DucatStable: The Bitcoin-Native Stablecoin Reinventing Decentralized Finance

In the ever-evolving world of cryptocurrencies, the search for stability within a volatile market has long been a challenge. Stablecoins have stepped into this gap, offering digital assets pegged to the value of fiat currencies like the U.S. dollar, but they often come with significant trade-offs—centralization, custodial risk, regulatory vulnerability, and overdependence on other blockchain ecosystems.

Enter DucatStable, a Bitcoin-native stablecoin project that aims to change that narrative. With a mission to bring trustless stability directly to the Bitcoin blockchain, Ducat is seeking to bridge the gap between the unyielding security of Bitcoin and the practical needs of everyday financial use, all without compromising decentralization or self-custody.

This article explores what makes DucatStable unique, its architecture and design, how it works, and why it might be the most significant evolution in Bitcoin-native DeFi yet.

The Problem DucatStable Aims to Solve

Bitcoin is often hailed as the most secure and decentralized cryptocurrency. It’s a store of value, a censorship-resistant network, and arguably the most battle-tested digital asset. However, Bitcoin's utility in day-to-day financial use remains limited. It is too volatile to be used as a reliable medium of exchange or unit of account.

Stablecoins—like USDT, USDC, and DAI—attempt to solve this problem by providing a stable medium of exchange. However, most existing stablecoins are either:

- Centralized, relying on custodians like Circle or Tether to hold fiat reserves.

- Ethereum-based, excluding the vast liquidity and community native to Bitcoin.

- Overcollateralized with volatile assets, making them fragile in high-volatility scenarios.

Moreover, these stablecoins often compromise on decentralization and transparency. For Bitcoin holders who value trust-minimized systems, there’s a clear need for a stablecoin that is native to the Bitcoin blockchain, respects the ethos of self-sovereignty, and operates without centralized intermediaries.

That’s where DucatStable steps in.

What Is DucatStable?

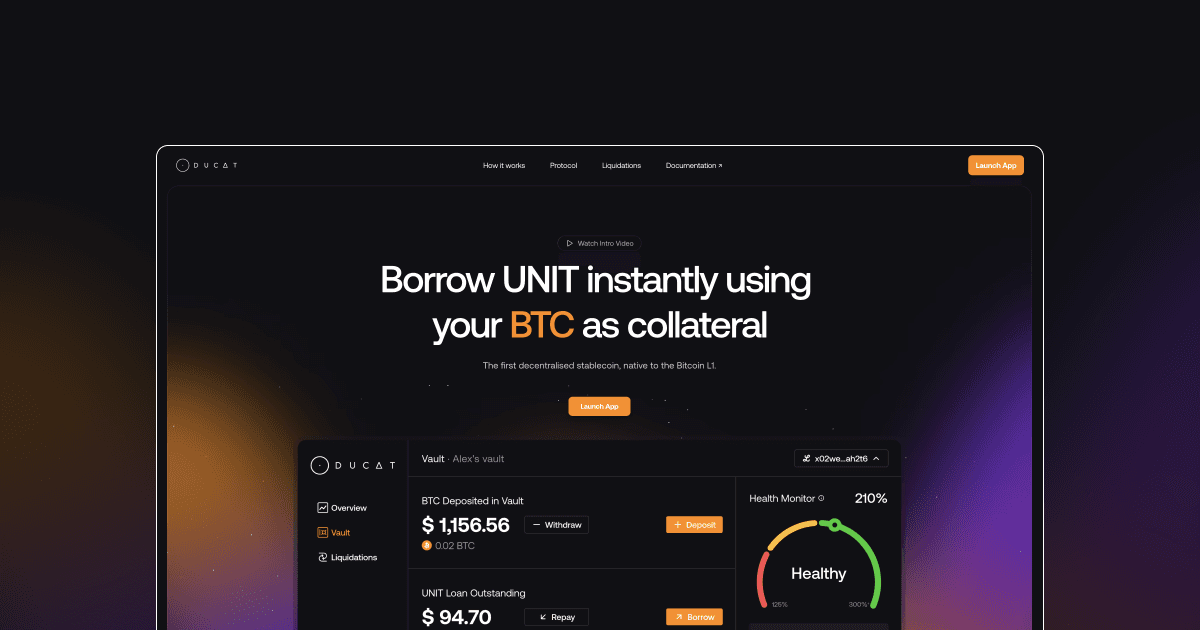

DucatStable is a decentralized stablecoin protocol built natively on Bitcoin Layer 1. Its primary goal is to bring a censorship-resistant, fully decentralized, and trustless stablecoin to Bitcoin. At the heart of the protocol is the UNIT token, a stablecoin soft-pegged to the U.S. dollar and backed by Bitcoin collateral.

Rather than issuing tokens through centralized custodians or relying on Ethereum’s infrastructure, Ducat uses advanced Bitcoin-native infrastructure like the BITE standard to enable smart contract-like functionality. This allows the protocol to maintain decentralization while providing the flexibility needed for modern DeFi.

Key Features at a Glance

- Bitcoin Layer 1 Native: Operates directly on Bitcoin, no alt-layer dependencies.

- Self-Custodial: Users retain full control of their BTC throughout the lifecycle.

- Smart Contract-Like Logic via BITE: Implements complex rules and contracts natively.

- Collateralized Debt Position (CDP) Model: Minting UNIT requires BTC collateral.

- Soft USD Peg (1.01–1.04): Designed to remain stable within a narrow band, accounting for transaction costs.

- Governance via DUCAT Token: Allows protocol adjustments by community vote.

- Zero Interest, Fixed Fees: Initially offers 0% loan interest and set redemption/liquidation fees.

