Crypto Market Cycles & Indicators

Ever wonder why prices go up, then crash, then rise again?

Let’s break down how the crypto market moves in cycles — and how to spot them

What is a Market Cycle?

A market cycle is the pattern of ups and downs that prices follow over time.

In crypto, it usually goes like this:

Hope → Hype → Crash → Recovery → Repeat

Yes, it’s emotional

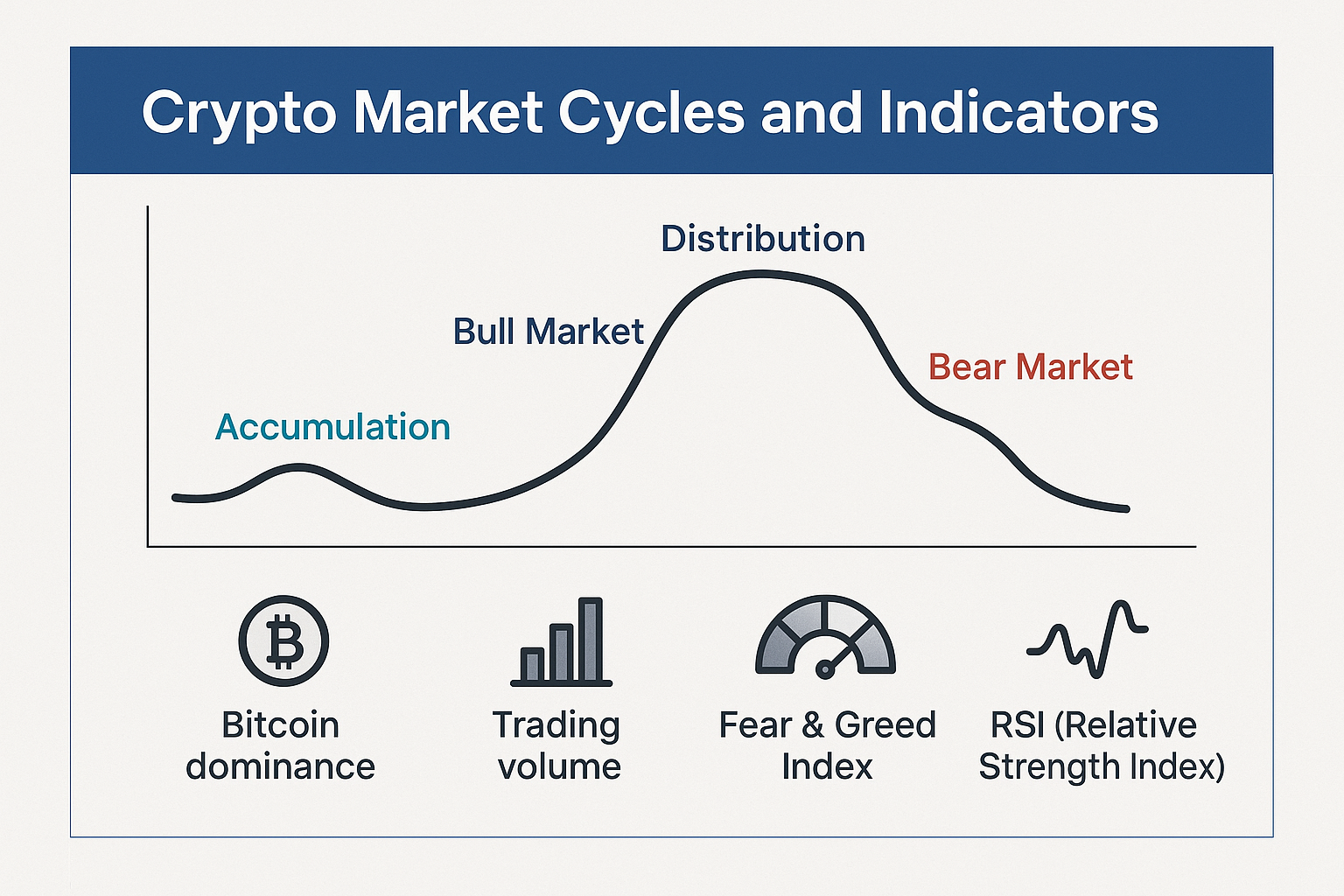

The 4 Phases of a Crypto Market Cycle

- Accumulation (smart money buys quietly)

- Bull Market (prices go up, hype grows)

- Distribution (whales sell, price slows)

- Bear Market (prices drop, panic hits)

Let’s break them down...

1) Accumulation Phase

- Prices are low

- People are scared or bored

- Smart investors are buying quietly

- Media isn’t talking much about crypto

Example: Bitcoin in late 2018 or early 2023

👉 This is usually the best time to buy (but it’s hard because confidence is low)

2) Bull Market Phase

- Prices start rising

- Excitement builds

- Media and influencers hype it up

- Everyone starts buying

Example: Bitcoin in 2021, ETH hitting new highs

🚨 This is when people FOMO (Fear Of Missing Out)

3) Distribution Phase

- Prices start to slow down

- Whales take profits

- Market looks strong, but momentum fades

- Smart investors sell to new buyers

It still feels bullish… until it suddenly doesn’t

4) Bear Market Phase

- Prices fall hard

- Panic and fear take over

- People sell at a loss

- Media calls crypto “dead” again

Example: Crypto winter 2022

But this phase sets up the next cycle 👀

Key Indicators to Watch

To spot where we are in the cycle, watch these:

- Bitcoin dominance: Is BTC leading the market?

- Trading volume: High in hype, low in fear

- Fear & Greed Index: Sentiment tool (0 = fear, 100 = greed)

- RSI (Relative Strength Index): Measures if assets are overbought/oversold

This visual shows the 4 market phases and key indicators to help you identify where we are in the cycle.

Pro Tip: Zoom Out

When in doubt, zoom out on the chart.

You’ll see crypto always moves in waves, but the trend has been up long-term.

Markets are emotional short term, but logical over years.

Final Thoughts

✅ Market cycles are normal

✅ Don’t chase hype or panic-sell dips

✅ Learn to spot the cycle phase

✅ Patience = profits in crypto

If you understand the cycle, you’re already ahead of 90% of the crowd.

Comments ()