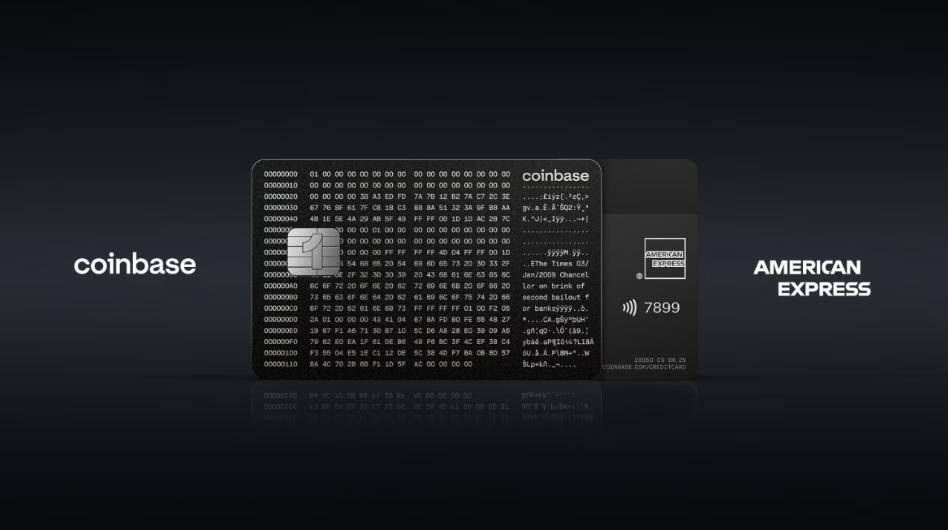

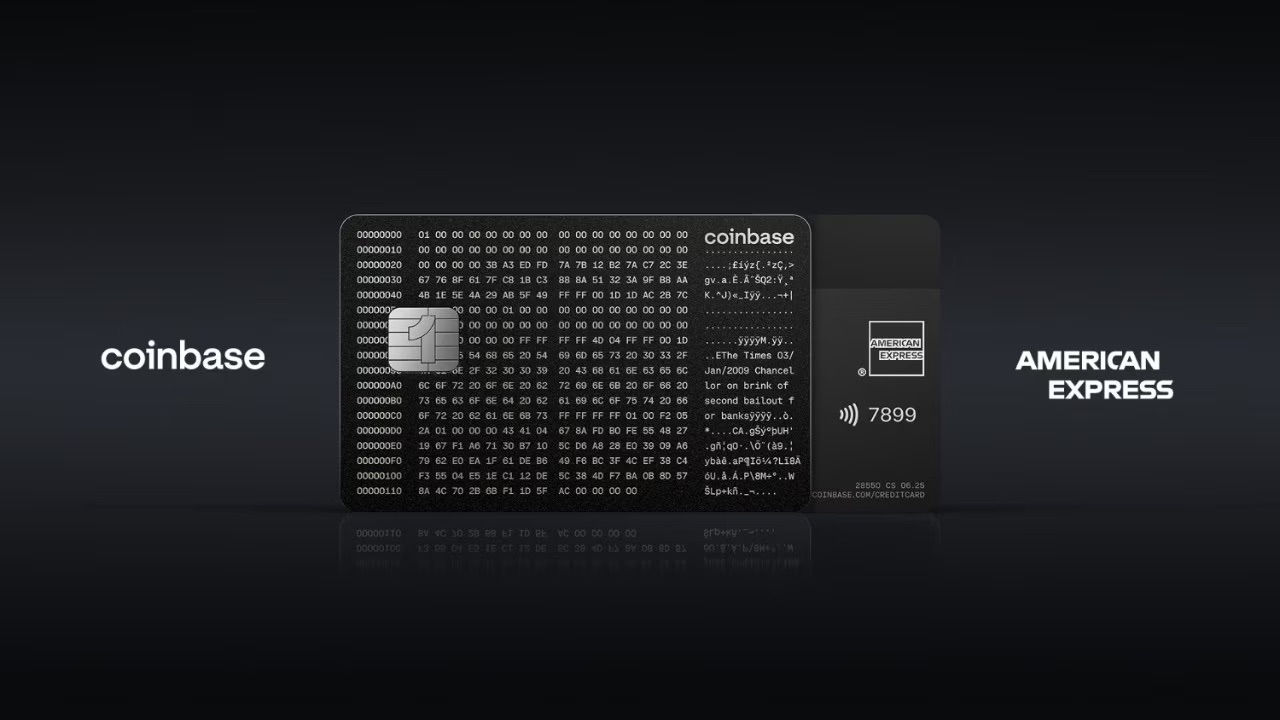

Coinbase & American Express Launch Bitcoin Rewards Card

Introduction: A New Era for Crypto and Credit Cards

In June 2025, Coinbase and American Express (Amex) shook the fintech and crypto space by launching a co-branded Bitcoin Rewards Credit Card. The move not only expands crypto utility for retail users but also signals a historic shift: one of the world’s most traditional financial institutions fully embracing blockchain-backed consumer finance.

