Cross-Chain Bridge Security in 2025: Risks, Standards, and Mitosis's Role in a Modular Future

Introduction

As blockchain ecosystems evolve towards modular architectures, the security of cross-chain bridges becomes paramount. These bridges facilitate interoperability between diverse blockchain networks, but they also introduce new vulnerabilities and challenges. This article explores the current landscape of cross-chain bridge security, emerging standards, and how Mitosis contributes to a more secure and modular blockchain future.

The Evolving Landscape of Cross-Chain Bridges

Cross-chain bridges are essential for enabling asset and data transfers between disparate blockchain networks. However, their complexity and the diversity of underlying technologies make them susceptible to various security risks. Recent studies have highlighted several common vulnerabilities.

- Smart Contract Vulnerabilities: Flaws in the code can be exploited to drain funds or disrupt operations.

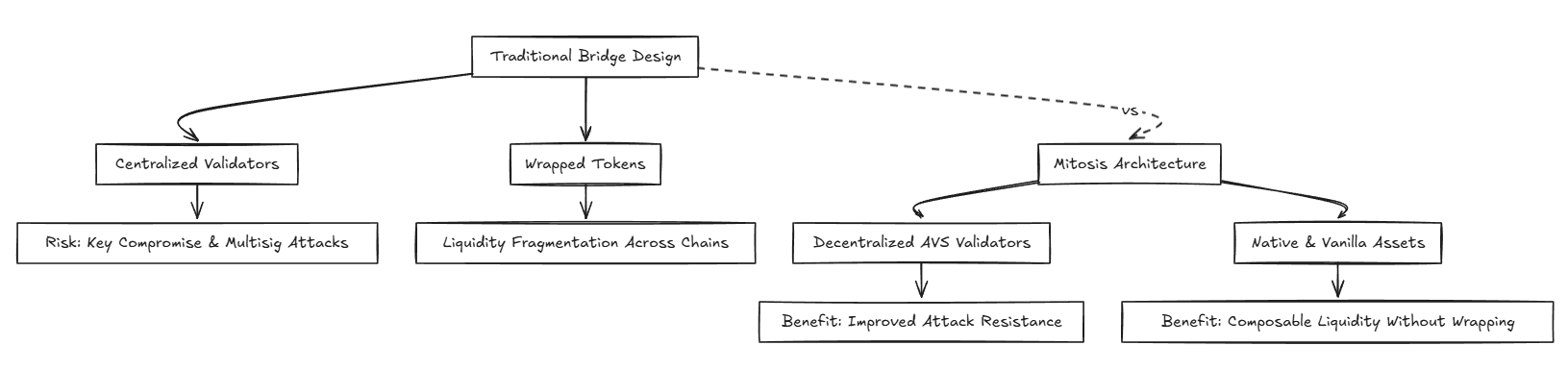

- Centralization Risks: Bridges often rely on centralized validators or oracles, creating single points of failure.

- Liquidity Issues: Inefficient liquidity management can lead to slippage and increased costs for users.

- Oracle Manipulations: Inaccurate or manipulated data feeds can result in incorrect transaction executions.

A comprehensive analysis of these challenges is presented in the study "Blockchain Cross-Chain Bridge Security: Challenges, Solutions, and Future Outlook"

Emerging Standards and Solutions

To address these vulnerabilities, the blockchain community is developing new standards and protocols:

- ERC-7683: A proposed standard for cross-chain intent formats, aiming to unify solver networks and enhance interoperability.

- Hyperlane's Interchain Security Modules (ISMs): These modules allow developers to customize security measures, enabling permissionless interoperability across chains.

- EigenLayer's Active Validator Sets (AVS): A mechanism to enhance security by leveraging restaked assets to validate cross-chain transactions.

Mitosis: A Modular Approach to Cross-Chain Liquidity

Mitosis emerges as a novel solution designed to address the unique challenges of the modular blockchain ecosystem. It introduces several key innovations:

- Ecosystem-Owned Liquidity (EOL): A decentralized governance model where the community manages and distributes liquidity, fostering inclusivity and resilience.

- miAssets: Tokens issued in a 1:1 ratio to assets deposited on the Mitosis chain, enabling seamless cross-chain liquidity without the need for traditional bridging mechanisms.

- Hyperlane Integration: By leveraging Hyperlane's permissionless interoperability, Mitosis ensures secure and efficient cross-chain communication .

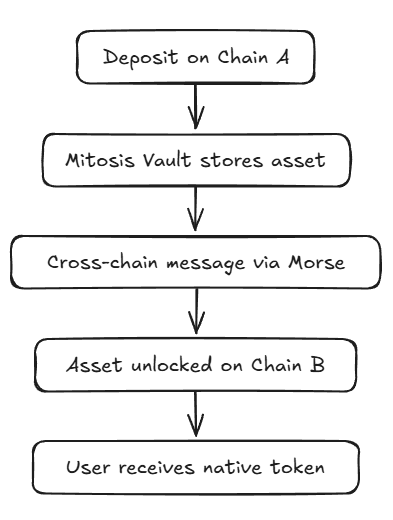

Morse: An infrastructure layer facilitating secure and efficient transfer of assets and data between interconnected networks, utilizing an asynchronous messaging system for real-time data exchange.

These components collectively position Mitosis as a foundational layer for liquidity in a modular blockchain world, aiming to unify fragmented liquidity pools and enhance capital efficiency.

Conclusion

As the blockchain industry progresses towards modular architectures, ensuring the security and efficiency of cross-chain bridges is critical. Mitosis offers a comprehensive solution by integrating community-driven liquidity management, innovative asset tokenization, and advanced interoperability protocols. By addressing the inherent challenges of cross-chain transactions, Mitosis contributes significantly to building a more secure and interconnected blockchain future.

References:

- Li, N., Qi, M., Xu, Z., Zhu, X., Zhou, W., Wen, S., & Xiang, Y. (2024). Blockchain Cross-Chain Bridge Security: Challenges, Solutions, and Future Outlook. ResearchGate.

- Mitosis. (2025). Architecting Seamless Liquidity Bridges in a Modular Blockchain World. Mitosis University.

- Hyperlane. (2024). How Permissionless Interoperability Scales Modular Liquidity. Medium.

- Mitosis. (2025). Understanding Intent-Based Swaps: The Future of Cross-Chain UX. Mitosis University.

Comments ()