Dark Pools: Trading in the Shadow Markets - Power, Privacy, Perils

“Dark pools”, fascinating, yet an often misunderstood component of modern financial markets. Private trading platforms operating outside the public eye, authorizing large-scale trades with minimal market impact.

What Are Dark Pools?

Dark pools are private, off-exchange trading venues where participants, typically large institutional investors can buy or sell large quantities of securities, such as stocks, crypto tokens, bonds, or derivatives, exchange traded funds (ETFs) etc. without revealing their orders to the public market until the trade is executed.

Unlike public exchanges like the New York Stock Exchange (NYSE), NASDAQ, Binance CEX, where order books are visible and trades are transparent, dark pools operate with limited transparency, hence the term "dark."

The term “dark pools" reflects its opaque nature, as it screens trading activity from public view, allowing participants to execute large orders discreetly. Dark pools are regulated but distinct from traditional exchanges.

Why Do Dark Pools Exist?

Their primary purpose is to minimize market impact, which occurs when a large trade influences the price of a security before the trade is complete. For example, if a fund wants to sell millions of shares of a stock on a public exchange, the visible order could signal to other traders, causing the stock price to drop before the sale is finalized, resulting in a worse price for the seller.

Dark pools solve this problem by:

- Providing Anonymity: Traders can place orders without revealing their identity or intentions, reducing the risk of other market participant’s front-running or manipulating prices.

- Reducing Market Impact: By keeping trades hidden until they are executed, dark pools prevent large orders from moving the market prematurely.

- Improving Execution Efficiency: Large trades can be executed in a single transaction or in smaller chunks, often at better prices than on public exchanges.

Dark pools originated in the late 1980s but gained prominence in the 2000s with advancements in electronic trading and regulatory changes, which encouraged alternative trading venues.

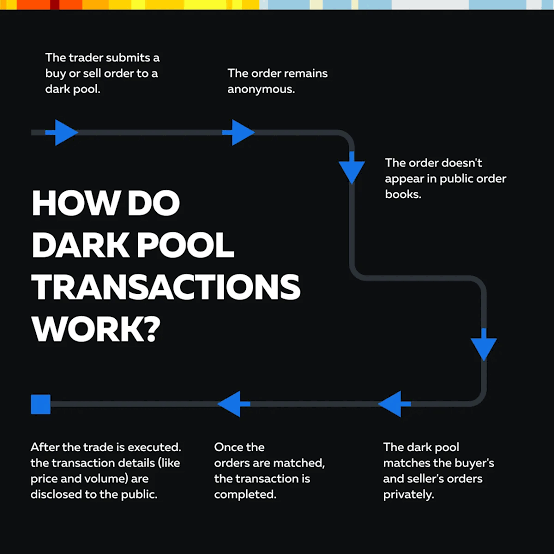

How Do Dark Pools Work?

Dark pools operate as private marketplaces that match buy and sell orders internally, often using sophisticated algorithms.

- Order Submission: Participants submit buy or sell orders to the dark pool. These orders are not displayed publicly, unlike the order books of traditional exchanges.

- Matching Process: The dark pool’s system matches buyers and sellers based on price and quantity. Most dark pools use the midpoint of the National Best Bid and Offer (NBBO)—the average of the best bid and ask prices on public exchanges—to ensure fair pricing.

- Execution: Once a match is found, the trade is executed privately. The details of the trade (e.g., price and volume) are reported to the public after a delay, as required by regulators, but the identities of the traders remain anonymous.

Who Uses Dark Pools?

Dark pools are primarily used by institutional investors who need to trade large volumes without disrupting markets. Key users include:

- Hedge Funds: Seeking to execute complex trading strategies without revealing their positions.

- Mutual Funds and Pension Funds: Managing large portfolios and aiming to minimize transaction costs.

- Investment Banks: Trading on behalf of clients or for their proprietary accounts.

- Large Corporations: Engaging in stock buybacks or other significant transactions.

