DeFi’s TVL Boom Meets Mitosis: Unlocking Cross-Chain Liquidity in a $153B Market

Introduction: DeFi TVL Hits New Highs, Multichain Momentum Builds

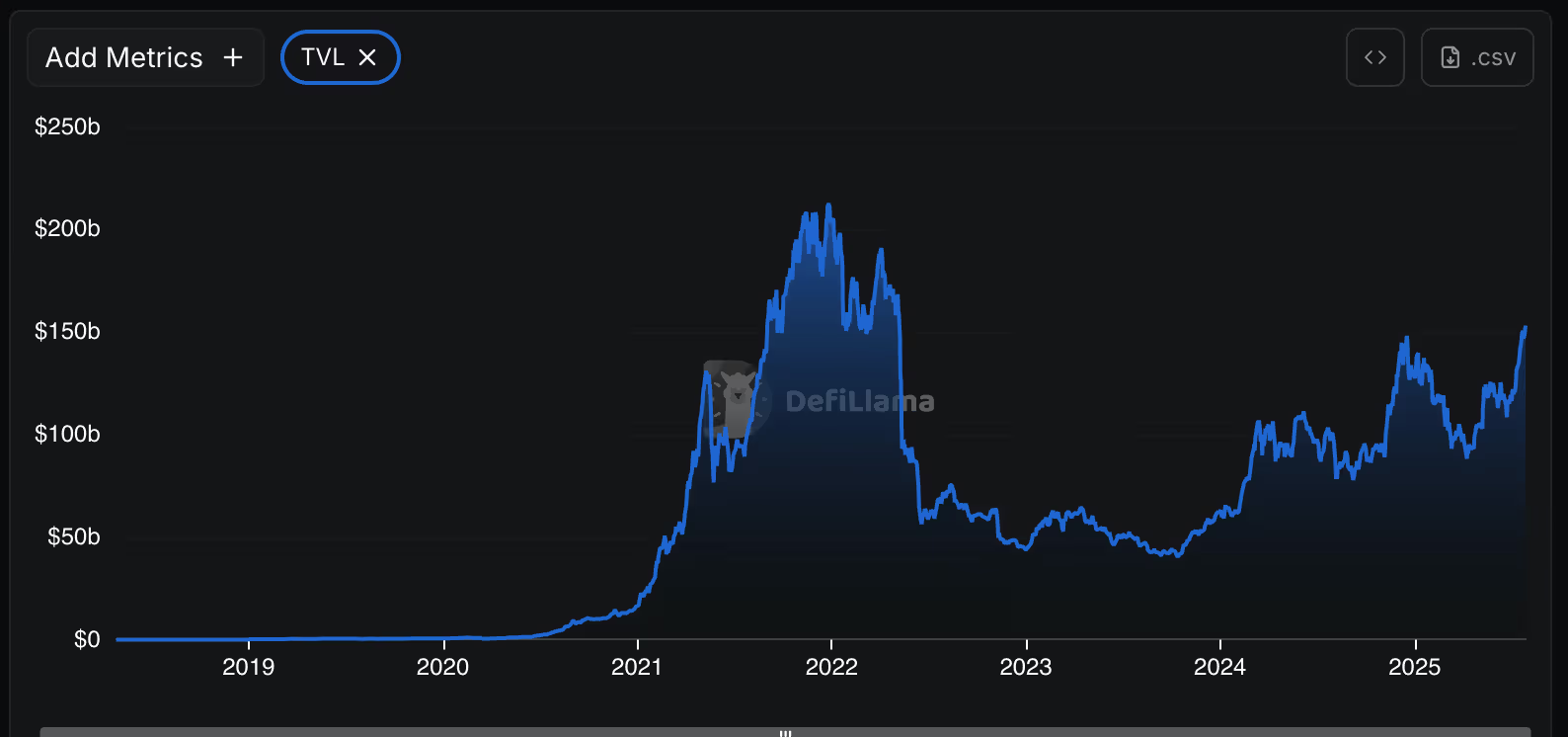

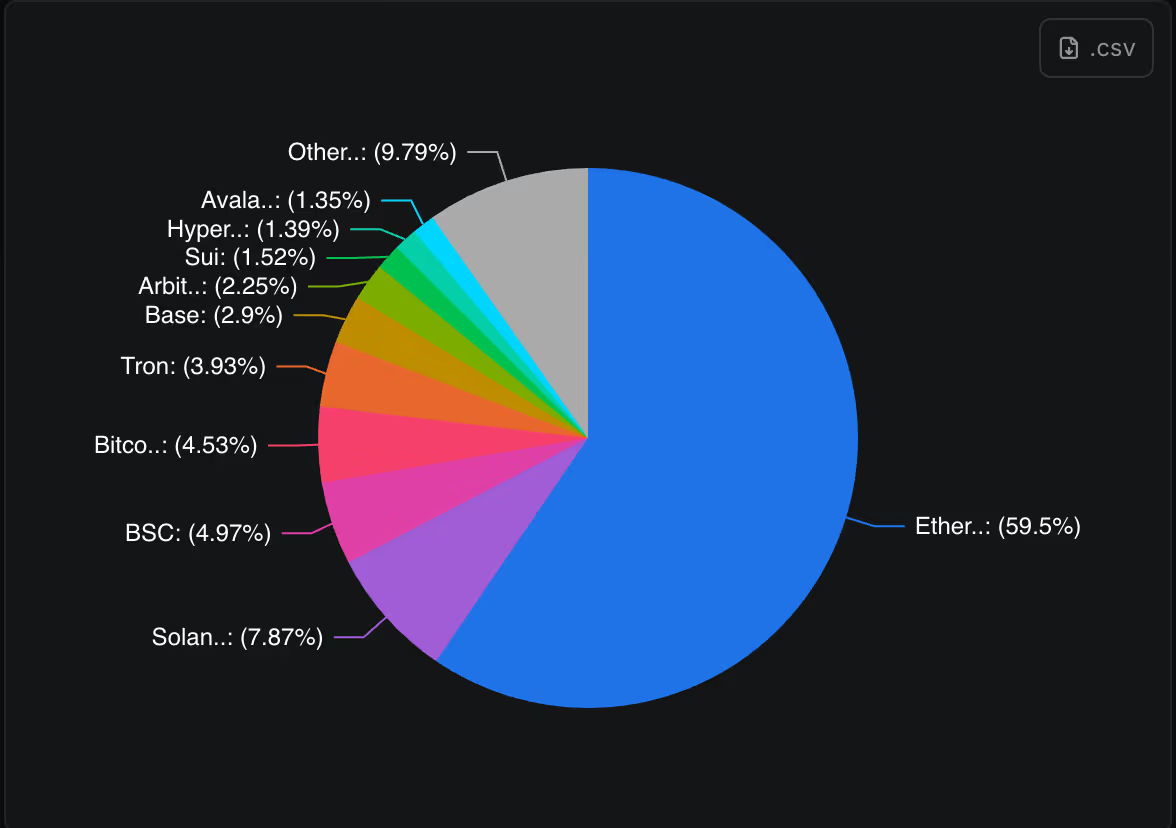

The decentralized finance (DeFi) sector is experiencing a renaissance. Total value locked (TVL) in DeFi just surged to around $153 billion, marking a three-year peak not seen since mid-2022. This resurgence is fueled by a potent mix of rising crypto prices (ETH soaring ~60% in a month) and fresh capital chasing yields across protocols and chains. Ethereum remains the dominant hub – commanding nearly 60% of all DeFi capital – largely thanks to cornerstone protocols like Lido (liquid staking) and Aave (lending), each boasting over $30B TVL on Ethereum alone. But the story doesn’t end on Ethereum. A wave of activity is lifting other ecosystems too: Solana, Avalanche, and even newer networks like Sui have seen double-digit TVL growth, signaling that cross-chain opportunity is in vogue.