The question now isn’t just “how does it work?” it’s what does it mean for crypto adoption, rewards ecosystems, and user safety?

How the Bitcoin Rewards Card Works

The Coinbase x Amex Bitcoin Card functions similarly to traditional credit cards—with a crypto twist.

Key Features:

- 1.5%–3% cashback in Bitcoin on all purchases

- No annual fee for base users, premium tiers unlock higher rewards

- Crypto-native benefits: staking bonuses, gas fee rebates for ETH Layer 2s

- Integration with Coinbase Wallet for real-time BTC transfer or conversion

- International usage support, including travel and dining perks

It uses Amex’s global merchant network, but all rewards are issued in BTC, not points or fiat equivalents.

The Strategic Play: Competing with Traditional Credit Cards

This launch positions Coinbase against heavyweights like Chase Sapphire and Apple Card. The difference? Crypto-native incentives.

| Card | Cashback | Reward Format | Fees | Crypto Support |

|---|---|---|---|---|

| Coinbase-Amex | 1.5–3% | Bitcoin | $0–$95 | Full (staking, wallet, swaps) |

| Chase Freedom | 1–5% | Points | $0 | None |

| Apple Card | 2–3% | Apple Cash | $0 | None |

Bitcoin rewards, unlike traditional points, are non-expiring and potentially appreciating assets. This could turn routine spending into long-term investment - if BTC keeps rising.

Why Amex’s Involvement Is a Big Deal

American Express is historically risk-averse and late to adopt fintech trends. So why crypto now?

Reasons for the pivot:

- Consumer demand: Over 28% of U.S. adults now hold crypto (source: Pew, Q2 2025)

- Loss of Gen Z users to fintech alternatives

- Regulatory clarity: SEC and CFTC now recognize Bitcoin as a commodity, not a security

- Stablecoin integration: Amex quietly piloted USDC in cross-border payments since late 2024

“Crypto is no longer a fringe asset. We see it as a core part of future personal finance,” said Lisa Stevens, EVP at Amex Consumer Banking.

This sets a new precedent: legacy institutions are not just partnering with crypto companies, they're co-building consumer-facing products.

Risks and Caveats: What Users Should Watch Out For

Despite the appeal, the card isn't without downsides.

Potential Risks:

- Taxable rewards: BTC cashback may be considered taxable income in many jurisdictions.

- Volatility exposure: Unlike fixed fiat points, BTC rewards could drop in value overnight.

- Privacy concerns: Integration with Amex means spending data may be more exposed than with DeFi-native cards.

- Regulatory reversals: A change in U.S. crypto policy could disrupt or limit card functionality.

Real-World Example: User Scenario

Jessica spends ~$2,000/month on her card. With 2% cashback, she earns ~$40 in BTC monthly. Over a year, that’s $480 in BTC.

If BTC appreciates 20% over that time, her rewards total grows to $576 - compared to ~$480 in fiat points elsewhere. However, if BTC falls 30%, she ends up with only $336. Her rewards are a speculative asset, not guaranteed cash.

Alternatives and Competitors

Several other players have launched crypto-linked cards, but none with Amex’s gravitas.

| Provider | Type | Cashback | Crypto Support |

|---|---|---|---|

| Coinbase-Amex | Credit | 1.5–3% BTC | Full |

| Crypto.com | Debit | Up to 5% CRO | Partial (CRO ecosystem) |

| BlockFi (suspended 2023) | Credit | 1.5% BTC | No longer active |

Difference: Coinbase-Amex operates in the credit space, offering borrowing capacity - which crypto debit cards lack.

Expert Tip: Should You Get This Card?

✅ Get it if:You already spend $1K+ per month and want BTC exposureYou're comfortable managing crypto assetsYou treat BTC as long-term savings, not spendable cash

❌ Avoid it if:You can't tolerate asset volatilityYou’re unsure about crypto tax lawsYou need stable cashback (e.g., for budgeting)The Coinbase x Amex card is more than just a crypto cashback tool. It’s a signal that crypto is maturing and that traditional finance wants in.

While risks remain, the potential upside for savvy users is clear. If Bitcoin continues its climb, paying with plastic could quietly turn into stacking sats.

Mitosis links:

Comments ()