DeFi Insurance Protocols: How Nexus Mutual and InsurAce Mitigate Risks in Decentralized Finance

In the rapidly evolving world of decentralized finance (DeFi), where smart contracts and blockchain technologies underpin financial operations, the need for robust risk mitigation strategies has become paramount. DeFi platforms are revolutionizing traditional finance by offering transparent, decentralized, and borderless financial services. However, with this innovation comes increased exposure to various risks, including smart contract vulnerabilities, hacks, and systemic failures within protocols. To address these concerns, decentralized insurance protocols like Nexus Mutual and InsurAce have emerged as pivotal players, offering innovative solutions to safeguard users against these risks and provide peace of mind to investors and DeFi participants.

The Rise of Decentralized Finance (DeFi) and the Need for Insurance

DeFi applications have grown exponentially, offering a wide array of services, such as lending, borrowing, decentralized exchanges (DEXs), and yield farming. However, unlike traditional financial systems, the DeFi ecosystem operates without intermediaries, which means the risk of smart contract bugs, malicious attacks, and hacking is a constant concern.

As the market capitalization of DeFi grows, so does the need for risk mitigation, and insurance is an essential component of this. Traditional insurance models rely on centralized intermediaries like insurance companies, which act as middlemen between policyholders and those providing coverage. However, in the world of decentralized finance, the insurance models have adapted to leverage blockchain technology to eliminate the need for intermediaries while offering transparent, secure, and peer-to-peer insurance solutions.

Nexus Mutual: A Community-Driven Insurance Model

Nexus Mutual operates as a decentralized insurance platform built on the Ethereum blockchain. The platform utilizes a mutual insurance model, where members pool resources to provide coverage for specific risks associated with DeFi protocols and smart contracts. This mutual cover model is quite different from traditional insurance, where a centralized entity determines premiums and claims.

Key Features of Nexus Mutual:

- Smart Contract Coverage: Nexus Mutual allows users to purchase coverage for individual smart contracts, which helps mitigate the risks associated with vulnerabilities, hacks, and bugs in the code of smart contracts. Given that many DeFi platforms rely on complex smart contracts to manage assets and transactions, this coverage provides essential protection for users.

- Fund Portfolio Coverage: In addition to coverage for individual smart contracts, Nexus Mutual also offers protection for entire portfolios of DeFi assets. This coverage is particularly appealing to institutional investors, who often have large portfolios and need protection against systemic risks such as smart contract exploits, governance attacks, and platform failures.

- Governance and Claims Assessment: Nexus Mutual’s governance structure is based on its native token, NXM, which is held by members. These token holders participate in the platform’s governance and claims assessment processes. When a claim is made, it is evaluated by the community of NXM holders, who vote to determine whether the claim should be paid out. This decentralized decision-making process ensures that the platform is governed by its users, maintaining the ethos of decentralized finance.

- Integration with DeFi Protocols: Nexus Mutual collaborates with many of the top DeFi protocols, such as Compound, Aave, and Uniswap, to offer coverage for their smart contracts. This integration ensures that users of these platforms can easily obtain coverage for their investments, adding an extra layer of security to the DeFi ecosystem.

- Sustainability and Capital Efficiency: Nexus Mutual is designed to be sustainable in the long term. Its capital efficiency is achieved through the use of a risk-pooling model, which allows it to cover a wide range of risks while keeping premiums lower than traditional insurance models. This setup ensures that the platform can remain viable and competitive in the growing DeFi space.

