Decoding Mitosis: A Deep Technical Dive into EOL, Matrix Vaults & Cross-Chain Primitives

Introduction

Imagine DeFi not as a collection of siloed chains, but as a single liquidity superhighway, where assets flow automatically to the best opportunities and users co-design the network’s fate. That’s the vision at the heart of Mitosis—a Layer 1 built for programmable liquidity and cross-chain composabilityMitosis.

In the sections that follow, we’ll unpack:

- Modular Architecture: How Mitosis leverages EVM compatibility plus Cosmos SDK security to run a dual‐layer chain.

- Vaults & Assets: The mechanics of Vault deposits, withdrawals, and tokenized liquidity positions.

- Matrix Vault & EOL: Governance-driven vs. campaign-driven liquidity frameworks.

- Developer Primitives: Interfaces, Engine API compatibility, and tooling for dApp builders.

- Security & Governance: Validator roles, upgrade safety, and community-owned liquidity.

- Interoperability: Cross-chain messaging with Hyperlane and beyond.

Ready to dive in? Let’s go!

1. Modular Architecture: Execution ↔ Consensus

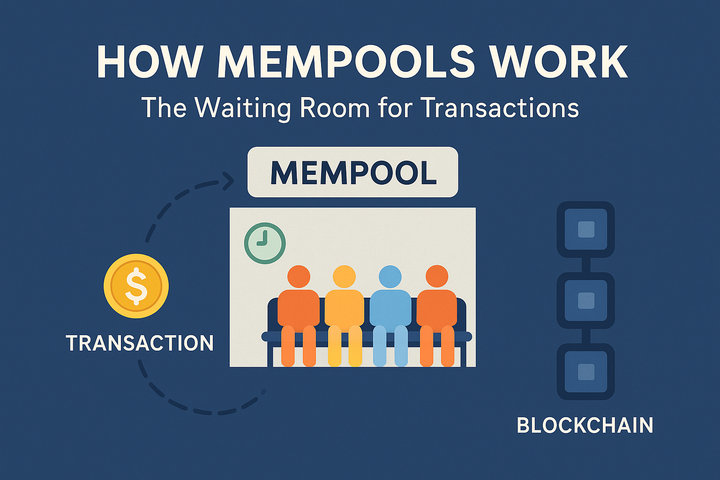

At its core, the Mitosis Chain splits execution (transaction processing) from consensus (block ordering) into two distinct layers, communicating via the Ethereum Engine APIMitosis Docs | Mitosis Docs.

- Execution Layer (EL) runs unmodified Ethereum clients—processing EVM bytecode, managing state, and executing smart contracts just like Ethereum itselfMitosis Docs | Mitosis Docs.

- Consensus Layer (CL) uses the Cosmos SDK & CometBFT consensus to sequence blocks securely, benefiting from a mature, battle-tested frameworkMitosis Docs | Mitosis Docs.

This separation mirrors Ethereum’s design post-Merge, where execution and consensus clients work in tandem to improve modularity and client diversityethereum.org.

By adopting this model, Mitosis instantly inherits:

- EVM compatibility (so existing dApps deploy unmodified)Mitosis Docs | Mitosis Docs

- Cosmos SDK security and upgradeability

- A clear path to integrate other consensus frameworks (e.g., Bitcoin-backed, VeraChain, etc.)Mitosis Docs | Mitosis Docs

Together, these layers form a robust foundation for programmable liquidity markets—where capital can be tokenized, traded, and composed across ecosystems.

2. Vaults & Tokenized Liquidity: Vanilla Assets → miAssets → maAssets

Mitosis transforms static deposits into tradeable, composable assets through a three‐stage lifecycle:

- Deposit → Vanilla Assets

- Users send tokens (e.g., ETH, USDC) into a Mitosis Vault, which mints 1:1 Vanilla Assets on the Mitosis ChainMitosis University.

- Vanilla Assets retain full value peg while remaining ERC-20 compatible, so you can move them anywhere.

- Supply → miAssets (EOL)

- Vanilla Assets staked into the Ecosystem-Owned Liquidity (EOL) pool earn collective yields and governance rights, receiving miAssets in returnMitosis Docs | Mitosis Docs.

- miAssets represent your share of EOL, fluctuate with performance, and carry voting weight in community proposals.

- Campaigns → maAssets (Matrix Vault)

- For targeted strategies, users commit Vanilla Assets to Matrix Vaults, which run structured campaigns (fixed lock-ups, defined yields) and issue maAssets as on-chain receiptsMitosis University.

- maAssets unlock bespoke incentives—ideal for yield-hungry participants who prefer predefined outcomes.

When withdrawing, participants burn their miAssets or maAssets, and the Vault releases underlying tokens seamlesslyMitosis University. This fluid lifecycle unlocks $10 billion+ in stranded cross-chain liquidity, according to recent DeFi studies.

👉 Quick challenge: Think of three ways you might compose Vanilla Assets in other DeFi protocols—liquidity pools, lending markets, or NFT collateral?

