🏛️ Crypto’s Quiet Revolution: Real-World Assets Are Going On-Chain

While meme coins and AI tokens grab the spotlight, something more serious is happening behind the scenes. Real world assets like government bonds, real estate, and private loans are being brought onto the blockchain.

Companies like BlackRock, Franklin Templeton, and Société Générale are moving traditional assets on chain using smart contracts, trusted custody, and regulated platforms. These assets are not just stored digitally, they can now interact with DeFi tools, generate yield, and provide new options for stable returns.

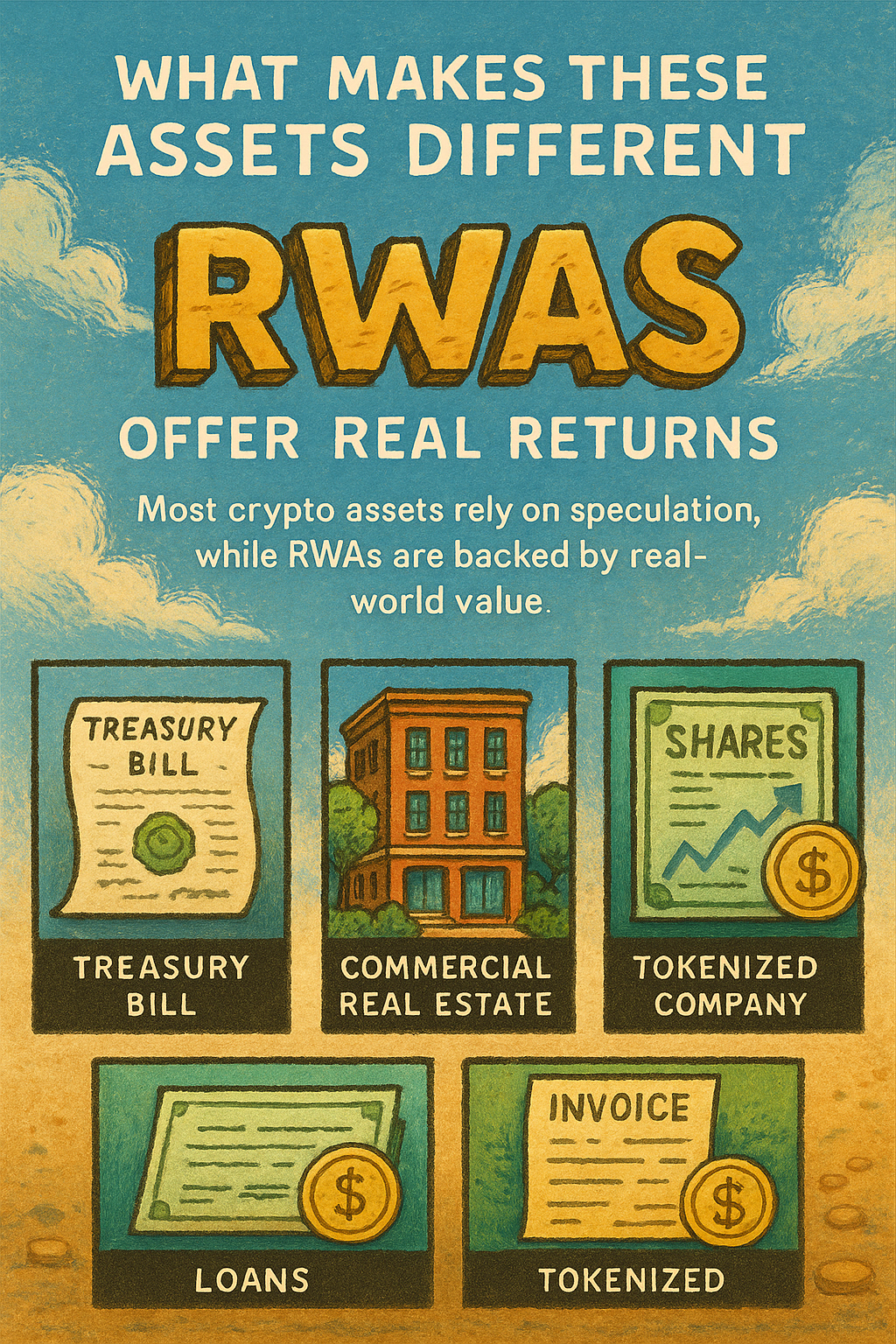

🧱What Makes These Assets Different

RWAs (real world assets) are exactly what they sound like. They exist in the physical or traditional financial world and are represented digitally on chain. Think of:

- Treasury bills

- Commercial real estate

- Tokenized company shares

- Revenue-generating loans

- Tokenized invoices

But here’s what sets them apart: they provide real returns. While most crypto assets rely on speculation or inflationary rewards, RWAs are backed by income streams from the real economy.