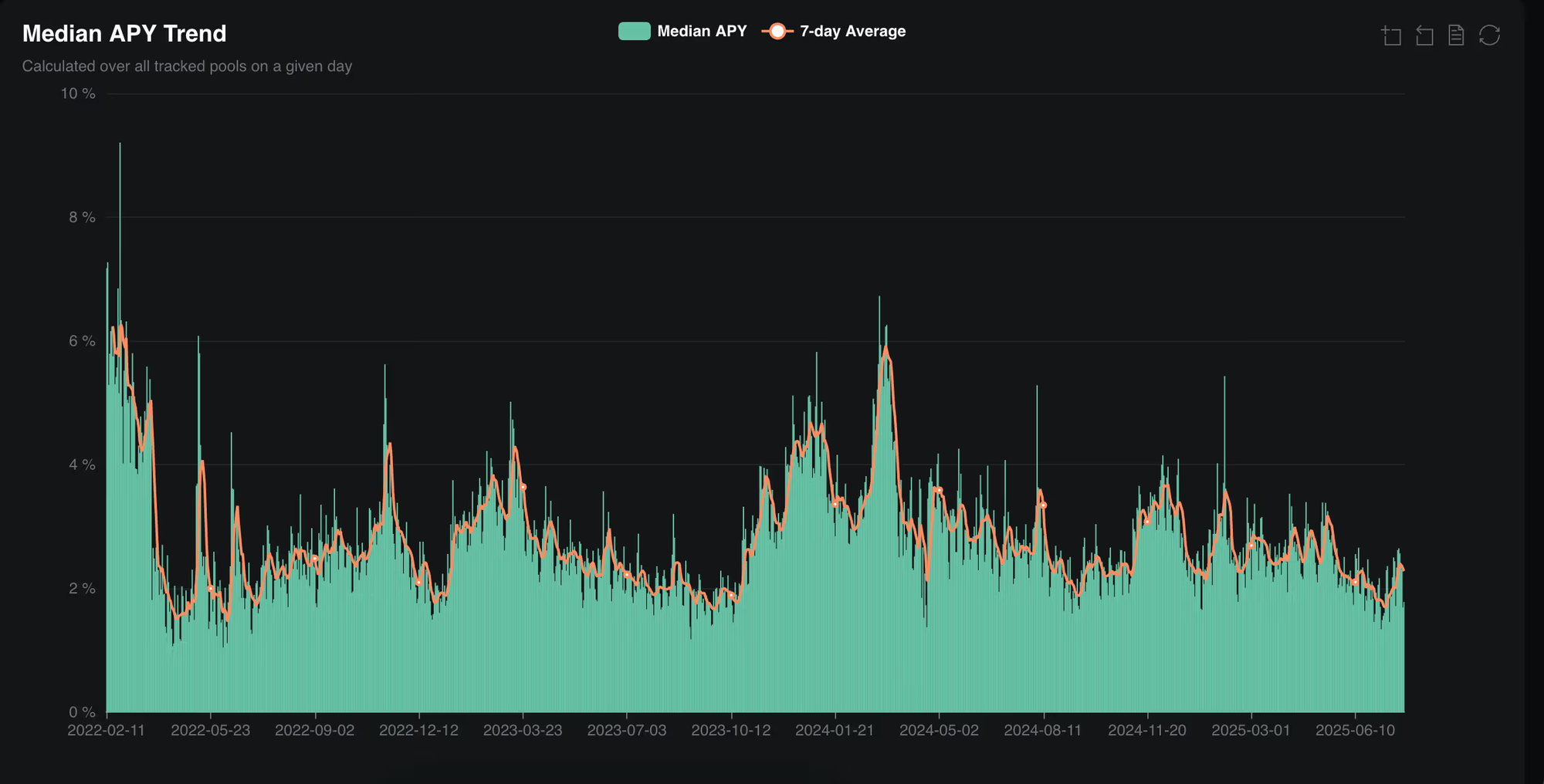

This TVL boom underscores a broader trend: investors aren’t just holding crypto, they’re deploying assets aggressively to farm yield. Beyond basic staking, many are embracing advanced strategies – for example, “looping” stablecoin loans across protocols like Euler and Spark (MakerDAO’s lending platform) to earn up to 25% APY with low risk. Crucially, these juicy yields often span multiple platforms and even multiple chains. However, capitalizing on cross-platform yields has traditionally been a headache. Shuffling funds from Ethereum to an L2, or between an L1 like Avalanche and back to Ethereum, can involve clunky bridges, high fees, and significant risk. Each blockchain has been a silo with its own isolated opportunities, making it hard for users to fluidly chase the best returns. In short, DeFi may be decentralized, but it hasn’t been unified – liquidity is fragmented and stuck in each chain’s walled garden.

