Composability in DeFi

The ability to interact and build on each other is one of DeFi's standout feature.

This composability is what allows different components and protocols to freely integrate and build on themselves to create an improved financial system.

This article covers everything you should know about composability, its benefits, and innovations from composed protocols.

Composability in literal terms, is the ability of different components or systems to combine and integrate to create a larger and more complex system.

Composability in DeFi refers to the ability of different protocols and applications to seamlessly connect and interact with each other.

With this, protocols can combine and integrate to create greater functionalities and new products.

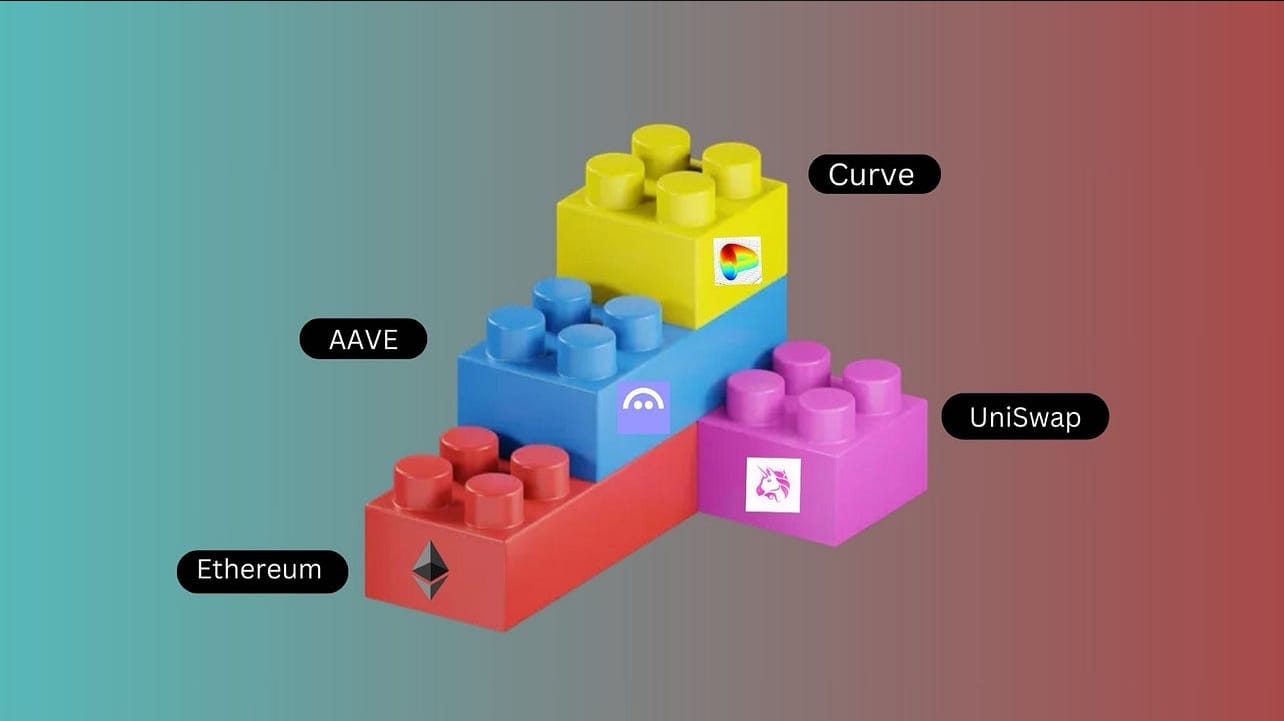

The LEGO Block has always been a perfect example of composability in DeFi. Different pieces represent different financial services or protocols. Each piece can be composed in different ways, to form a more complex and innovative structure.

Think of Ethereum, its composable structure allows users and devs to freely interact and permissionlessly build on it in diverse ways.

Protocols built on it are also composable which has led to the creation of more protocols with enhanced functionalities and products.

This flexible and modular nature of DeFi helps drive innovation which gives Decentralized Finance (DeFi)

most edge over Traditional Finance (TradFi).

→ Key components of Composability in DeFi.

→ Interoperability: The ability of different DeFi protocols to work together and exchange information.

→ Permissionless Integration: DeFi protocol codes are open-source, allowing developers to build on preexisting protocols or integrate with them.

→ Modularity: In DeFi, each protocol is a module and be combined and built upon in different ways to create more complex solutions.

→ Components of Composability in DeFi.

Composability in DeFi utilizes several core components to operate. These components are what allow devs to build on already existing protocols-

At the heart of DeFi are smart contracts, self-executing contracts with terms of agreement written in codes, and thus form the basis of DeFi composability.

Developers can freely access and use preexisting smart contracts like LEGO blocks to build more sophisticated products.

→ APIs and SDKs.

The Application Processing Interface (API) allows protocols work together, communicate, and share information.

Software Development Kits (SDKs) simplify integration. It provides prebuilt tools to help developers build easily and faster.

These tools are crucial for protocols to interop. They form the basis of connection in DeFi.

→ Token Standard.

Token Standard is another vital component for composability in DeFi.

ERC-20 tokens, for example, can be utilized on all Ethereum and ETH-compatible protocols.

$DAI minted on MakerDAO can be used to provide liquidity on Compound. That's the power of composability.

→ Protocols.

Protocols like lending and borrowing and DEXes also contribute to composability in DeFi. They interact and integrate to create new functionalities like flash loans and yield farming

→ Let's check out some practical examples of Composability in DeFi

→ Token Movement.

A user can borrow a loan in ETH on Aave by providing DAl as collateral. The borrowed ETH can be swapped for another token (e.g., USDC) on Uniswap. And can be staked on Curve.

→ Flash Loans for Arbitrage (without Collateral).

A user can borrow USDC without collateral on Aave, execute arbitrage like swapping the USDC for ETH on UniSwap at a lower price, sell back to USDC on SushiSwap, and repay the loan - all within one transaction and take the surplus. This is only possible with composability.

→ Integration and Yield Farming.

Yearn Finance automates yield farming by integrating with Aave (lending) and Curve (liquidity pools). Users can deposit funds in YearnFi, which then distributes them across Aave and Curve to maximize returns.

→ Cross-Chain Liquidity.

A user can use Wormhole to bridge USDT from Ethereum to Solana and use a DEX to swap it to SOL to maximize opportunities on the Solana chain.

→ Benefits.

→ Innovation Acceleration.

The main benefit of Composability in DeFi is the innovations and continuous improvement.

It doesn't just allow you build new protocols but also allows you integrate into existing protocols, enabling an easier and faster creation of new protocols and solutions.

→ User Experience.

Composability enhances user experience. By allowing different protocols work together, composability allows you perform different functions in one action at lower cost.

→ Efficiency.

By allowing different protocols interop, liquidity flows seamlessly among them thereby increasing capital efficiency.

→ Future Prospective.

Composability is shaping the Future of DeFi and Blockchain as a whole.

Thanks to the composable nature of DeFi, new financial products, and services are cropping out, we now have complex solutions like flash loans and yield farming, and soon even more complex solutions will spur.

As DeFi continues to grow, its composability will transform the financial landscape, pushing the boundaries of innovation and driving collaboration.

Comments ()