Cross-Chain Liquidity Management: How Mitosis Unifies DeFi Liquidity

From Fragmented Silos to a Cohesive Financial Ecosystem

The Cross-Chain Liquidity Crisis

Imagine a world where your crypto assets move seamlessly across blockchains, unlocking yield opportunities without manual bridging or complex workflows. This is the vision of Mitosis, a protocol designed to unify fragmented liquidity across decentralized finance (DeFi).

Today, DeFi’s liquidity is trapped in isolated silos—Ethereum, Solana, Avalanche, and others operate as separate ecosystems. This fragmentation leads to inefficiencies, volatile yields, and barriers to innovation. Mitosis tackles these challenges by introducing a programmable liquidity framework that enables assets to move dynamically across chains while retaining utility and security.

The Problem with Cross-Chain Liquidity

Liquidity Fragmentation in DeFi

- Chain-Specific Silos: Assets like ETH on Ethereum or SOL on Solana cannot natively interact with protocols on other chains.

- Capital Inefficiency: Over $50B in Total Value Locked (TVL) sits idle or underutilized due to fragmentation.

- User Friction: Manual bridging, wrapping assets (e.g., wETH), and managing multiple wallets erode user experience.

Example: A liquidity provider (LP) on Ethereum’s Uniswap cannot deploy the same ETH to a lending protocol on Avalanche without complex bridging.

The Limitations of Existing Solutions

- Bridges: Centralized risks (e.g., hacks) and liquidity bottlenecks (e.g., limited wrapped assets).

- Multichain Protocols: Require users to manually rebalance liquidity across chains.

Mitosis’ Solution – A Unified Liquidity Framework

Core Philosophy

Mitosis treats liquidity as a programmable primitive, enabling assets to move dynamically across chains while retaining utility. Unlike bridges or wrapped tokens, Mitosis uses its native chain to unify liquidity without intermediaries.

Key Analogy:

Imagine Mitosis as a global rail network, where trains (liquidity) move seamlessly across borders (chains) using standardized tracks (Vanilla Assets).

Technical Architecture: How Mitosis Works

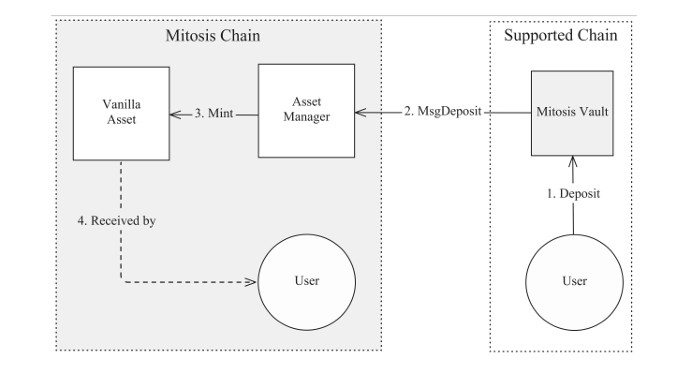

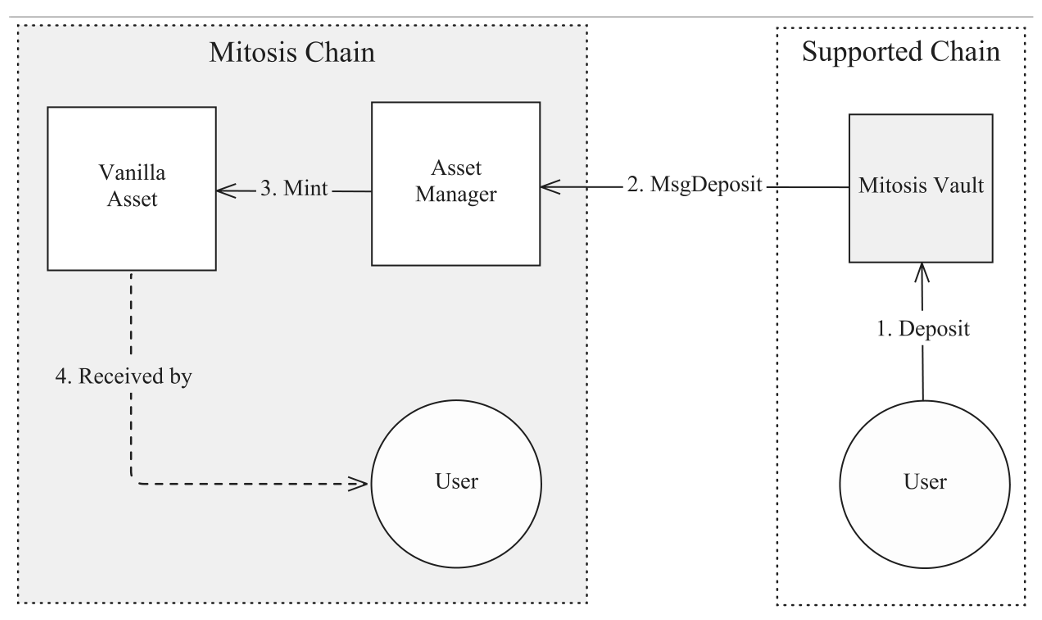

Mitosis Vaults: The Gateway to Cross-Chain Liquidity

- Function: Secure smart contracts deployed on supported chains (e.g., Ethereum, Monad) that lock assets and mint Vanilla Assets (1:1 representations) on the Mitosis Chain.

