DeFi Lending: How to Earn, Borrow, and Stay Ahead

What is DeFi Lending?

DeFi lending, short for Decentralized Finance lending, is a blockchain-driven platform that allows people to lend or borrow cryptocurrency assets without relying on a trusted third party or traditional financial institutions. In contrast to conventional lending, where banks serve as middlemen, DeFi lending employs smart contracts to automate and safeguard transactions, resulting in a more transparent and efficient system.

The DeFi lending process usually consists of lenders putting money into lending pools on decentralized platforms, while borrowers utilize those funds by offering collateral in cryptocurrencies. These systems can be accessed by anyone with a crypto wallet, providing open access to financial services irrespective of location or credit background.

Why DeFi Lending is Transforming the Financial System

The rise of DeFi is transforming the worldwide financial system by removing obstacles and providing users greater control over their assets. Traditional banking systems depend on centralized organizations and strict regulations, frequently leaving out individuals who lack adequate credit histories or income proofs. In contrast, DeFi platforms offer equal chances to everyone, facilitating involvement in the open market with reduced limitations.

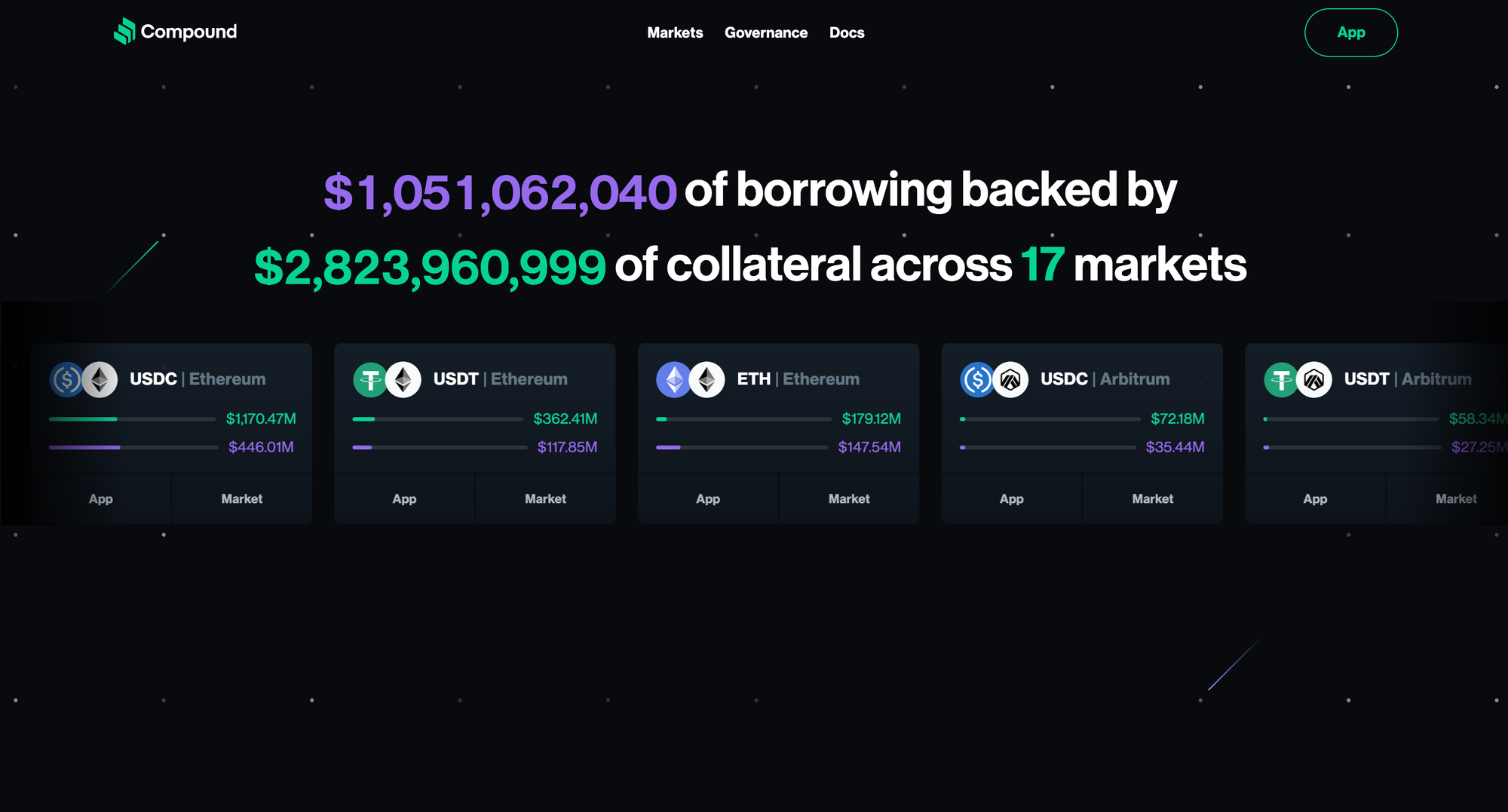

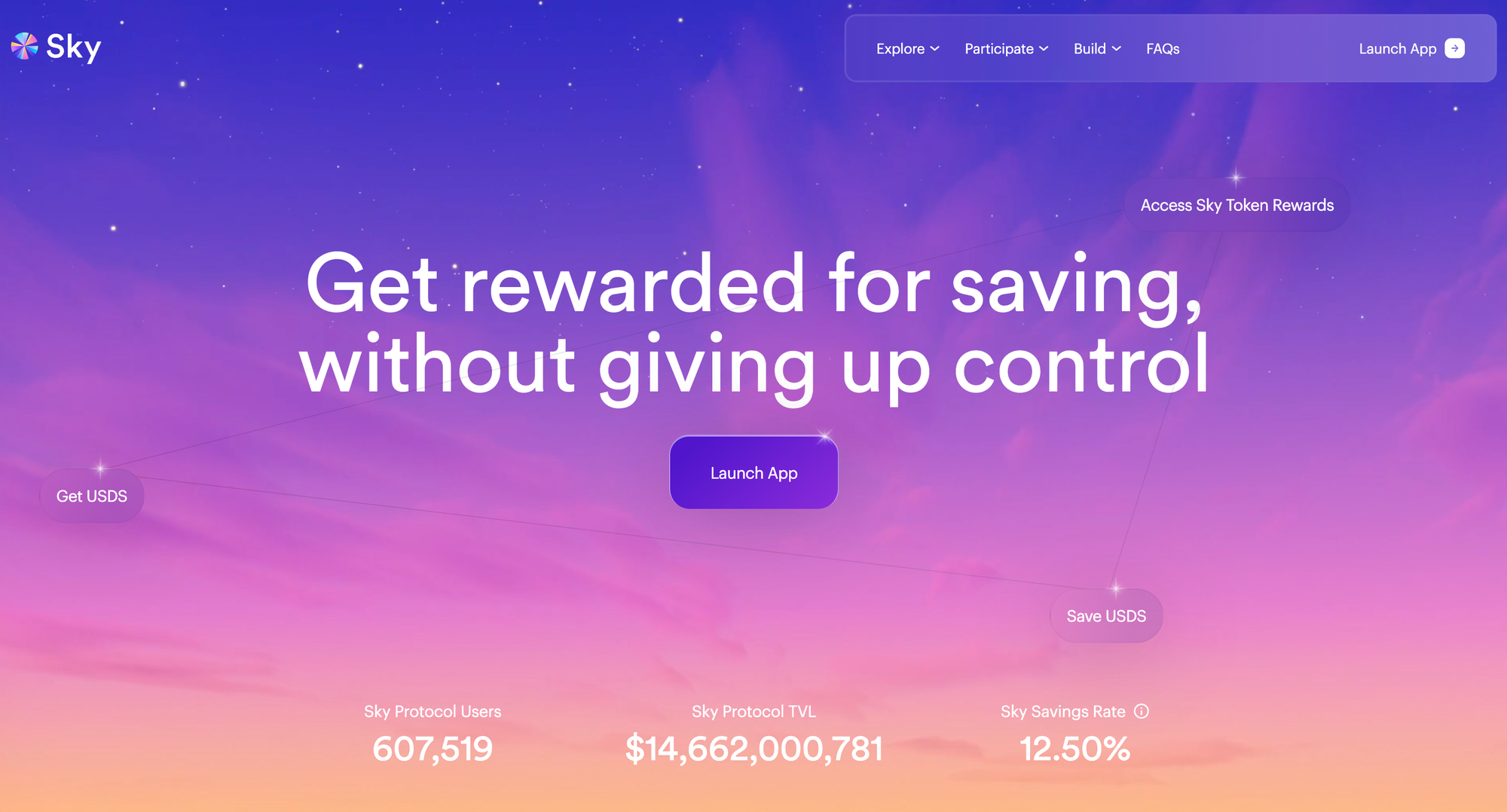

The total value locked (TVL) in DeFi lending protocols has surged to $100 billion as of January 2024, with platforms like Aave, Compound, and Sky Protocol leading the way. Sky Protocol, formerly known as MakerDAO, announced its rebranding in August 2024, introducing SKY as its new governance token and USDS as an upgraded stablecoin available from September 2024. The explosive growth underscores DeFi’s ability to revolutionize financial services by providing accessible, decentralized options and introducing innovative tools such as flash loans and fixed interest rates.

