Crypto Project's Massive Fundraising: A Blessing or a Warning Sign?

Another day, another headline: “Project X raises $50M!”, “$100M secured in funding!”, “$150M funding round closed!”. Sounds exciting, right? Big funding often makes people think, ‘This project must be amazing! The airdrop will be huge!’

But have you ever stopped to wonder if massive funding is really good news? While raising large amounts shows the project caught investor’s attention and the team nailed their pitch, it can also come with serious downsides. In fact, these big announcements could be a double-edged sword, setting the stage for future challenges that could hurt the project, the community, and even the ecosystem. Let’s break down why.

Big Funding = Big Token Allocation to Institutions/VCs

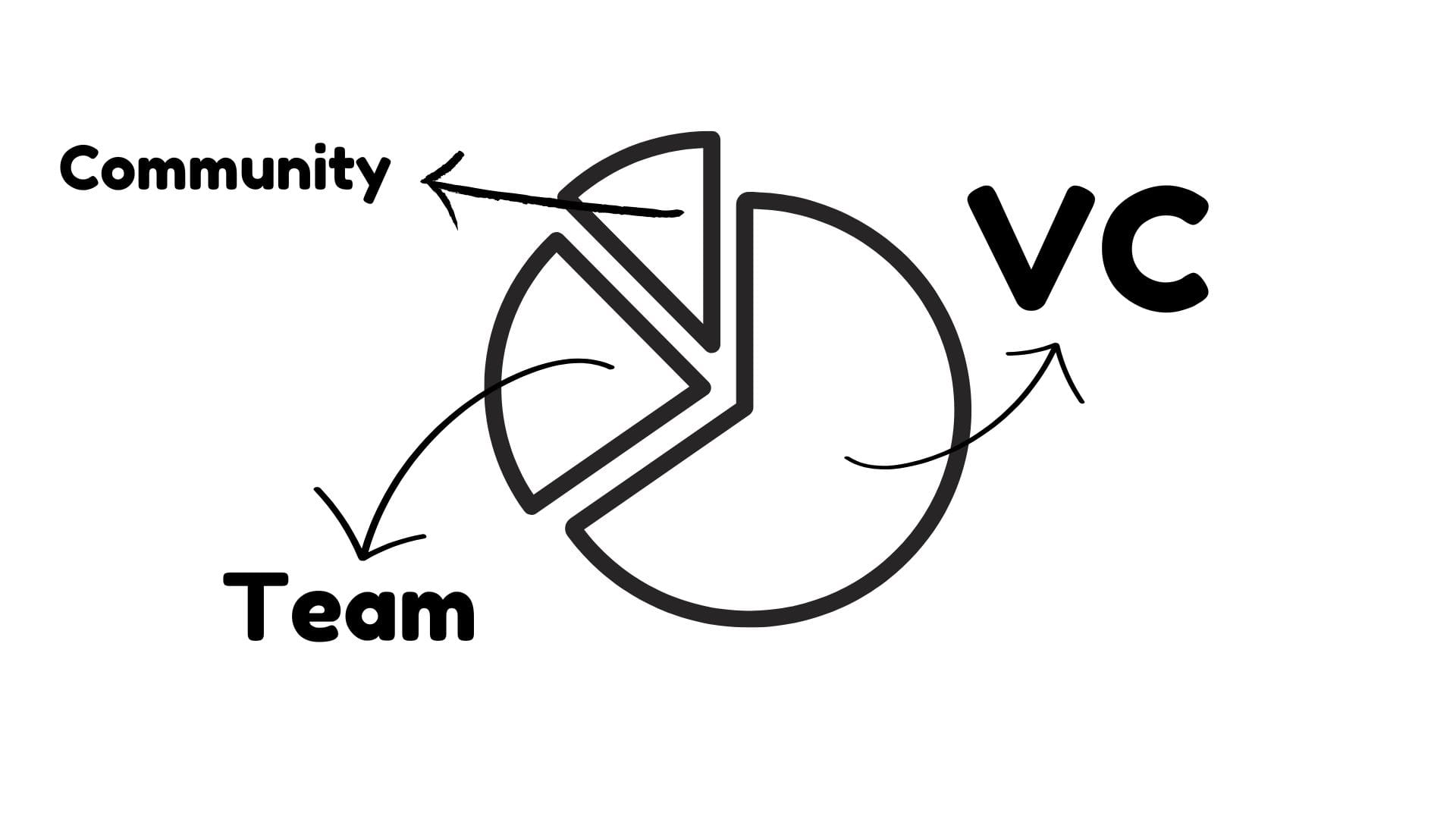

Token allocations for institutions and VCs often fall into categories like private sales, seed rounds, or strategic funding. These allocations are designed to raise essential capital for a project in exchange for tokens. However, securing a large fundraising round often comes at a price: a significant portion of the token supply is handed over to investors. And when the Token Generation Event (TGE) happens, there’s a real risk that these investors will dump their tokens, leaving retail participants to bear the brunt of the sell-off.