- Example: Deposit ETH on Ethereum → Mitosis Vault locks ETH → Vanilla ETH (vETH) is minted on Mitosis Chain.

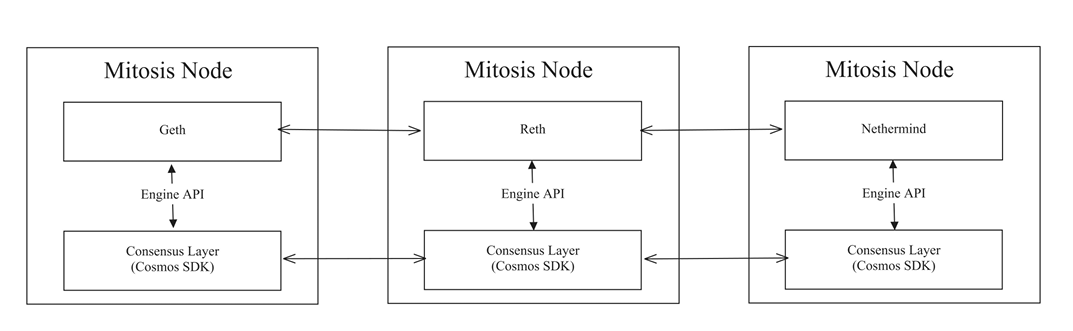

The Mitosis Chain: Powering Cross-Chain Interoperability

- Consensus: Built on Cosmos SDK with CometBFT (Byzantine Fault-Tolerant consensus).

- EVM Compatibility: Supports Ethereum Virtual Machine (EVM) smart contracts.

- Cross-Chain Messaging: Uses an arbitrary message bridge to coordinate asset transfers between chains.

Workflow: From Deposit to Cross-Chain Yield Generation

Step 1: Deposit Assets

- Action: A user deposits ETH into a Mitosis Vault on Ethereum.

- Behind the Scenes:

- The Vault locks ETH on Ethereum.

- The Mitosis Chain mints vETH (Vanilla ETH).

Step 2: Generate Yield with EOL or Matrix

- EOL (Ecosystem-Owned Liquidity): Stake vETH to receive miETH (governance + yield).

- Matrix: Lock vETH in a 90-day campaign to earn maETH (fixed-term rewards).

Step 3: Cross-Chain Deployment

- Example: miETH holders vote to deploy liquidity to Aave on Avalanche.

- Result: ETH liquidity from Ethereum is routed to Aave on Avalanche via Mitosis’ cross-chain messaging.

Security and Efficiency: Mitosis’ Unique Advantages

Arbitrary Message Bridge: Secure Cross-Chain Coordination

- Function: Facilitates communication between Mitosis Vaults and external chains.

- Security: Leverages CometBFT’s BFT consensus to prevent double-spending or fraud.

Example:

When miETH holders vote to deploy liquidity to Avalanche:

- The bridge verifies the governance vote.

- It instructs the Avalanche Vault to release ETH to Aave.

Automated Settlement System

- Real-Time Reconciliation: Tracks yields, losses, and rewards across chains.

- Dynamic Rebalancing: Algorithms optimize liquidity allocation based on demand.

Real-World Applications: Bridging DeFi and TradFi

For Retail Users: Democratizing Access

- Cross-Chain Yield Farming: Deposit ETH on Ethereum → Earn yield from a Solana-based AMM.

- Liquidity as Collateral: Use miETH to borrow stablecoins on Mitosis’ lending markets.

For Institutions: Capital Efficiency at Scale

- Case Study: A hedge fund deploys $100M in USDC across 5 chains via Mitosis, optimizing returns through unified liquidity pools.

- Regulatory Compliance: Permissioned Vaults with KYC/AML integration for institutional participation.

The Future: What’s Next for Cross-Chain Liquidity?

Multi-Asset Liquidity Pools

- Vision: Enable single-asset liquidity provision (e.g., ETH-only pools) across chains.

Cross-Chain Governance

- Innovation: Allow miETH holders on Ethereum to govern protocols on Avalanche.

Institutional-Grade Tools

- Structured Products: Tokenized ETFs backed by Mitosis liquidity.

- Risk Management: Insurance pools for smart contract failures.

Conclusion: Redefining DeFi’s Liquidity Landscape

Mitosis isn’t just a protocol—it’s a paradigm shift. By abstracting cross-chain complexity into a seamless, programmable framework, Mitosis unlocks DeFi’s full potential. Whether you’re a developer building the next killer dApp or an institution seeking efficient capital deployment, Mitosis provides the infrastructure to thrive in a multichain world.

Comments ()