Collective Intelligence for Liquidity: The DAO's Role in Governing Mitosis's EOL and Treasury

1. Introduction: EOL – A Powerful Tool Demanding Wise Governance

One of the most innovative and discussed features of the Mitosis protocol is its Ecosystem-Owned Liquidity (EOL) model – liquidity that belongs to the ecosystem itself. Instead of relying entirely on external liquidity providers, Mitosis accumulates and strategically manages its own asset pools through its treasury. This gives the protocol significant advantages:

- Liquidity Stability: Reduces dependence on market sentiment and capital "migration."

- Capital Efficiency: Enables directing liquidity where it is most in demand.

- Reduced Slippage: Deeper pools can provide better execution for users.

- Potential Revenue Source for the Protocol: Prudent EOL management can generate income for the further development of the ecosystem.

However, owning and managing significant volumes of liquidity is not only a great opportunity but also a great responsibility. How can it be ensured that these assets are used as effectively, securely, and in the best interests of the entire Mitosis ecosystem as possible? Who should make decisions about EOL allocation, treasury asset selection, and risk management strategies?

Centralization vs. Decentralization in EOL Governance

In the early stages of a project's development, decisions regarding treasury and EOL management might be made by the core development team. This allows for quick responses to market changes and efficient protocol launch. However, in the long term, centralized governance carries risks:

- Risk of Power Concentration: Decisions are made by a narrow circle of individuals.

- Insufficient Consideration of Community Interests: The team's priorities may not always align with the priorities of all users and ecosystem participants.

- Vulnerability to Errors or Abuse: Even the most competent teams can make mistakes, and centralized points of control are always more vulnerable.

For a project striving for true decentralization and building a sustainable, self-regulating ecosystem, the only correct path is to transfer the governance of EOL and the treasury to the community through a Decentralized Autonomous Organization (DAO).

The Mitosis DAO: Collective Intelligence Serving Liquidity

The Mitosis DAO (when fully formed and launched) can become that very "collective intelligence" that will determine the EOL management strategy. This means that Mitosis governance token holders (or other authorized community members) will be able to:

- Propose and discuss liquidity management initiatives.

- Vote on key decisions.

- Oversee the execution of these decisions.

Such an approach not only aligns with the spirit of Web3 but also carries practical benefits: leveraging the wisdom and experience of the entire community to make more balanced and effective decisions.

What Will You Learn From This Article?

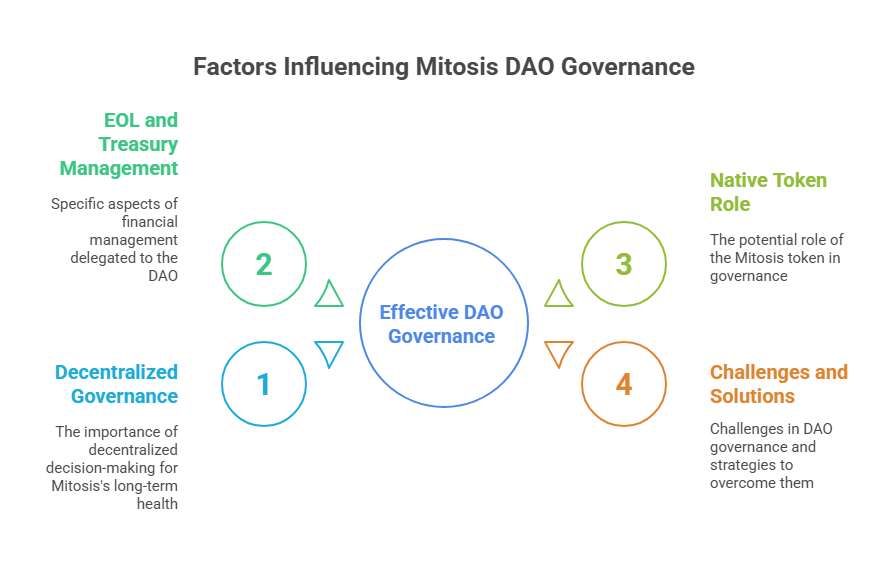

In this article, we will explore in detail how the Mitosis community, through a DAO mechanism, can become the key to successful and sustainable EOL and treasury management:

- Why is decentralized EOL governance so important for the long-term health of Mitosis?

- What specific aspects of EOL and treasury management can be delegated to the DAO?

- What is the potential role of the native Mitosis token in this process?

- What challenges lie in the path of effective DAO governance of complex financial assets, and how can they be overcome?

We will investigate how Mitosis can harness the power of collective intelligence to ensure that its most valuable asset – Ecosystem-Owned Liquidity – works for the benefit of the entire ecosystem.

2. DAO Governance Mechanisms for EOL and Challenges on the Path to Decentralization

Transferring the governance of such a complex and important component as Ecosystem-Owned Liquidity (EOL) and the treasury into the hands of a DAO is an ambitious task. Let's examine what specific functions can be delegated to the Mitosis community and what challenges this process might face.