According to Pantera Capital’s report, Optimizing Your Token Distribution 2023, private investors, on average, receive around 20% of the token supply in new projects. While this percentage might seem reasonable, without proper safeguards or structured vesting schedules, this can easily lead to massive sell pressure from investors once tokens unlock.

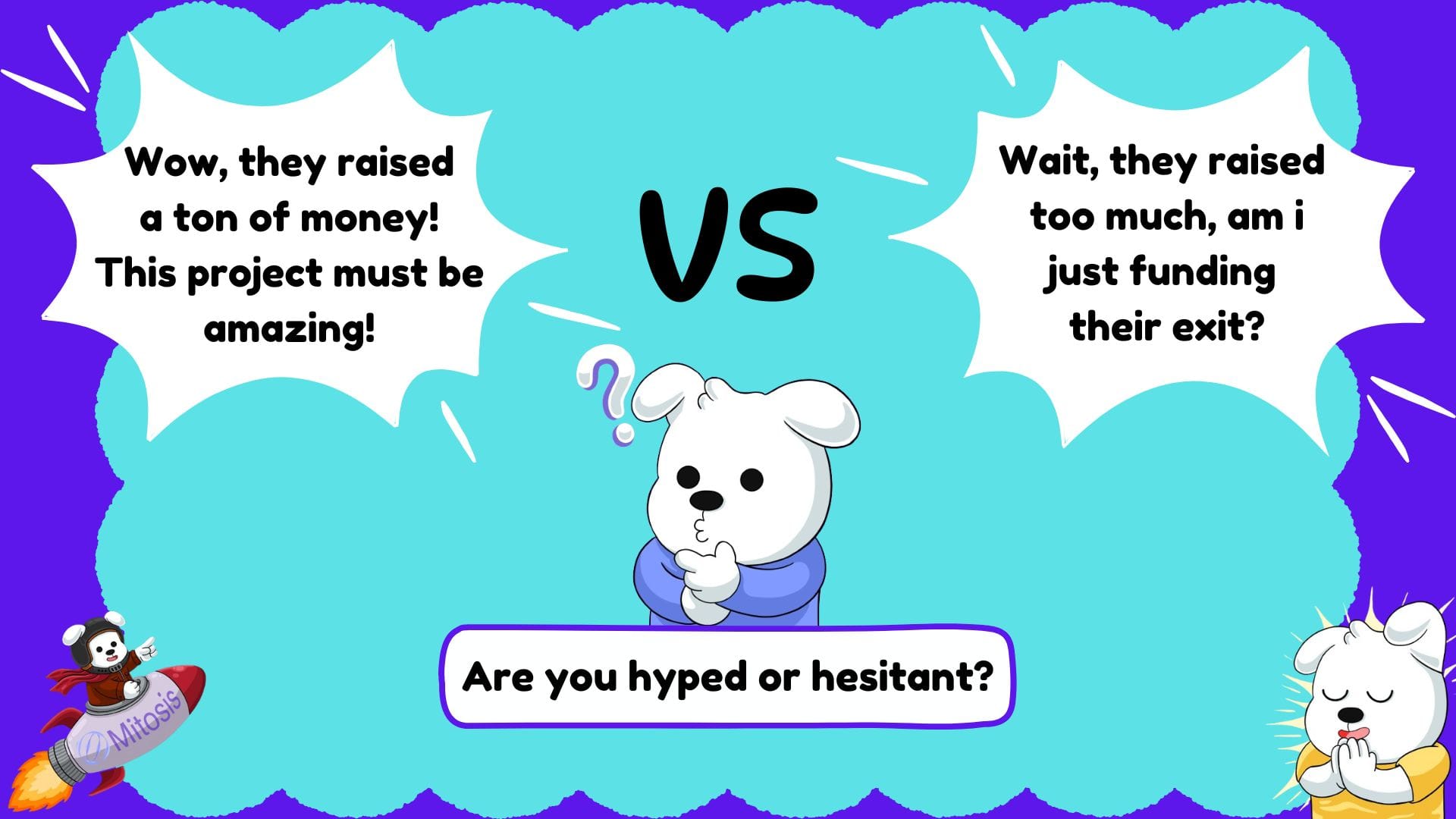

Token allocation isn’t just a technicality, it’s one of the most critical decisions a project team makes. Proper allocation prevents excessive concentration of power among a select few stakeholders. Balanced distribution ensures that all contributors, including the community, are fairly rewarded for their involvement.