How Does DeFi Lending Work?

Decentralized Platforms and Lending Pools Explained

DeFi lending protocols function on decentralized platforms. These platforms utilize blockchain technology to substitute conventional banks, facilitating peer-to-peer lending and borrowing activities. Here’s the way the DeFi lending process works:

- Lenders Contribute Assets: Participants deposit resources (e.g., ETH, USDS, or USDC) into a liquidity pool overseen by the platform.

- Borrowers Obtain Capital: Borrowers provide crypto assets as collateral to secure the loan, ensuring its value is protected.

- Variable Interest Rates: Lending rates are influenced by supply and demand, fostering a competitive atmosphere for lenders and borrowers alike.

For instance, adding USDC to Compound's money market enables users to generate passive income while borrowers use the liquidity from the pool. The whole procedure is regulated by smart contracts, guaranteeing transparency, precision, and removing the need for manual involvement.

Role of Smart Contracts and Open-Source DeFi Protocols

Smart contracts serve as the backbone of DeFi applications, automating loan terms, collateral handling, and repayments. Being open-source, these contracts can be audited, which enhances security and builds trust among users. Platforms such as Chainlink provide price feeds to evaluate collateral, guaranteeing system stability.

Moreover, decentralized protocols remove the requirement for personal information, ensuring financial confidentiality. Both borrowers and lenders gain advantages from the secure, inclusive, and transparent processes facilitated by blockchain technology.