Retail investors rarely access dark pools directly due to the high minimum order sizes and the platforms’ focus on institutional clients. However, retail orders may indirectly interact with dark pools if routed through brokers who use these venues.

The Good Side of Dark Pools

Dark pools offer several benefits to market participants and the broader financial system:

- Reducing Market Impact: By hiding large orders, dark pools prevent price volatility that could harm both the trader and the market.

- Cost Efficiency: Large trades can be executed at better prices, reducing transaction costs for institutional investors, which ultimately benefits their clients (e.g., pensioners or mutual fund shareholders).

- Anonymity: Traders can protect their strategies from competitors, preventing front-running or copycat trading.

- Liquidity for Large Orders: Dark pools provide a venue for trading large blocks of securities that might be difficult to execute on public exchanges without significant price disruption.

- Market Stability: By smoothing out the impact of large trades, dark pools can contribute to overall market stability, especially during volatile periods.

The Bad Side of Dark Pools

Despite their advantages, dark pools have been criticized for several reasons:

- Lack of Transparency: The opacity of dark pools can obscure price discovery, making it harder for the broader market to determine the true value of a security.

- Potential for Manipulation: The anonymity and lack of real-time reporting can create opportunities for unethical practices, such as insider trading or predatory HFT strategies.

- Unequal Access: Dark pools are primarily accessible to large institutions, potentially giving them an advantage over retail investors and creating a two-tiered market.

- Fragmentation of Liquidity: By diverting trades from public exchanges, dark pools can reduce liquidity on those exchanges, potentially leading to wider bid-ask spreads and higher costs for retail traders.

- Regulatory Concerns: Critics argue that dark pools are not as tightly regulated as public exchanges, raising risks of abuse. For example, some dark pools have been accused of allowing HFT firms to exploit slower institutional orders.

- Conflict of Interest: Broker-dealer dark pools may prioritize their own interests or those of favored clients, potentially leading to unfair execution practices.

Regulation of Dark pools

Dark pools are subject to regulation, though the extent varies by jurisdiction. Despite these regulations, enforcement remains a challenge majorly due to the complexity and opacity of dark pool operations.

With dark pools having becoming a significant part of global financial markets, with estimated 15-20% of equity trading volume in the U.S, ethical and economic implications have begun to stir up

The rise of dark pools raises broader questions about market fairness and efficiency:

- Fairness: Do dark pools create an uneven playing field by favoring large institutions over retail investors? Critics argue they exacerbate inequality in access to market opportunities.

- Price Discovery: By diverting trades from public exchanges, dark pools may undermine the process of determining fair market prices, which is critical for efficient capital allocation.

- Systemic Risk: The opacity of dark pools could mask systemic risks, such as excessive leverage or coordinated trading strategies that destabilize markets.

On the other hand, proponents argue that dark pools enhance market efficiency by enabling large trades without disrupting prices, ultimately benefiting all market participants indirectly.

The Future of Dark Pools

- Increased Regulation: Regulators worldwide are pushing for greater transparency and oversight, which could limit dark pool activity or alter its structure.

- Competition from Public Exchanges: Exchanges are developing tools to compete with dark pools, such as hidden order types & block trading facilities.

- Retail Investor Access: Some platforms are exploring ways to give retail investors indirect access to dark pool-like mechanisms, potentially democratizing their benefits.

The future of dark pools will be shaped by advancement in technology, regulatory changes, and evolving market dynamics.

Conclusion

Dark pools are a critical yet controversial feature of modern financial markets, offering significant benefits for institutional investors, including reduced market impact, cost efficiency, and anonymity. However, their lack of transparency, potential for manipulation, and unequal access raise valid concerns about fairness and market integrity.

As markets evolve, dark pools will likely continue to play a significant role, but their future depends on balancing the needs of large traders with the broader goals of transparency, fairness, and efficiency. For investors, regulators, and market participants.

About Mitosis

X

Docs

Discord

Mitosis App

Comments ()