The real challenge lies in striking the right balance. Projects need to secure the necessary funding without granting investors too much influence, as they typically don’t represent the project’s end users or long-term participants. Imagine a scenario where 40% of tokens are allocated to private investors, 55% to the team, and only 5% to the community. This imbalance leads to centralized power between teams and investors, discouraging community participation and eroding trust. Over time, such an approach can harm the ecosystem the project seeks to build.

Large fundraising amounts can be both an opportunity and a potential pitfall. The key lies in structuring allocations and incentives to align the interests of all participants, from institutional investors to the end users driving real adoption.

Do Projects Really Need to Launch a Token?

When a project raises significant funds, the next question often arises: Does it really need a token? What drives this decision? and who benefits the most? projects or investors? Let’s break it down!

Project perspective

Tokens are often at the heart of web3 projects. They serve multiple purposes, which explains why launching one is a common move. According to Designing Tokenomics there are three key reasons why projects launch tokens:

- Funding

Every web3 project starts with an idea. But bringing ideas to life, especially a new one requires time and money. Launching a token is a way to raise funds, especially for early-stage projects that might struggle to secure traditional funding.

- Governance

Governance is a cornerstone of web3. The idea of democratization and giving power back to the community is often realized through tokens. These tokens are used as voting mechanisms, allowing community members to influence a project’s direction.

- Utility

Tokens often play a central role in protocols and projects. Their utilities can include: coordinating participation, used to pay gas fees or access to the protocol’s, incentivized community engagement and reward participation.

For projects, these utilities go beyond funding, they help build ecosystems, incentivize collaboration, and align stakeholders’ interests.

Investor Perspective

For investors, token launches can represent an attractive opportunity to maximize returns and participate in a project’s growth. Here’s why:

- Fast ROI (Return on Investment)

Tokens offer liquidity. After a token is launched, early investors can potentially capitalize on speculative buying and high valuations during the initial listing. This can provide a faster return on investment compared to traditional equity models.

- Shared Incentives

A token aligns investor success with the project’s success. As the project grows and the token gains adoption, its value increases, benefiting both the investors and the project.

- Token vs Equity

Tokens provide exposure to different aspects of a project’s value. While equity holders benefit from company profits, token holders can benefit from ecosystem growth and adoption. This diversification appeals to many investors.

- Long-Term Vision

Some investors look beyond short-term gains and align with a project’s mission. They may see tokens as a way to support innovative ideas or to foster synergies between projects they’ve invested in within the same ecosystem.

The decision to launch a token can bring significant benefits for both projects and investors. For projects, it provides a way to raise funds, foster community participation, and build a thriving ecosystem. For investors, tokens offer liquidity, shared incentives, and exposure to a project’s growth and adoption. However, launching a token isn’t always the right move, it requires careful planning and well-thought-out tokenomics. Success lies in balancing the needs of all stakeholders and ensuring that incentives align to support both short-term growth and long-term sustainability.

Big Funding Isn’t Always Good, Small Funding Isn’t Always Bad

So, does this mean small funding is better than massive funding to avoid potential token dumps by investors? Not exactly, it’s not as simple as big funding being bad or small funding being good. It all comes down to the project team, their vision, and how they manage the funds.

Massive fundraising can indicate that a project has a compelling vision or that the team has done an excellent job pitching their idea to investors. It often reflects the belief that the project has high potential. However, it also carries risks, such as creating excessive centralization of tokens in the hands of a few investors, which can lead to market instability.

On the other hand, small funding doesn’t necessarily mean a lack of capability or ambition. In some cases, smaller fundraising rounds show that the team is deliberate and precise in raising only what they need, avoiding overcommitment or the risk of becoming over-reliant on investor backing. Smaller funding can also indicate a more community-focused approach, with teams prioritizing fair token distribution, incentivizing community engagement, or reserving a significant portion for airdrops and ecosystem rewards.

Ultimately, what matters most is the team’s strategy and how well they execute it. As investors and users, it’s crucial to conduct thorough research examining the team’s track record, their goals, and how they plan to balance investor interests with community empowerment. At the end of the day, funding size isn’t the sole determinant of success, it’s how the resources are utilized to foster sustainable growth and decentralization.

Things to Watch When Investing in Web3 Projects or Chasing Airdrops

- Don’t get swayed just because a project boasts massive fundraising.

- Don’t dismiss an idea or product solely because it has a smaller funding round.

- Always dig deeper on the the project’s idea, product, team, and the market it aims to serve.

At the end of the day, most web3 projects will eventually launch their own tokens, whether it’s driven by the project’s needs, investor goals, or a mix of both. What truly matters is the team’s ability to manage the entire token launch process effectively. From planning to distribution, everything must be handled fairly to ensure alignment between all stakeholders: the investors, the community, and the project itself.

Fundraising size, while important, is just one part of the equation. A project’s success ultimately depends on how well its resources are managed and how committed the team is to fostering sustainable growth, innovation, and community trust.

Reference:

Comments ()