Chainlink: Bridging Blockchain and Real World Data

Imagine you're building a smart contract that automatically pays farmers if a drought occurs in their region. The contract is perfectly coded and deployed on the blockchain, but there's one critical problem: how does it know when a drought actually happens? Blockchains, by design, cannot access real-world information like weather data. This is where Chainlink comes in – it's the bridge that connects the isolated world of blockchain to the vast ocean of real-world data.

Understanding the Oracle Problem Through Real Examples

To truly grasp why Chainlink matters, let's explore what happens without reliable data feeds. Picture a decentralized lending platform like Aave, where users deposit cryptocurrency as collateral to borrow other assets. The platform needs to know the current price of Bitcoin to determine if a borrower's collateral is sufficient. Without accurate price data, the system could either liquidate users unfairly or become vulnerable to bad debt.

Traditional centralized solutions create dangerous single points of failure. If one company provides all the price data and their servers go down, the entire DeFi ecosystem could freeze. Even worse, a malicious actor could manipulate a single data source to trigger millions of dollars in liquidations, profiting from the chaos they created.

Chainlink solves this by creating a decentralized network of independent data providers, each competing to provide the most accurate information. It's like having multiple weather stations reporting temperature instead of relying on just one – the more sources you have, the more confident you can be in the accuracy of the data.

How Chainlink Actually Works: A Step-by-Step Journey

Let's follow a real transaction to understand Chainlink's mechanics. When a DeFi protocol needs the current price of Ethereum, here's what happens:

Step 1: The Request The smart contract creates a data request specifying what information it needs (ETH/USD price), how many oracle nodes should respond (typically 7-31 nodes), and how much it's willing to pay in LINK tokens.

Step 2: Node Selection The Chainlink network automatically selects the most reliable oracle nodes based on their historical performance, reputation scores, and stake amounts. These nodes compete for the job by demonstrating their reliability and speed.

Step 3: Data Gathering Each selected oracle node independently fetches the ETH price from multiple sources – exchanges like Coinbase, Binance, and Kraken, as well as professional data providers like CoinGecko and CoinMarketCap. This redundancy ensures no single exchange can manipulate the final price.

Step 4: On-Chain Aggregation All oracle responses are submitted to an aggregation contract on the blockchain. This contract calculates the median price, automatically filtering out any outliers that might indicate faulty or malicious data. If one node reports $2,000 while six others report around $3,000, the outlier is discarded.

Step 5: Final Delivery The aggregated, verified price is delivered to the requesting smart contract, which can now safely execute its logic – whether that's calculating collateral ratios, executing trades, or triggering automated actions.

Breaking Down Chainlink's Advanced Features

Chainlink VRF: The Unbreakable Random Number Generator

Traditional random number generators can be predicted or manipulated, which is catastrophic for gaming or lottery applications. Chainlink VRF (Verifiable Random Function) generates random numbers that are cryptographically proven to be unpredictable and unbiased.

Here's a practical example: Imagine a blockchain-based lottery with a $10 million jackpot. Using traditional randomness, the lottery operator could potentially predict or influence the winning numbers. With Chainlink VRF, the randomness is generated using cryptographic proofs that can be verified by anyone, making manipulation mathematically impossible.

Chainlink Keepers: The Automation Engine

Smart contracts are reactive – they only execute when someone triggers them. Chainlink Keepers solve this by automatically monitoring conditions and triggering contract executions when needed. Think of them as the cron jobs of the blockchain world.

A practical use case: Yield farming protocols often need to compound rewards regularly to maximize returns. Instead of requiring users to manually claim and reinvest their rewards (paying gas fees each time), Chainlink Keepers can automatically perform these actions when it becomes profitable to do so.

Cross-Chain Interoperability Protocol (CCIP): Breaking Down Blockchain Silos

Different blockchains are like isolated islands – they can't naturally communicate with each other. CCIP acts as a universal translator and secure bridge between these islands.

For example, imagine you have USDC on Ethereum but want to use a DeFi protocol on Polygon. CCIP can securely transfer your tokens across chains while maintaining security guarantees. More importantly, it enables smart contracts on different blockchains to call functions on each other, opening up entirely new possibilities for cross-chain applications.