Let’s break this down.

The UNIT Token: A Bitcoin-Backed Stable Asset

The star of the Ducat ecosystem is the UNIT token, which acts as a stable representation of value soft-pegged to the U.S. dollar. Unlike fiat-collateralized stablecoins, UNIT is created by locking up Bitcoin in what’s called a Collateralized Debt Position (CDP)—a vault-like mechanism inspired by the MakerDAO model but fully self-custodial and native to Bitcoin.

To mint UNIT, users deposit Bitcoin into a CDP and receive UNIT tokens proportional to the value of their collateral. Because Bitcoin is volatile, the system enforces a minimum collateralization ratio (similar to a loan-to-value ratio), ensuring UNIT remains sufficiently backed.

For example:

- Deposit 1 BTC (valued at $60,000)

- System requires 150% collateralization

- You can mint up to $40,000 worth of UNIT

The protocol also sets a narrow soft-peg band between 1.01 and 1.04 UNIT/USD to absorb network fees and price variations. This is different from hard-pegged stablecoins but is a deliberate design to reflect the real-world costs of minting and redeeming on Bitcoin.

The BITE Standard: Smart Contracts on Bitcoin

One of the most remarkable aspects of DucatStable is how it enables smart contract-like behavior on Bitcoin—traditionally a non-Turing-complete environment.

Ducat leverages the BITE (Bitcoin Inscription Trustless Execution) standard, an open-source protocol that extends Bitcoin's scripting capabilities. BITE allows for deterministic, script-based execution environments that operate trustlessly using on-chain inscriptions, without needing to fork Bitcoin or rely on off-chain logic.

This innovation means Ducat can enforce rules such as:

- Automatic liquidations of undercollateralized vaults

- Conditional minting and redemption of UNIT

- Governance decisions around fees, ratios, or parameters

All this happens directly on Bitcoin Layer 1, preserving the security and decentralization of the base chain.

Governance and the DUCAT Token

The DUCAT token governs the DucatStable protocol. Holders of DUCAT can vote on:

- Collateralization requirements

- Liquidation penalties

- Interest rates (currently 0%)

- Redemptions fees (initially 1%)

- Future feature implementations

Governance is on-chain and decentralized, ensuring the protocol evolves through community consensus rather than centralized decision-making.

This structure echoes what many DeFi veterans appreciate from Ethereum governance models but is adapted uniquely to Bitcoin’s conservative, security-first culture.

Risk Management: Liquidations and Peg Mechanisms

To protect the value of UNIT and the health of the protocol, Ducat includes robust risk controls:

- Overcollateralization: Every UNIT minted must be backed by more BTC than its nominal value.

- Liquidation Mechanism: If the BTC price falls and a vault drops below the required collateral ratio, it gets liquidated with a fixed penalty (currently 16%) and redistributed to stablecoin holders and liquidators.

- Soft Peg Band: The narrow 1.01–1.04 peg band accounts for BTC transaction fees and small fluctuations, reducing reliance on external price oracles or market makers.

These measures help maintain systemic integrity without relying on human intervention or off-chain infrastructure.

Ducat Protocol v2.0: What Changed?

In 2024, Ducat launched Protocol v2.0, bringing several key upgrades:

- Improved Interoperability: Smoother interactions between vaults, wallets, and third-party tools.

- Simplified UX: Easier vault creation, clearer UI, and better peg visibility.

- Faster Liquidations: Improved BITE scripting for liquidation triggers.

- Expanded Governance: More granular control over protocol parameters via DUCAT token holders.

This upgrade represented a significant milestone in Ducat’s development, aligning its design closer to production-grade financial infrastructure.

Funding and Team

In August 2024, DucatStable closed a $1.25 million pre-seed funding round, led by UTXO Management with contributions from:

- Bitcoin Frontier Fund

- Revelo Intel

- A few unnamed angel investors from the Bitcoin development community

The core team comprises long-time Bitcoin developers, smart contract engineers, and cryptographic researchers. While still early-stage, Ducat’s contributors emphasize transparency, open-source code, and alignment with Bitcoin’s principles.

The Bigger Picture: Why This Matters for Bitcoin

DucatStable is more than just another stablecoin project—it’s part of a broader movement to bring real financial utility to Bitcoin without compromising on its values.

Historically, Bitcoin has served as a store of value or base layer for value transfer, but not as a flexible financial platform. Ducat changes that, offering:

- A reliable medium of exchange

- A stable unit of account for contracts and payments

- A native DeFi primitive for loans, swaps, and derivatives

Imagine paying for goods, issuing payroll, or locking in lending agreements—all denominated in a Bitcoin-native stablecoin, without touching centralized exchanges or wrapped assets. That’s the future Ducat is building.

Challenges Ahead

No protocol is without risk, and Ducat faces several challenges:

- Liquidity and Adoption: The success of UNIT depends on users trusting and using it.

- Peg Volatility: The soft-peg model could confuse users accustomed to hard pegs.

- Smart Contract Risk: Although BITE is innovative, it’s still a new and lightly audited execution standard.

- Regulatory Environment: Even decentralized projects may come under scrutiny.

Still, the team appears prepared to navigate these complexities with transparency and ongoing development.

Conclusion: A Bitcoin-Native Revolution in the Making?

DucatStable is a bold and necessary evolution in the Bitcoin ecosystem. By merging decentralized stability with Bitcoin’s unmatched security, it brings DeFi utility to an asset class that has often resisted it.

It’s not just another stablecoin—it’s a financial protocol tailored for Bitcoiners, built on-chain, self-custodial, and trustless.

As Bitcoin continues to mature, projects like DucatStable will!

References

Comments ()