🏦Who’s Leading the Way?

Some projects are small and experimental, others are run by the biggest firms in finance:

🟡 BlackRock

Partnered with Coinbase and Securitize to offer tokenized U.S. Treasuries on Ethereum.

🔵 Franklin Templeton

Running a full mutual fund on chain, now expanding to Polygon and Stellar.

🟣 Ondo Finance

Takes stablecoins and connects them to tokenized bonds, offering yield that feels native to DeFi.

🟢 Centrifuge

Focuses on tokenizing loans, invoices, and real estate to be used as collateral in MakerDAO.

🔴 Maple Finance

Provides structured credit lending for institutions, now enhanced with token-based access and transparency.

These are no longer experiments. These are functioning bridges between banks and blockchains.

⚙️DeFi Use Cases: Beyond Just Holding Tokens

What can you do with RWAs? A lot more than just sit on them.

Some RWAs can be:

- Used as collateral to mint stablecoins (like DAI)

- Deposited into vaults that auto-distribute yield

- Lent out on protocols with pre-programmed repayments

- Swapped across blockchains using chain abstraction

- Combined with programmable liquidity strategies for custom portfolios

RWAs turn DeFi into something closer to a functioning financial system, with real products, real yield, and real accountability.

📉Risk Is Still Real

RWAs sound clean and safe, but they aren’t without problems:

🛑 Centralization: Most tokens are issued and managed by trusted custodians, not protocols.

🛑 Regulation varies: Some assets are legal in one country, grey zones in another.

🛑 Liquidity can dry up: Unlike ETH or USDC, RWAs aren’t always instantly tradable.

🛑 Smart contract risk: A bug or exploit could freeze token transfers or reward flows.

🛑 Transparency vs. privacy: Investors want returns, but don’t always want visibility.

The more “real” the asset, the more traditional rules start to apply.

📚Why It Actually Matters

This trend isn’t just about institutions joining the blockchain party. It’s about changing what crypto means. With RWAs, Ethereum is no longer just a playground for speculation. It’s becoming a platform for real capital markets.

What we’re witnessing is the early version of a new economy, where:

- Yield is sustainable, not farmed out of inflation

- Assets are useful, not just held for price pumps

- Protocols become platforms, not casinos

RWAs may not be flashy, but they’re powerful. And they might just be the quiet revolution crypto needs.

I hope you guys enjoyed this thread about Mitosis. If you have any feedback feel free to hit me a dm on https://x.com/FarmingLegendX

If you want to check out my latest Mitosis University Thread you can visit it here:

📚Bibliography

Official Mitosis Documentation & Whitepapers

Mitosis Team. (2024). Mitosis: Network for programmable liquidity [Whitepaper]. Mitosis Documentation. Retrieved from: https://docs.mitosis.org

Institutional Reports & Blockchain Documentation

BlackRock. (2025). Mitosis: Digital Asset Treasury Strategies ReportReportReport. BlackRock Documentation.

Retrieved from: https://www.blackrock.com

Franklin Templeton. (2025). Mutual Funds On Chain: Expansion to Polygon InstitutionalUpdateInstitutional UpdateInstitutionalUpdate. Franklin Templeton.

Retrieved from: https://www.franklintempleton.com

Ondo Finance. (2025). Real Yield Vault Design and Tokenized Bond Framework TechnicalPaperTechnical PaperTechnicalPaper. Ondo Documentation.

Retrieved from: https://ondo.finance

MakerDAO Forum. (2025). Collateral Types: Real World Assets and Risk Mitigation Models DiscussionDiscussionDiscussion. MakerDAO Governance.

Retrieved from: https://forum.makerdao.com

Comments ()