Decentralizing Success: How Mitosis’s DNA Program Aligns Every Stakeholder

In a lot of blockchain ecosystems, incentive structures often start with great potential but quickly get tangled up in conflicting interests. Users chase after temporary APYs, validators zero in on block rewards, developers work in isolation, and liquidity providers find themselves without much say. This four-way tug-of-war undermines long-term growth and trust. So, is there a way to turn these conflicting incentives into a smooth, self-reinforcing cycle? Let’s dive into how Mitosis’s DNA Program takes on this challenge directly.

What Sets the DNA Program Apart?

Traditional models usually depend on centralized foundations that dictate how resources are allocated or on rigid formulas that can’t keep up with changing conditions. Both of these approaches tend to promote short-term thinking and lead to those frustrating “pump-and-dump” scenarios—just think about the collapse of Terra Luna or the bank run on Iron Finance. Mitosis cleverly avoids these traps by establishing a network of interdependent incentives, where the success of one group boosts the success of all. This brings us to the heart of the DNA Program: aligning interests through shared rewards and governance. See https://university.mitosis.org/aligning-blockchain-incentives-the-mitosis-dna-programs-innovative-approach/

How Does a Three-Token System Foster Balance?

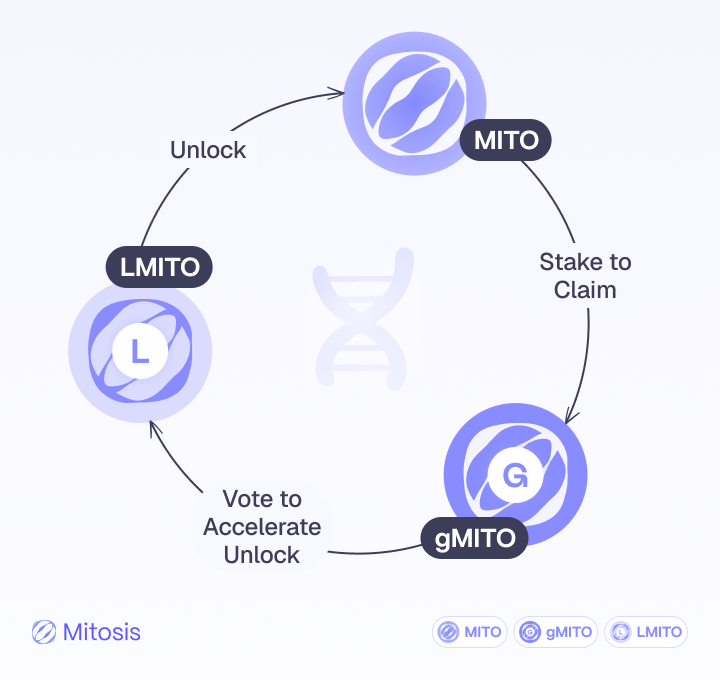

The magic of the DNA Program lies in its three-token system. First up, MITO powers transactions and can be staked to validators. Then there’s gMITO (Governance MITO), which you earn by staking MITO and gives you voting rights—these can’t be transferred to prevent vote buying. Lastly, LMITO (Locked MITO) gradually unlocks, rewarding those who stick around for the long haul and speeding up unlocks through active governance. This setup creates a natural balance between immediate utility and long-term commitment, ensuring that the ecosystem thrives together. See https://mitosis.org/. For proper understanding, refer to the diagram below:

Can Rewards Drive True Community Engagement?

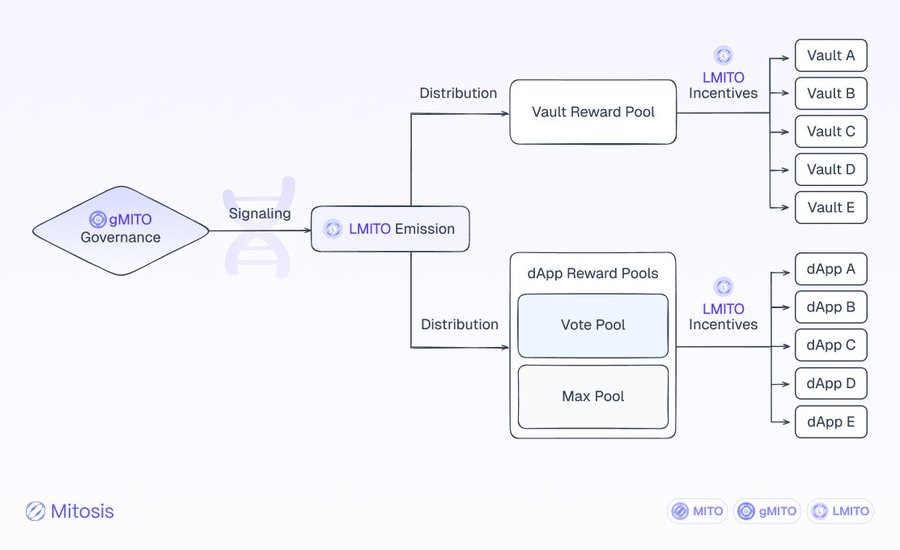

Instead of just throwing tokens around, Mitosis channels LMITO through two key avenues: the Vault Reward Pool and the dApp Reward Pool. Vaults, which are where outside liquidity flows in, get priority funding based on votes from gMITO holders. On the other hand, dApps benefit from a mix of a formula-driven “Max Pool” and a governance-driven “Vote Pool,” blending solid math with community input. This two-pronged strategy not only guarantees consistent rewards but also offers flexible support for innovation, creating a cycle of value. See https://docs.mitosis.org/docs/learn/matrix/intro

How Do Users Benefit from Double-Dipping?

