Breaking Down Web3: Bridges, Burns, and Blockchain Made Super Simple

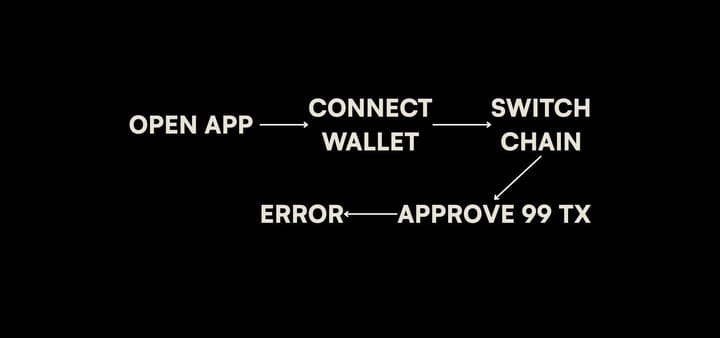

When you first step into Web3, it can feel like you’ve landed in a foreign country where everyone speaks in secret code:

“Bridge your wrapped ETH to Layer 2, stake it for yield, then burn the rewards.”

If you’re new, you might just nod politely while thinking:

“What on earth did you just say to me?”

Don’t worry, you’re not alone. Web3 has its own language, and while the terms sound complicated, most of them describe simple concepts you already understand, just with new names.

In this guide, we’re going to take common Web3 terms like blockchain, wallet, bridges, burns, staking, and liquidity pools and explain them in plain English, using real-world analogies and examples so they finally click.

Part 1: The Foundation: Understanding Blockchain

Before we talk about bridges or burns, you need to understand what they’re built on the blockchain.

What Is a Blockchain?

A blockchain is like a giant, shared notebook that lives on the internet.

- Anyone can write in it (record transactions).

- Everyone can read it.

- Once something is written, you can’t erase or change it ever.

Instead of being stored in one computer, it’s copied across thousands of computers worldwide. This makes it really hard to hack or fake.

Why It’s Different from a Bank Database

If you send money through a bank, the bank’s private database records it. You trust the bank not to change the numbers.

In blockchain, no single person or company owns the database. The “trust” comes from math, transparency, and the fact that every copy of the notebook matches.

Real-life analogy:

Imagine a neighborhood noticeboard where every resident has their own exact copy. If someone tries to cheat and write “John owes me $100” without proof, their version won’t match the others, so it gets rejected.

Part 2: Wallets: Your Digital Backpack

What Is a Wallet?

Your Web3 wallet is like your digital backpack that holds your coins, NFTs, and the keys to prove they’re yours.

Unlike a physical wallet, the crypto itself doesn’t “live” inside it, it lives on the blockchain. The wallet just holds the keys that let you access it.

Public Key vs Private Key

- Public key: Like your bank account number. You share it so people can send you money.

- Private key: Like your bank PIN. Never share it. If someone gets it, they can take everything.

Example:

You give your friend your public address so they can send you 0.01 ETH. Your private key is what you use to “unlock” that ETH and move or spend it.

Pro tip: Use a hardware wallet (like Ledger or Trezor) for long-term storage, it keeps your keys offline, safe from hackers.

Part 3: Bridges: Moving Value Across Chains

What’s a Blockchain Bridge?

A bridge is a tool that lets you move crypto or assets from one blockchain to another.

Why We Need Bridges

Think of blockchains as separate countries:

- Ethereum speaks “ETH”

- Solana speaks “SOL”

- Polygon speaks “MATIC”

If you have ETH but want to use an app on Solana, you can’t just send ETH directly, it would be like trying to use dollars in a store that only accepts yen.

A bridge is like a currency exchange booth for blockchains.

How a Bridge Works (Simplified)

- You send ETH to a bridge.

- The bridge “locks” your ETH on Ethereum.

- It creates an equivalent token (like wrapped ETH) on the other blockchain.

When you want to go back, the bridge reverses the process.

Real-life analogy:

You have gold in New York but want to spend it in London. You deposit your gold in a secure vault in New York, get a certificate for it, and spend that certificate in London.

