Breaking Down the Mitosis x Theo Matrix Campaign: How It Works and Why It Matters

Mitosis has officially announced its first protocol partnership through the Matrix liquidity framework, collaborating with Theo to bring institutional-grade, delta-neutral yield strategies to DeFi participants of all sizes. This inaugural Matrix Vault represents a significant milestone in Mitosis' mission to transform how liquidity functions in decentralized finance.

The purpose of this article is to:

- analyze Theo’s strategy and value proposition

- provide the fundamental notions needed to clearly understand the underlying strategies being utilized

- evaluate alternatives currently available on the market

The Matrix Framework & Partnership Overview

As introduced in the Mitosis Litepaper published at the end of January, Matrix is one of the Mitosis Liquidity Frameworks (MLFs) designed to connect capital providers with protocols seeking to bootstrap predictable liquidity. Unlike traditional liquidity provision models that either impose rigid timeframes or suffer from unstable capital flows, Matrix offers a balanced approach where users maintain flexibility while protocols receive the sustainable liquidity needed to operate effectively.

The partnership with Theo exemplifies how Matrix bridges the gap between low-accessibility financial strategies (which stems mainly from a lack of trading knowledge or time-commitment) and everyday users.

Theo, a Stablecoin Network built to supercharge onchain markets, coordinates assets across multiple execution environments to enable capital-efficient applications. Their featured app is called Theo Earn, which currently prides itself on its Straddle (USD and ETH) product — delta-neutral vaults that capture funding rates by simultaneously leveraging lending platforms and perpetual futures markets.

Trading Concepts for Everyone: Laying the Foundation

Before delving deeper into the inner-workings of Theo, I think it’s important to break down key concepts such as delta-neutral, funding rates, basis trade, etc. in simple terms so that even those who are not familiar with these notions can have a solid foundation to thoroughly understand the following paragraphs.

Delta neutral

A delta neutral position has no directional exposure to the underlying asset — price moves in either direction do not affect your position.

Running delta neutral portfolios is common practice for funds and market makers (the latter focuses on capturing the bid and ask spread), however it’s used also by retail traders for various purposes.

Let’s suppose you’re already spot long (e.g. BTC) on a directional trade opened at $20,000 with a $100,000 price target.

During periods when price approaches resistance or there’s overall market uncertainty, you may want to edge your position instead of outright exiting it.

In that case, the process entails shorting perps 1:1 to go delta neutral and then closing the short position either when you feel like it has bottomed or it’s back at entry. The point is not necessarily to take profit on the hedge, because that would defeat its purpose, but to have a safety net for your spot holdings during adverse market conditions.

Funding rates

The funding rate is a mechanism used to keep the balance between the price of a perpetual futures contract and an underlying spot price index, as these contracts often trade at a premium or discount relative to the mark price.

This incentivizes traders to close price gaps, keeping these instruments in line with one another.

When perpetual futures deviate too far above the spot index, positive funding occurs — long positions pay the funding rate to shorts to keep their position open, and the opposite is true for negative funding.

Since crypto markets usually present an underlying long-bias, it’s very common for big players to harvest funding by hedging (shorting) their spot buys with derivatives, thus effectively getting paid to maintain their overall position.

Basis trade and Carry

Basis trading strategies aim to earn positive carry or predict the future term structure of interest rates.

The beauty of basis trading is that you are price neutral. Generally you will construct a strategy where the delta risk, or change in price due to a change in spot, is eliminated. This allows you to place larger bets, and capture small changes in the basis.

Basis = Contract Price - Coin Average Price

A carry trade involves borrowing a currency with a low interest rate to purchase financial assets in another currency that yield more or have a higher chance of appreciation.

When it comes time to repay the loan, money is lost if the currency borrowed appreciates relative to the currency of the assets you purchased. If the currency borrowed depreciates, money is made.

Understanding Theo’s Straddle Matrix Vault: Strategy & Value Proposition

What sets Theo apart in the crowded DeFi landscape is its focus on connecting disparate liquidity venues through a unified, decentralized system. By leveraging a custom validator set, proprietary internal oracle systems, and advanced risk management engines, Theo creates a secure and efficient environment that can significantly enhance yields for depositors.

