CLOBs: On-Chain Trading Beasts

Traditional order book systems are central to pro trading. In DeFi, dYdX pioneered the model. Now, a new class of CLOBs is driving innovation: focusing on speed, fairness, privacy, and extensibility. Here's a deeper dive, with current stats and features.

dYdX – The OG Perps Powerhouse

dYdX redefined decentralized trading with:

- ~$1.4 trillion in lifetime trading volume

- $200 million in open interest across 220+ markets

- $12 million in MegaVault TVL

Governed by its community, dYdX remains the benchmark for serious DeFi traders and institutional-grade access.

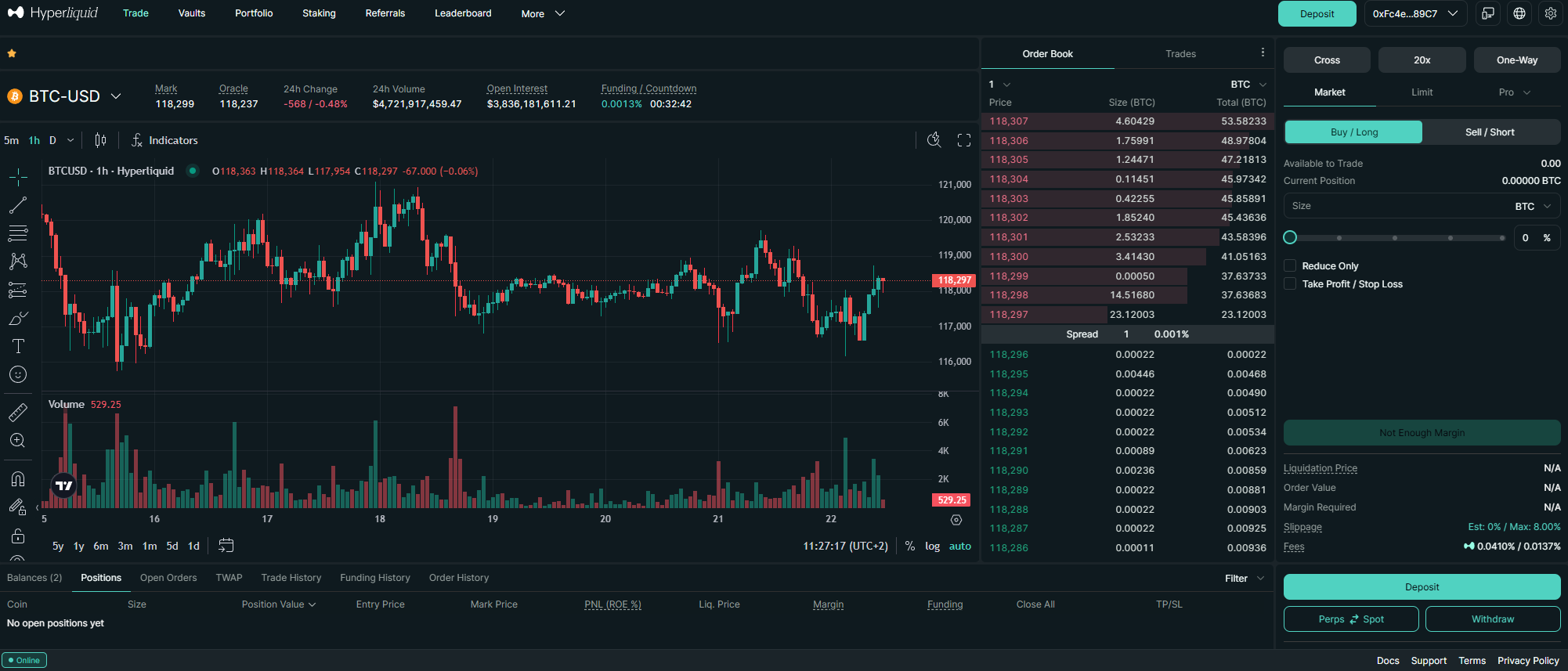

Hyperliquid – CEX Speed Meets On‑Chain Transparency

Hyperliquid features:

- Zero gas and low fees: Streamlined UX with no wallet approvals

- Up to 40× leverage: Efficient capital use

- Native vaults & API: Designed for community-run market-making

Key stats (24 h):

- Volume: $15 billion

- Fees: $5.1 million (≈$1.8 b earn annualized)

- Spot USDC liquidity: $445 million

- TWAP-based $HYPE buy pressure: $300k

HyperEVM delivers near‑0.07 s block times and ~200k TPS, all community-led, no VC or centralized MM involvement.

