DeFi 2.0: Mitosis as a Catalyst for the Evolution Towards Sustainable and Connected Finance

1. Introduction

DeFi 1.0: The Revolution and Its "Growing Pains"

The first wave of decentralized finance (DeFi 1.0) was a true revolution. It brought the world open, permissionless financial instruments: decentralized exchanges (DEXs), lending protocols, algorithmic stablecoins, and much more. Billions of dollars in liquidity poured into this new economy, driven by the promise of high yields and financial freedom.

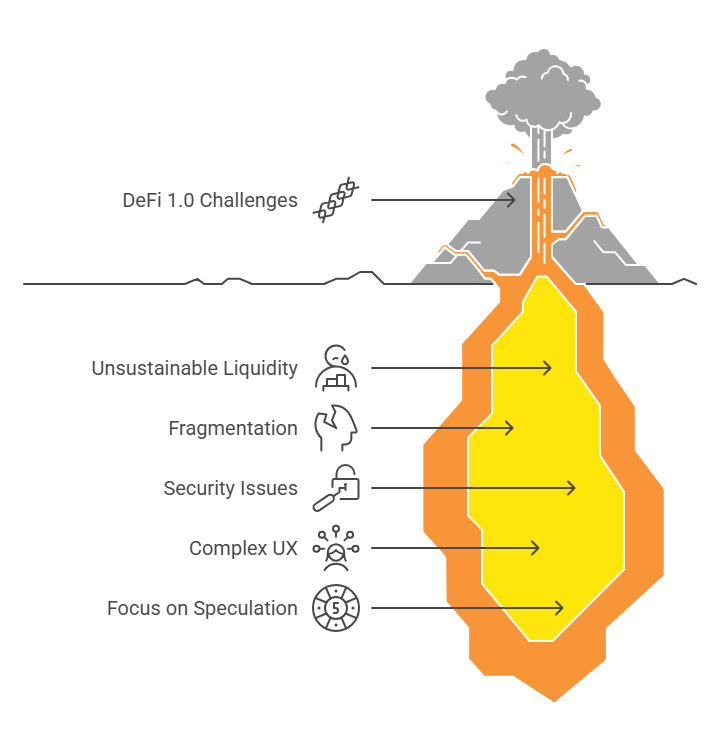

However, like any revolution, DeFi 1.0 faced serious "growing pains":

- Unsustainable Liquidity: Many protocols relied on short-term incentive programs (yield farming) to attract liquidity. Once the rewards dried up, liquidity would leave, leaving protocols "dry." This created instability and a so-called "yield farming war" for capital.

- Fragmentation: As we have discussed multiple times, the emergence of numerous blockchains led to the fragmentation of liquidity and user bases, complicating interaction and reducing overall capital efficiency.

- Security Issues: Bridge hacks, smart contract exploits, and economic attacks became common occurrences, undermining trust in the sector.

- Complex UX: A high barrier to entry for newcomers due to complex interfaces, the need to manage multiple wallets, and understanding technical nuances.

- Focus on Speculation: Many DeFi 1.0 protocols and tokens were more geared towards short-term speculation than creating long-term value and real-world use cases.

The Dawn of DeFi 2.0: In Search of Sustainability and Maturity

Against the backdrop of these challenges, the industry began to seek paths towards a more mature and sustainable model – the so-called DeFi 2.0. Although there is no clear, universally accepted definition of DeFi 2.0 yet, several key characteristics and trends that shape it can be identified:

- Sustainable Liquidity (Protocol-Owned Liquidity - POL): Protocols aim to own their liquidity or ensure its long-term loyalty, reducing dependence on "mercenary" liquidity.

- Risk Management: Greater emphasis on financial and technical risk management mechanisms, insurance, and more sophisticated collateral assessment models.

- Real Yield: A shift from inflationary rewards to yield generated by the protocol's real economic activity (fees, services).

- Improved User Experience (UX): Simplification of interfaces, abstraction of complexity, and solutions for cross-chain interaction.

- Long-Term Value and Governance: Focus on creating products with real utility and developing decentralized governance models (DAOs) geared towards sustainable growth.

Mitosis: A Key Ingredient for DeFi 2.0?

In this context of DeFi's evolution, the Mitosis protocol appears not just as another infrastructure solution, but as a potential catalyst and key component for the emergence of DeFi 2.0. Its core principles and technological solutions directly address many of the "growing pains" of DeFi 1.0 and align with the goals of a new, more sustainable paradigm.

What Will You Learn From This Article?