The Economic Engine: How LINK Token Powers Everything

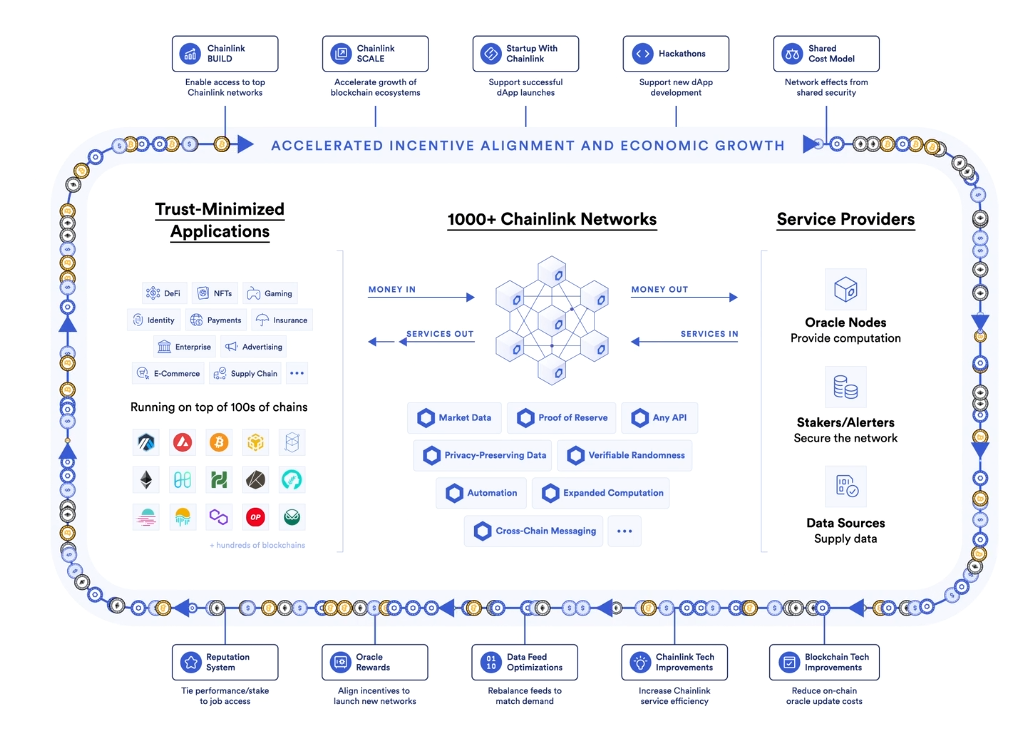

The LINK token isn't just a speculative asset – it's the fuel that powers the entire Chainlink ecosystem. Here's how the economics work:

Payment Currency: When smart contracts request data, they pay oracle nodes in LINK tokens. As more applications use Chainlink services, demand for LINK increases.

Staking Security: Oracle nodes stake LINK tokens as collateral. If they provide inaccurate data or behave maliciously, their stake gets slashed (taken away). This creates powerful economic incentives for honest behavior.

Service Quality: Nodes with larger stakes and better performance histories get selected for more jobs, earning more fees. This creates a virtuous cycle where successful nodes accumulate more LINK, which helps them maintain their competitive advantage.

Challenges and the Road Ahead

The Scalability Challenge

As Chainlink grows, it faces the same scalability challenges as other blockchain projects. More data requests mean higher gas costs and longer confirmation times. The team is addressing this through off-chain reporting, where multiple oracle responses are aggregated off-chain and only the final result is submitted on-chain, dramatically reducing costs.

Competition and Innovation

New oracle solutions emerge regularly, each claiming to solve specific limitations of existing approaches. API3 focuses on first-party oracles (data providers running their own nodes), while Band Protocol emphasizes cross-chain compatibility. Chainlink responds by continuously innovating and expanding its service offerings.

The Future: Chainlink Economics 2.0

The upcoming Chainlink Economics 2.0 introduces explicit staking, where LINK holders can stake their tokens to secure specific oracle services and earn rewards. This creates additional utility for the LINK token while strengthening the network's security through increased economic stake.

Why Chainlink Matters for Web3's Future

Chainlink isn't just another cryptocurrency project – it's fundamental infrastructure that enables the Web3 vision of programmable, automated systems that can interact with the real world. Without reliable oracles, smart contracts remain trapped in their blockchain silos, unable to respond to real-world events or provide real-world utility.

As Web3 applications become more sophisticated and mainstream adoption grows, the demand for reliable, decentralized data feeds will only increase. Chainlink's head start in this space, combined with its robust network effects and continuous innovation, positions it as one of the most critical pieces of Web3 infrastructure.

The next time you use a DeFi protocol, participate in a blockchain game, or benefit from automated smart contract functions, remember that Chainlink is likely working behind the scenes, quietly ensuring that the digital world stays synchronized with reality.

References:

- Nazarov, S., & Ellis, S. (2017). ChainLink: A Decentralized Oracle Network.

- Ellis, S., Juels, A. & Nazarov, S. (2021). Chainlink 2.0: Next Steps in the Evolution of Decentralized Oracle Networks.

- Chainlink Labs. (2023). Cross-Chain Interoperability Protocol Documentation.

- Chainlink Labs. (2023). Economics 2.0: Chainlink's Sustainable Oracle Economics Model.

- Chainlink Documentation. (2024). Getting Started with Chainlink.

- Chainlink VRF Documentation. (2024). Verifiable Random Function.

About Mitosis:

Mitosis APP

Blog

Docs

X

Discord

Comments ()