Lighter – Provably Fair Trading

On Ethereum L2, Lighter brings trust-less transparency:

- Zero maker/taker fees

- ZK‑verified matching & liquidations: Every action is cryptographically provable

- Built for fairness and scalability

Stats (private beta):

- 24 h volume: $3 billion

- Open interest: $250 million

Backed by a16z, Lighter is redefining trust in DeFi trading.

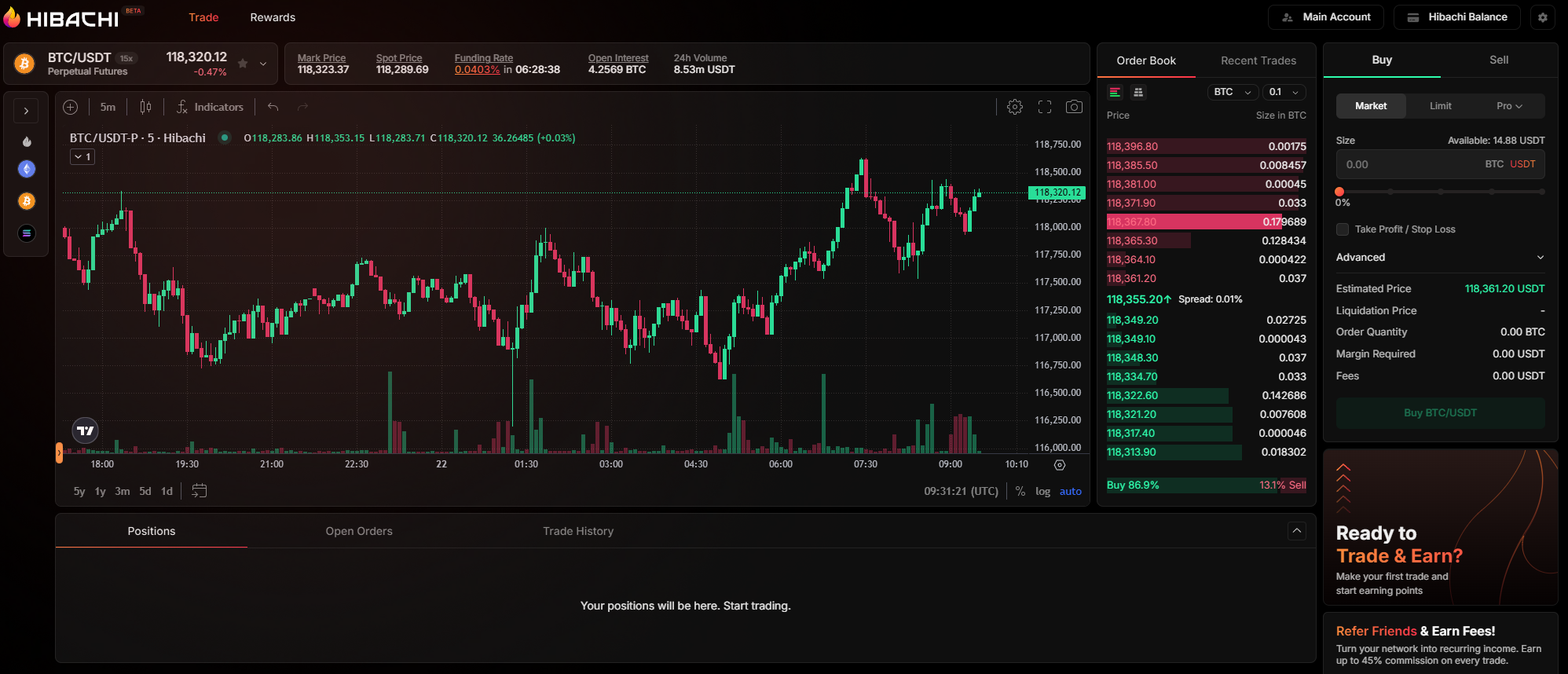

Hibachi – ZK-Encrypted Perps

Hibachi is Privacy-focused with Succinct ZK proofs layered on Celestia’s Private DA:

- Encrypted order book state published to Celestia

- Provable and private via Succinct ZK Proofs

- High‑performance CLOB with built‑in secrecy

For traders wanting confidentiality and efficiency in one package.

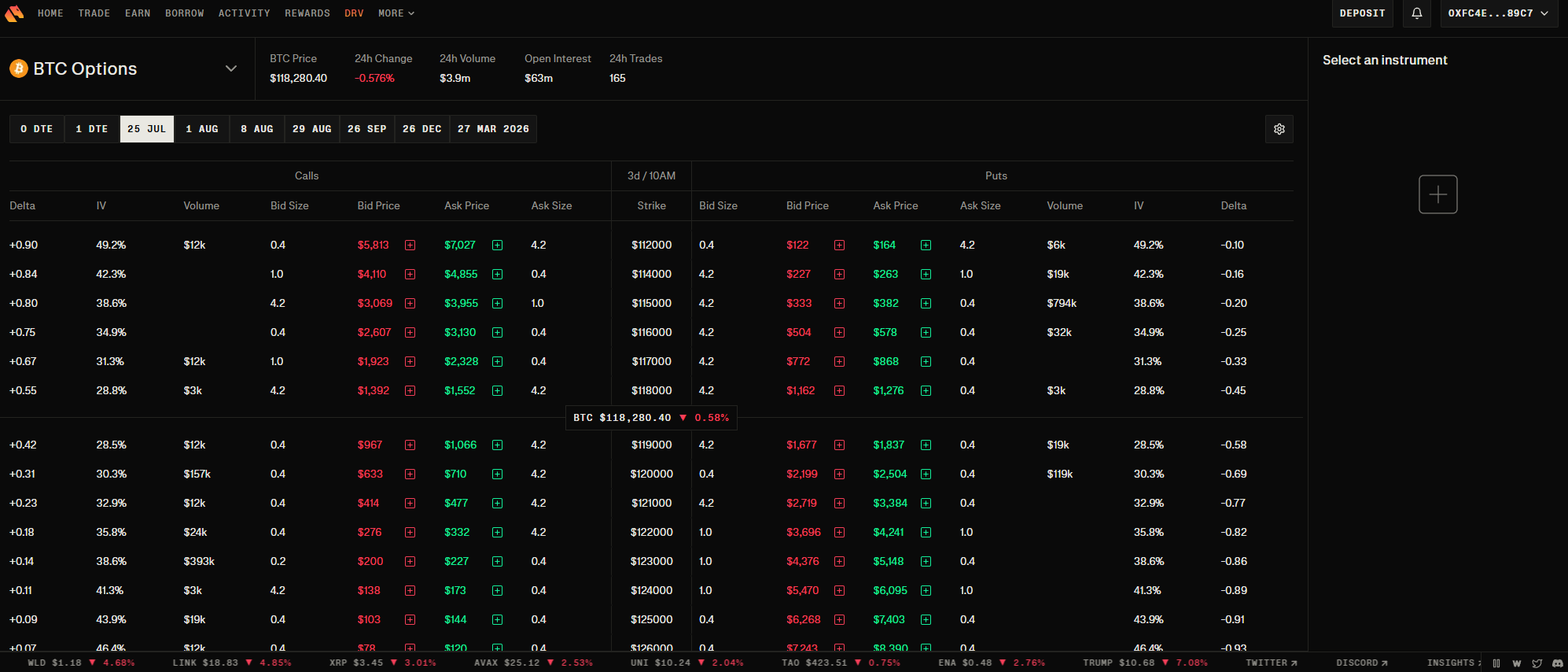

Derive – Options & Structured Trading Lab

Derive serves as a hub for BTC/ETH options, perps, structured products, yield, lending, and insurance:

- Fully onchain, permissionless options and perpetuals

- Integrated yield from restaked collateral

- Governed by users via the Derive DAO and $DRV

Built on an Optimistic Rollup, Derive extends trading beyond just perps into comprehensive structured finance territory.

