DeFi’s Core Challenge: Unlocking True Capital Efficiency

Most DeFi protocols used in the crypto world suffer from two major issues that don’t help solve this dilemma. When users deposit assets into these protocols, their positions become static and illiquid.

These assets get locked and can no longer be used elsewhere to generate additional yield, leading to inefficiencies across the board.

This reminds me a lot of the early days of PoS, when a massive portion of networks’ native tokens were locked in staking. Sure, the staking process is crucial for network security and validation, but it also created a serious capital efficiency issue.

The solution?

The rise of Liquid Staking Tokens (LST).

On the podcast, Jake, co-founder of Mitosis, admits that when he began his journey as a crypto builder, his biggest ambition was to develop an LST protocol, back when no one was even talking about the concept.

He may have been a bit too early for that wave, and his initial proposal didn’t receive the backing it deserved.

But things are different now… because today, he’s bringing a similar value proposition to DeFi, this time focused on liquidity positions rather than staked tokens.

Mitosis: The Programmable Liquidity Network

Mitosis is a protocol designed to transform liquidity positions in DeFi into programmable components, while simultaneously addressing fundamental market inefficiencies.

When users deposit assets into Mitosis Vaults across different blockchains, they receive Hub Assets on the Mitosis Chain that represent those deposits. There are currently two distinct vault models:

➢ Ecosystem-Owned Liquidity (EOL), accessed through the Expedition Campaign, and

➢ Matrix Vaults, accessed via curated campaign deposits like Theo Straddle or Zootosis.

EOL enables collective management of pooled assets through democratic governance, where participants vote on allocation strategies.

Matrix Vaults, on the other hand, allow direct participation in liquidity campaigns with predefined terms.

Both models issue specialized tokens: miAssets for EOL and maAssets for Matrix Vaults, tokenized representations of users’ positions.

Remember that example we talked about earlier with LSTs replacing regular staking?

Once LSTs were introduced, their utility exploded: they started being used in liquidity pools, accepted as collateral in money markets, and protocols like Pendle broke them down into PT and YT, unlocking new strategies and significantly increasing capital efficiency.

Now, let’s connect that to Mitosis.

The logic is very similar. But instead of unlocking capital from staked native tokens, Mitosis is applying the same concept to DeFi liquidity positions.

So what does that mean for you?

After depositing into a Mitosis Vault (either EOL or Matrix) you’ll receive yield from the respective strategy, while also maintaining a liquid position via miAssets or maAssets issued on the Mitosis Chain.

And here’s where it gets even more powerful: on the EVM-compatible Mitosis Chain, you can deploy your miAssets or maAssets in all sorts of DeFi operations across the Mitosis Ecosystem:

➢ Provide liquidity in DEXs

➢ Use as collateral in money markets

➢ Loop your positions with Multiply Vaults

➢ Split into PT/YT in Pendle-style yield protocols

➢ And countless other DeFi strategies

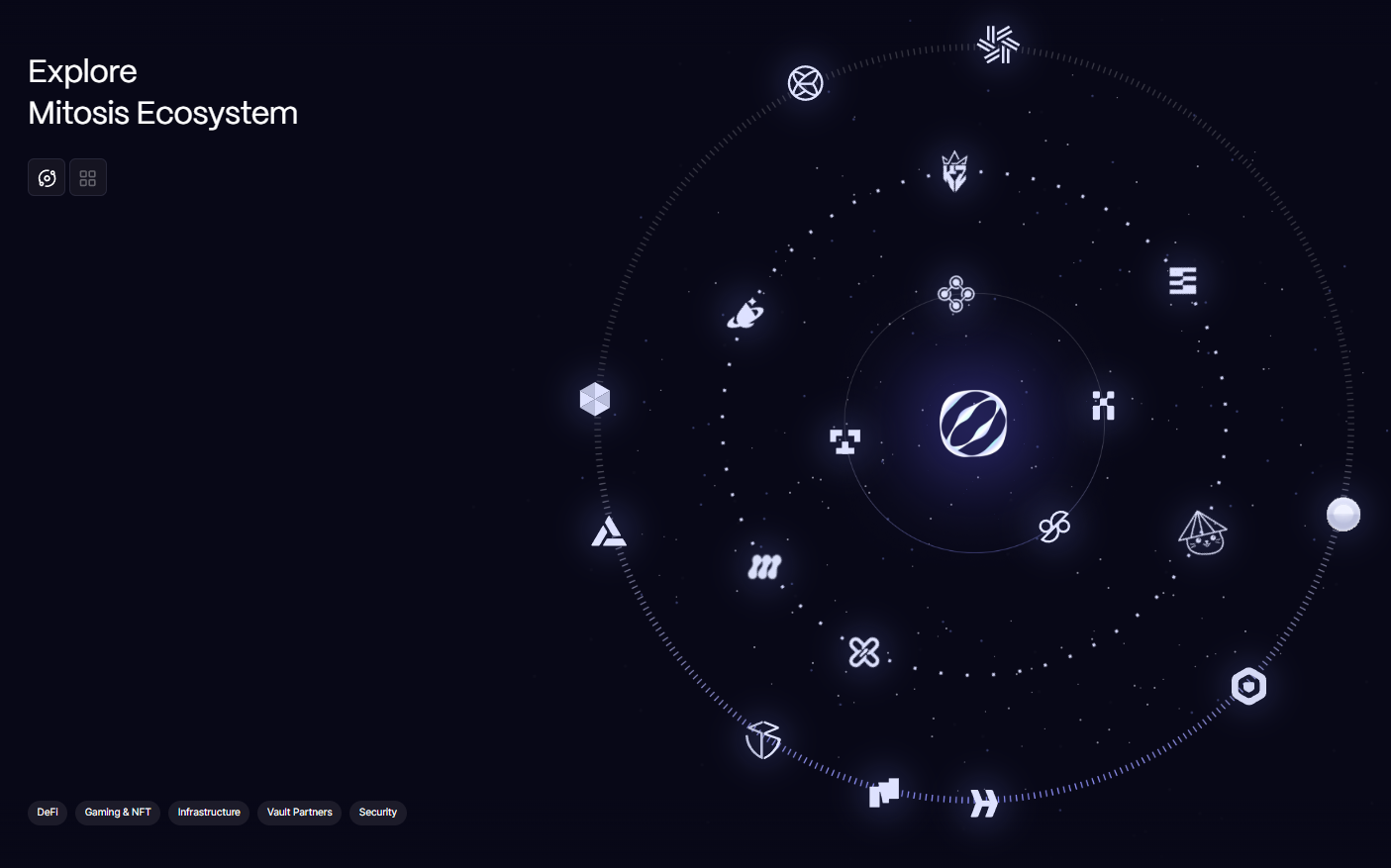

Some of the live protocols in the Mitosis ecosystem

➢ Chromo Exchange | AMM DEX

➢ Telo Money | Money Market

➢ Clober DEX | On-chain order book infra

➢ Spindle | Yield trading platform (PT/YT)

➢ Zygo Finance | Perp DEX

➢ Milky Way | Liquid staking protocol

➢ Stork Oracle | Oracle & Infra

➢ Hyperlane | Interop & Infra

➢ Mikado Hub Labs | Games & NFT

➢ Yieldkingz | Games & NFT

➢ Morse_404 | Games & NFT

➢ and many more…

Mitosis – The Programmable Liquidity Network

This ability to turn traditionally illiquid DeFi positions into tokenized, tradable, and composable assets is exactly what “Mitosis – The Programmable Liquidity Network” is all about.

Through this comprehensive approach, Mitosis sets a new paradigm in DeFi liquidity, where positions are no longer just passive stores of value, but programmable components in a sophisticated financial system.

But capital efficiency isn’t the only problem Mitosis is tackling.

Another key issue is the access gap in yield opportunities, something that exists in both CeFi and DeFi.

The most profitable strategies are usually reserved for large investors who can negotiate private deals for higher returns, creating a deeply unequal playing field.

Mitosis flips that model

By pooling retail capital into collective vaults, it negotiates better yield terms on behalf of all participants, democratizing access and redistributing advantages once locked behind closed doors.

By combining democratized access to high-yield strategies with cutting-edge financial engineering, Mitosis builds the foundation for a more efficient, equitable, and innovative DeFi ecosystem.

And that wraps up this article…

where I’ve tried to break down the core mechanics and vision behind Mitosis and the powerful concept of the Programmable Liquidity Network.

Throughout the article, I also included some insights from Jake’s appearance on

PukeCast.

If you want to understand more about his background and the roots of the Mitosis

vision, I strongly recommend watching the full interview.

Finessing Guards, Yeeting into VIP Parties, Cooking Anchor — @Jake_on_me’s Insane Glow-Up with @MitosisOrg 😮💨

— Pukecast (@pukecast) May 30, 2025

00:28 - Crypto Come-Up :

Jake slid into crypto in 2018, bet big on a staking idea at a Cosmos event, but it flopped. Flipped to @keplrwallet , now flexing 2M+ users.… pic.twitter.com/2k1CNOiczK

Did you enjoy this content?

If it helped you in any way, I’d really appreciate your support!

Feel free to connect with me on Twitter/X, and if you’d like to send a Praise, my Discord is open too. 🙏

Thanks in advance for your trust and support — it means a lot! 🙌

Follow me on Twitter/X: febarce |DeFi

My Dircord: febarce |DeFi

Check out my other articles

Comments ()