Enter Mitosis. Just as this multichain yield frenzy hits a fever pitch, Mitosis is emerging as a protocol designed to tear down those walls. Mitosis is a new cross-chain liquidity network purpose-built to let capital flow wherever the yields and opportunities are, without the usual friction. In this post, we’ll explore how Mitosis’s design and philosophy align perfectly with the current DeFi landscape – one where cross-chain yield farming, real yield strategies, and TVL optimization are front and center. We’ll also draw an analogy to the biological process of mitosis (cell division) to illustrate how the Mitosis blockchain grows ecosystems modularly, and examine how it could become a backbone for DeFi’s next chapter by integrating with heavyweight protocols like Aave, Lido, Spark, and more.

Mitosis: Unifying Liquidity in a Fragmented DeFi Universe

Mitosis is on a mission to unstick liquidity. Today’s DeFi user often has to hop between networks: one day Ethereum for a yield farm, the next day an Arbitrum lending pool, maybe a Solana vault after that. Moving assets around is tedious and risky – as many have learned from notorious bridge hacks and painful wait times. Mitosis tackles this head-on by acting as a universal liquidity layer that connects multiple blockchains. Think of it as a liquidity router for DeFi: instead of juggling a dozen wallets and bridges, you deposit into Mitosis once and gain the freedom to deploy that liquidity on any supported chain with ease. As the Mitosis team puts it, it’s like giving your capital a passport to travel wherever the best opportunities arise, automatically and securely.

How does Mitosis achieve this? At its core, the protocol introduces the concept of programmable, cross-chain liquidity. When you deposit assets into Mitosis’s smart contracts (called Matrix Vaults), your funds are locked on their origin chain and you receive miAssets (e.g. miUSDC, miETH) in return. These miAssets are 1:1 token representations of your liquidity within the Mitosis system, and they are the key that unlocks seamless movement. With miAssets, you can swap, lend, or farm across any connected chain without manually bridging every time. For example, deposit USDC on Ethereum, get miUSDC, and you can instantly put that miUSDC to work on, say, a Polygon yield farm or an Avalanche lending market through Mitosis – all from one interface. Mitosis’s infrastructure handles the cross-chain settlement behind the scenes using secure fast-finality bridges and light-client verification, so your liquidity moves swiftly but safely. In essence, Mitosis builds “liquidity highways, not toll booths,” enabling capital to flow freely instead of getting stuck at each chain’s border.

By making liquidity chain-agnostic, Mitosis addresses the fragmentation problem directly. No more siloed pools that can’t interoperate – Mitosis treats all connected chains as part of one fluid ecosystem. This means as a user, you don’t have to worry about which chain has the best yield this week; with Mitosis your assets can be wherever they’re most effective almost on demand. The result is not only convenience, but also improved capital efficiency for DeFi as a whole. Idle funds on one chain can find productive use on another, and yield opportunities aren’t missed due to the frictions of moving money around. In a period where everyone is hunting for the best returns, that flexibility is golden.

From Cell Division to Chain Expansion: Mitosis’s Modular Growth Philosophy

Even the name Mitosis hints at how this project views growth. In biology, mitosis is the process by which a cell divides to form two identical cells, each carrying the same DNA. It’s nature’s way of multiplying resources and growing an organism in a modular, resilient fashion. The Mitosis protocol takes inspiration from this organic process – it’s designed so that liquidity and functionality can replicate and spread across networks, growing the overall DeFi ecosystem in a modular way (almost like new “cells” in a larger organism).

How does this analogy play out in practice? Consider that every time Mitosis connects to a new blockchain or integrates a new DeFi protocol, it’s akin to a cell dividing and creating a new cell. The new environment gains the full “genetic code” of Mitosis’s capabilities: programmable liquidity, yield strategies, and seamless interoperability. Each chain added via Mitosis doesn’t have to reinvent DeFi liquidity from scratch – it inherits a copy of the Mitosis toolkit (vaults, miAssets, etc.), just like a daughter cell inherits DNA. This modular expansion means Mitosis-based liquidity can propagate into emerging ecosystems rapidly, helping nascent chains bootstrap DeFi activity by tapping into a unified liquidity pool. In the biological world, mitosis enables exponential growth; in the blockchain world, Mitosis enables an expanding web of interconnected liquidity hubs.