Protocols in Development

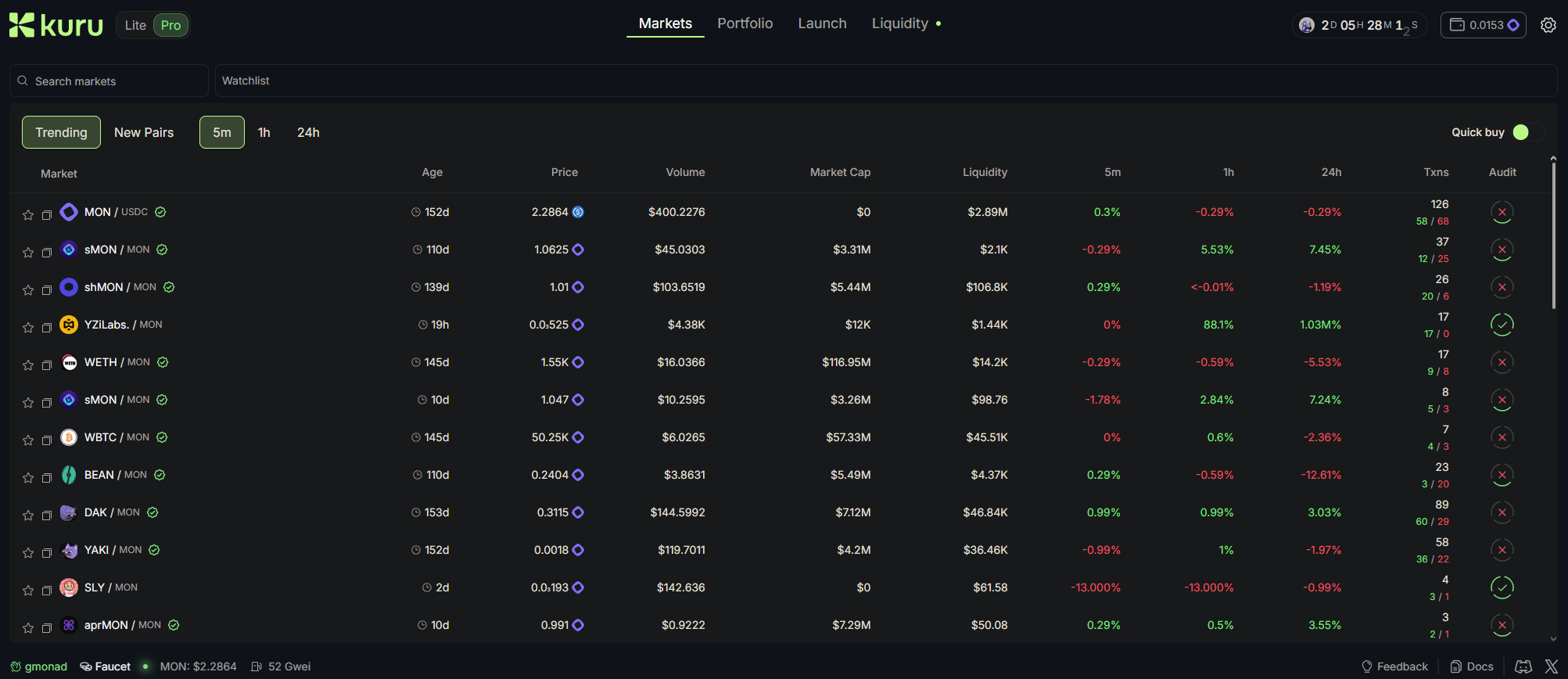

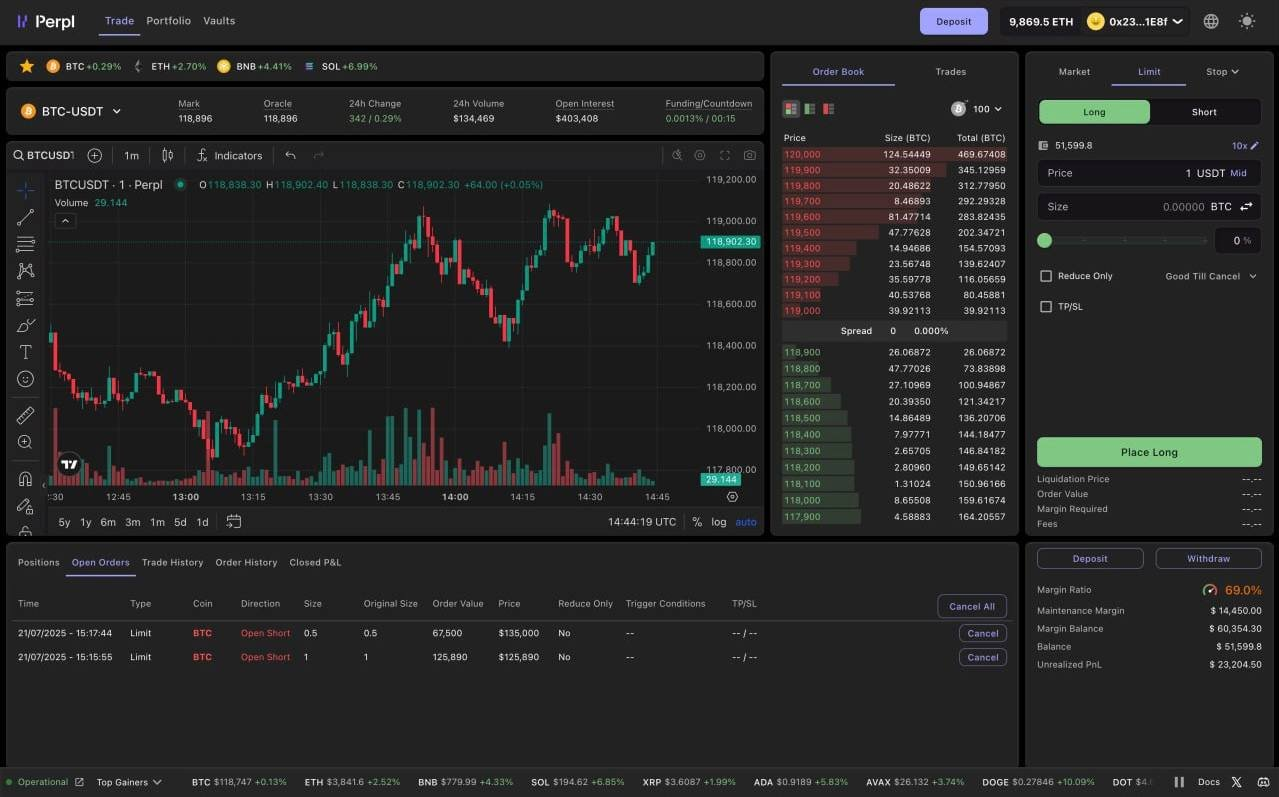

Monad Ecosystem: Kuru & Perpl

- Kuru (live on testnet): Native Monad CLOB optimized for cost and market-making

- Flip Orders: auto-flip limit orders post-fill, reducing manual quoting

- Consistent gas usage for market makers, tight spreads, steady liquidity

- Perpl (coming soon): Monad native perps DEX

- On-chain matching, full verifiability, deep liquidity