Benefits of DeFi Lending

Accessibility and Open Access

One of the biggest reasons for DeFi lending’s popularity is its accessibility. In contrast to conventional banks that demand credit evaluations and prolonged approval procedures, DeFi protocols enable anyone with a crypto wallet to get involved. For example, people in areas with restricted banking systems can reach global financial markets via platforms such as Aave or Compound. This open access facilitates financial inclusion for unbanked and underbanked communities globally, closing gaps created by traditional financial institutions.

Opportunities for Generating Passive Income

In DeFi, lenders generate passive income by placing their money into lending pools. These deposits accrue interest, usually exceeding that of standard savings accounts, which generally provide an APY of under 1%. Lending USDS on Aave can yield 4-8% APY, depending on supply-demand dynamics and market conditions. Along with interest, certain platforms offer governance tokens to token holders, adding an additional layer of benefits. This dual-income opportunity makes DeFi lending attractive for generating steady returns.

To explore more ways to optimize earnings through strategies like staking and liquidity provision, check out the guide on Yield Strategies for DeFi Lending.

Transparency and Control

Unlike centralized systems, where entities establish loan terms and oversee finances, DeFi platforms provide full transparency. The level of transparency minimizes hidden fees, fosters user confidence, and ensures total oversight of finances. DeFi lending protocols allow users to participate in a fairer and more transparent financial system by eliminating intermediaries.