Their Straddle strategy is entirely delta-neutral with conservative risk parameters, meaning it aims to generate consistent returns regardless of market direction. This approach provides a compelling alternative to conventional DeFi yield sources, which often rely on token incentivized emissions or are heavily exposed to directional market risk.

Vault Mechanics: How Capital Flows are Adapted to Market Conditions

The Theo Straddle Matrix Vault operates on a cyclical deployment model with clearly defined processes for deposits, strategy execution, and withdrawals.

For detailed technical specifications about the deposit mechanics, please refer to the official Mitosis Blog article. Here I will be focusing on the strategy execution.

Rather than rigidly adhering to a single approach regardless of market conditions, the Theo Straddle (mi)weETH vault dynamically adjusts itself between two primary strategies based on the prevailing yield environments.

Basis Trade Strategy (when demand for being long on perpetual contracts is significant, creating yields exceeding 10%):

- weETH collateral is deposited to the local Aave instances (e.g. Zerolend on Linea)

- USDC is borrowed against this collateral and bridged to Hyperliquid to establish short positions

- This positioning captures the ETH funding rate, which forms a significant component of the yield

Leveraged ETH Strategy (when yields fall below 10%):

- The system unwinds the basis trade positions

- Capital pivots to a looped leveraged ETH strategy

- This adaptive approach ensures continued yield even during unfavorable funding environments

Throughout the operating cycle, positions are continuously monitored and automatically rebalanced as ETH price fluctuates. This active management maintains the delta-neutral exposure while optimizing risk parameters, ensuring both capital efficiency and protection against adverse market movements.

Yield Generation: Multiple Revenue Streams

What makes the Theo Straddle weETH particularly attractive is its multi-faceted approach to yield generation. Users benefit from several complementary revenue streams:

- Base Yield: Underlying staking returns from weETH

- Lending Yield: Interest earned from supplying assets to Aave

- Funding Rate Harvest: Revenue from Hyperliquid short positions

- Token Incentives: Additional rewards in the form of Theo tokens exclusive to Matrix campaign participants

- Mitosis Points: Exclusive to Mitosis users

This diversified approach to yield creates a more stable and predictable return profile than many alternatives in DeFi. By targeting a positive 10-15% real yield against deposited assets regardless of market conditions, the strategy provides users with meaningful returns without relying on unsustainable token emissions or high-risk positions.

Theo vs. Market Alternatives: Ethena

In the evolving space of decentralized finance, delta-neutral strategies have emerged as powerful yield-generating mechanisms that appeal to both risk-conscious investors and those seeking stable returns.

Ethena is one of the leading players and since its protocol launch it has accrued notable market traction with billions of dollars in TVL.

Ethena's synthetic dollar, USDe, provides the crypto-native, scalable solution for money achieved by delta-hedging Bitcoin, Ethereum and Solana spot assets using perpetual and deliverable futures contracts, as well as holding liquid stables such as USDC and USDT.

Similar Core Mechanics

Both Theo and Ethena operate on the same fundamental principle: capturing funding rates from perpetual futures markets through delta-neutral positions.

In each system, user capital becomes the foundation for structured trading strategies that harvest the cryptocurrency markets' funding rate premiums. These premiums manifest because perpetual futures typically trade at higher prices than spot markets, requiring long position holders to to compensate shorts through funding payments.

By strategically positioning themselves on the receiving end of these payments, both protocols transform what would otherwise be a trading cost into a sustainable yield source for their users.

Architecture and Product Focus

Ethena's ecosystem revolves around USDe (synthetic dollar) and sUSDe, which is the staked and reward-accruing version. Users mint USDe by supplying collateral assets, primarily stablecoins like USDC and USDT, on Ethereum.

The revenue generation comes from three primary sources: staking returns from ETH LSTs that are part of the backing long spot portfolio, fixed rewards from liquid stables held in the reserves, and most significantly, the funding and basis spread captured through delta-hedging derivatives positions.

