CLOBs on Blobs: Powering DeFi’s Institutional Future

Introduction: The Emergence of CLOBs in DeFi

Decentralized finance (DeFi) is undergoing a major shift with the adoption of Central Limit Order Books (CLOBs) a trading model long used in traditional finance and centralized exchanges, now emerging as a powerful innovation in the decentralized space., a trading mechanism that has long defined centralized exchanges (CEXs) and traditional finance (TradFi) but is now emerging as a new phenomenon in the decentralized ecosystem (CoinMarketCap). Unlike Automated Market Makers (AMMs), which have dominated DeFi through liquidity pools and algorithmic pricing, CLOBs enable precise order matching, advanced order types (e.g., limit and stop orders), and superior capital efficiency, catering to the needs of professional and institutional traders (TradingView). Historically, implementing CLOBs on-chain was challenging due to the scalability limitations of monolithic Layer 1 (L1) blockchains, such as high gas fees, network congestion, and vulnerabilities to Maximal Extractable Value (MEV) exploits (Astroport). Recent advancements in blockchain technology, including high-throughput Layer 1s and modular architectures, have made on-chain CLOBs viable. Hyperliquid, with its purpose-built Layer 1 blockchain and fully on-chain CLOB, has been a leading pioneer, processing up to 200,000 orders per second and achieving over $1 trillion in trading volume since its 2023 launch. The "CLOBs on Blobs" model, combining off-chain efficiency with on-chain verifiability through zkVMs and data availability layers like Celestia, is revolutionizing decentralized trading, offering a pathway to institutional-grade financial ecosystems.

CLOBs: Precision and Control in Decentralized Trading

Core Functionalities

CLOBs operate by matching buy and sell orders based on predefined prices and quantities, offering traders granular control over their strategies. Unlike AMMs, which rely on constant product formulas to determine prices, CLOBs enable precise order placement, advanced order types (e.g., market, limit, and stop orders), and real-time order book updates (TradingView). These features align with the expectations of high-frequency traders and institutional investors, who require millisecond-level execution and sophisticated tools to manage risk and optimize returns. For example, a trader using a CLOB can place a limit order to buy at a specific price, ensuring execution only when the market meets their terms, unlike 'most' AMM swaps that execute instantly at pool-defined prices.

Comparison with AMMs

CLOBs and AMMs serve distinct purposes in DeFi. Traditional AMMs, popularized by platforms like Uniswap, are ideal for retail users seeking simplicity and instant liquidity through pooled assets. However, they suffer from capital inefficiency, as liquidity providers (LPs) must deposit assets across a wide price range, often leading to impermanent loss. CLOBs allow concentrated liquidity at specific price points, improving capital efficiency and reducing slippage for large trades. For instance, a large trade on an AMM might shift pool prices significantly, while a CLOB matches orders directly, minimizing price impact.

Table 1: Comparing CLOBs and AMMs in DeFi Trading

Feature | CLOBs | AMMs |

|---|---|---|

Order Matching | Precise, price-based matching | Algorithmic, pool-based pricing |

Capital Efficiency | High, concentrated liquidity | Lower, broad price range |

Trader Control | Advanced order types (limit, stop) | Simple swaps, no order control |

Execution Speed | Millisecond-level updates | Slower, pool-dependent |

Target Audience | Professional/institutional traders | Retail users, quick swaps |

Incentives | Order book transparency | Swap fees, LP incentives |

Management | Requires active order management | Passive liquidity provision |

Table 1: Comparing CLOBs and AMMs in DeFi trading

Challenges of On-Chain CLOBs

Implementing CLOBs on monolithic L1 blockchains faces significant hurdles:

- High Gas Fees: Every order placement, cancellation, or trade match requires a blockchain transaction, incurring prohibitive costs on networks like Ethereum. For example, a single order update on Ethereum could cost $10–$50 in gas fees during peak congestion (Astroport).

- Network Congestion: The high transaction volumes of CLOBs can overload L1 networks, degrading performance for all users. Ethereum’s 15 transactions per second (TPS) limit struggles with CLOBs’ frequent state changes (CryptoRobotics).

- Maximal Extractable Value (MEV): Transparent order books on public blockchains enable front-running, where miners or bots exploit visible orders to profit, compromising market fairness. For instance, a trader’s buy order could be preempted by a bot, driving up prices (Astroport).

These challenges stem from the architectural limitations of monolithic blockchains, which handle consensus, execution, and data availability within a single layer, creating bottlenecks for high-throughput applications like CLOBs.

