Decoding LSDfi: How Liquid Staking Is Reshaping DeFi Yields

2020 was the year of yield farming and 2021 the rise of DeFi blue chips, 2025 belongs to LSDfi which is a sector built around Liquid Staking Tokens (LSTs) and the new wave of protocols leveraging them.

At its core, LSDfi merges Ethereum staking yields with DeFi composability, creating a yield-on-yield economy that could redefine capital efficiency.

What Is LSDfi?

Liquid Staking Derivatives (LSDs) are tokenized representations of staked assets most commonly ETH that continue earning staking rewards while remaining liquid for use in DeFi.

Examples:

- stETH (Lido)

- eETH (EtherFi)

- rETH (Rocket Pool)

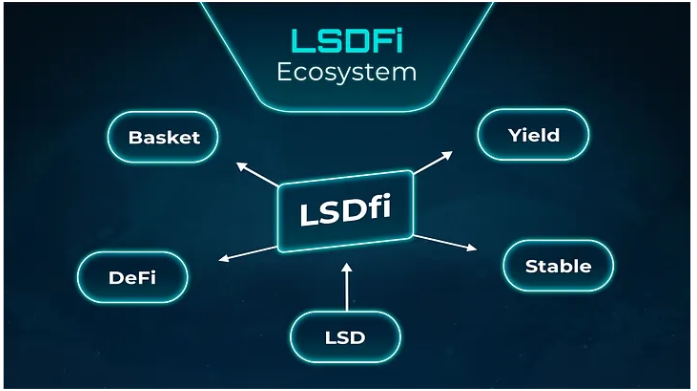

LSDfi refers to the DeFi ecosystem built around these LSDs, enabling:

- Lending & borrowing against LST collateral

- Yield trading & tokenization

- Restaking for additional rewards

Why LSDfi Matters

Before LSDs, staking ETH meant locking it up and sacrificing liquidity. Now, you can:

- Stake ETH → Receive LST (e.g., stETH, eETH)

- Use LST as collateral → Earn DeFi yield

- Restake LST → Earn even more yield

This creates stacked returns and new capital strategies for DeFi power users.

Key Players in LSDfi

1. EtherFi – User-Centric Liquid Staking

- Asset: eETH

- Feature: Fully non-custodial, users hold withdrawal keys

- DeFi Play: Deep integrations with lending markets, DEXs, and points programs

- Edge: Security and self-sovereignty with the same liquidity benefits as stETH

2. EigenLayer – Restaking Super Protocol

- Concept: Take LSTs and “restake” them to secure new networks

- Rewards: Earn base ETH staking yield + restaking yield from securing AVS (Actively Validated Services)

- DeFi Angle: Creates a new security marketplace where stakers monetize trust

- Risk: Smart contract + slashing risk if AVS misbehaves

3. KelpDAO – LSD Indexing & Liquidity Routing

- Product: rsETH (Restaked ETH)

- Function: Aggregates across multiple LSTs and routes to restaking opportunities

- Value Prop: Diversifies LSD exposure and boosts returns via auto-yield optimization

4. Pendle – Yield Tokenization Leader

- Mechanism: Splits yield-bearing assets into:

- Principal Token (PT) → fixed-income style

- Yield Token (YT) → trade the variable yield separately

- LSDfi Role: Enables traders to speculate on ETH staking yields or lock in fixed rates

- Example: Tokenize stETH yield for yield curve trading

How LSDfi Creates a Yield Derivatives Market

With LSDfi protocols like Pendle, we’re seeing the birth of:

- Yield curves for on-chain staking rates

- Fixed vs. floating yield markets

- Leverage on future staking income

This turns ETH staking from a passive activity into a tradeable, hedgeable, and speculatable asset class similar to interest rate markets in TradFi.

Risks in LSDfi

While LSDfi unlocks powerful yield strategies, risks include:

- Smart contract exploits in LSD or LSDfi protocols

- Slashing events from validator misbehavior (EigenLayer restaking risk)

- Liquidity crunches if secondary markets dry up

- Correlation risk (if multiple LSDs fail together)

The Future of LSDfi

Expect:

- Cross-chain LST usage via bridging protocols

- LSD indexes as tradable DeFi assets

- Institutional adoption as yield markets mature

- On-chain options/futures for staking yield volatility

LSDfi is evolving into Ethereum’s fixed-income market but with DeFi’s permissionless edge.

Final Takeaway

LSDfi is about unlocking the liquidity of staked assets, stacking multiple yield layers, and turning staking into a fully composable financial primitive.

From EtherFi’s self-custody staking to Pendle’s yield tokenization, LSDfi is reshaping DeFi from the ground up.

In the years ahead, the protocols that can combine security, liquidity, and composability will dominate Ethereum’s yield economy.

Comments ()