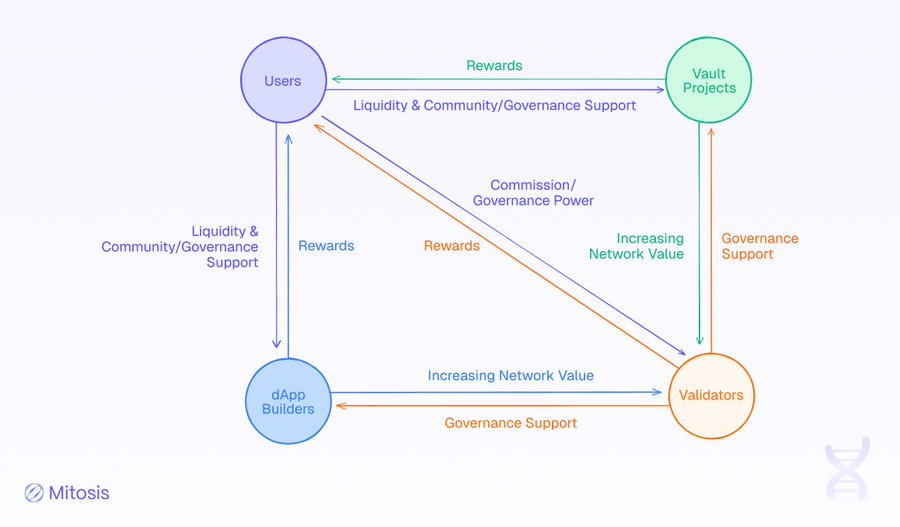

For DeFi users who are fed up with constantly jumping from one yield farm to another, the DNA Program introduces “double-dipping”: you can earn vault yields while also gaining governance power at the same time. Active participants can speed up their LMITO unlocks by voting, increase their influence over the protocol’s direction, and enjoy a variety of returns across the entire Mitosis ecosystem. This setup promotes long-term loyalty instead of just chasing after high APYs. See https://docs.mitosis.org/docs/learn/litepaper. See the diagram below

Why Are Validators More Than Just Block Producers?

Validators on Mitosis are not just there to process transactions—they take on the role of ecosystem stewards. By staking MITO, they earn gMITO and commission rewards, and they also get to vote on how rewards are allocated to vaults and dApps. Their performance has a direct effect on the network’s health, which means they have a real stake in promoting valuable applications. This connection turns validators into protectors of both security and innovation.

Can Developers Escape Boom-and-Bust Funding Cycles?

The days of unpredictable incentive drops that leave projects in a lurch are over. With the DNA Program, developers can count on steady, formula-based rewards from the Max Pool, which are tied to MITO usage, along with customized boosts from the Vote Pool when the community sees potential. This dual approach offers stable funding and community backing, allowing builders to concentrate on product quality instead of scrambling for grants. See https://docs.mitosis.org/docs/developers/chain

What Makes Vault Projects Central to the Ecosystem?

Vault projects, especially those collaborating with Theo Network, hold a special spot in the reward hierarchy. They enjoy early access to incentives, form direct partnerships with protocols, and benefit from governance-approved fee structures. This empowers vault creators to kickstart liquidity and build vibrant communities. As these vaults thrive, they draw in more gMITO votes, setting off a positive cycle of growth and stability. Also see the diagram below:

How Does Governance Stay Secure and Effective?

Mitosis’s governance, driven by gMITO, addresses common vulnerabilities found in DAOs. gMITO is non-transferable, time-weighted, and adheres to a strict “one gMITO, one vote” principle—no flash loans or vote buying allowed. Holders have a say in crucial aspects like fee allocation, reward distribution, and vault parameters, ensuring that governance decisions prioritize the long-term interests of the community over short-term gains.

Will This Model Stand the Test of Time?

The DNA Program is rolled out in phases: starting with a Foundation Phase to set up core operations and early governance, followed by a Community Control Phase where LMITO emissions, vault parameters, and dApp rewards are fully managed under gMITO oversight. This gradual approach guarantees stability and avoids sudden changes that could disrupt the network.

In conclusion, Mitosis’s DNA Program isn’t just another token scheme—it’s a well-rounded framework that aligns the interests of users, validators, developers, and vault projects. By integrating utility, governance, and time-locked rewards, it fosters a self-sustaining ecosystem where everyone’s success is interconnected. In light of DeFi’s previous challenges, could this really be the key to sustainable growth? How might other ecosystems adopt similar multi-token, community-focused models to secure their futures?

🔗Links:

Comments ()