CLOBs on Blobs: The Next Era of On-Chain Trading

The Narrative

The "CLOBs on Blobs" introduces a completely new framework in decentralized trading by mirroring the speed and precision of centralized exchanges (CEXs) with the transparency and security of decentralized systems. It decouples execution from settlement: trades are matched off-chain using high-speed engines, while settlements and order data are verified and stored on-chain using modular data availability layers like Celestia. This architecture enables scalable, low-cost trading without sacrificing transparency, and addresses core risks in centralized systems such as hidden order flows and custody vulnerabilities, by ensuring that all trades are auditable, open and censorship-resistant.

In some implementations, Zero-Knowledge Proofs (ZKPs) can further enhance the model by proving that off-chain trade execution followed the correct logic, without revealing sensitive order flow or trader behavior.

Celestia’s Role: The Data Availability Layer

Celestia, a modular data availability (DA) layer, is central to the "CLOBs on Blobs" model. Unlike monolithic blockchains, Celestia separates data availability from consensus and execution, allowing rollups and application-specific chains to focus on efficient processing. Its key innovation, Data Availability Sampling (DAS), enables lightweight nodes to verify block data by sampling small portions, like checking a book’s availability in a library by skimming a few pages instead of reading the entire book. This reduces hardware requirements, with nodes verifying data in seconds using minimal resources. Celestia uses 2D Erasure Coding and Namespaced Merkle Trees (NMTs) to add data redundancy and isolate chain-specific data, enhancing efficiency.

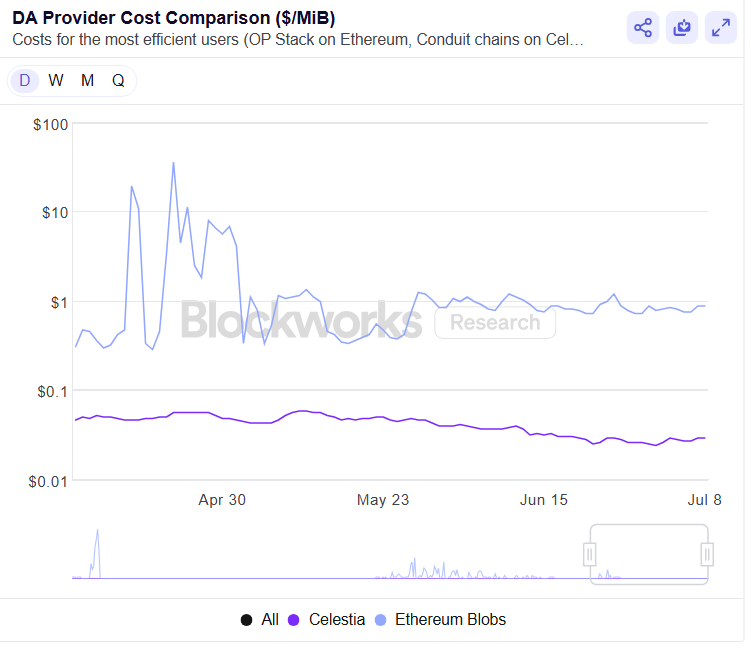

In the context of "CLOBs on Blobs," Celestia's low-cost, scalable blobspace plays a critical role. Off-chain CLOB matching engines can publish order and trade data directly to Celestia’s data availability layer, ensuring public verifiability without the high costs of execution-layer blockchains. Thanks to Celestia’s modular architecture and innovations like DAS, storing data is radically cheaper — within the range of $0.01 to $0.08 per megabyte, compared to around $10 on Ethereum mainnet (depending on network usage/at maximum capacity) This makes it economically viable to provide transparent order books and trade histories at scale, supporting institutional-grade infrastructure with decentralized guarantees.

Case Study

- Hibachi is a decentralized derivatives protocol on Base that uses an off‑chain CLOB matching engine with ZK proofs generated by Risc Zero (via Succinct). These proofs and encrypted trade data are published to Celestia for data availability and verifiability. The system achieves CEX-level latencies of around 5–6 milliseconds, while providing cryptographic proof of asset solvency and transaction integrity (Hibachi)

Battle of Blockchains: High-Throughput Contenders for CLOBs

Decentralized trading via Central Limit Order Books (CLOBs) demands high throughput, low latency, minimal fees, and strong decentralization. Emerging Layer 1s and Layer 2s—Monad, MegaETH, Berachain, Solana, and Hyperliquid are racing to meet these needs.

