Crypto Microtransactions

Introduction to Crypto Microtransactions

Crypto microtransactions refer to very small cryptocurrency transactions, typically less than a dollar, designed for applications like tipping content creators, purchasing digital goods, or facilitating machine-to-machine payments in the Internet of Things (IoT). These transactions leverage blockchain's decentralized nature to enable direct, low-cost value transfers, potentially transforming digital commerce. However, their feasibility hinges on addressing significant technical and economic challenges, which this analysis will explore in depth.

Scalability: The Technical Foundation

Scalability is crucial for crypto microtransactions, as they require blockchain networks to handle a high volume of small transactions efficiently. Current blockchain networks face notable limitations:

- Transaction Throughput and Speed: Bitcoin processes approximately 7 transactions per second (TPS), while Ethereum manages around 30 TPS. In contrast, traditional payment systems like Visa can handle up to 24,000 TPS, highlighting a significant gap for microtransaction scalability.

- Network Congestion: During peak usage, blockchains often experience congestion, leading to high transaction fees and delayed confirmations. For microtransactions, where the value transferred might be mere cents, high fees can render them uneconomical.

To address these issues, several scalability solutions have been developed, categorized into Layer-1, Layer-2, and consensus mechanism improvements:

Layer-1 Solutions

- Sharding: Splits the blockchain into parallel chains (shards) for simultaneous transaction processing, increasing throughput. This is particularly useful for handling the volume required for microtransactions.

- Segregated Witness (SegWit): Separates transaction signatures from data, optimizing block space and allowing more transactions per block.

- Hard Forks: Upgrades like Bitcoin Cash increase block size to accommodate more transactions, though this can impact decentralization.

These solutions, particularly Layer-2 protocols like the Lightning Network, are critical for enabling microtransactions at scale, ensuring low fees and high transaction speeds. For example, Decred’s Lightning Network achieves up to 100,000 TPS, comparable to Visa, with minimal storage (less than 2 GB) and RAM (1 GB) requirements, making it feasible for widespread adoption.

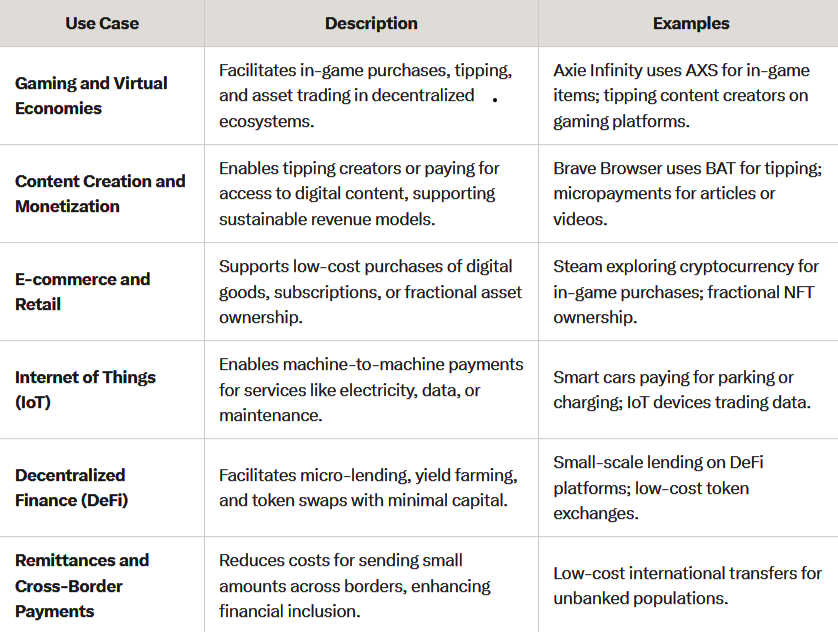

Use Cases: Applications Across Industries

Crypto microtransactions have diverse applications, leveraging their ability to handle small-value transfers efficiently. Below is a detailed breakdown, supported by real-world examples:

Other use cases include:

Remittances and Cross-Border Payments

Description: Reduces costs for sending small amounts across borders, enhancing financial inclusion.

Examples: Stellar Lumens for low-cost international transfers; BitPesa for remittances in Africa.