Another aspect of the analogy is coordination. In multicellular life, cells communicate and work in concert to keep the organism healthy. Similarly, Mitosis ensures that all these “liquidity cells” across different chains remain coordinated parts of one whole. For instance, if one chain (or “cell”) is experiencing congestion or an overload of capital (imagine a spike of deposits chasing a yield there), Mitosis can redistribute or clone that liquidity to other chains where it’s needed, maintaining balance. By growing modularly, Mitosis avoids single-chain bottlenecks – much like how having many cells allows an organism to handle stress better than a single-celled creature. This modular blockchain approach is a big shift from the old monolithic model where one chain had to do everything. Mitosis exemplifies the modern modular blockchain philosophy: decouple tasks, spread out workload, and allow specialization, all while staying interoperable.

In simple terms, Mitosis’s design means the ecosystem can scale organically. Need more capacity or a new yield strategy? Spin up a new vault or connect another chain – Mitosis can integrate it without disrupting the existing system, just as organisms grow by adding more cells. This synergy of biology and blockchain isn’t just a gimmick; it’s reflected in Mitosis’s architecture being multi-layered and extensible. There’s a Matrix layer for user-facing vaults and an EOL layer for protocol-level liquidity coordination, ensuring each new “cell” or module can plug in at the appropriate layer and immediately start contributing to the whole. The end result is an ever-expanding, living network of liquidity that can grow and adapt along with DeFi’s evolution.

Real Yield, Everywhere: Cross-Chain Farming Powered by Mitosis

One of the most exciting implications of Mitosis is how it enables real yield strategies across chains. In today’s DeFi boom, “yield farming” is back in a big way – but it’s far more sophisticated than the liquidity mining of 2020. Farmers now chase real yield (revenues from fees or interest, not just token emissions) and often stack multiple strategies: think staking ETH for staking rewards, then borrowing against it to farm stablecoin yields, etc. Doing this on a single chain is complex enough; doing it across multiple chains can be a nightmare of transactions and bridges. Mitosis makes it simple by treating yield opportunities on any chain as part of one big buffet that your liquidity can sample from.

Consider a concrete example. Suppose you have ETH and you want to maximize its yield. With Mitosis, you could deposit that ETH into a Mitosis Matrix Vault and receive miETH. Now miETH is like a supercharged deposit receipt – it’s earning base yield because Mitosis can stake the underlying ETH in a restaking or lending protocol, and miETH stays liquid so you can use it elsewhere. With your miETH, you could farm on a decentralized exchange on Arbitrum, provide liquidity to an Avalanche DEX, or collateralize a loan on an L2, all at the same time. In fact, Mitosis’s Ecosystem-Owned Liquidity (EOL) system is specifically built to let one deposit earn yield simultaneously from multiple sources. As the Mitosis documentation highlights, an LP could deposit ETH and get miETH, and that single position might concurrently earn lending interest from Aave, staking rewards via Lido, and trading fees from a DEX – all at once! This kind of omni-sourced yield turns the traditional one-dimensional yield farm on its head. Instead of hopping in and out of different protocols, you stay in Mitosis and let Mitosis allocate slices of your liquidity to various yield streams in parallel.

The benefit is twofold: you maximize returns and also reduce risk of missing out. No more pulling funds from one pool (losing that yield) to try something on another chain. Mitosis effectively spreads your capital like a savvy farmer planting crops in different fields, ensuring you’re always capturing the best of what’s out there. For users, this greatly lowers the bar to access complex strategies – what previously required expert knowledge and constant attention can become as easy as depositing into a Mitosis vault that automates cross-chain yield optimization. And for the DeFi ecosystem, it means liquidity becomes highly fluid and efficient. Capital goes where it’s treated best, and it can do so on demand. High-yield opportunities on smaller chains won’t languish just because users are hesitant to bridge over; Mitosis can pour liquidity in quickly. This helps balance yields across the market (if one opportunity gets overcrowded, yield drops and Mitosis can route funds elsewhere) and prevents extreme arbitrage gaps between chains.

