Bridging Modular Worlds Through Liquidity Synchronization

Introduction

In the ever-fragmenting world of cryptocurrency, where new chains, rollups, and app-specific blockchains are born daily, one question keeps echoing: How do we make all these ecosystems talk to each other seamlessly?

Enter The Mitosis Ecosystem—a cross-chain liquidity coordination layer purpose-built for the modular future. It’s not just another bridge. It’s not just another DEX. It’s a modular middleware protocol designed to synchronize liquidity across chains, enabling capital efficiency, fast finality, and a native cross-chain experience.

Let’s unpack what makes the Mitosis Ecosystem revolutionary, piece by piece.

The Modular Thesis: Mitosis Was Built for the New Stack

Modular blockchain infrastructure is rapidly replacing monolithic designs. Instead of one chain doing everything—from execution to consensus to data availability—these layers are being decoupled and optimized. As chains specialize, liquidity becomes fragmented. Capital sits idle, duplicated, or siloed across ecosystems.

Mitosis is a response to this fragmentation. Like its biological namesake, it enables replication and distribution, but in this context, it’s of liquidity and messaging, not chromosomes.

Core Mission: Liquidity Without Borders At its heart,

Mitosis solves one problem: Capital Isolation.

In a world with Ethereum L2s, Cosmos zones, Solana SVMs, and dozens of sovereign rollups, capital can’t flow freely. Legacy bridges are slow and often insecure. Cross-chain apps are clunky. Native UX suffers.

Mitosis introduces synchronized liquidity pools—smart vaults that exist across chains and are updated via light clients and intent-based relayers. These vaults enable:

• Single-sided deposits from any chain

• Instant withdrawals and swaps

• Cross-chain execution without needing to wrap or bridge assets manually

The endgame? Users and dApps tap into a shared liquidity layer—no matter the chain.

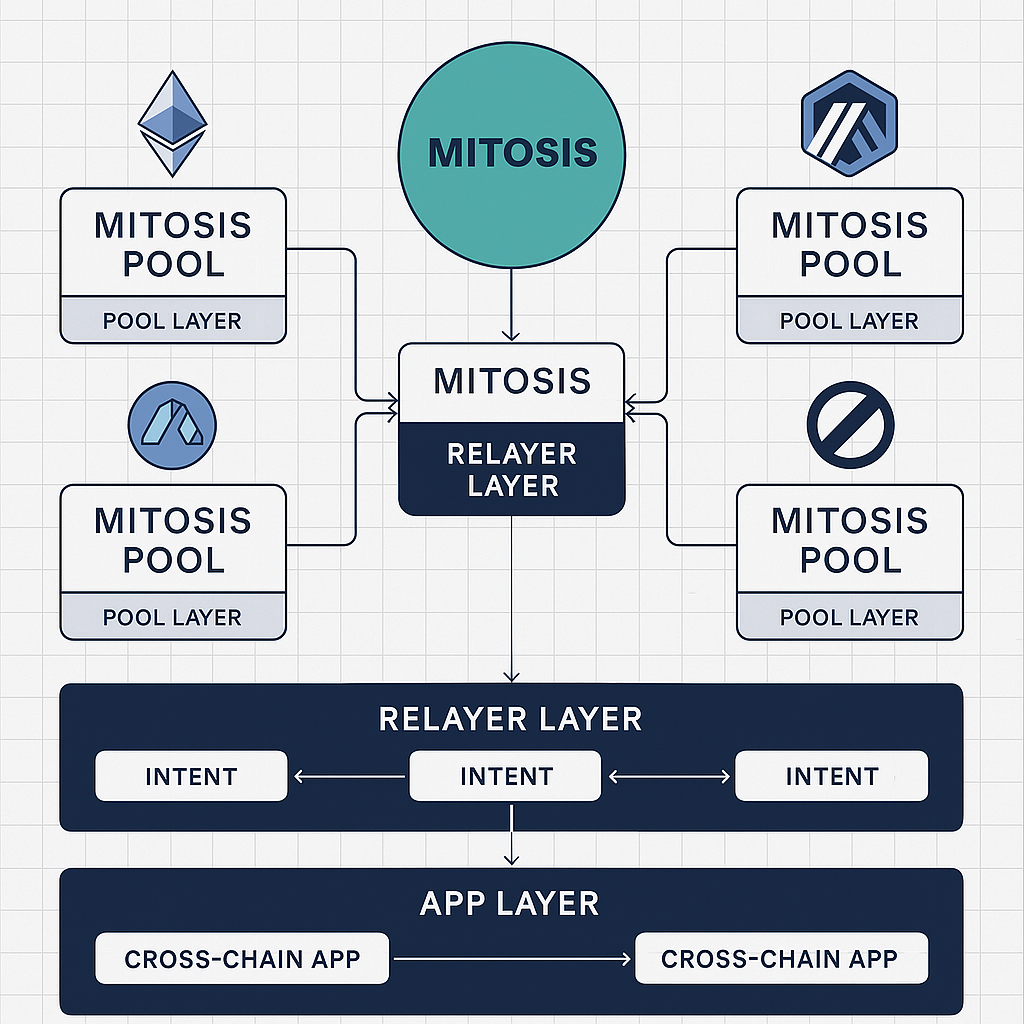

The Three-Layer Architecture of Mitosis

The Mitosis Ecosystem is composed of three tightly integrated components:

