Chainlink, Pyth, RedStone, Chronicle, Supra & Switchboard: Which Oracle Powers What?

Not all oracles are built the same. While Chainlink still dominates the Total Value Secured (TVS) leaderboard, the oracle landscape has gotten a lot more competitive — and more interesting. Whether you’re building a DeFi protocol or just mapping out alpha paths, it’s worth knowing who’s securing what, on which chains, and why new players are starting to eat into old territory.

Let’s break down the six most popular oracles and the roles they’re carving out.

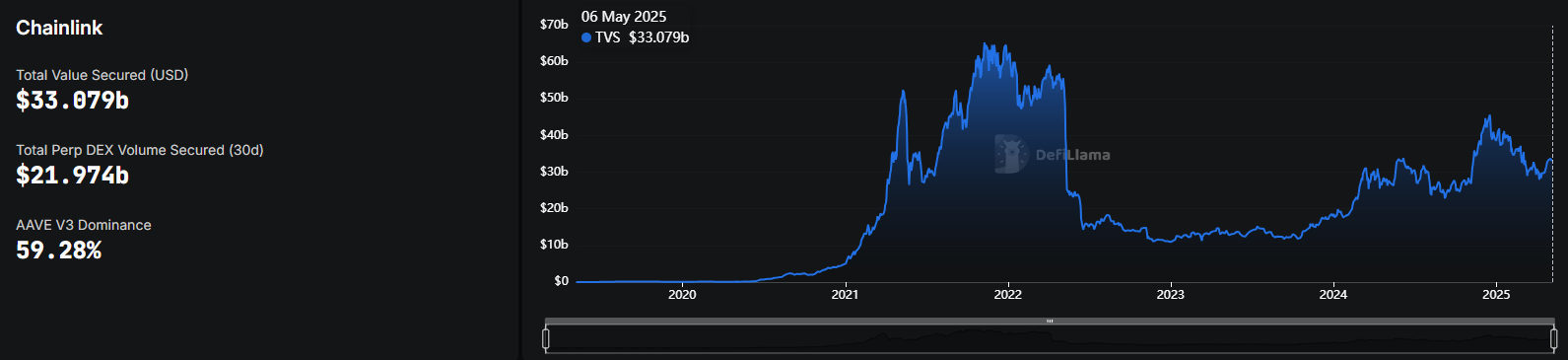

Chainlink: The Established Standard

- Chains Secured: 20

- Protocols Secured: 436

- TVS: $33B+

Chainlink’s reputation still speaks loudest in the room. With integrations across blue-chip protocols like Aave, Compound, Venus, and Morpho Blue, it's the go-to oracle for battle-tested DeFi. Despite onboarding fewer new chains than others, the trust factor and deep liquidity protection it offers keeps it at the top.

Beyond price feeds, Chainlink network powers verifiable randomness, off-chain computation, and data bridges to external APIs. You’re paying premium for it, but it works.

Chronicle: Another OG in the Space

- Chains Secured: 13

- Protocols Secured: 9

- TVS: $9.2B+

Chronicle flies under the radar, but its integration with OG protocols like EtherScan, SparkLend and Euler puts it on the serious map. Despite low protocol count, it ranks second in TVS — largely due to a strong footprint in tokenized assets and RWAs.

Its custom oracle product, Verified Asset, is RWA-native and reflects a growing niche: high-integrity, low-noise data services for asset-backed ecosystems.

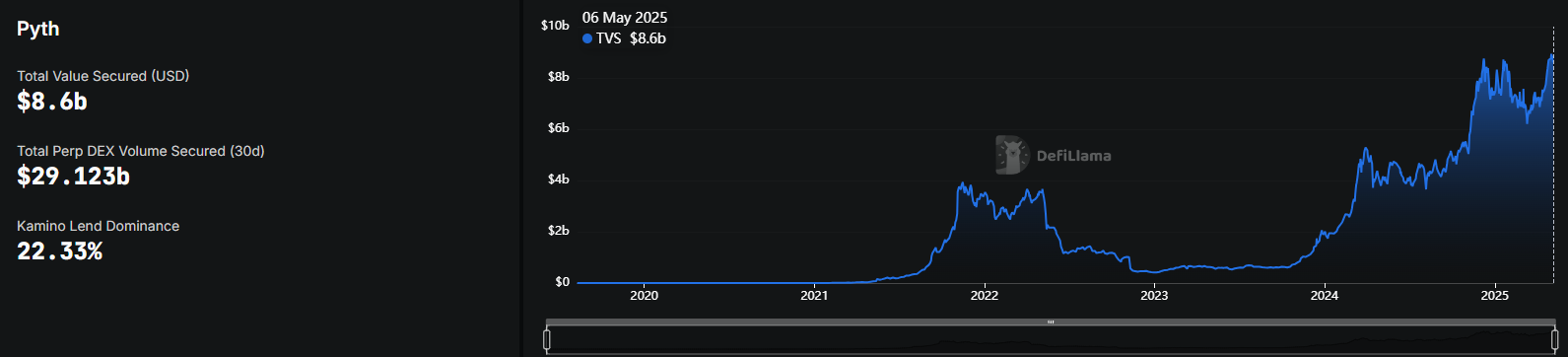

Pyth: Real-Time Data for Emerging Chains

- Chains Secured: 81

- Protocols Secured: 273

- TVS: $8.6B+

Pyth has pulled off a strong distribution play across newer chains like Solana, Sui, and Hyperliquid. It aggregates first-party price data from over 70 contributors — including trading firms and exchanges — giving it a data quality edge, especially for volatile assets.

