Cross-Chain Swaps That Just Work: How Mitosis Makes It Real

Introduction

Cross-chain swaps sound like a dream, right? Move tokens across blockchains, tap into better yields, and explore new DeFi opportunities.

But anyone who’s actually tried it knows—it’s rarely that simple.

You hit "swap" expecting magic, and suddenly you're juggling multiple wallets, wrapped tokens, confusing bridges, long wait times, and wondering if your funds are lost in the void.

It’s frustrating. And let’s be honest—most people end up going back to centralized exchanges just to keep their sanity. But that defeats the purpose of DeFi, doesn’t it?

What if cross-chain swaps see could just... work? Seamlessly. Instantly. Safely. That’s exactly what Mitosis is making happen.

Why Cross-Chain Swaps Are Still a Mess

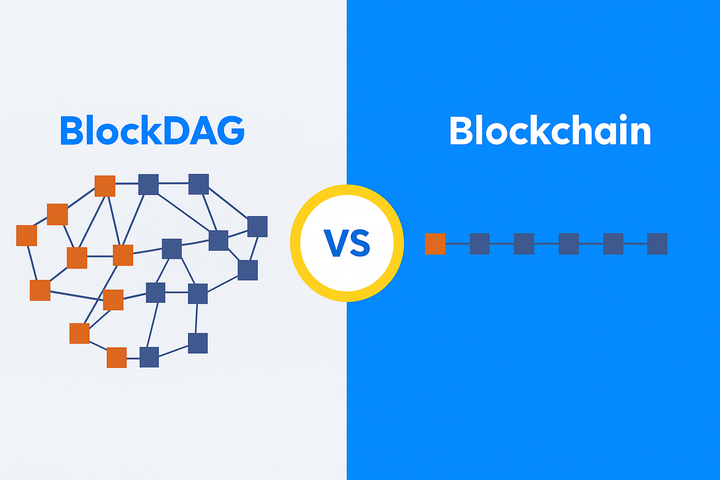

Most Layer 1 blockchains are like isolated islands. They have their own rules, tokens, and infrastructure—and getting assets from one island to another isn’t smooth sailing.

You typically need a third-party bridge. And that means:

◈ Slow, expensive transactions

◈ Added risks (we’ve all seen the bridge hacks)

◈ Liquidity spread too thin across multiple chains

Even with sleek UIs, the backend is still clunky. Users end up crossing their fingers every time they hit "confirm."

How Mitosis Makes Cross-Chain Feel Effortless

Mitosis didn’t just slap a bridge on top of another L1. It rethought how liquidity should move between chains from the ground up.

Here’s how it flips the script:

- The Matrix Liquidity Model

Imagine a network of liquidity pools that are already talking to each other. When you want to swap, Mitosis doesn’t bridge tokens—it routes the liquidity smartly, instantly, and natively.

No more crossing chains and hoping for the best. Just tap into the Matrix, and it handles the rest.

- No Wrapping. No Waiting. No Worries.

You don’t need to wrap your tokens, approve three different contracts, or wait 15 minutes for confirmations. Mitosis keeps it behind the scenes—you send tokens, and receive native tokens on your target chain, fast.

- Smarter Use of Liquidity

Instead of splitting capital across dozens of pools, Mitosis optimizes liquidity distribution automatically. That means:

⇨ Better swap rates

⇨ Fewer failed transactions

⇨ More efficient use of capital for everyone

Why It Actually Matters

Let’s face it—most users don’t care about bridges or token standards. They just want to move their assets, use an app, and make it all work.

Mitosis brings us closer to that future. It treats liquidity like it should be: simple, smart, and invisible. When cross-chain feels like single-chain, that’s when DeFi goes mainstream.

Conclusion: Cross-Chain Without the Headache

If we want DeFi to rival traditional finance, the experience has to be better. Cleaner. Smoother. Safer.

Mitosis isn’t just talking about it—it’s building it. Cross-chain swaps, minus the pain. That’s how we win.

Key Takeaways

➢ Cross-chain swaps today are complex and risky.

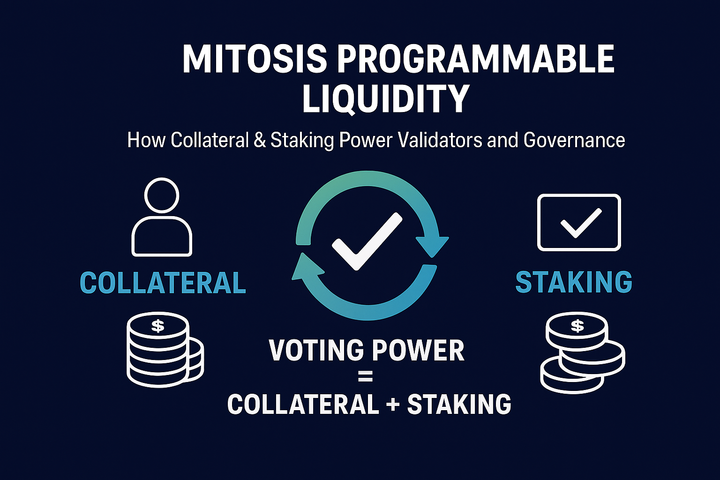

➢ Mitosis replaces bridges with a native, programmable Liquidity layer

➢ No wrapping, no waiting—just fast, native swaps.

➢ The Matrix Model makes sure liquidity flows where it’s needed, in real-time.

Mitosis doesn’t just fix cross-chain. It reimagines it.

Comments ()