Democratizing Liquidity Mitosis

How Mitosis Governance Shapes Yield Strategies

In the rapidly evolving world of decentralized finance (DeFi), liquidity is king. However, the way liquidity is sourced, deployed, and rewarded remains one of the most complex and often opaque aspects of the ecosystem.

Introducing Mitosis - a protocol that introduces a groundbreaking approach to DeFi liquidity through Customizable liquidity building blocks. Central to this innovation is democratized governance, which empowers participants to directly shape liquidity strategies through active decision-making by the users incoporation with the ecosystem. In this article, we explore how Mitosis uses governance, specifically through the Ecosystem-Owned Liquidity (EOL) framework to give users control over capital deployment and yield generation.

The Problem: Opaque and Inefficient Liquidity Allocation

Traditional DeFi systems face challenges like capital inefficiency, lack of fair market price discovery, and unstable TVL (Total Value Locked). In many cases, large players strike exclusive deals with DeFi protocols, leaving smaller participants with limited opportunities and minimal influence over capital flows. This imbalance creates an ecosystem where liquidity providers (LPs) may earn suboptimal yields, and protocols suffer from unsustainable liquidity models.

Mitosis tackles this with a unique approach that tokenizes LP positions and introduces collective governance through the EOL framework, ensuring all participants—not just whales—can vote on how capital is allocated across the ecosystem.

EOL: A Governance-Led Liquidity Engine

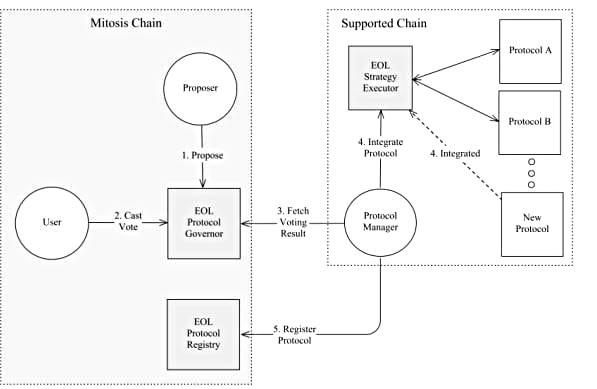

The Ecosystem-Owned Liquidity (EOL) framework within Mitosis allows users to pool their assets and deploy them in a governance-driven manner. When users deposit assets into EOL, they receive miAssets, which represent their share of the liquidity pool and confer voting rights. These rights are not just symbolic—they directly influence protocol integration and liquidity allocation decisions.

Governance in Action: Initiation and Gauge

EOL governance operates through a two-phase process:

- Initiation Governance – Users propose and vote on which DeFi protocols should be integrated into the EOL system. Proposals are reviewed based on yield structure, risk profile, technical integration, and strategic value.

- Gauge Governance – Once protocols are approved, miAsset holders vote on how much liquidity to allocate to each. This voting process occurs in recurring epochs, using a Time-Weighted Average Balance (TWAB) model to ensure fairness and prevent manipulation.

This dual-phase structure ensures both strategic onboarding and dynamic capital reallocation—empowering the community to collectively manage liquidity with surgical precision.

Liquidity Providers as Decision Makers

Unlike most DeFi platforms where users simply stake and wait, Mitosis invites its users to become active decision-makers. miAsset holders wield substantial influence:

- Decide which protocols get access to EOL liquidity

- Vote on the volume of liquidity directed toward each integrated protocol

- Influence yield distribution models and reward structures

This transforms liquidity providers from passive yield farmers into stakeholders with strategic influence over the protocol’s direction. Their votes aren’t just for show; they are tied directly to real asset flows and returns.

Settlement and Rewards: Transparent and Fair

Once capital is deployed, the EOL framework features a settlement system that ensures transparent accounting of yields, losses, and extra rewards:

- Yield Settlements: When protocols generate returns in the same asset, the system mints new Vanilla Assets to reflect gains, increasing the miAsset value.

- Loss Settlements: If a strategy underperforms, Vanilla Assets are burned to reduce miAsset value.

- Extra Rewards: Rewards like governance tokens are distributed either in real time or via periodic claims, depending on the asset type.

This transparent mechanism ensures that users see the exact results of their governance decisions—good or bad.

Governance Participation Challenges (and Solutions)

Of course, governance systems are only as strong as their participation levels. Mitosis recognizes two potential challenges:

- Low Participation – Many users may not have time to vote or stay informed.

- Expertise Gaps – Some participants may lack the knowledge to assess technical proposals.

To address this, Mitosis plans to implement delegation mechanisms:

- Stakeholder Delegation: Users can delegate their votes to experienced strategists.