Caution:

Bridges are big hacker targets. Billions have been stolen from poorly secured bridges (like the Ronin Bridge hack in 2022).

Safety tip: Use bridges with a solid reputation and large user base.

Part 4: Burns: Making Coins Disappear

What’s a Token Burn?

A token burn is when crypto is sent to a special wallet that no one can access, permanently removing it from circulation.

Why Burn Tokens?

- Increase scarcity: Fewer coins can mean higher value.

- Control inflation: Keeps the supply from growing too fast.

- Marketing: Projects sometimes burn tokens to create buzz.

Example:

Binance regularly burns millions of dollars’ worth of BNB tokens. This reduces supply and can make remaining tokens more valuable.

Real-life analogy:

A bakery makes 100 cupcakes, but locks 20 in a vault they can’t open. The remaining 80 cupcakes are now in higher demand.

Tip: Burns don’t guarantee price increases, other market forces still apply.

Part 5: Staking: Earning While Helping the Network

What Is Staking?

Staking means locking up your crypto to help run a blockchain, and earning rewards in return.

Why It Exists

Some blockchains use “Proof of Stake” (PoS) instead of “Proof of Work” (mining). People who stake their coins become “validators,” checking and approving transactions.

Example:

On Ethereum, you can stake 32 ETH to become a validator. You process transactions and earn ETH as a reward.

Real-life analogy:

It’s like putting money in a fixed deposit account. You can’t touch it for a while, but you earn interest.

Tip: You can also stake through pools, which let you join with less than the required amount.

Part 6: Liquidity Pools: The Community Piggy Bank

What Is a Liquidity Pool?

A liquidity pool is a pot of crypto that users contribute to so others can trade easily on decentralized exchanges (DEXs).

Why They Matter

Without liquidity pools, it would be hard for traders to swap tokens without huge price changes.

Example:

You put in $1,000 worth of ETH and $1,000 worth of USDC into a pool. Traders use your pool to swap between ETH and USDC, and you earn a fee from each trade.

Real-life analogy:

It’s like everyone in the neighborhood adding apples and oranges to a fruit stand. People can swap anytime, and contributors get a small profit.

Part 7: Gas Fees: The Blockchain’s Service Charge

What Are Gas Fees?

Gas fees are payments to validators for processing transactions.

Why They Change:

On busy days, gas fees rise because more people are competing to have their transactions processed quickly.

Example:

Sending $20 in ETH might cost $2 on a quiet day, or $40 during peak activity.

Real-life analogy:

It’s like paying a toll on a highway, higher during rush hour.

Part 8: Airdrops: Free Crypto (Sometimes)

What Is an Airdrop?

An airdrop is when a project gives free tokens to users often to promote the project or reward loyalty.

Example:

In 2020, Uniswap gave early users 400 UNI tokens for free. Some people sold them for thousands of dollars.

Real-life analogy:

It’s like a coffee shop giving a free drink to early customers.

Caution:

Some airdrops are scams. Don’t connect your wallet to random sites to “claim” tokens.

Part 9: Rug Pulls: The Vanishing Act

What’s a Rug Pull?

When a project collects investor funds and then disappears, taking the money.

Example:

A DeFi project promises high returns. People deposit millions. The next day, the team drains the funds and deletes their social media.

Real-life analogy:

A shop takes pre-orders for a hot new gadget, then shutters overnight.

Tip: Check for audits, transparent teams, and liquidity lockups.

Part 10: DAO: The Internet Clubhouse

What Is a DAO?

A DAO (Decentralized Autonomous Organization) is an online group that uses blockchain voting to make collective decisions.

Example:

A DAO raises funds to buy a rare NFT. Members vote on which one to buy.

Real-life analogy:

It’s like a community club where every decision is voted on, but the voting is transparent and tamper-proof.

Final Takeaway

Web3 terms sound intimidating because they’re new, not because they’re impossible to understand. Once you translate “bridge” into “currency exchange” or “burn” into “throw away tokens,” it all starts to make sense.

The best way to learn? Keep asking questions, look for analogies, and never be afraid to say,

“Explain it to me like I’m five.”

Comments ()