Charity and Crowdfunding

Description: Allows small, transparent donations to causes, ensuring funds reach recipients efficiently.

Examples: GiveCrypto.org enables micro-donations to disaster relief; The Giving Block for crypto-based charity.

Healthcare

Description: Supports micro-payments for telemedicine consultations, health data sharing, or medical research contributions.

Examples: Solve.Care uses SOLVE tokens for small healthcare payments; patients share anonymized data for research rewards.

These use cases highlight the versatility of microtransactions, from enhancing user engagement in gaming to enabling new financial models in DeFi. For instance, Axie Infinity’s use of AXS for microtransactions demonstrates how gaming can integrate blockchain for seamless, low-cost transactions.

Economic Impact: Broad Implications

The economic impact of crypto microtransactions is multifaceted, influencing market dynamics, user behavior, and regulatory landscapes. Below, we analyze key aspects, supported by recent data and trends:

Market Dynamics

- Increased Liquidity: Microtransactions allow more users to participate with small amounts, increasing overall market liquidity. For example, crypto payments accounted for $6 billion of the $10 trillion global e-commerce market in 2020, with micropayments forming a fraction.

- Diverse Business Models: Platforms can leverage microtransactions for tipping, subscriptions, or pay-per-use models, creating new revenue streams. SatoshiPay, for instance, generated over €1 million for publisher clients in two years, showcasing potential.

- Price Sensitivity: Small payments can make cryptocurrencies more attractive for everyday use, potentially stabilizing prices by increasing demand, though volatility remains a concern.

User Behavior and Adoption

- Lower Barriers to Entry: Microtransactions reduce the risk for new users, making cryptocurrency more accessible. This is evident in platforms like Brave Browser, with 55 million monthly active users by 2022, generating revenue for content creators.

- Enhanced User Experience: Low-cost, seamless transactions encourage frequent use, fostering greater adoption. For example, 5thwork, a BSV-enabled learn-and-earn platform, incentivizes education in Africa, expanding to new markets.

- Incentivized Participation: Reward systems based on microtransactions motivate active engagement, creating a positive feedback loop, as seen in gaming ecosystems with tipping and asset trading.

Regulatory and Social Considerations

- Regulatory Scrutiny: As microtransactions grow, they may face scrutiny over taxation, consumer protection, and AML compliance. The evolving regulatory landscape, still in flux as of 2025, could impact viability.

- Consumer Protection: Ensuring users are protected from fraud in decentralized systems is crucial, especially with the pseudonymous nature of transactions.

- Economic Inclusion: Microtransactions can enhance financial inclusion by providing access to services for unbanked populations, particularly in developing countries, through low-cost cross-border payments.

Challenges and Opportunities

- Volatility: Cryptocurrency price fluctuations can make microtransactions risky, as the value of payments can change rapidly, deterring adoption.

- Adoption Barriers: Technical limitations, user education, and integration into existing systems pose challenges. For instance, high fees from traditional providers and blockchain scalability issues hinder widespread use.

- Innovation Driver: Overcoming these challenges can spur innovation, leading to more efficient blockchain solutions like Teranode, currently in testing for high-volume, low-cost transactions.

Conclusion

Crypto microtransactions hold significant potential to revolutionize digital economies, with scalability solutions like the Lightning Network and diverse use cases spanning gaming, content creation, and IoT. Their economic impact could increase liquidity, foster new business models, and enhance financial inclusion, though challenges like volatility and regulatory scrutiny remain.

Key Points

Research suggests crypto microtransactions can revolutionize digital payments, but scalability remains a challenge.

It seems likely that use cases include gaming, content creation, and IoT, with potential economic benefits like increased liquidity.

The evidence leans toward economic impacts being significant, though adoption barriers and volatility pose risks.

Key Citations

- Understanding Microtransactions in Cryptocurrency

- Blockchain scaling to include micro transactions

- The Micropayment Economy What It Is and Why It Matters

- Microtransactions The fuel of peer-to-peer economy

- Exploring Blockchain Scalability and Its Impact on Adoption

- A Deep Dive Into Blockchain Scalability

MITOSIS official links:

GLOSSARY

Mitosis University

WEBSITE

X (Formerly Twitter)

DISCORD

DOCS

Comments ()