It’s worth noting that these aren’t just theoretical benefits – early tests show Mitosis’s model working in practice. During Mitosis’s testnet phase (“Game of MITO”), tens of thousands of users tried out cross-chain strategies, and the platform facilitated huge volumes, demonstrating that people want this kind of flexibility. With over $80M TVL amassed in a few months of testing, it’s clear there is appetite for a one-stop cross-chain yield engine. Now, as DeFi enters a new cycle of growth, Mitosis is well-positioned to serve as the yield farming hub that connects all corners of the multichain universe.

Integration Potential: Aave, Lido, Spark and the Making of a DeFi Backbone

If Mitosis realizes its vision, it could become a foundational backbone for DeFi strategies – akin to an underlying liquidity highway that many protocols ride on. Let’s explore how Mitosis might integrate with some of the biggest DeFi players:

- Aave (Lending): As one of DeFi’s largest lenders, Aave thrives on having deep liquidity in its markets. Currently, Aave is deployed on multiple networks (Ethereum, Polygon, Avalanche, etc.), each with separate capital pools. Mitosis can supercharge Aave by funneling liquidity to whatever chain Aave yields are most attractive at a given time. For example, if borrowing demand (and thus interest rates) spikes on Aave’s Polygon market, Mitosis could seamlessly shift more stablecoins into Polygon to lend out, capturing that yield for its users while helping Aave fill demand. Conversely, if Ethereum’s Aave has better rates, liquidity can flow back. This dynamic allocation means Aave gets a unified liquidity pool across chains – effectively erasing the silo between, say, Aave on Ethereum and Aave on Optimism. Mitosis’s EOL mechanism even enables protocol-to-protocol collaboration, so Aave could potentially co-own vaults on Mitosis or use Mitosis as a backend to balance its cross-chain liquidity needs. The end result is a more capital-efficient Aave and better, more stable yields for users.

- Lido (Liquid Staking): Lido’s liquid staking derivatives like stETH (staked Ether) have massive TVL and are integral to Ethereum’s yield landscape. Yet today, using stETH beyond Ethereum (e.g. on other chains) relies on ad-hoc bridges or wrapper tokens. With Mitosis, a Lido staker could deposit stETH into a Mitosis vault and receive, for instance, miStETH. That miStETH is not stuck on Ethereum – it could be used as collateral on a lending protocol in an L2, or supplied to a farm on another chain, all while continuously accruing staking rewards in the background. This unlocks true cross-chain utility for liquid staking tokens. Lido benefits by seeing its staked assets gain usage across the entire DeFi spectrum via Mitosis, potentially increasing demand for staking. Meanwhile, Mitosis users benefit by getting the “real yield” from Ethereum staking plus extra yield elsewhere. The earlier example of earning from Lido + Aave + DEX simultaneously is a perfect illustration – Mitosis could route part of the miETH into Lido for staking yield, and use that same asset in Aave for lending interest, etc. Lido’s dominance in TVL (over $16B as of mid-2025 on Ethereum alone) could extend even further when those assets become mobile via Mitosis.

- Spark (MakerDAO’s Lending Arm): Spark Protocol is a newer entrant (launched in 2025) but quickly climbed the ranks as a top DeFi lending platform, focused on DAI-centric markets. In fact, Spark saw a rapid TVL increase (nearly 40% in one month) making it the 6th-largest DeFi protocol by mid-2025 – a testament to the appetite for efficient stablecoin yield. Spark is essentially an Aave v3 fork tailored for DAI, and it even operates on custom layers (like a so-called Unichain for Maker’s ecosystem). This is exactly the kind of scenario Mitosis shines in: connecting siloed but high-yielding environments to the broader liquidity pool. Through Mitosis, a user could tap Spark’s attractive DAI lending rates without manually bridging DAI into Maker’s niche chain. Mitosis can allocate DAI liquidity into Spark wherever it lives, and bring the returns back to its users. Moreover, if Spark is expanding to multiple chains, Mitosis can serve as the cross-chain glue ensuring Spark’s interest rates equilibrate and its liquidity is optimally distributed. Essentially, Mitosis can act as Spark’s multichain liquidity partner, driving more deposits to Spark (since Mitosis LPs would vote to deploy liquidity where yields like Spark’s are juicy) and giving users easy access to Spark’s offerings. In a world where an advanced strategy might loop assets between Euler and Spark on different networks, Mitosis could handle that loop behind the scenes – automating what is currently a power-user trick into a one-click strategy for the average user.