Risks and Challenges in DeFi Lending

Volatility of Collateralized Assets

The natural instability of crypto assets presents considerable dangers for lenders and borrowers in DeFi lending protocols. Borrowers must offer collateral exceeding the borrowed amount, yet market changes can significantly diminish the value of that collateral. This may initiate liquidation, in which the platform sells the collateral to reclaim the loan. For instance, in the 2022 market downturn, numerous Aave borrowers forfeited their collateralized ETH as its value dropped significantly.

Risk Management Tip: To lessen the effects of volatility, borrow carefully and think about using stablecoins such as USDC for collateral. Stablecoins are tied to fiat currencies, minimizing the risk of severe price fluctuations.

Smart Contract Risks and Security Issues

Although smart contracts enhance and simplify the lending procedure, they are still susceptible to weaknesses. Vulnerabilities in the code can lead to considerable losses. For example, the 2020 bZx exploit enabled cybercriminals to manipulate DeFi protocols and deplete funds, highlighting the dangers associated with inadequately secured platforms.

Risk Management Tip: Opt for platforms that have had their smart contracts comprehensively audited and demonstrate a history of dependability. Seek out those who consistently refresh their code and utilize external security assessments to protect assets.

Regulatory Challenges and Taxable Events

The growing DeFi space has attracted more attention from governments, resulting in regulatory ambiguity. Limitations on specific DeFi applications or lending services might restrict platform access. Moreover, generating interest or rewards from DeFi platforms usually qualifies as a taxable event, necessitating users to declare their profits.

Risk Management Tip: Keep updated on the regulatory environment of DeFi in your area. Maintain thorough documentation of your lending transactions, encompassing earned interest, rewards, and any possible taxable occurrences. Seeking advice from a tax expert knowledgeable about cryptocurrency regulations can assist you in remaining compliant and sidestepping unforeseen liabilities.

Learn More About Managing DeFi Risks

Navigating regulatory challenges and taxable events is just one part of managing risks in DeFi lending. To better understand common pitfalls and how to address them, explore our guide on Top 5 Risks in DeFi Lending and How to Manage Them.

Types of DeFi Lending

Collateralized Loans

Collateralized loans are the most common type of lending in the DeFi ecosystem. Borrowers lock up crypto assets like ETH, BTC, or stablecoins as collateral to secure a loan. The value of the collateral must exceed the value of the loan, ensuring lenders are protected against borrower defaults.

For instance, platforms such as Sky Protocol enable users to create USDS by putting up ETH as collateral. When a borrower secures $10,000 in ETH and takes out a $5,000 loan in USDS, their collateralization ratio stands at 200%, offering protection from price changes. If the collateral value decreases significantly from market fluctuations, the system will automatically sell it to settle the loan.

This over-collateralized framework is crucial for preserving confidence in decentralized lending protocols, as it removes the requirement for credit assessments or personal information.

Flash Loans

Flash loans represent a distinctive and novel aspect of DeFi lending protocols, enabling users to obtain funds without needing to offer collateral. Nonetheless, the borrowed amount has to be paid back within the identical blockchain transaction. If repayment does not succeed, the transaction is reversed, guaranteeing no risk for the lender.

These loans are typically used for more sophisticated use cases such as:

- Arbitrage: Gaining profits from price discrepancies on decentralized exchanges.

- Liquidation: Settling under-collateralized loans on alternative platforms.

- Collateral Swaps: Modifying the collateral securing a loan without the need for a manual repayment.

For example, a trader might take out a $1,000,000 flash loan to buy an undervalued token on one platform and then sell it for a higher price on another. If the trade yields a profit post fees, the trader retains the surplus.

Flash loans necessitate technical knowledge and are mainly utilized by developers, traders, and market makers for specific opportunities in the DeFi space.

Uncollateralized Loans

Beyond flash loans, uncollateralized loans are emerging as a potential breakthrough in crypto lending. These loans rely on credit-based systems, where the borrower’s on-chain activity, reputation, or external verification determines their creditworthiness.

Platforms like TrueFi are pioneering this concept by enabling borrowers to provide real-world documentation or establish trust through decentralized identity solutions. Unlike collateralized loans, this model removes the need for borrowers to lock up assets, opening lending opportunities for users with limited digital assets.

While still in its infancy, uncollateralized loans could drive mass adoption by addressing the limitations of over-collateralized systems. However, they also pose greater risks to liquidity providers, making strong risk management frameworks essential for their success.