In this article, we will explore the role Mitosis plays and can play in shaping DeFi 2.0. We will examine:

- How Mitosis's Ecosystem-Owned Liquidity (EOL) model addresses the problem of unsustainable liquidity characteristic of DeFi 1.0.

- How Mitosis's focus on security and efficiency in cross-chain interactions contributes to creating a more reliable and connected DeFi ecosystem.

- How Mitosis can help improve UX and lower barriers to entry in DeFi.

- Why unified liquidity, provided by Mitosis, is the foundation for sustainable growth and innovation in DeFi 2.0.

2. Mitosis Contribution to the Rise of DeFi 2.0

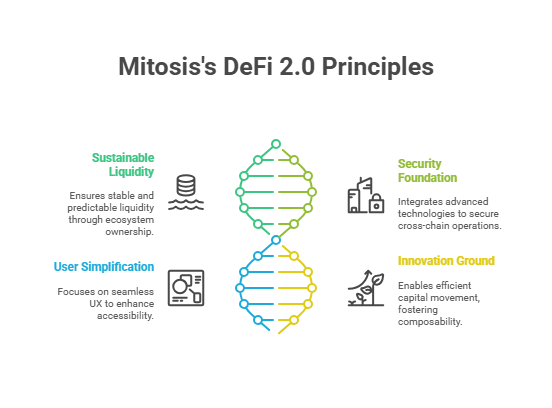

We've identified the key characteristics of DeFi 2.0: sustainable liquidity, improved risk management, real yield, quality UX, and a focus on long-term value. Now let's see how Mitosis, with its technologies and philosophy, contributes to each of these aspects.

1. Solving the Unsustainable Liquidity Problem via EOL

- DeFi 1.0 Problem: "Mercenary liquidity" – arrives for high rewards, leaves when they end, leaving protocols with insufficient market depth.

- Mitosis Approach (Ecosystem-Owned Liquidity - EOL):

- Protocol's Own Liquidity: Instead of being entirely dependent on external liquidity providers (LPs), Mitosis owns a significant portion of its liquidity. This liquidity is accumulated in the Mitosis Treasury (e.g., from a share of fees) and strategically deployed where it is most needed to ensure the smooth operation of cross-chain transfers.

- Stability and Predictability: EOL provides a baseline level of liquidity that won't suddenly disappear. This makes the protocol more resilient to market fluctuations and capital "migration." Users can expect more stable slippage and transaction execution.

- Long-Term Interest Alignment: When a protocol owns its liquidity, its interests are better aligned with the long-term success of the ecosystem, rather than short-term attraction of "yield farmers."

Contribution to DeFi 2.0: Mitosis's EOL is a direct response to DeFi 2.0's need for sustainable liquidity models. It's a step from "rented" liquidity to "owned," which increases reliability and reduces systemic risks.

2. Enhancing Security and Cross-Chain Risk Management

- DeFi 1.0 Problem: Frequent bridge hacks and exploits, undermining trust and leading to huge financial losses.

- Mitosis Approach:

- Security as a Priority: Mitosis is designed from the outset with a strong emphasis on security, using cutting-edge solutions like EigenLayer AVS. This allows it to borrow Ethereum's cryptoeconomic security to protect cross-chain messages, which is orders of magnitude more reliable than traditional multi-sig bridges.

- Reduced Counterparty Risk: Dependence on small, potentially vulnerable groups of bridge validators is diminished.

- Well-Thought-Out Architecture: The separation of messaging logic and liquidity management can also contribute to reducing complexity and potential attack vectors.

Contribution to DeFi 2.0: DeFi 2.0 demands a higher level of security and a mature approach to risk management. By betting on the most reliable available technologies, Mitosis contributes to creating safer infrastructure for interoperability, which is critical for trust and mass adoption.

3. Improving User Experience (UX) and Accessibility

- DeFi 1.0 Problem: Complex interfaces, the need to work with multiple bridges and networks, and high fees – all of which deter newcomers.

- Mitosis Approach:

- Striving for Seamlessness: Mitosis aims to make the cross-chain transfer process as simple and intuitive as possible for the user. Ideally, the user shouldn't even have to think about which bridge or technology is being used "under the hood."

- Speed and Efficiency: Optimizing transaction times and costs makes multichain interactions less burdensome.

- Complexity Abstraction: Mitosis can serve as an infrastructure layer for dApps, which can then offer their users cross-chain functions without them needing to leave the application interface.