Rather than creating a synthetic dollar, Theo focuses on creating different vaults with a straightforward value proposition: allow users to maintain exposure to their preferred crypto asset like weETH (ether.fi's LST), USDC, etc. while further enhancing its yield through the protocol's trading strategies.

Market Approach and Positioning

Ethena has scaled to billions in TVL with an established market presence. Its synthetic dollar approach has resonated strongly in the current market, particularly with users seeking dollar-denominated returns without fully exiting their crypto exposure. The protocol has built a robust infrastructure around its stablecoin vision, integrating with numerous DeFi protocols and centralized exchanges.

Theo positions itself as a newer entrant still in its early adoption phase, targeting a different segment with its multi-venue approach. Instead of directly competing with Ethena's stablecoin model, Theo focuses on becoming an infrastructure layer connecting diverse liquidity venues and assets into a unified system capable of deploying capital efficiently across the entire DeFi landscape.

Theo's Unique Advantages

Adaptive Strategy Selection Framework

Theo's true distinction lies in its contingency planning. When funding rates decline below target thresholds, the vault doesn't simply accept diminished returns – it pivots its entire strategy. The system can rebalance positions to exit the basis trade partially or completely, redirecting capital to looped ETH strategies utilizing staking solutions like EigenLayer to maintain competitive yield figures.

