Democratizing Yield: The Power of Collective Investing in Mitosis

In traditional finance, access to high-yield strategies is usually reserved for institutions, hedge funds, and those with deep technical resources. Mitosis changes the paradigm: it gives everyone — from DeFi beginners to experienced users — access to professional-grade strategies through a decentralized, community-powered model. Yield is no longer a privilege — it’s an opportunity open to all.

1. Collective Yield Pooling: Strength in Capital Unity

Mitosis replaces isolated effort with coordinated liquidity deployment.

Instead of each user hunting for strategies alone, Mitosis introduces EOL (Ecosystem-Owned Liquidity) — a shared liquidity pool where participants deposit their assets as Vanilla Assets (e.g., vUSDC or vETH). This pool is then efficiently directed into the most promising strategies, developed both in-house and by third-party contributors. Learn more about EOL’s architecture in the official documentation.

By eliminating liquidity fragmentation and acting with pooled capital, Mitosis enables users to tap into institutional-grade efficiency — without middlemen or high barriers to entry.

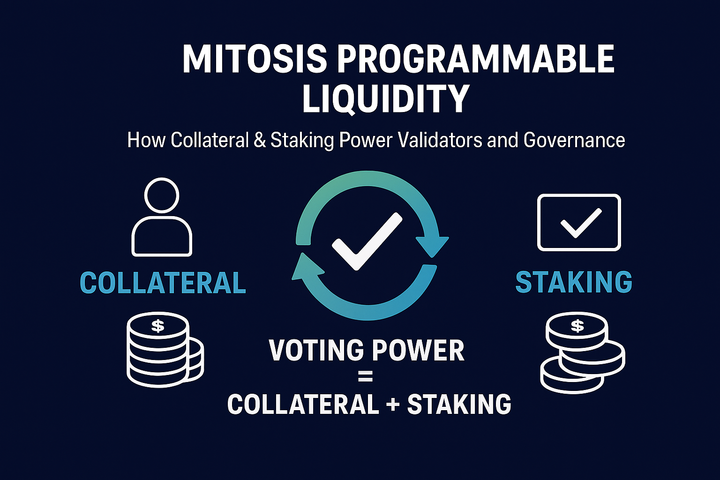

2. Yield Controlled by the DAO: Community-Driven Decision Making

Transparent governance where every participant has a voice.

Instead of relying on centralized control, Mitosis empowers its community through DAO governance. Token holders can vote on which strategies receive funding, propose new initiatives, and shape the future of the protocol. This puts real control in the hands of users and aligns incentives between the protocol and its participants.

All yield-generating strategies are built into the Mitosis Matrix — a modular layer where strategies are deployed as smart contracts. You can explore how this works in the Mitosis GitHub repository.

3. Pro Strategies Made Accessible: Simplicity Without Compromise

Mitosis lowers the entry barrier to advanced financial tools.

One of Mitosis' core missions is to democratize access to yield-generating strategies that were once only available to professionals. With its plug-and-play architecture, users can allocate their Vanilla Assets into pre-built strategies with just a few clicks. The protocol takes care of complexity — no need to manage risks manually or write code.

It’s DeFi made simpler, but without giving up control or transparency.

Conclusion

Mitosis introduces a new model for DeFi: open, decentralized, and inclusive. It’s more than just a protocol — it’s an infrastructure where everyone can participate in strategies previously reserved for elite players. Through pooled liquidity, DAO governance, and accessible strategies, Mitosis paves the way for a more fair and efficient Web3 financial system.

Want to dive deeper into how it works? Explore these key resources:

What is Mitosis? — Docs

Mitosis GitHub Repository

Mitosis Protocol on Twitter

Comments ()