- Near-zero gas, high TPS (~10k), sub-500 ms blocks, fully composable

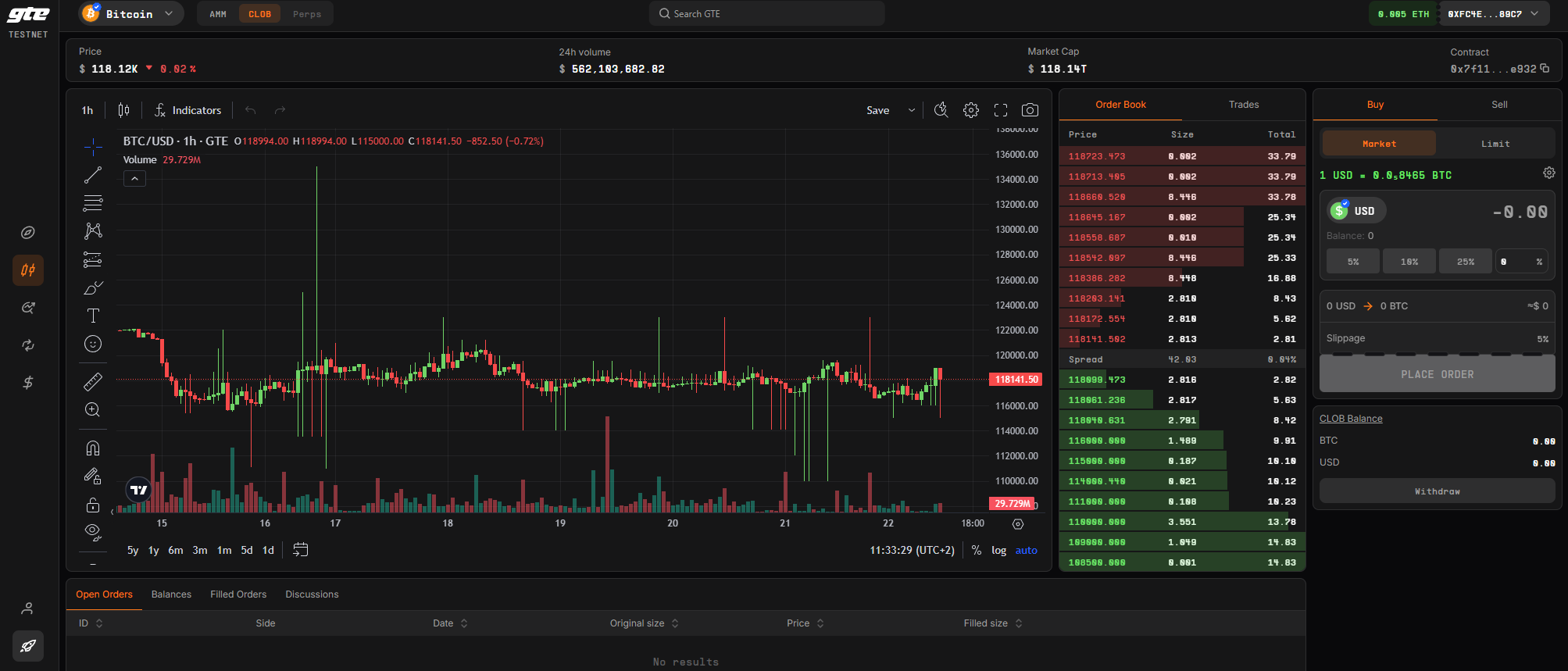

GTE: On MegaETH Testnet atm

A unified trading venue combining CLOB, AMM, launchpad, and swaps:

- Non-custodial, CEX-grade speed

- Price aggregation across AMM and CLOB

- Token lifecycle tools, launchpad and bonding curve support

- Integrated native CLOB for low-slippage execution

Built to serve from token launch to mature liquidity.

Final Thoughts

CLOBs are growing fast:

- dYdX is the gold OG

- Hyperliquid is the new leader

- Lighter proves fairness by design

- Hibachi brings privacy to perps

- Derive expands into options and yield primitives

- Kuru and Perpl are building Monad-native futures

- GTE bundles full lifecycle trading on MegaETH

This is no hype. These platforms are building the next-gen trading infrastructure: fast, fair, private, and composable. If you're creating or trading at scale, this new wave of CLOBs is the navigation layer you need.

Comments ()