- Application-Level Delegation: Governance rights can be automatically assigned when users interact with specific dApps.

These features aim to increase participation while maintaining decentralized principles, ensuring governance decisions reflect collective intent, not just a vocal minority.

Why This Matters: A More Democratic DeFi

In traditional finance, major capital decisions are often made behind closed doors. Mitosis flips that model by embedding capital allocation decisions into a transparent, on-chain governance system. This democratization ensures:

- Equal Access to Yield Opportunities

- Transparent Capital Flows

- Sustainable Protocol Growth

By tokenizing liquidity and enabling democratic control, Mitosis creates a more inclusive financial system where users don’t just participate in yield generation they design it.

The Bigger Picture: Infrastructure for Programmable Liquidity

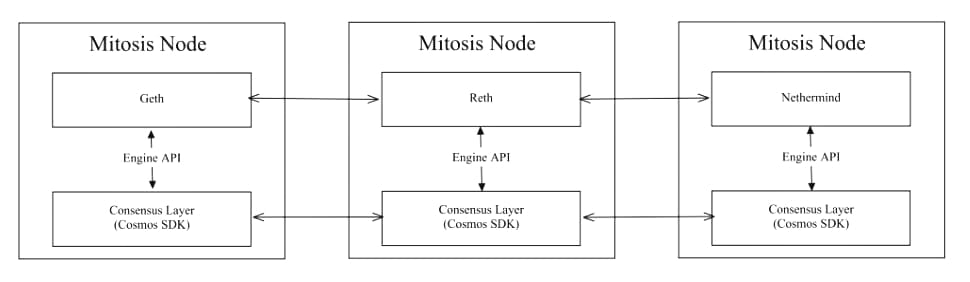

Mitosis doesn’t stop at governance. It provides the infrastructure for a full liquidity capital market powered by its native blockchain built on Cosmos SDK and an EVM-compatible execution layer.

Tokenized LP positions (like miAssets and maAssets) become composable building blocks for:

- Lending markets: refer to decentralized platforms or mechanisms within the Mitosis ecosystem that allow users to lend their digital assets in exchange for interest or to borrow assets by providing collateral. These markets would likely be built using smart contracts, enabling seamless, trustless transactions between borrowers and lenders within the Mitosis framework. Lending markets within Mitosis could help users earn returns on their idle assets by lending them to others, while borrowers could access liquidity without having to sell their assets. This could be crucial for liquidity management, enabling users to take advantage of their holdings or raise capital without needing to liquidate their positions, all while benefiting from the flexible and transparent infrastructure provided by Mitosis.

- Automated market makers (AMMs): Automated Market Makers (AMMs) are decentralized protocols that facilitate cryptocurrency trading without traditional order books or centralized intermediaries. Instead of matching buyers and sellers, AMMs rely on smart contracts and liquidity pools to execute trades algorithmically. These pools use mathematical formulas to determine asset prices based on the ratio of tokens within the pool, enabling seamless token swaps in decentralized exchanges (DEXs).

- Yield tokenization protocols: is referred to the mechanisms within the ecosystem that enable users to tokenize the future yield or returns generated from assets within the Mitosis platform. These protocols would allow individuals to convert their expected earnings, such as rewards or interest from staked assets or liquidity pools, into tradable tokens. This would enhance liquidity, allowing users to trade, leverage, or transfer their future income streams within the Mitosis ecosystem.

Such protocols could create additional flexibility and value within Mitosis by offering a way for users to monetize their anticipated rewards before they are fully realized.

- Stablecoins and liquidity indices: A stablecoin is a type of cryptocurrency designed to maintain a stable value by being pegged to a fiat currency, commodity, or algorithmic mechanism. Unlike volatile cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), stablecoins offer price stability, making them suitable for payments, remittances, DeFi transactions, and as a store of value.

This broad utility means that governance isn’t just about strategy—it’s about ecosystem design. Every vote helps sculpt a landscape of products and strategies that benefit the entire network.

Conclusion: Empowering the Future of DeFi

Governance is more than a checkbox on a roadmap. In Mitosis, it’s a core engine of value creation. Through frameworks like EOL, Mitosis empowers liquidity providers to move beyond passive participation into active, strategic leadership.

By enabling users to vote on protocol integrations, influence capital flows, and directly share in the ecosystem’s success, Mitosis turns yield strategies into community-driven initiatives. In doing so, it reshapes DeFi into a more democratic, transparent, and effective financial system.

Whether you’re a retail user or an institution, Mitosis offers a compelling new model: a world where every token isn’t just capital, but a voice which will be loudly heard.

Comments ()