3. Matrix Vault & Ecosystem-Owned Liquidity

Mitosis offers two complementary liquidity frameworks:

3.1 Ecosystem-Owned Liquidity (EOL)

- Community governance steers capital. Validators and miAsset holders vote on yield sources, risk parameters, and asset allocationsMitosis Docs | Mitosis Docs.

- Dynamic rebalancing keeps funds optimized across top DeFi platforms.

- Rewards distribution occurs continuously—staking yields, external incentives, and governance tokens flow back to miAsset holders.

3.2 Matrix Vault Campaigns

- Structured campaigns suit participants who want predictable terms: lock periods, target APYs, and risk profilesMitosis University.

- Composability: You can layer Matrix Vault maAssets into other programs or trade them on DEXs.

- Governance-aware: Campaigns integrate with the broader Matrix Engine for seamless coordination.

Both models share the same underlying Vault infrastructure, meaning gas, settlement, and security are consistent across user experiencesMitosis University.

4. Developer Primitives & Tooling

For builders, Mitosis exposes rich interfaces and frameworks:

- Protocol Overview & SDKs: The developer overview details smart-contract ABIs, subgraph schemas, and CLI toolchainsMitosis Docs | Mitosis Docs.

- Engine API Support: Full JSON-RPC compatibility lets you plug in unmodified Ethereum tools (Hardhat, Truffle, Remix) to target Mitosis directlydocs.story.foundation.

- Cross-Chain Messaging: Native integration with Hyperlane and other bridges simplifies asset ingress/egress—no custom adapters requiredMitosis University.

- Modular Framework: Use “money-legos” from other chains (Cosmos, Polkadot) alongside Mitosis primitives in a single dAppMitosis University.

💬 Discussion prompt: Which dApp would you build first on Mitosis—cross-chain AMM, real-time yield optimizer, or something entirely new?

5. Security, Validators & Governance

Mitosis’s security model blends established standards with novel checks:

- CometBFT ensures Byzantine fault tolerance and fast finality—battle-tested by Cosmos chainsMitosis Docs | Mitosis Docs.

- Validator Roles: Node operators stake native tokens to run consensus clients, while separate execution clients handle transactions. This division prevents single-point failures and enables client diversityethereum.org.

- On-chain Upgrades: Governance proposals can upgrade modules (Vault logic, token parameters) with multisig-protected timelocks, ensuring safety and transparencyMitosis University.

- Community Redistribution: Early exit penalties fund ongoing security audits and reward long-term holders, aligning incentives across stakeholdersMitosis University.

6. Interoperability: Beyond One Chain

True DeFi is multi-chain, and Mitosis leads with:

- Hyperlane Integration for fast, secure cross-chain transfers and messagingMitosis University.

- Canonical & Non-Canonical Assets: Support for bridged tokens, native tokens, and IBC assets under one protocol umbrellaMitosis University.

- Modular Data Availability: Future plans to integrate with Celestia-style DA layers for scalable rollups.

By dissolving chain borders, Mitosis empowers liquidity to roam free—like bees flitting from flower to flower, harvesting yield wherever it blooms.

Conclusion

Mitosis is more than “another Layer 1.” It’s a programmable liquidity engine built on:

- A modular chain blending Ethereum execution and Cosmos consensus.

- Vault primitives that tokenize deposits into Vanilla Assets, miAssets, and maAssets.

- Dual liquidity frameworks (EOL + Matrix Vault) for community-driven and structured campaigns.

- Full Engine API compatibility, cross-chain messaging, and developer SDKs.

- Security via CometBFT, multisig governance, and client diversity.

- Seamless interoperability powered by Hyperlane and IBC.

For users, this means frictionless yield, equitable governance, and composable assets. For developers, it’s an open canvas for the next wave of DeFi innovation.

What will you build, govern, or optimize first on Mitosis? Share your ideas on the Mitosis Forum or in our Discord—let’s co-author the future of programmable liquidity!

Internal Links

Citations

- Mitosis modular chain and programmable liquidity Mitosis

- Execution/consensus separation details Mitosis Docs | Mitosis Docs

- EVM client compatibility & CometBFT security Mitosis Docs | Mitosis Docs

- Ethereum Engine API & client diversity ethereum.org

- Vanilla Assets lifecycle Mitosis University

- Ecosystem-Owned Liquidity (EOL) framework Mitosis Docs | Mitosis Docs

- Matrix Vault campaign mechanics Mitosis University

- DeFi liquidity statistics (fragmentation)

- Developer overview & SDKs Mitosis Docs | Mitosis Docs

- Engine API support for JSON-RPC docs.story.foundation

- Cross-chain messaging with Hyperlane Mitosis University

- Rise of programmable liquidity primitives Mitosis University

- Validator roles & governance safety Mitosis University

- Governance forum & EOL governance intro Mitosis Docs | Mitosis Docs

- Matrix Vault architecture overview Mitosis University

Comments ()