrum

- Polygon, Optimism (coming soon)

- Partnerships: Binance, Galxe, Project Galaxy, Impossible Finance

With V3, Solv is expanding to Solana, Avalanche, and Base, aiming to become the de facto standard for on-chain structured products.

10. The Future: Building a Modular Financial System

Solv V3 is a foundational upgrade, not just for the protocol but for DeFi as a whole. By offering an open, extensible, and composable platform, Solv enables a future where anyone can build complex financial tools without reinventing the wheel.

Key roadmap elements include:

- Solv SDK: For custom strategy builders and DAOs

- ZK Compliance Layer: Privacy and KYC options for institutions

- Structured Fund Marketplace: Trade and discover financial NFTs

Conclusion

Solv V3 delivers on its promise of modular, scalable, and cross-chain structured financial instruments. With its unique blend of financial NFTs, flexible architecture, and interoperability, Solv is no longer just a DeFi project, it is an infrastructure layer for programmable finance.

As users and institutions alike explore this new frontier, Solv V3 may very well become the protocol that shapes the next generation of asset management on-chain. Solv V3 marks a pivotal evolution in the DeFi landscape, setting a new standard for structured financial products through its modular, interoperable, and institution-ready framework. By decoupling complex asset mechanics into customizable modules and enabling cross-chain deployment, Solv V3 doesn’t merely upgrade the existing DeFi playbook, it rewrites it entirely.

Its embrace of Financial NFTs as a versatile wrapper for yield strategies, vesting contracts, and asset management introduces a new layer of financial engineering, democratizing access to sophisticated tools previously exclusive to traditional finance. Whether it’s DAO treasuries seeking transparent investment strategies, institutions building compliant on-chain funds, or individual users optimizing yield, Solv V3 provides the infrastructure to deliver these outcomes at scale.

What sets Solv apart is not just its innovation but its composability. The protocol’s plug-and-play model empowers developers, protocols, and fund managers to craft tailor-made financial instruments without the burden of building from scratch. Combined with its native support for multi-chain operations and ongoing roadmap including zk-compliance, a strategy SDK, and marketplace integrations, Solv is poised to become the foundational layer for DeFi’s next era.

In essence, Solv V3 isn’t just about structured products. It’s about structuring the future of decentralized finance, flexible, programmable, interoperable, and open for everyone.

Comments ()