Contribution to DeFi 2.0: One of the key promises of DeFi 2.0 is to make decentralized finance accessible to a broader audience. By improving the UX of cross-chain operations, Mitosis helps lower the entry barrier and makes DeFi more user-friendly.

4. Foundation for Real Yield and Innovation

- DeFi 1.0 Problem: Yield was often artificial, based on token inflation, and fragmentation hindered composability and the creation of complex financial products.

- Mitosis Approach:

- Efficient Capital Movement: By enabling a free and cheap flow of liquidity between networks, Mitosis allows capital to find its most productive use, where real yield is generated (e.g., in lending protocols with high loan demand or in real blockchain-based business models).

- Restoring Composability: By simplifying the movement of assets and data between networks, Mitosis creates the foundation for a new level of composability. Protocols from different ecosystems will be able to interact, creating innovative DeFi products that were impossible under total fragmentation.

- Supporting Modularity: In the world of modular blockchains, Mitosis becomes a critically important connecting link, allowing various specialized rollups and appchains to efficiently exchange liquidity and data.

Contribution to DeFi 2.0: Mitosis creates the infrastructure upon which DeFi 2.0 protocols that generate real value can thrive. Unified liquidity is fertile ground for innovation and the construction of more complex and sustainable financial systems.

Thus, Mitosis doesn't just solve the technical problem of cross-chain transfers. It lays down the fundamental components necessary for the entire DeFi industry to transition to a new, more mature stage of development – the DeFi 2.0 stage.

3. Mitosis and the Future of DeFi: Towards a Mature Ecosystem

DeFi 2.0: Not Just Trends, but a Necessity

The transition from DeFi 1.0 to DeFi 2.0 is not just a change in fashionable trends or a marketing ploy. It is a natural evolution driven by the need to solve fundamental problems that have prevented decentralized finance from realizing its true potential. The lessons learned from the turbulent growth and painful falls of the first wave of DeFi have shown that without sustainability, security, and real value, it is impossible to build a long-term and trustworthy financial system.

DeFi 2.0 aims to become precisely such a system – more mature, reliable, and user-oriented. And infrastructure projects capable of providing the necessary foundation play a key role in this transition.

Mitosis: More Than Infrastructure – A Catalyst for Change

As we have seen, Mitosis is more than just a protocol for moving assets. Its architecture and philosophy resonate deeply with the core principles of DeFi 2.0:

- Sustainable Liquidity via EOL: Mitosis directly addresses one of the main "headaches" of DeFi 1.0 by creating a stable and predictable liquidity base owned by the ecosystem itself.

- Security as a Foundation: Integration with cutting-edge technologies like EigenLayer AVS demonstrates Mitosis's commitment to creating a secure environment for cross-chain operations, which is critically important for restoring and strengthening trust in DeFi.

- Simplification for the User: The pursuit of a seamless UX and complexity abstraction makes DeFi more accessible, a necessary condition for mass adoption.

- Creating Fertile Ground for Innovation: By enabling the free and efficient movement of capital and data between networks, Mitosis stimulates composability and allows developers to create more complex and valuable DeFi products that generate real yield.

Mitosis acts not just as a passive observer of DeFi's evolution, but as an active participant and catalyst in this process. By providing reliable rails for liquidity movement in the multichain world, it helps the entire ecosystem move forward, overcoming the limitations of the past.

Conclusion: Mitosis and a New Chapter in the History of Decentralized Finance

The evolution of DeFi is inevitable. The industry is learning from its mistakes and striving to create more perfect, sustainable, and user-oriented financial systems. DeFi 2.0 is the next chapter in this story, and it is being written right now.

Mitosis, with its innovative approach to liquidity (EOL), focus on security, and aspiration for seamless cross-chain interaction, has every chance to become one of the key infrastructural pillars of this new era. It not only solves the problems of DeFi 1.0 but also lays the groundwork for the growth and prosperity of DeFi 2.0 – an ecosystem where liquidity is unified, security is robust, and the user experience is intuitive.

The future of decentralized finance will be determined by the industry's ability to overcome fragmentation, ensure sustainability, and win the trust of a broad audience. And Mitosis is making a significant contribution to achieving these goals, helping DeFi transition from a stage of rapid but chaotic growth to an era of maturity and stable development.

Learn more about Mitosis:

- Explore details on the official website: https://www.mitosis.org/

- Follow announcements on Twitter: https://twitter.com/MitosisOrg

- Participate in discussions on Discord: https://discord.com/invite/mitosis

- Read articles and updates on Medium: https://medium.com/mitosisorg

- Blog: https://blog.mitosis.org/

Comments ()