With integrations on Drift, Suilend, Kamino Lend, and others, it’s carving out dominance in Solana DeFi and other high-throughput chains. If you’re building in that ecosystem, it’s probably already your default.

RedStone: Modular and Ultra-Fast

- Chains Secured: 79

- Protocols Secured: 74

- TVS: $7.2B+

RedStone is taking a different route. Instead of streaming data on-chain 24/7, it stores signed data off-chain and delivers it on-demand when smart contracts actually need it. That saves gas and unlocks modular design flexibility.

This model has made it attractive for newer protocols like Dolomite, Cygnus Restake, and Resolv — especially those focused on restaking and yield design. Think of RedStone as an oracle-as-a-toolbox for builders looking to optimize for costs and custom feeds.

Switchboard: Plug-and-Play Everything Oracle

- Chains Secured: 9

- Protocols Secured: 17

- TVS: $3B+

Switchboard is built for flexibility and permissionless integration, with an early focus on Solana and Sui-based apps. It’s already live on dApps like Kamino Lend, marginfi, and Scallop.

Its key value prop? You can submit any data stream, and use custom logic or scripts to validate it. That’s appealing to builders who don’t want to rely on centralized reporting pipelines but still need reliable feeds.

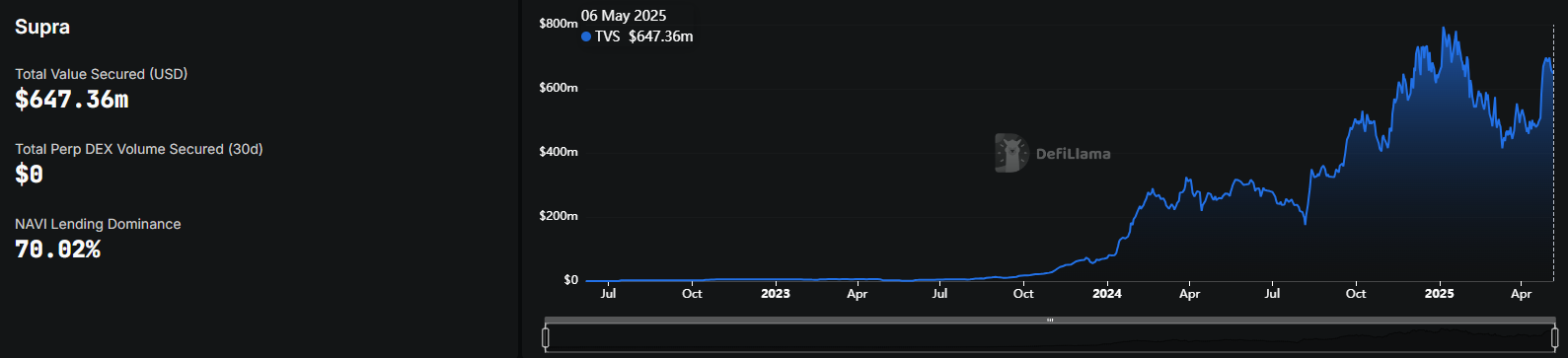

Supra: Cross-Chain and Developer-Friendly

- Chains Secured: 45

- Protocols Secured: 14

- TVS: $650M+

Supra is still in its ramp-up phase, but it’s going after an ambitious goal: fast finality oracles across public and private blockchains. It offers fully onchain automation, aiming to create a more composable cross-chain oracle layer.

Current integrations include NAVI Lending, Bucket CDP, and Mole — mostly smaller protocols on emerging chains. Infra-focused teams may want to watch this one long-term.

Final Thoughts

We’re past the point where oracles are just about posting ETH/USD prices on Ethereum mainnet. The space is evolving, fast.

- Chainlink still wins on scale and trust.

- Pyth leads on multi-chain reach and first-party accuracy.

- RedStone innovates on cost-efficiency and modularity.

- Chronicle keeps a tight grip on OG and RWA-focused protocols.

- Switchboard focuses on being permissionless, customizable and seamless.

- Supra is cross-chain and developer-friendly first.

Every oracle on this list plays a distinct role. The alpha is in knowing when and why to use each — and watching how their traction shifts as the next generation of DeFi primitives take shape.

Comments ()