Learn more about how collateralized and uncollateralized loans differ in DeFi by exploring: Collateralized vs. Uncollateralized Loans in DeFi: What’s the Difference?

Peer-to-Peer (P2P) Lending

P2P lending returns DeFi to its origins by facilitating direct connections between lenders and borrowers without depending on liquidity pools. Platforms such as Atomic Loans enable users to set terms like fixed interest rates, repayment timelines, and loan lengths.

The procedure is regulated by smart contracts, guaranteeing that each party meets their responsibilities. For instance, a lender could provide a loan with a 6% interest rate for a duration of three months, with the borrower consenting to use BTC as security.

P2P lending provides greater flexibility compared to pool-based systems and can address specific niche requirements. Nonetheless, its implementation has progressed at a slower pace because of the manual work needed to align parties and set terms.

Top DeFi Lending Platforms

Aave Protocol

- Unique Features:

- Flash loans for instant borrowing.

- Collateral swaps to adjust collateral without liquidation.

- Multi-chain support, including Ethereum and Polygon.

- Best For: Advanced users seeking innovative tools and flexibility in crypto lending.

Compound

- Unique Features:

- User-friendly interface for easy navigation.

- Dynamic interest rates based on supply and demand.

- Best For: Beginners new to DeFi lending who want a straightforward platform.

Sky Protocol (formerly, MakerDAO)

- Unique Features:

- Minting USDS (formerly DAI), a decentralized stablecoin pegged to the US dollar.

- A strong focus on stablecoin lending for borrowers.

- Best For: Borrowers prioritizing stablecoin lending and long-term stability.

Comparison at a Glance

| Platform | Unique Features | Lending Rates | Best For |

|---|---|---|---|

| Aave | Flash loans, multi-chain, collateral swaps | Competitive | Advanced users |

| Compound | Stable APYs, simplicity | Moderate | Beginners |

| Sky Protocol | Minting USDS, stablecoin focus | Moderate-High | Borrowers seeking stability |

What Makes These Platforms Stand Out?

Each platform serves different needs within the DeFi ecosystem, whether you’re a beginner exploring lending pools, an advanced user leveraging flash loans, or a borrower focused on stablecoin solutions. Choose the platform that aligns with your goals and risk tolerance.

The Future of DeFi Lending

Cross-Chain Lending: Unlocking New Opportunities

The upcoming stage of DeFi lending is propelled by progress in cross-chain lending, which removes the constraints of single-chain protocols. By facilitating smooth asset transfers between various blockchains, cross-chain lending provides access to a variety of liquidity pools, lowering transaction expenses and improving yield possibilities across ecosystems. Platforms such as Avalanche and Polygon provide users with reduced fees and more appealing lending rates than Ethereum, rendering cross-chain lending a vital aspect of a dynamic and competitive DeFi ecosystem.

Programmable Liquidity: Driving Scalability

Programmable liquidity improves efficiency by reallocating funds dynamically based on real-time market demand. Platforms like Mitosis lead the way in this innovation, providing modular liquidity solutions that enhance capital movement and minimize fragmentation across blockchains. These innovations not only tackle operational issues but also improve the scalability and accessibility of DeFi lending protocols for borrowers and liquidity providers alike.

Modular Liquidity: Building a More Interconnected Future

Modular liquidity is emerging as a fundamental element of the DeFi ecosystem, enabling platforms to connect effortlessly across decentralized applications. Modular liquidity promotes the use of sophisticated financial instruments and guarantees that DeFi stays responsive to users' changing needs by enabling seamless asset transfers and steady liquidity provision across networks.

A More Efficient DeFi Ecosystem

As cross-chain and modular liquidity solutions evolve, they are creating a future in which DeFi lending protocols are not limited to individual ecosystems. Instead, the focus is on creating a more interoperable and inclusive financial system. This change embodies the wider goal of DeFi: enabling crypto owners, borrowers, and liquidity contributors to utilize a simplified and adaptable framework of decentralized financial offerings.

Through these advancements, DeFi lending is set to transform the functioning of financial systems, establishing a more fair and effective environment for users globally.

Comments ()