Monad: EVM-Compatible Scalability

Monad is a high-performance EVM-compatible L1 targeting 10,000 TPS and 1s finality. It features optimistic parallel execution and MonadBFT consensus. With low fees and strong developer interest, projects like Kuru and Perpl Trade are building on Monad's testnet. Backed by Paradigm and Coinbase Ventures, Monad is progressing toward mainnet with a validator set of ~100-200.

MegaETH: Low-Latency Rollup for Real-Time Trading

MegaETH is an Ethereum L2 rollup with testnet benchmarks reaching up to 20,000 TPS and 10ms latency. It uses a centralized sequencer, Ethereum settlement, and EigenDA for scalable data availability. Projects like GTE use MegaETH to enable high-speed order execution. Its architecture favors speed, though centralization remains a trade-off.

Solana: Proven High-Performance Layer 1

Solana delivers ~400–700 TPS and 400ms block times using Sealevel for parallel execution. It supports mature DeFi apps like Drift, which uses decentralized order books. With low fees and over 1,500 validators, Solana is a performant, moderately decentralized choice for CLOBs. (Bitget)

Hyperliquid: Fully On-Chain CLOB Leader

Hyperliquid is a purpose-built L1 for trading, handling up to 200,000 orders per second (~50,000 TPS) with sub-second latency. It uses a fully on-chain CLOB for matching and settlement, and dominates the on-chain perpetuals market with 70%+ share. Despite only 16 validators, it leads in performance-driven decentralized derivatives. (Gate)

CLOB Suitability Table (2025)

| Chain | TPS (Actual/Target) | Latency | Fees (USD) | Validator Count | CLOB Projects |

|---|---|---|---|---|---|

| Monad | ~10,000 (Target) | ~1s | < $0.01 | ~100–200 | Kuru, Perpl Trade |

| MegaETH | ~20,000 (Testnet) | ~10ms | ~$0.01–0.05 | Centralized seq. | GTE |

| Solana | ~400–700 | ~400ms | ~$0.001–0.05 | ~1,500 | Drift |

| Hyperliquid | ~50,000 | ~0.2s | ~$0.001–0.01 | 16 | Hyperliquid core |

Each chain represents a different balance of performance, decentralization, and cost. Hyperliquidcore and MegaETH lead on throughput and latency, Monad and Solana balance performance with ecosystem depth.

How Zero-Knowledge Virtual Machines (zkVMs) Could Enhance CLOBs for Advanced Decentralized Trading

Central Limit Order Books (CLOBs) need fast, cheap, and verifiable execution to match traditional trading platforms. Zero-Knowledge Virtual Machines (zkVMs) are becoming key tools to achieve this in Web3.

Why zkVMs Matter for CLOBs

1. Lower Costs & More Speed

zkVMs run complex matching logic off-chain and post a short proof on-chain. This slashes gas fees and allows fast, high-volume trading.

- Succinct’s SP1 zkVM reduces verification cost to ~3,000 gas.

- Programs written in Rust or C++ run off-chain, verified on-chain.

2. Trust Without Revealing Data

Even if trades are matched off-chain, zkVMs can prove that all rules were followed. No need to trust any one actor.

- Succinct proofs ensure no hidden manipulation.

3. Optional Privacy

zkVMs can prove you had enough balance for a trade without showing your exact numbers, useful for private strategies.

4. Works Across Chains

zkVMs help different chains talk to each other securely. This supports cross-chain CLOBs where liquidity can flow freely.

Leading zkVM Projects

- Succinct (SP1): A Rust-based zkVM that enables fast proof generation for trading apps like CLOBs. (Succinct)

- RISC Zero (Boundless): Uses zk-STARKs with a RISC-V VM. Already powering early DeFi apps like Hibachi. (Risc Zero)

zkVMs bring performance and trust to DeFi trading, helping CLOBs compete with centralized exchanges, without giving up decentralization.

Balancing Performance and Decentralization

High-performance CLOBs like Hyperliquid and Sei prioritize speed but face decentralization trade-offs. Hyperliquid’s 16 validators (vs. Ethereum’s 800,000+) enable its 200,000 orders per second but sparked concerns during the JELLY memecoin delisting, where centralized controls mitigated a liquidity crisis (Forbes, CoinLedger). In contrast, Hibachi’s zkVM-based approach and Sei’s Cosmos architecture prioritize trustlessness, using ZKPs or distributed validators to maintain DeFi’s ethos (pontem.network). Celestia’s neutral DA layer complements both models, ensuring verifiable data without dictating execution. This balance is critical as institutions demand both performance and trust.