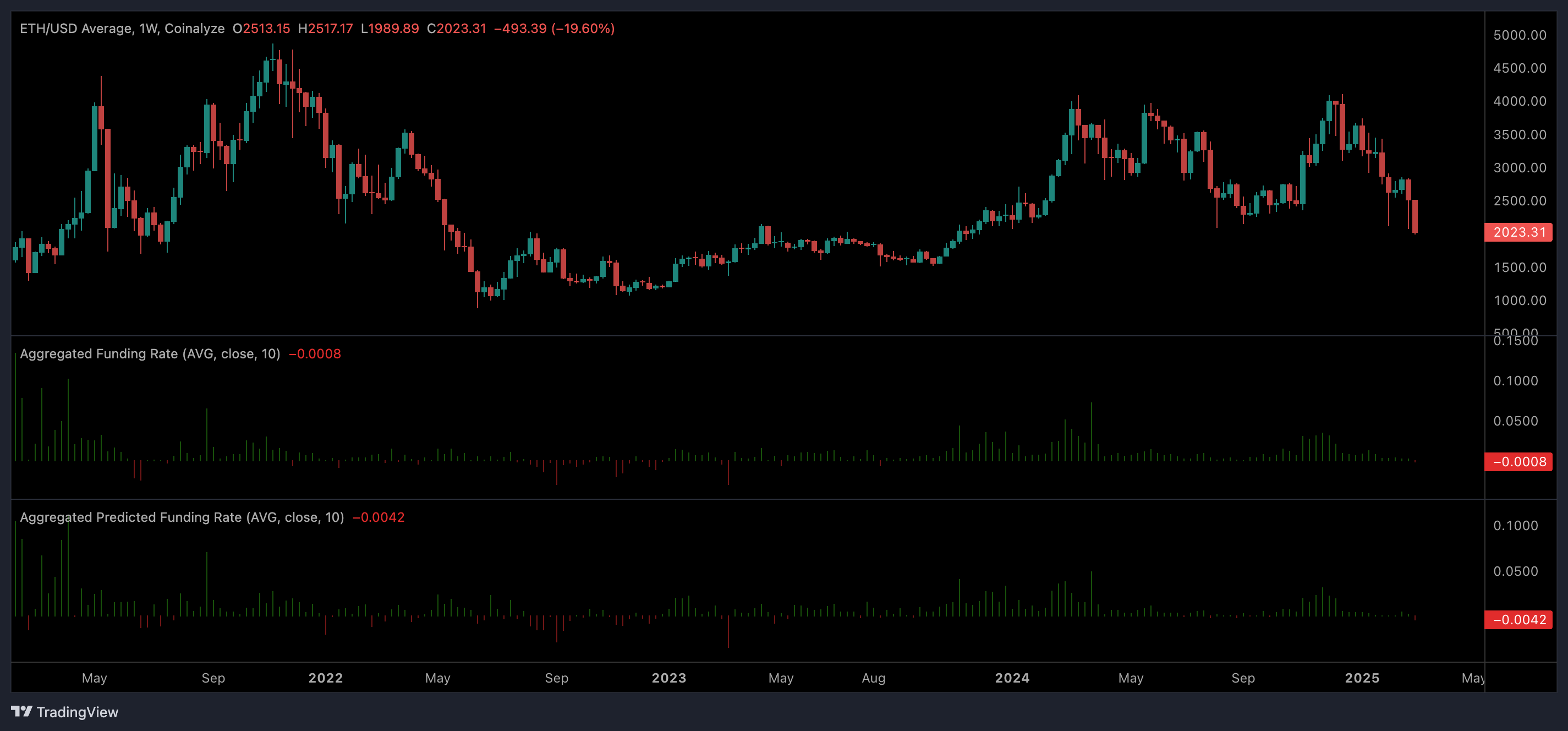

This adaptive approach allows Theo to target consistent yield profiles regardless of market conditions, potentially offering more stability than systems that rely exclusively on a single yield source susceptible to market fluctuations and participation (for example, on the 5th of March 2025, sUSDe APY has dropped to 4.99%).

Moreover, the Theo Straddle strategy implements a bi-daily schedule for withdrawals tied to vault round rollovers, in contrast with Ethena's more restrictive 7-day cooldown period after unstaking sUSDe. Theo's approach strikes an optimal balance — providing sufficient operational stability for the strategy execution while respecting users' liquidity needs during market volatility.

LST Integration and Optimization

The Mitosis Matrix campaign specifically leverages weETH as the base deposit asset, representing a deliberate design choice that enhances total yield potential. By using liquid staking tokens as the strategy foundation, Theo combines the native staking rewards inherent to weETH with the funding rate capture from its delta-neutral strategy.

For depositors, this means extracting maximum efficiency from their ETH exposure across multiple yield vectors simultaneously.

Composability Through Mitosis Integration

The most significant innovation in the Mitosis x Theo partnership lies in the programmable liquidity it enables.

As detailed in the Mitosis Litepaper, the protocol transforms traditionally illiquid LP positions into standardized tokens with full composability, unlocking powerful new capabilities unavailable in traditional yield strategies.

The Mitosis Chain infrastructure enables these tokens to be traded, used as collateral in lending protocols, or incorporated into more complex financial instruments – all while the underlying capital continues generating yield through Theo's delta-neutral strategy.

This composability layer creates an entire ecosystem of opportunities around maAssets that extends beyond simple yield accrual, whereas Ethena's sUSDe functions primarily as a yield-bearing receipt token and sENA (their liquid receipt token for staked ENA) accrues additional value through ecosystem airdrops and rewards but with more limited composability outside the Ethena Network Ecosystem Applications.

Conclusion

The Mitosis and Theo partnership represents a significant advancement in DeFi's maturation, offering sustainable yield strategies through an adaptive framework that intelligently responds to changing market conditions rather than relying on speculative mechanisms.

While Ethena focuses on building an ecosystem based on synthetic dollars, Theo takes a complementary approach by enhancing yields on users' existing assets, and Mitosis transforms illiquid positions into composable tokens — increasing capital efficiency across the ecosystem.

For everyday users, this partnership democratizes access to sophisticated financial strategies and the underlying ultra low latency execution infrastructure offered by Theo, where no complex trading knowledge or significant time commitment is required — potentially bridging the adoption gap between crypto-native users and mainstream finance.

As DeFi evolves, such collaborations point to a future where liquidity becomes more programmable, stable, and efficient. Sustainable yield generation, rather than shadowy token emissions or speculative trading, will likely form the foundation of DeFi's next growth phase, with protocols that effectively balance risk, return, and usability positioned to lead the market.

Mitosis Website | Mitosis X (prev. Twitter) | kumatycoon X (author)

Comments ()