DAO Functions in Governing Mitosis's EOL and Treasury

The Mitosis Decentralized Autonomous Organization can take on a wide range of responsibilities related to managing the ecosystem's liquidity:

- Strategic EOL Allocation:

- Blockchain Selection: The DAO can vote on which new Layer 1 and Layer 2 networks EOL liquidity should be deployed to, based on an analysis of their potential, security, and user needs.

- Priority Asset Determination: The community can decide which assets should primarily be accumulated in the treasury and used to provide liquidity (e.g., stablecoins, major cryptocurrencies, promising RWA).

- Liquidity Pool Sizes: Establishing optimal EOL pool sizes on various networks to ensure sufficient market depth and minimize slippage.

- Treasury Risk Management:

- Asset Diversification: The DAO can approve treasury asset diversification strategies to reduce risks associated with the volatility of individual cryptocurrencies or stablecoin depegging.

- Selection of DeFi Protocols for EOL Deployment: If part of the EOL is placed in third-party DeFi protocols to generate yield (e.g., in lending pools), the DAO must approve a list of trusted and secure protocols and set deployment limits.

- Hedging Policies (Potentially): In a more mature phase, the DAO might consider and approve hedging strategies to protect the value of treasury assets.

- Protocol Economic Parameters:

- Mitosis Usage Fees: The DAO can vote on the size of fees charged by the protocol for cross-chain transfers, a portion of which may be directed to the treasury to replenish EOL.

- Incentive Mechanisms (if applicable): If, in addition to EOL, the protocol also uses external liquidity, the DAO can determine incentive programs for such liquidity providers.

- Distribution of Treasury Revenue:

- Reinvestment: Directing revenue generated from EOL management (e.g., from fees or yield farming) to further increase liquidity.

- Ecosystem Development Funding: Awarding grants to developers, marketers, and researchers who contribute to Mitosis's growth.

- Buyback & Burn Programs (Potentially): If Mitosis has its own token, the DAO can make decisions on token buyback and burn programs funded by treasury revenues.

- Protocol Upgrades and Security:

- While direct development and auditing may remain with the core team or specialized firms, the DAO can approve key protocol upgrades, especially those affecting EOL economics or security.

The Role of the Native Mitosis Token in Governance

(Assuming Mitosis will have a native governance token)

The native Mitosis token will likely be the cornerstone of DAO participation. Its holders will be able to:

- Vote: Use their tokens to vote on all the aforementioned issues. Voting power may depend on the number of tokens held.

- Delegate Votes: Transfer their voting rights to more active or competent community representatives.

- Create Proposals: Submit their own initiatives for EOL and treasury management to the DAO for consideration.

- Stake Tokens (Potentially): Token staking might be required for voting participation or to receive a share of protocol revenue, creating an additional incentive for long-term holding and active participation.

Challenges on the Path to Effective DAO Governance of EOL

Despite all the advantages, decentralized governance of complex financial systems like EOL comes with several challenges:

- Competency Problem ("Voter Apathy" and "Tyranny of the Minority"): Not all token holders possess sufficient knowledge and time to make informed financial decisions. This can lead to low voter turnout or decisions being made by small but well-organized groups.

- Possible Solutions: Educational programs for the community, vote delegation systems to experts, creation of specialized working groups or committees within the DAO.

- Speed of Decision-Making: DAO voting processes can be slow, making it difficult to react quickly to changing market situations, especially in liquidity management.

- Possible Solutions: Multi-layered governance systems where operational decisions can be made by elected committees with subsequent approval by a broader vote; emergency protocols.

- Risk of Governance Capture: The possibility of a large number of governance tokens being concentrated in the hands of one person (or a group), which could lead to decisions being made in their personal interest rather than in the interest of the entire ecosystem.

- Possible Solutions: Well-thought-out tokenomics with broad initial distribution, quadratic voting mechanisms, limiting the influence of large holders.

- Coordination Complexity: Organizing effective discussion, proposal analysis, and voting in a large and distributed community requires good tools and processes.

Conclusion: The Power of Community as a Guarantee of Sustainability

Transferring the governance of Ecosystem-Owned Liquidity and the treasury to a DAO is a complex but necessary step for Mitosis on its path to creating a truly decentralized, sustainable, and community-oriented protocol. The success of this endeavor will depend on many factors: the sophistication of the DAO mechanisms, the design of the tokenomics, the quality of voting tools, and, most importantly, the activity, competence, and engagement of the Mitosis community itself.

It is collective intelligence, the ability for constructive dialogue, and a shared interest in the long-term prosperity of the project that can turn the Mitosis DAO into a powerful tool for effective EOL management. This will not only protect and grow the ecosystem's assets but also ensure that Mitosis develops in accordance with the interests of those for whom it is created – its users.

Learn more about Mitosis:

- Explore details on the official website: https://www.mitosis.org/

- Follow announcements on Twitter: https://twitter.com/MitosisOrg

- Participate in discussions on Discord: https://discord.com/invite/mitosis

- Read articles and updates on Medium: https://medium.com/mitosisorg

- Blog: https://blog.mitosis.org/

Comments ()