Institutional Demand

Financial institutions’ entry into DeFi, coupled with surging stablecoin adoption (e.g., AMINA’s support for Ripple USD), highlights the need for CLOBs aligning with TradFi standards for speed, precision, and regulatory compliance (Fintech Finance).

The Dominance of the Modular Stack

The modular blockchain stack, separating execution, settlement, and data availability, is the most promising path for high-performance CLOBs. zkVMs handle computation, while Celestia’s DA layer ensures cost-effective data storage. The "CLOBs on Blobs" model uses off-chain matching and ZKPs, storing data on Celestia’s blobspace for transparency at approximately ~$0.1 per MB. FuelVM, SVM, and CosmWasm excel in specific niches, but zkVMs’ verifiable compute offers a trust advantage (Risc Zero). HyperVM’s performance relies on a centralized validator set, limiting its decentralization appeal (deBridge). Celestia’s neutral DA layer, with $1.2 billion in TIA market cap, supports all VMs, solidifying its foundational role (CoinMarketCap).

Conclusion

CLOBs are a big step forward for DeFi, moving past AMMs to faster, more advanced trading. The “CLOBs on Blobs” setup—using zkVMs and Celestia—gives centralized exchange speed with decentralized trust. It shows a shift to modular blockchains, where zkVMs handle secure compute and Celestia keeps data costs low. Projects like Hyperliquid, Hibachi, Sei, and Econia prove there's strong interest, especially from institutions and stablecoin users.

Future Trends in DeFi CLOBs

Emerging trends will influence CLOB adoption:

- Hybrid AMM-CLOB Models: Kuru Labs’ $1.5 million funding round indicates a growing interest in blending AMM liquidity with CLOB precision (The Block).

- Stablecoin Integration: Institutional demand for regulated stablecoins, like Ripple USD, will drive CLOB platforms tailored for compliance.

- Cross-Chain CLOBs: CosmWasm’s IBC and zkVM interoperability enable multi-chain liquidity, enhancing CLOB scalability.

Continued innovation in modular designs, zkVM development, and DA layers is essential to solidify DeFi’s place in global finance, transforming it into a robust, demand-driven ecosystem.

References

- Astroport. DEX wars: An analysis of the AMM vs CLOB debate. https://blog.astroport.fi/post/dex-wars-an-analysis-of-the-amm-vs-clob-debate

- Celestia. Data availability sampling. https://celestia.org/glossary/data-availability-sampling/

- CoinMarketCap. Central Limit Order Books (CLOBs) definition. https://coinmarketcap.com/academy/glossary/central-limit-order-books-clobs

- CoinMarketCap. Celestia (TIA) price today, market cap. https://coinmarketcap.com/currencies/celestia/

- CoinLedger. What is Hyperliquid? https://coinledger.io/learn/what-is-hyperliquid

- CryptoRobotics. The EVM: A glimpse at its future amidst new competitors. https://cryptorobotics.ai/news/limitations-of-ethereum-virtual-machine-evm/

- deBridge. What is HyperEVM? A comprehensive guide to its features. https://debridge.finance/learn/guides/what-is-hyperEVM/

- Fintech Finance. AMINA becomes the first bank globally to support Ripple USD (RLUSD). https://ffnews.com/newsarticle/cryptocurrency/amina-ripple-rlusd/

- Forbes. Hyperliquid delists JELLY memecoin. https://www.forbes.com/sites/digital-assets/2025/02/18/hyperliquid-delists-jelly-memecoin/

- Fuel Labs. Fuel VM: High-performance execution layer. https://blockapex.io/fuel-vm-high-performance-execution-layer/

- Hyperliquid. Hyperliquid - Dapps. https://iq.wiki/wiki/hyperliquid

- pontem.network. On-chain order books 101: Econia & more. https://pontem.network/posts/on-chain-order-books-101-econia-more

- Risc Zero. RISC Zero: Zero-knowledge verifiable computing platform. https://github.com/risc0/risc0

- Succinct. SP1 testnet launch: The fastest, feature-complete zkVM. https://www.succinct.xyz/blog_articles/sp1-testnet-launch-the-fastest-feature-complete-zkvm-for-developers

- The Block. Paradigm leads $1.5 million funding round in Kuru Labs. https://www.theblock.co/post/363325/paradigm-leads-1-5-million-funding-round-in-kuru-labs-a-decentralized-exchange-blending-clob-and-amms

- TradingView. The role of central limit order book DEXs in decentralized finance. https://www.tradingview.com/news/cointelegraph:1546d5f5f2094b:0-the-role-of-central-limit-order-book-dexs-in-decentralized-finance/

Comments ()