Chromo DEX on Mitosis: How to Trade Smart and Avoid Costly Mistakes

As Mitosis nears mainnet, its native decentralized exchange which is Chromo DEX emerges as the central liquidity engine powering on-chain swaps, incentives, and composable DeFi.

But let’s be clear: Chromo is not just another DEX.

It’s the liquidity brain of Mitosis.

That means it comes with advanced tooling, deeper market logic, and strategic power but also real risks if you’re not paying attention to how it works.

This guide breaks down the slippage, APR dynamics, and timing mechanisms that matter especially if you’re trading during volatility or gamified events like the Game of Mito.

🔍 What Is Chromo DEX?

Chromo DEX is the native decentralized exchange of the Mitosis blockchain, purpose-built for:

- 💧 Deep liquidity with low-slippage trades

- 🔗 Composable DeFi : it plugs into other protocols seamlessly

- ⚙️ Programmable logic and customizable trading parameters

- 👥 Community-led upgrades that make it adaptive and flexible

Think of Chromo as Uniswap + Curve + Balancer — but tailored to Mitosis’ programmable liquidity model and economy-owned logic.

🧠 The Game of Mito: What Really Happened?

Many users experienced unexpected losses during swaps. Here’s why:

- Swapped $MITO during volatile moments

- Got less than expected due to slippage

- Rushed into actions without adjusting parameters

Confirmed trades too slowly

Let’s break down the mechanics behind those mistakes so you don’t get wrecked again.

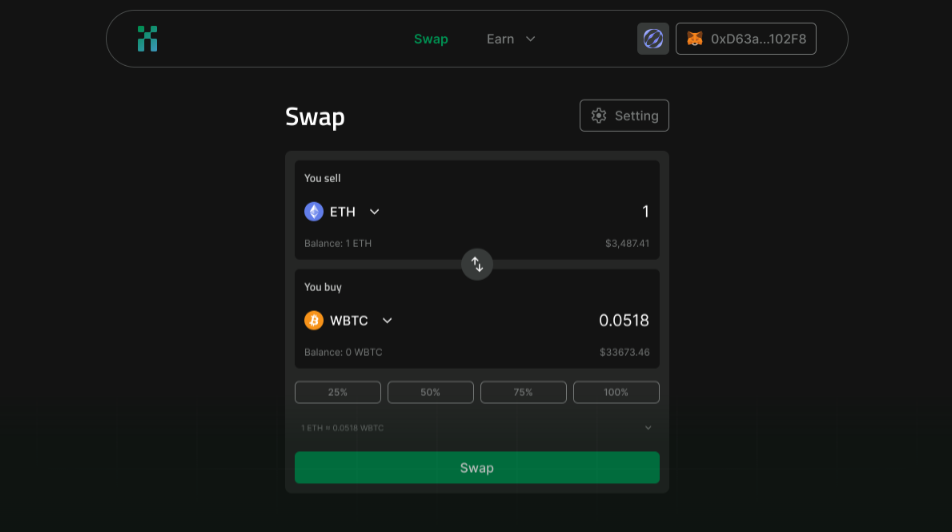

⚠️ 1. Slippage: The Hidden Swap Killer

Definition:

Slippage is the difference between the expected price and the executed price of a trade.

Why it happens:

- Low liquidity in the pool

- High volatility (price moves between confirmation and execution)

- Large trades in small pools

- Network congestion or delay

On Chromo DEX:

Although Chromo is optimized for lower slippage via deeper liquidity pools, it’s still vulnerable during high-activity periods like launches or incentive rounds.

How to protect yourself:

- ✅ Manually set slippage tolerance (start with 0.5–1%)

- ✅ Avoid large trades when liquidity is thin

- ✅ Never “Confirm” if you don’t understand the token price behavior

- ✅ Watch token activity in real-time

Pro Tip: If you see a high “Price Impact” warning, stop—you're likely getting a worse deal than expected.

💸 2. APR: The Illusion of High Returns

Definition:

APR (Annual Percentage Rate) shows projected yield for liquidity providers. But projections change block by block.

What goes wrong:

- APR spikes → Users FOMO in → Pool dilutes → APR crashes

- APR doesn’t include impermanent loss

- Flashy numbers often hide real risks

On Chromo:

APR can come from:

- Swap fees

- Incentive rewards

- Emissions (if farming is active)

Protect yourself:

- Don’t chase high APRs blindly

- Understand that APR is dynamic, not guaranteed

- Monitor pool share size and reward mechanics

Remember: High APR = High volatility = High risk of IL (impermanent loss)

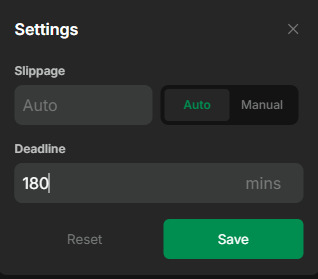

⏱️ 3. Timing: Every Second Counts on Chain

Why it matters:

Chromo runs on-chain, and all trades depend on block confirmation, not real-time speed.

What can go wrong:

- Waiting 10 seconds can shift token prices

- Front-running bots might beat you to execution

- Gas spikes can delay transactions

How to stay ahead:

- Use a wallet with fast gas settings (e.g., set to "High")

- Confirm trades quickly—but not blindly

- Always check the “Minimum Received” value before confirming

📘 Final Lessons from the Game of Mito

Chromo gives you powerful tools but that power comes with responsibility.

Here’s your DEX Survival Guide for mainnet:

✅ Set your slippage tolerance manually (don’t leave it on “Auto”)

✅ Use fast gas settings in volatile periods

✅ Don’t blindly chase flashy APRs

✅ Start with small swaps to test the water

✅ Stay calm during incentive rounds as rushing leads to losses

🔮 Conclusion: Trade Like a Pro on Chromo

Mitosis’ design philosophy is about empowering users and protocols through programmable liquidity.

Chromo is where that vision becomes tradable.

But like any advanced tool, it rewards understanding and punishes haste.

If you learn the mechanics now, you won’t just protect your tokens but you’ll also thrive in the next incentive round, farming event, or yield cycle.

Comments ()