Cryptocurrency Liquidity Challenges and Mitosis’s Innovative Solutions

Liquidity in cryptocurrency markets is defined as the ease with which a digital asset can be converted to another asset or cash without significantly impacting its price. This is critical for market efficiency as it ensures traders can execute orders quickly and at fair prices. According to Investopedia: The Liquidity of Bitcoin and the Factors That Affect It, high liquidity contributes to price stability by reducing the impact of large trades, a necessity given the volatility inherent in crypto markets.

However, the decentralized and fragmented nature of crypto markets often leads to liquidity challenges, which can deter market participants and hinder growth. Research from ScienceDirect: Liquidity in the cryptocurrency market and commonalities across anomalies suggest that low liquidity can enhance anomalous returns, preventing markets from achieving efficiency, particularly in the short term.

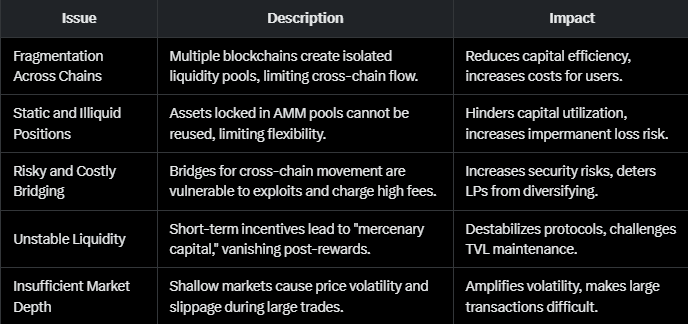

Key Liquidity Issues in Crypto

Based on a review of various sources, the following table summarizes the main liquidity issues in the cryptocurrency market:

These issues are well-documented. For instance, notes that high volatility and regulatory uncertainties further discourage market participants, reducing market depth. Similarly, ScienceDirect: Cryptocurrency returns and the volatility of liquidity highlights a positive correlation between liquidity volatility and expected returns, suggesting investors demand a premium for high variation, which can exacerbate instability.

Mitosis: A Modular Solution

Mitosis is an EOL Layer-1 blockchain designed to transform the DeFi liquidity provision experience. It aims to address the identified challenges through a programmable and modular liquidity framework, leveraging its architecture built on the Cosmos SDK with EVM compatibility.

Overview of Mitosis

Mitosis is positioned as a platform that unifies liquidity provision across multiple blockchains through its EOL model. It facilitates newly created modular blockchains to capture TVL and attract users via governance processes, as noted in Mitosis Docs. This aligns with its mission to enhance composability in an increasingly multi-chain DeFi era, as discussed in Introducing Mitosis: The Modular Liquidity Protocol | Mitosis Blog.

Addressing Specific Liquidity Issues

- Unifying Fragmented Liquidity: Mitosis acts as a liquidity hub, connecting various blockchains via Mitosis Vaults and Chain. When users deposit assets (e.g., ETH on Ethereum), they receive "Vanilla Assets" (e.g., vETH) on the Mitosis Chain at a 1:1 ratio. These can be used across supported chains without traditional bridging, reducing fragmentation. This approach is detailed in the Mitosis litepaper (Mitosis Litepaper), which emphasizes aggregating TVL into unified markets, enhancing capital efficiency.

- Programmable and Liquid Positions: Mitosis introduces miAssets and maAssets to transform static positions into programmable components. miAssets offer governance rights and passive yield, while maAssets are obtained through time-bound Matrix campaigns, providing fixed-term rewards. This flexibility allows LPs to engage in various DeFi strategies, unlocking idle capital.

- Eliminating Bridge Risks: Mitosis leverages Hyperlane’s permissionless interoperability and modular security modules (ISMs) for trust-minimized cross-chain operations. This avoids the risks associated with traditional bridges, which are prone to exploits, as noted in security discussions on Mitosis Docs. This approach contrasts with protocols relying on centralized relayers, enhancing security and reducing costs.

- Stabilizing Liquidity with Ecosystem Ownership: Through its EOL model, Mitosis empowers LPs to collectively govern liquidity allocation, aligning incentives between providers and protocols. This reduces reliance on short-term incentives, fostering sustainable TVL growth. Protocols can propose campaigns via the Matrix, offering transparent, high-yield opportunities, ensuring stable and committed liquidity.

- Enhancing Market Depth and Efficiency: By aggregating liquidity from multiple chains and enabling dynamic deployment, Mitosis deepens market liquidity. Its scalable architecture supports permissionless chain integration, adapting to the multi-chain landscape. This is expected to reduce slippage and enhance capital efficiency, as highlighted in the litepaper (Mitosis Litepaper).

Significance and Future Implications

Given the current state of DeFi, with over $50 billion in TVL potentially underutilized due to liquidity inefficiencies, Mitosis's approach could unlock significant value. Its focus on programmability and governance aligns with the growing need for scalable, interoperable solutions in a multi-chain world.

You can keep in touch with MITOSIS by following:

WEBSITE || X (Formerly Twitter) || DISCORD|| DOCS

Comments ()