- Other Protocols: The integration potential doesn’t stop at these three. Yield aggregators, decentralized exchanges, restaking services, and new appchains can all plug into Mitosis. Because Mitosis is permissionless at the protocol layer, any project can create a vault or campaign to attract liquidity via Mitosis. For example, a new DEX on an emerging L2 could launch a Mitosis vault to attract stablecoin liquidity from across the multichain world, rather than just relying on the funds already on that L2. Protocols like Compound, Curve, or Spark’s future iterations could similarly use Mitosis’s EOL to rent or share liquidity instead of competing for it in isolation. Over time, this could make Mitosis something of a common layer that many DeFi applications use for liquidity – a true backbone where liquidity is pooled, then funneled out to various front-end protocols as needed.

If this vision plays out, the DeFi experience would change fundamentally: users might interact with a single interface (Mitosis Matrix) to deploy capital, and under the hood that capital might be working in Aave, Lido, Spark, Uniswap, you name it, all coordinated by Mitosis. It’s a win-win-win scenario: users get the best yields with minimal hassle, protocols get more consistent liquidity and reach, and the ecosystem as a whole becomes more composable and efficient. Mitosis’s cross-chain composability ensures that using one protocol doesn’t mean foregoing opportunities on another – everything remains interoperable. By aligning incentives through features like EOL (where protocol and users co-own the liquidity and share rewards), Mitosis also curbs the “mercenary capital” issue and encourages a more loyal liquidity base. All these points suggest that Mitosis could quietly become the connective tissue of a multichain DeFi world.

Securing and Scaling DeFi in a Multichain World

As DeFi scales across chains, new challenges emerge: network congestion, security risks from bridging, and liquidity getting fragmented in ways that can cause inefficiencies or even vulnerabilities. Mitosis is strategically positioned to help secure and stabilize this multichain expansion.

Mitigating Congestion: Anyone who tried using Ethereum during a hype cycle knows that congestion and spiking gas fees can derail strategies (or make them unprofitable). In the current TVL boom, if one chain gets congested, users and liquidity need to spill over to other chains to keep things flowing. Mitosis makes this adaptive liquidity rebalancing much smoother. It can shift users’ funds to less congested chains when needed, without them having to manually intervene. For instance, if Ethereum gas fees skyrocket, yield opportunities on cheaper Layer-2s like Optimism or Base become more attractive – Mitosis can automatically route new deposits or even migrate some liquidity to those L2s to dodge the congestion costs. Later, if Ethereum cools down or a unique opportunity arises there, Mitosis can bring liquidity back. This flexibility not only optimizes user returns (you’re not stuck earning 0% because you can’t afford to move to the hot new L2 farm) but also helps chains load-balance. Essentially, Mitosis acts like a traffic router for blockchain activity, alleviating pressure on any single network by utilizing the highways available on others. In doing so, it contributes to a more scalable DeFi environment where high user activity can be absorbed across many platforms.

Enhanced Security via Trust-Minimization: Bridge exploits have been the bane of cross-chain DeFi, with billions lost in hacks when bridges failed. Mitosis tackles this risk by using a native L1 blockchain as its base and employing robust cross-chain communication methods (fast finality bridges with light client proofs, decentralized verification, etc.). By handling the bridging in-house with security top of mind, Mitosis reduces reliance on third-party bridges that often have centralized weak points. Liquidity providers in Mitosis don’t have to constantly transfer assets through unknown bridges; they entrust the Mitosis system to mirror their assets across chains safely. Additionally, because Mitosis uses a vault + tokenized asset model (miAssets and so on), the movement of liquidity is abstracted – your actual asset might stay locked in a secure vault on the source chain while only its representation moves. This containment limits the attack surface. Moreover, the EOL governance adds an extra layer of security: decisions on deploying liquidity can be voted on by the community, creating transparency about which protocols or bridges are utilized. If a certain cross-chain route is deemed risky, Mitosis participants can collectively steer away from it. In short, Mitosis aims to make cross-chain as secure as staying on one chain, dissolving the false choice between diversification and safety.