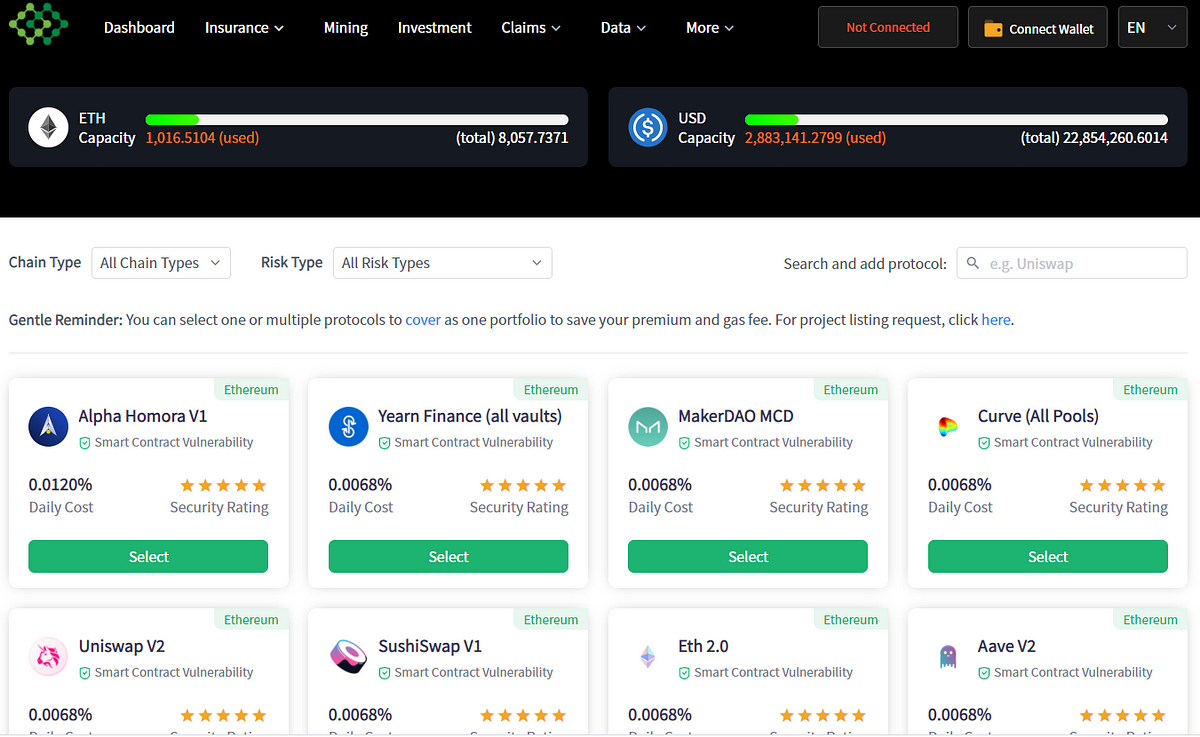

InsurAce: Comprehensive Coverage Across the DeFi Landscape

Another prominent player in the DeFi insurance space is InsurAce, a decentralized insurance protocol that offers comprehensive coverage solutions to mitigate the risks faced by DeFi users. InsurAce distinguishes itself by providing a range of insurance products, including smart contract insurance, exchange insurance, and more.

Key Features of InsurAce:

- Portfolio-Based Coverage: InsurAce provides a more holistic insurance solution by allowing users to bundle multiple DeFi protocols into a single insurance portfolio. This approach reduces premiums and simplifies the process for users who are active in multiple DeFi platforms. It is especially useful for investors looking to insure a diversified portfolio rather than individual assets or protocols.

- Smart Contract and Custody Coverage: InsurAce offers coverage against risks associated with smart contracts, as well as custodial risks tied to centralized exchanges or platforms. This is crucial because even though many DeFi protocols are decentralized, some users still interact with centralized exchanges for trading or liquidity provisioning. These exchanges are vulnerable to hacking and other risks, and InsurAce ensures that users’ assets are protected.

- Claims Assessment Process: Like Nexus Mutual, InsurAce relies on a decentralized claims assessment process. The community plays a role in evaluating claims, with participants voting to determine whether or not a payout should be made. This decentralized approach ensures fairness and transparency while also maintaining the integrity of the system.

- Multi-Chain Support: One of the unique features of InsurAce is its multi-chain support, allowing users to insure assets on various blockchains. Whether users are involved in Ethereum, Binance Smart Chain (BSC), or other blockchain ecosystems, InsurAce enables them to obtain coverage across multiple platforms, further expanding its user base and offering more flexible coverage options.

- Risk Pooling and Capital Efficiency: InsurAce utilizes a decentralized risk pooling model, where users can stake capital to create liquidity pools that back insurance coverage. This pooling system ensures that the platform can cover a wide range of risks while maintaining capital efficiency. This helps the platform remain sustainable as it grows and attracts more users.

Comparative Overview: Nexus Mutual vs. InsurAce

| Feature | Nexus Mutual | InsurAce |

|---|---|---|

| Coverage Model | Mutual Cover | Portfolio-Based Coverage |

| Governance | NXM Token Holder Participation | Community Participation |

| Claims Assessment | Decentralized via NXM Token Holders | Decentralized Community Involvement |

| Integration with DeFi | Extensive (e.g., Compound, Aave) | Broad (Multiple DeFi Protocols) |

| Target Audience | Individual and Institutional Investors | Individual and Institutional Investors |

| Smart Contract Coverage | Yes | Yes |

| Multi-Chain Support | No | Yes |

The Role of DeFi Insurance in the Future of Finance

The rapid expansion of decentralized finance calls for an equally rapid evolution of the systems designed to manage and mitigate risk. Traditional insurance models are not well-suited for the dynamic and decentralized nature of DeFi, which is why platforms like Nexus Mutual and InsurAce are so important. They offer tailored solutions that help users secure their investments in an ecosystem that is still in its infancy.

As the DeFi space continues to mature, it is likely that insurance protocols will become even more sophisticated, incorporating advanced features like risk modeling, dynamic pricing, and additional layers of coverage. The continuous integration of DeFi insurance with new and existing protocols will lead to broader adoption, and more users will feel confident engaging in decentralized finance knowing their assets are protected.

Conclusion

Both Nexus Mutual and InsurAce play essential roles in enhancing the security and reliability of the DeFi ecosystem. They provide innovative and decentralized insurance products that help mitigate the risks associated with smart contract vulnerabilities, hacks, and platform failures. As decentralized finance continues to grow, the importance of these insurance protocols in fostering a secure and resilient financial environment cannot be overstated. Through decentralized risk-sharing, transparency, and community governance, platforms like Nexus Mutual and InsurAce are paving the way for a more secure DeFi future, helping users protect their investments and encouraging further growth in the space.

References

Comments ()