📍 Mitosis Pool Layer This is where capital lives. Mitosis pools are deployed across different chains and remain in sync using light clients and GMP (General Message Passing) protocols like Hyperlane and LayerZero. Each pool supports native assets—no wrapping, no headaches. Behind the scenes, vault states are synchronized, ensuring 1:1 backing and instant availability for swaps or withdrawals.

📍Mitosis Relayer Layer This is the beating heart of communication. Instead of relying on a single relayer or oracle, Mitosis uses intent-based relaying, meaning users sign off on what they want to do, and relayers compete to execute these intents.

The design ensures:

• Fast finality

• Minimal trust assumptions

• Composable cross-chain UX

Relayers earn fees, and users get execution guarantees.

📍 Mitosis App Layer This is where innovation blooms. The Mitosis App Layer enables cross-chain apps to be built natively on top of the synchronized liquidity. Imagine:

• DEX aggregators that use liquidity from 10+ chains in one click

• Yield strategies deployed across L2s from a single interface

• Cross-rollup lending, staking, or options platforms with unified accounting

Liquidity as a Primitive

Unlike many bridging protocols, Mitosis doesn’t treat liquidity as an afterthought. It treats it as a first-class primitive—a building block for every dApp in the modular stack.

By abstracting where liquidity is, Mitosis lets developers build as if the entire crypto economy were on a single unified ledger.

Security: Trust-Minimized from Day One

Most cross-chain exploits happen due to centralized relayers or weak oracle assumptions. Mitosis is built around light clients and intent verification, minimizing reliance on off-chain consensus.

This makes the ecosystem resilient to:

• Oracle manipulation

• Relayer collusion

• Message reordering or censorship

Plus, it’s fully compatible with emerging ZK light clients—which could make trust assumptions approach zero.

Use Cases: Mitosis in Action

So what does the Mitosis Ecosystem actually enable? Here are just a few real-world examples:

• Cross-chain stable-coin swaps: Move stablecoins between rollups instantly, without bridging

• Unified DeFi strategies: Deploy capital across chains from a single vault

• Composable money markets: Borrow on Optimism, repay on Arbitrum

• Multi-chain DEX routing: Tap into liquidity on Base, Zora, and Polygon in one atomic swap

These aren’t just hypotheticals. They’re being built now.

Mitosis x Modular Ecosystems

Mitosis is aligned with the deepest currents in crypto evolution:

• Celestia, EigenLayer, and Avail for data availability

• OP Stack and Arbitrum Orbit for execution

• ZK rollups for secure scaling

• Sovereign chains for custom applications

As these ecosystems grow, the demand for liquidity coordination becomes existential. Mitosis isn’t just compatible—it’s designed for them.

Governance and the $MITO Token

At the core of the Mitosis Ecosystem lies the $MITO token—a native utility and governance asset designed to align incentives and empower decentralized coordination. More than just a reward mechanism, $MITO acts as the control layer of the protocol. Tokenholders participate in governance, deciding on everything from which chains and assets to onboard, to protocol fee structures, vault incentives, and slashing parameters for malicious relayers.

The token also plays a vital role in the relayer economy. Relayers must stake $MITO to participate, creating skin in the game and enabling slashable accountability. In return, they earn $MITO-based rewards for executing intents and keeping liquidity synchronized across chains. Future applications may include cross-chain fee payments, access to premium dApp modules, and voting in Mitosis-powered appchains, making $MITO not just governance infrastructure, but a cross-chain coordination currency.

As the Mitosis Ecosystem grows to support more chains, apps, and liquidity layers, $MITO will become the connective tissue—securing the protocol and giving the community collective control over its evolution.

Tokenholders will govern:

• Which chains and assets to support

• Relayer incentives and slashing mechanisms

• Protocol fees and emissions

• App Layer funding and ecosystem growth

In time, $MITO could become a cross-chain coordination currency, anchoring the governance of modular liquidity.

Conclusion

Mitosis doesn’t believe the future is one chain to rule them all. It embraces plurality. The vision is a chain-agnostic liquidity mesh—a network of interoperable, composable, capital-efficient infrastructure for DeFi. In that vision, the Mitosis Ecosystem is not just a protocol. It’s a new base layer. A liquidity primitive. A peace treaty between fragmented chains.

And it’s arriving right on time. Be sat!🫶

Comments ()