Smoothing Liquidity Inefficiencies: In a multichain world without Mitosis, you often see weird inefficiencies – one chain’s DEX might have a huge surplus of, say, USDC, making yields low, while another chain has a shortage, leading to high borrow rates or trading fees. These imbalances persist only because capital isn’t moving freely. Mitosis’s unified liquidity layer obliterates these arbitrage gaps over time. High yields on one chain quickly attract Mitosis liquidity until yields normalize, while low-yield, capital-rich pools might see outflows through Mitosis to more productive uses. This creates a more stable DeFi economy with less extreme discrepancies. It also means protocols can rely on ongoing liquidity rather than short-term mercenaries – because with EOL, liquidity is sticky and shared, not just chasing the next pool blindly. For users, this translates to less volatility in returns and a more predictable yield environment (a lending rate on one chain won’t skyrocket or crash as easily when a wider base of liquidity can flow in to balance it).

In sum, Mitosis contributes to the robustness of DeFi’s multichain future. It helps avoid nightmare scenarios where one chain’s issues ripple uncontrollably through the ecosystem. By providing a common liquidity safety net, Mitosis can contain and redistribute pressures, whether they’re spikes in usage, security threats, or capital inefficiencies. This makes DeFi more resilient – akin to a well-designed power grid that can reroute electricity to prevent blackouts in one area from cascading. With Mitosis, the DeFi community gains a measure of insurance that as we onboard more users and more chains, the system can bend without breaking.

Conclusion: The Next DeFi Cycle – Mitosis at the Core

The return to a $153B+ TVL shows that DeFi is not only alive but evolving. Unlike past cycles, this resurgence isn’t confined to one chain or one type of yield; it’s happening everywhere at once, from Ethereum’s dominance in staking and lending to surging opportunities on alternative L1s and rollups. Such an environment demands connective tissue – a way for users and liquidity to seamlessly navigate the sprawling landscape. Mitosis is poised to be that connective layer. By making liquidity programmable, portable, and composable across chains, it transforms the old limitations (bridges, silos, fragmented yields) into a new paradigm where DeFi truly works as a unified ecosystem.

We’ve seen how Mitosis can enhance liquidity movement, empower cross-chain yield farming, and even draw inspiration from cell division to grow modularly. Its design – featuring Matrix vaults for user-friendly access and EOL for collaborative liquidity – hits right at the heart of DeFi’s current needs. As protocols like Aave, Lido, and Spark continue to attract billions in TVL, Mitosis can amplify their reach and effectiveness, acting as the multichain liquidity engine that pumps value wherever it’s most productive. In doing so, Mitosis doesn’t compete with these protocols; it completes them, offering a symbiotic relationship where all parties benefit from greater connectivity.

Looking forward, if the broader crypto market keeps climbing (as bold predictions like $250K BTC and $10K ETH suggest might happen), the influx of users and capital will likely flood every corner of DeFi. Cross-chain activity could explode as people seek yields on all platforms. This is the scenario Mitosis was practically built for. It could very well become the highway system for this new wave, ensuring that a boom in one area (say a hit dApp on an appchain) can immediately be accessed by capital from another area (Ethereum, L2s, etc.) via its liquidity highways. By acting as a backbone and an accelerant, Mitosis might play a key role in shaping the next DeFi cycle – one where the user experience is smoother, opportunities are more evenly distributed, and the entire ecosystem grows more interconnected and resilient.

In conclusion, the DeFi TVL boom is a sign of things to come: more growth, more chains, and more innovation in yield. Mitosis stands ready to tie these threads together. It offers a vision of DeFi where your money isn’t bound by one chain’s limits but can mitotically spread and multiply across the cryptoverse. As we ride this new cycle, keep an eye on Mitosis – it’s not just riding the multichain trend, it’s helping to define how the multichain future will function. In the financial world’s great experiment of decentralization, Mitosis could be the key that makes the whole greater than the sum of its parts. Here’s to an interconnected, liquid, and thriving DeFi ecosystem, with Mitosis helping to drive the next chapter of innovation.

Useful links:

Comments ()